November, 2024

- Release: 791 Check my version

Document Matching Tolerances

Our new matching tolerance feature enables you to configure acceptable overmatching between documents, such as matching between purchase orders and purchase invoices. This configuration is made on the document type matching tab. The tolerance is defined as an allowable percentage over the original detail line that is being matched.

This feature is useful when minor discrepancies arise between an order and an invoice, such as price fluctuations, and you would want the system to accept the variance within a set tolerance instead of raising a new order or modifying the existing one.

Amount based matching

For amount-based matching, the tolerance defines the percentage allowed over the total net amount of the line being matched.

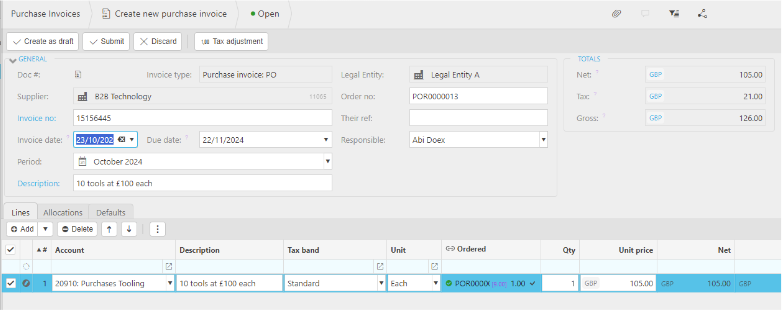

Example -

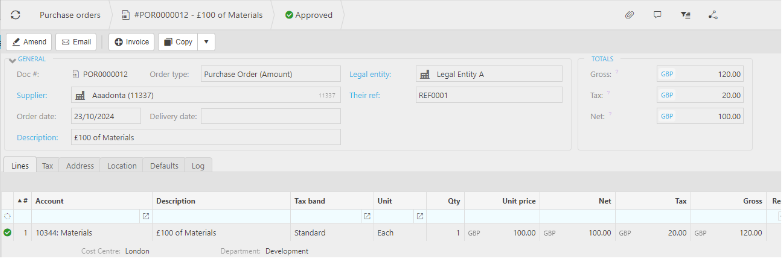

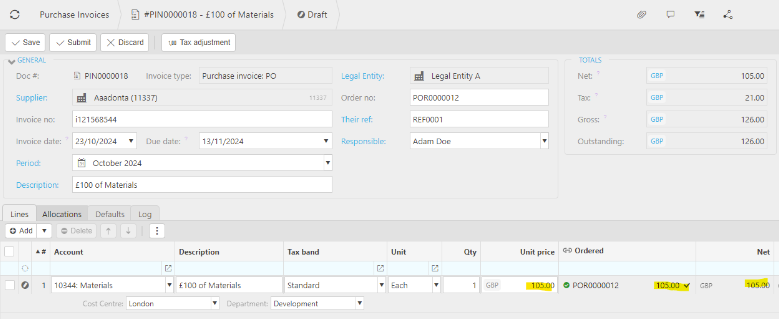

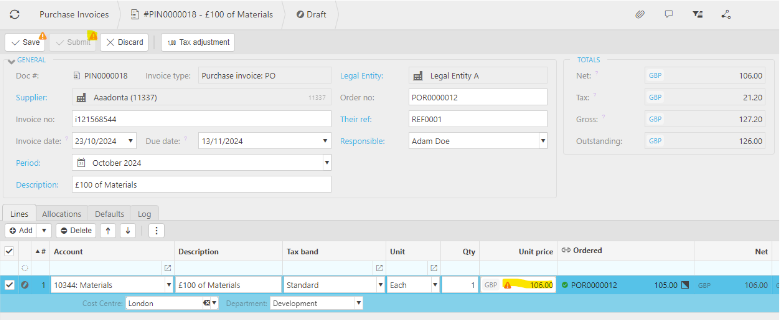

An approved amount-based purchase order for £100.

Matching tolerance between Purchase Order and Purchase Invoice is set to 5%.

A purchase invoice line can be matched up to 5% above the original order line amount.

Matching with an amount over the 5% tolerance will prevent the purchase invoice from being submitted (when the purchase invoice document type has been configured to require matching).

