Document Types

Documents play a crucial role in conveying a company’s financial activities.

Documents include Invoices, Orders, Balance sheets, Income statements, Cash flow statements, Journals, Budgets, to name a few.

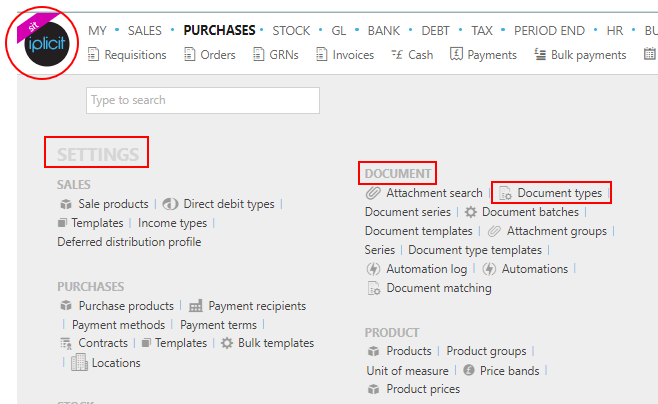

How to view Document types

Viewing Document types

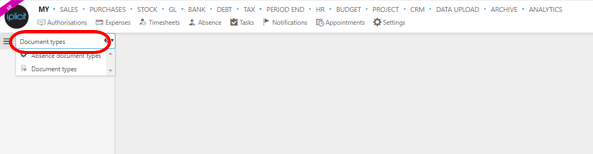

Select Document types from either the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution

or enter Document types in the Quick Launch Side Menu.

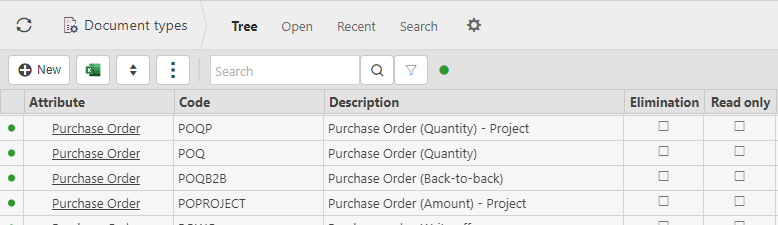

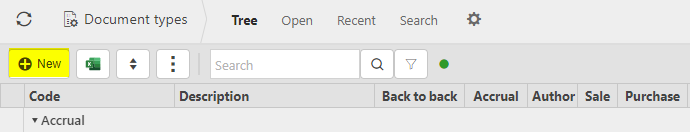

This will then show the Document types on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select

on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

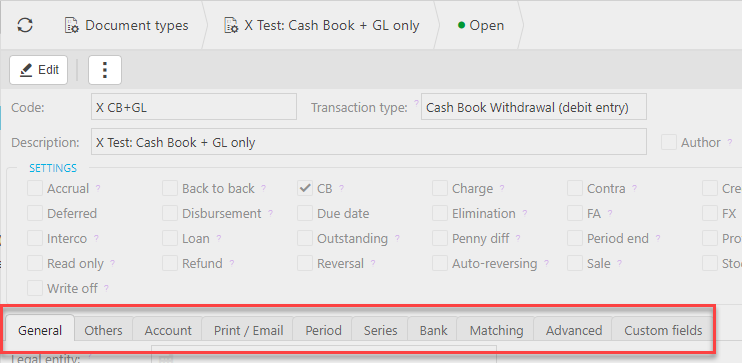

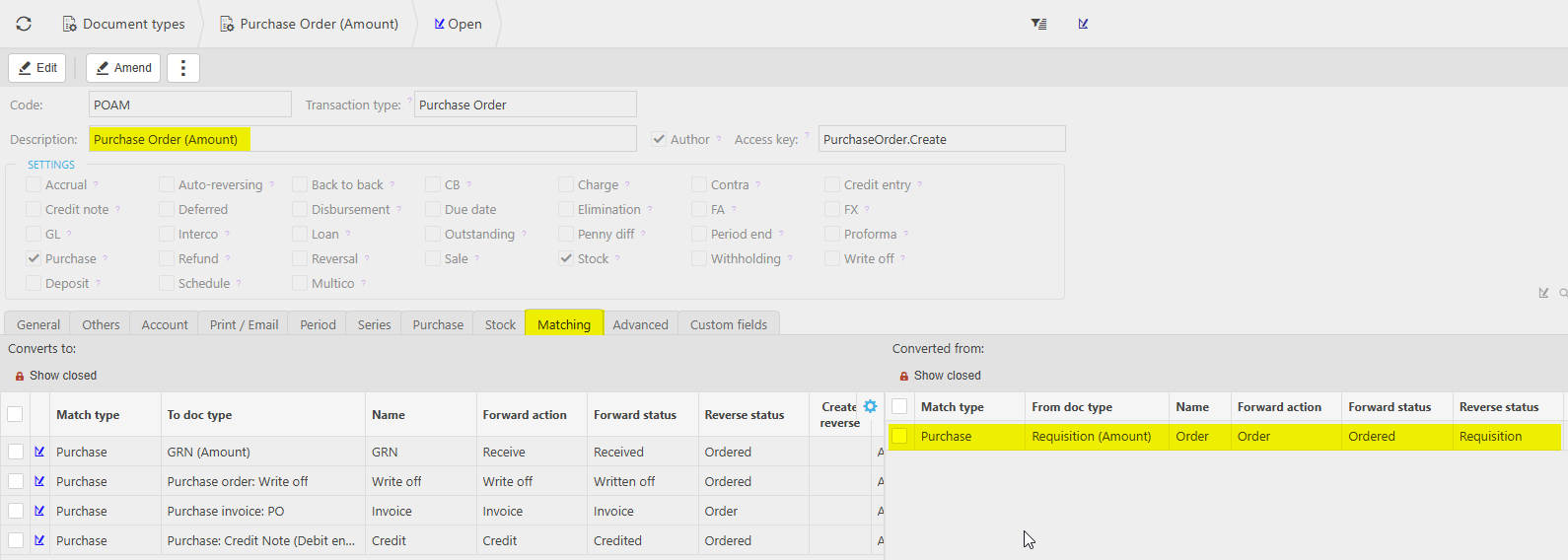

How to create/edit Document Types

Create/Edit Document Types

Select Document types from one of the options as shown above in Viewing Document types.

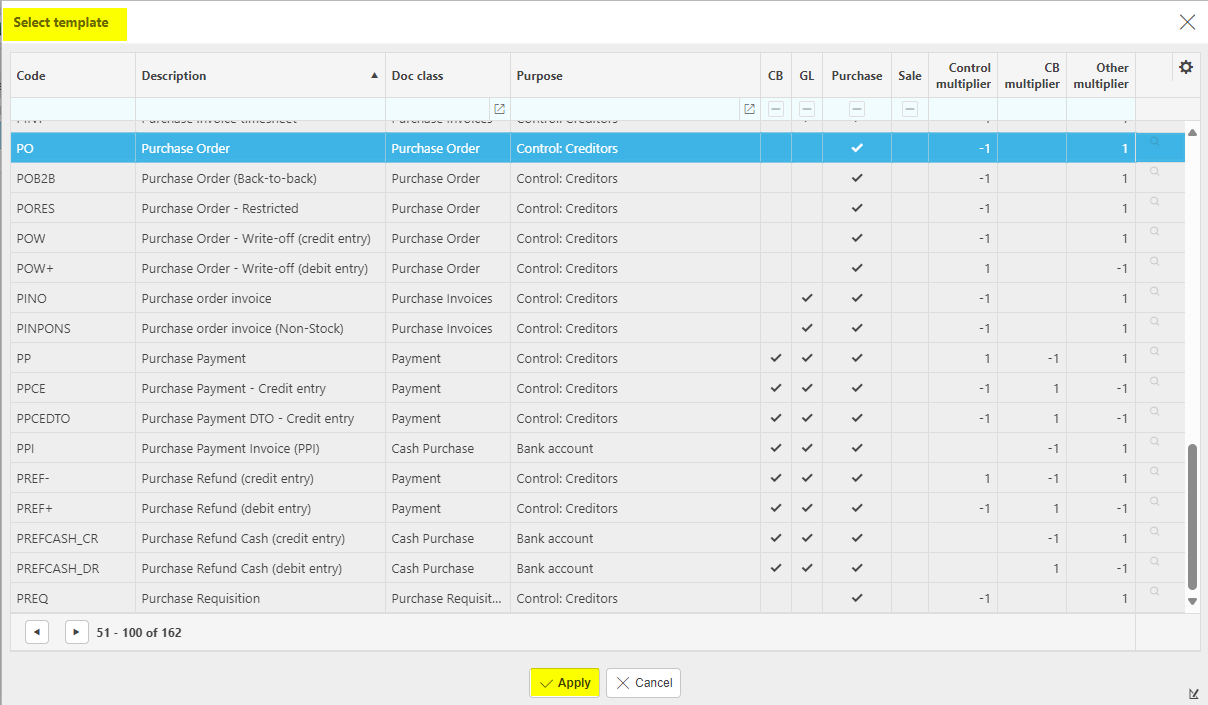

Either select New, then select template.