Quantity based matching

For quantity-based matching, the tolerance defines the percentage allowed over the original net unit price of the line being matched. The tolerance does not apply to overmatching of quantities.

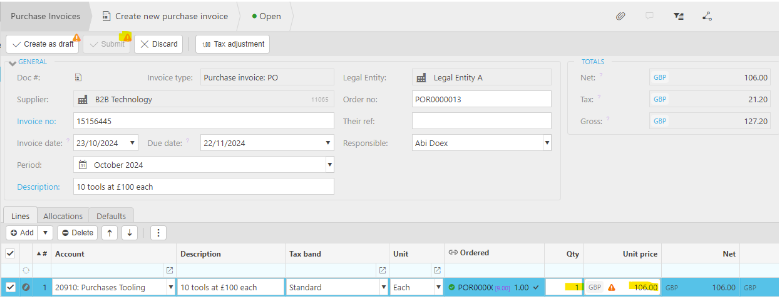

Example

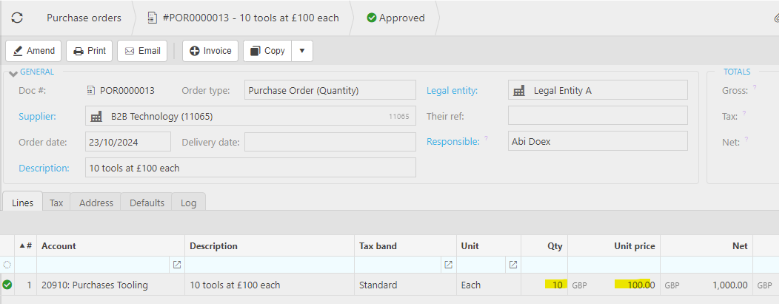

An approved quantity-based purchase order for 10 items at £100 each.

Matching tolerance between Purchase Order and Purchase Invoice is set to 5%.

A purchase invoice line can be matched up to 5% above the original order line unit price amount (e.g. quantity of 1 and price of £105).

Matching with a unit price over the 5% tolerance will prevent the purchase invoice from being submitted (when the purchase invoice document type has been configured to require matching).

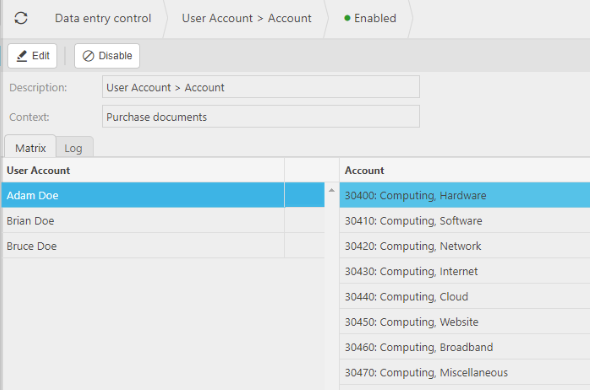

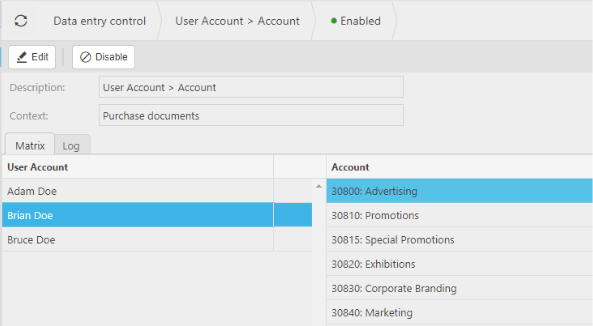

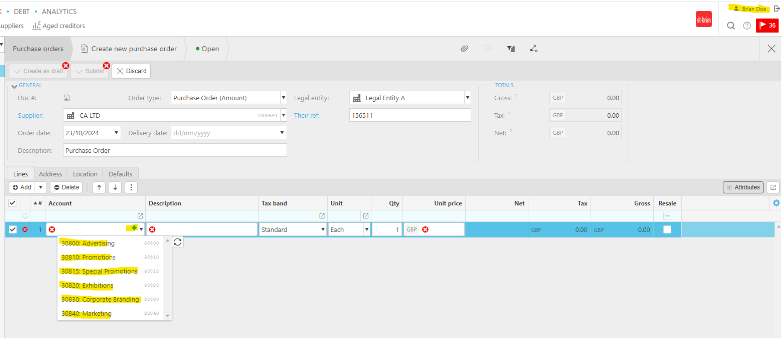

Data Entry Control by User

Our Data Entry Control functionality has received a significant upgrade and now allows for the management of data available for entry, based on User Account.