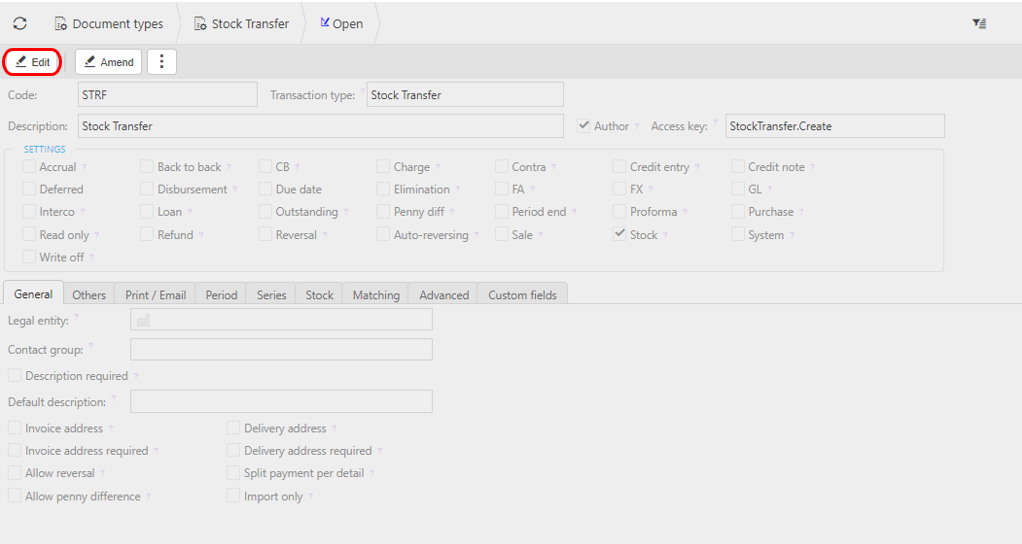

or select and open the Document type that you would like to edit, then select Edit.

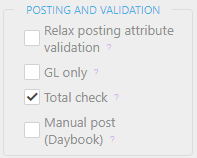

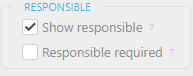

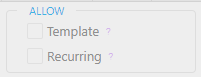

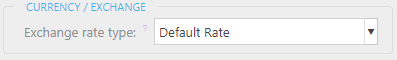

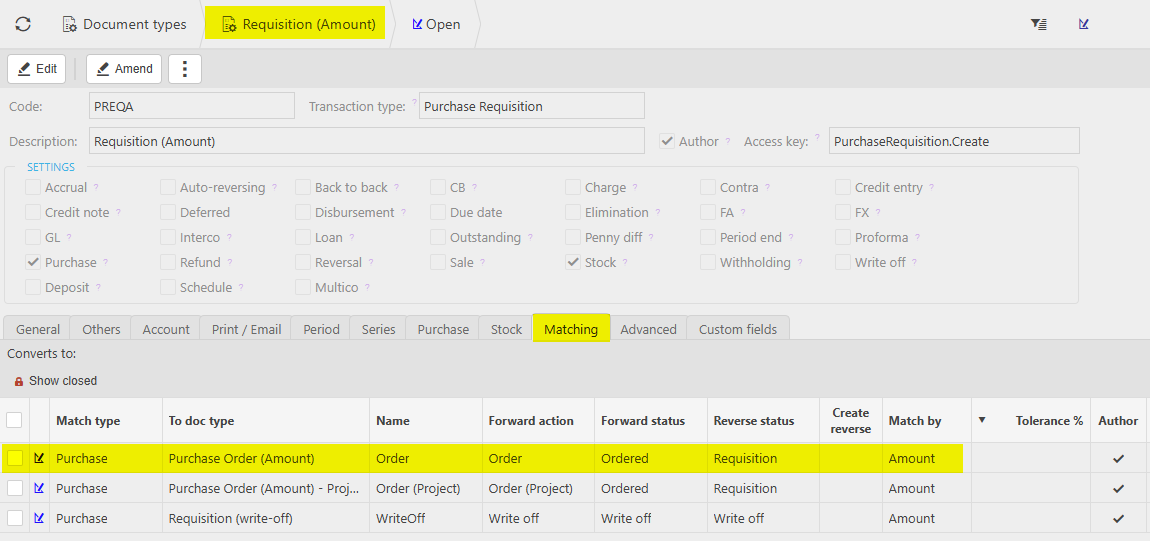

Select the following options in the Settings section.