User Accounts can now be directly related to other data control attributes values, such as chart of account codes, projects, departments etc.

This restricts the user to the specified values when the control is enabled for a context.

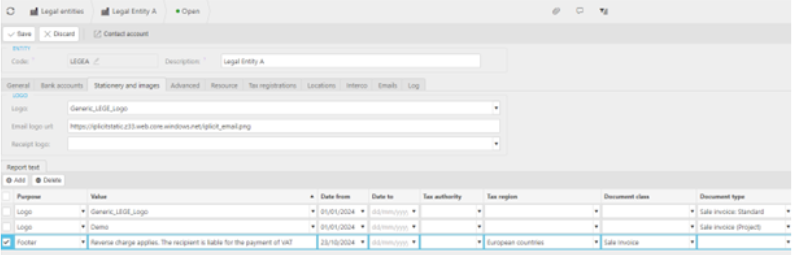

Legal Entity report output settings

The range of options for tailoring report outputs has been significantly expanded, allowing for more flexible and customised reporting without the need for technical modifications to reports. These apply to PDF report outputs from iplicit such as Sales Invoice, Purchase Orders, Remittances etc.

On Legal Entity records the Stationery and images tab now has various reporting overrides that can be added to affect the output of reporting from iplicit. The purpose defines the area where an override will be applied on a report output, criteria can be added for when the override applies.

Examples of usage are:

Changing the logo produced on sale invoices depending on the sale invoice document type & project.

Inserting free-form text in the header or footer of a Purchase Order based on the tax region.

Defining billing and registered addresses to be used and how they are formatted for specific document types.

Please note that these apply to standard authored reports that are supplied with iplicit and may not work with existing customised reports.

Accounts Payable Automation

Several enhancements have been made to our Accounts Payable Automation module based upon customer feedback and learnings from the AI model.

Registered documents: It is now possible to “pop-out” the attached document to a separate window. This feature is especially beneficial for users with multiple screens, as it allows the document image to be placed on a separate display, maximizing screen space.

Credit note identification and processing has been improved. The supplier record now includes an override to prevent creation of credit notes when certain text is detected during the automation. For instance, a standard purchase invoice for a particular supplier may always contain generic text that includes the phrase "credit note." This text can be used as an override on the supplier record to prevent the automation model from recognising it as a credit note.

The supplier record now includes a setting that fixes the currency for documents processed through accounts payable automation to the currency specified on the supplier record. This can be useful for suppliers whose invoices do not clearly identify the currency, or when the automation is not consistently or accurately detecting it.

The automation now has improved handling of unit price when there are three digits after a decimal point.

Other Enhancements

Project enhancements:

A new setting on the project group defines whether the completion date is mandatory for projects in the group.

Project codes can now be configured to be generated solely from the series defined in the project group, preventing manual entry of codes by users.

Imports & Exports:

Activities can now be imported and exported.

Properties can now be imported and exported.

Project's imports and exports now support custom data fields.

Document Imports now support the responsible resources field.

The unique code for contact accounts (customers, suppliers, resource, staff) can now be configured via an environment default setting to be generated solely from an internal numbering series, preventing manual entry of codes by users.

Billing schedule

Deposit invoicing can now be put on hold independently from scheduled invoicing, enabling more control over when invoices will be generated.

Deferred income lines can now be added after the invoicing schedule has been populated.

It is now possible to amend a schedule after the deposit invoicing has been generated.

Authorisation workflows have been enhanced to enable the distribution of items by Product Groups.

On Sale dispatch documents, if the customer has multiple tax authorities, the tax authority field is now displayed on the document and can be set by the user. Additionally, the tax authority is also now copied when converting between document types, for example converting a Sales Order to Sale Dispatch.

Currency codes have now been extended system wide to support up to 5-digit codes as used by crypto currencies.