Accrual: When this checkbox is ticked, this document type is available for accruals.

Auto reversing: When this checkbox is ticked, this document type is available to be auto reversed.

Back to back: When this checkbox is ticked, this document type is available for back-to-back sale & purchase orders.

CB: When this checkbox is ticked, this document type is available to populate the cash book.

Charge: When ticked, this document type is available for charge documents.

Contra: When this checkbox is ticked, the document type(s) will be available for Contra documents e.g. matching of sale and purchase invoices when a contact account is both customer and Supplier.

Credit entry: Credit entry can be ticked to allow users to enter values for credit notes, refunds and write offs as a credit. These document types will have different multipliers to their debit entry counterparts.

Credit note: The Credit note flag identifies the document type will be used for credit notes.

Deferred:

Deposit: When ticked, the document type is available for deposit creation.

Disbursement: When ticked, the document type can be used for the Sale Disbursement of selected purchases & expenses.

Due date:

Elimination: This checkbox is ticked when documents created using this document type will be treated as Interco eliminations.

FA: When this checkbox is ticked, this document type is available for Fixed Assets.

FX only: The FX only flag is used for FX corrections, it allows a base amount correction without a currency amount. It skips any currency rate calculations.

GL: The GL flag states whether the document will post lines to the general ledger.

Interco: The Interco flag is ticked on intercompany document types. These document types are more common within environments with multiple legal entities.

Loan: When this checkbox is ticked, this document type is available to for loan documents.

Outstanding: Any document type with the Outstanding flag ticked must also have the GL flag ticked. The Outstanding document indicates that the document must be allocated to another document.

Penny Diff: When this checkbox is ticked, this document type is available for Penny difference documents.

Period end: The Period end flag identifies documents used for year-end rollovers.

Proforma: When this checkbox is ticked, this document type is available for Proforma movements (e.g. payment in advance for Purchase Order).

Purchase: The Purchase flag allows documents to be used for purchases.

Refund: The Refund flag identifies the document type will be used for refunds.

Reversal: The Reversal flag identifies the document type will be used for reversals.

Sale: The Sale flag allows documents to be used for sales.

Schedule: When this checkbox is ticked, this document type is available for bill scheduling.

Stock: When this checkbox is ticked, this document type is available to populate stock levels. NB. You must also tick "Enable Stock" on the stock tab below.

Withholding: Tick the checkbox to enable the document to be used in the Withholding Tax process.

Write off: The Write off flag identifies the document type will be used for write offs.

Deposit: Tick this option to make this document available for deposit creation.

Schedule: Tick this option to make this document available for scheduling.

Add/edit options in the following tabs:

Note

The tabs differ slightly depending on the document type e.g. the purchase tab will be shown on purchase document types and the sales tab will be shown on a sales document type or as the picture shows below, the bank tab is shown instead as its a bank document type.

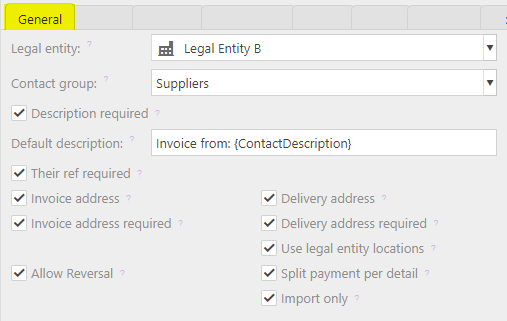

- General

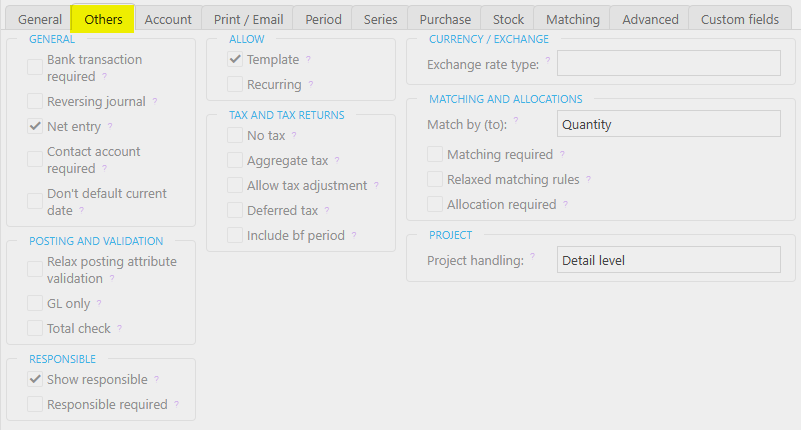

- Others

- Account

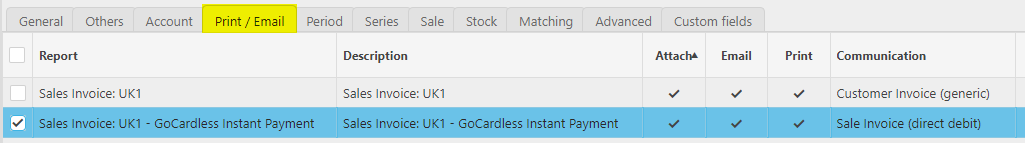

- Print/Email

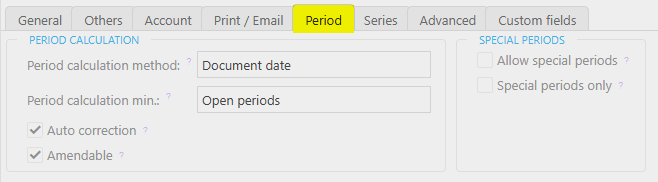

- Period

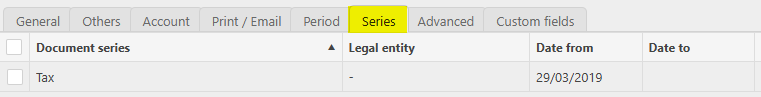

- Series

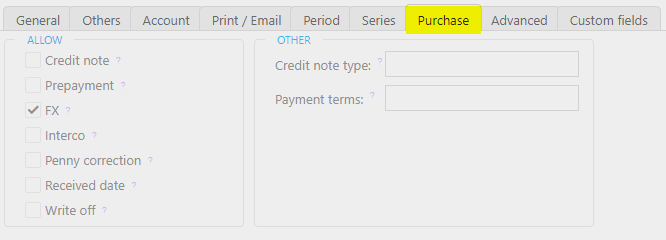

- Purchase

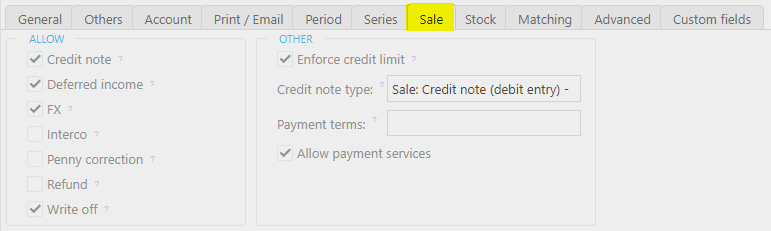

- Sale

- Bank

- Stock

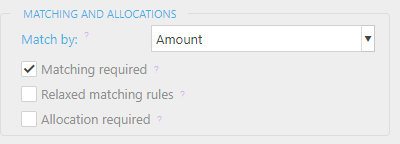

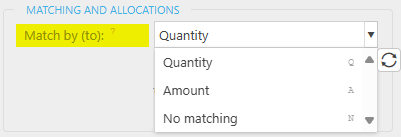

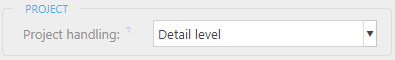

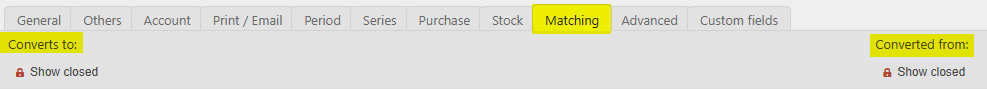

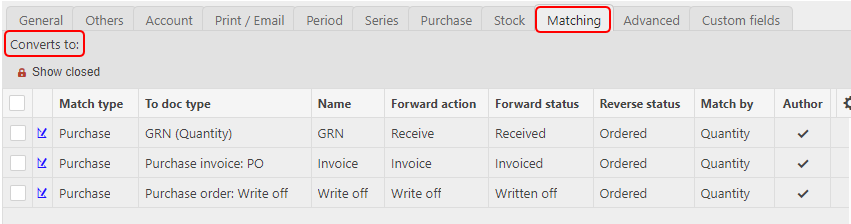

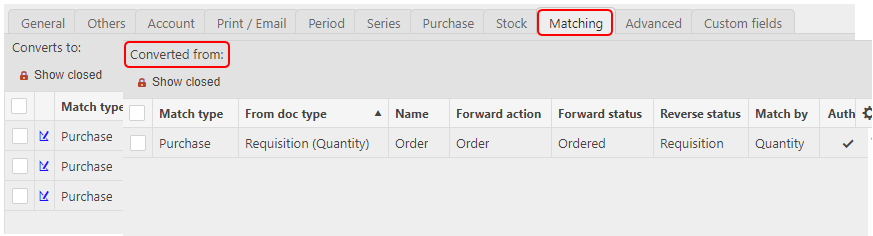

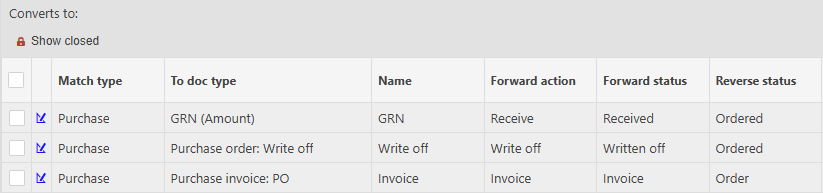

- Matching

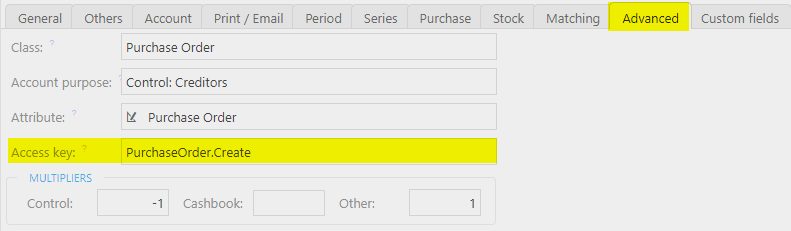

- Advanced

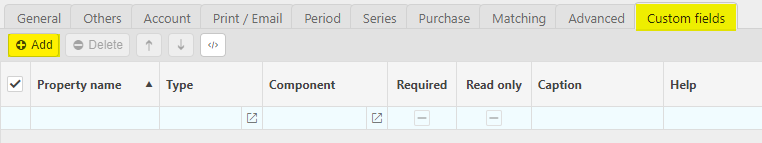

- Custom Fields

- Description required: Tick if you wish to enforce the entry of a description in the document header for this document type.

- Default description: Enter a default description for this document type. You can also include placeholders e.g.Invoice from: {ContactDescription}.

- Their ref required: Tick if you wish to enforce the 'Their Ref' entry on the document header.

- Invoice address: Tick if this document has an invoice address.

- Invoice address required: Tick if you wish to enforce the entry of an invoice address.

- Delivery address: Tick if this document has a delivery address.

- Delivery address required: Tick if you wish to enforce the entry of a delivery address.

- Delivery date required: Tick if you wish to enforce the entry of a delivery date on this document type.

- Free text delivery address: Tick if you want to input a delivery address that is not registered on the contact account.

- Use legal entity locations: Use the legal entity location as a delivery address.

- Allow Reversal: Tick if you want documents of this type to be available for reversal.

- Split payment per detail: Tick if you want each detail line on a Credit Card Expense to create an individual entry in the Cash Book.

- Import only: If set, this document type will not be available for manual creation.

Updated November 2025

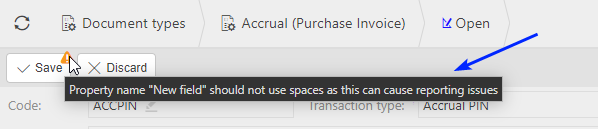

in this Custom fields tab, then filling out the selection criteria.

in this Custom fields tab, then filling out the selection criteria.