Automations that create documents now copy the Custom Data Access Control (CDAC) attribute from the source document when CDAC is enabled. For example, if department is defined as the CDAC attribute on Sales & Purchase invoices, an Intercompany Purchase Invoice generated from an automation will be created with the same department CDAC as the source Intercompany Sale Invoice.

It is now possible to create Asset Depreciation methods with a specific day of the month designated for use in the depreciation book and the resulting depreciation journals.

Cash Book Journal templates can now be created in draft and submitted for authorisation before being available for use.

Multi Co Purchase/Sale Automation, when a source Sale/Purchase Document that has related Multi Co purchase/Sale journal is abandoned, the related Multi Co Purchase/Sale Journals are also now abandoned at the same time to prevent the Purchase/Sale journals being left in a draft state.

Drilling down into values on the Stock level enquiry now observes filters the enquiry has been run with and the level of the tree that has been drilled into.

Goods received notes and sale dispatches now support delivery addresses on the document, this is enabled on the document type.

Support

The Customer finder set with debt now includes columns to show balance in both the Document and Base currencies.

Assets that have been capitalised from a purchase invoice in iplicit now display a link back to the purchase invoice when the invoice does not have a description in the header.

The Full option for Reducing Balance Depreciation Methods has been removed as it was redundant.

It is now possible to use the bulk amend function on Resource records to set the Allow Expense, Payment Method and Payment Terms fields for multiple resources.

Minor presentation fixes on the Sales Dispatch address tab.

The transaction history tab is now available for Contact Accounts

Improvements and fixes on un-posting bulk payments.

The Prepayment / Deferred income tick boxes are now set correctly on the document line entry from the supplier/customer record ignore prepayment/deferred income setting.

Copying manual journal lines now works correctly when coded to the Tax Only tax band.

Manual journal header values are now calculated correctly when editing and amending tax bands.

Issues resolved with values being lost when editing manual journal templates.

Partial tax net cost line descriptions are now truncated if it exceeds 237 characters to prevent document submission failure.

Partial tax now works with Domestic Reverse Charge.

Previewing Excel spreadsheets stored as attachments are now restricted to the first 40 columns/100 rows to enhance performance and stability.

Issues with saving and editing Dashboards have been resolved.

Document type refund tick box on purchase/sale tab removed as it is redundant.

User Roles

- ‘Legal entity: Admin’ role updated to include ability to edit Legal Entity Bank Account defaults.

Enquiries

Improvements to the Support Issues Enquiry.

When legal entity has a valid payment default bank and a valid bulk payment default bank, it no longer appears on the enquiry as it is valid.

When it has legal entity has NO valid payment default bank and a valid bulk payment default bank, it now shows on this enquiry as a potential issue.

When it has legal entity has valid payment default bank and a NO valid bulk payment default bank, it now shows on this enquiry as a potential issue.

Archive GL & Archive Documents.

- Refund document filter added.

Reports

The authored UK1, UK2, UK3 & UK4 reports for the following types have been updated to support the new Legal Entity report output settings.

- Sales Invoice

- Credit Note

- Sales Orders

- Sale Proforma

- Sales Quote

- Self-Billing Invoice

- Remittance

- Receipt

- Refund

- Customer Statement

- Purchase Order

Tax

New Tax Authority - Palestine.

New Tax Authority – South Sudan.

New Tax Authority – Canada (England & Wales).

- Sales tax – 5%

- Standard purchases – 5%

New Tax Authorities and Tax Return Types.

- Malta (GB)

- Portugal (GB)

- Spain (GB)

- Italy (GB)

- Netherlands (GB)

Interfaces

- Unity Bank Bulk Payment Interface

- Natwest Bankline Bacstel Bulk Payment Interface

- Maerki Baumann Bank Statement Import Interface

- Froes Bank Statement Import Interface

- Frick Bank Bulk Payment Interface

- Frick Bank Statement Import Interface

- Zand Bank Statement Import Interface

- Virgin Money Bulk Payment Interface for Faster Payments and BACs

- Commonwealth Bank of Australia (CBA) - ABA Bank Statement Upload/Import

- Commonwealth Bank of Australia (CBA) – CommBiz File Bulk Payment Export

- Danske Bulk Payment/GBP Statement Bank Interface

- HSBC Autopay bank export interface

- Mizuho bank Bulk Payment interface

API

See API changelog for an update on what's new.