Legal Entities

A Legal Entity is required for each organisation that financial documents will be entered against.

One or many Legal Entities may exist within each environment and they can share details e.g. Tax Authority, Financial Year Group, Base currency, etc.

Note

Where multiple Legal Entities exist, consolidated reporting options are available, regardless of shared periodicity and even base currency.

The decision to share setup e.g. Financial Year Group, apart from the commonality of year end date may be governed by the business process to e.g. share period end handling.

Tip

Select

to jump to the Legal Entity contact account and see the related addresses, phones, emails, contacts, URLs.

to jump to the Legal Entity contact account and see the related addresses, phones, emails, contacts, URLs.Entity

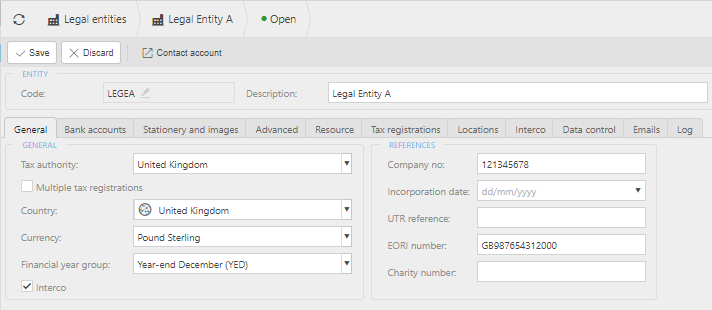

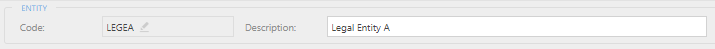

Code: Unique code for the Legal Entity

Note

Use an easy to remember code as it will be:

- Shared with the associated contact account.

- The Interco code (if applicable) and thus be used as a posting attribute value.

Description: Meaningful description.

The Tabs

- General

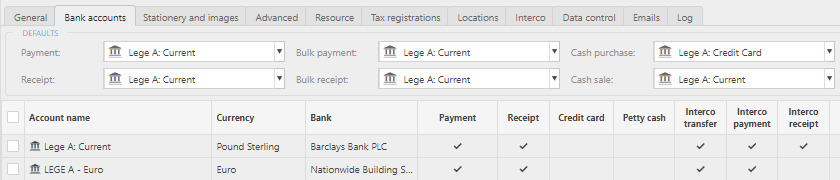

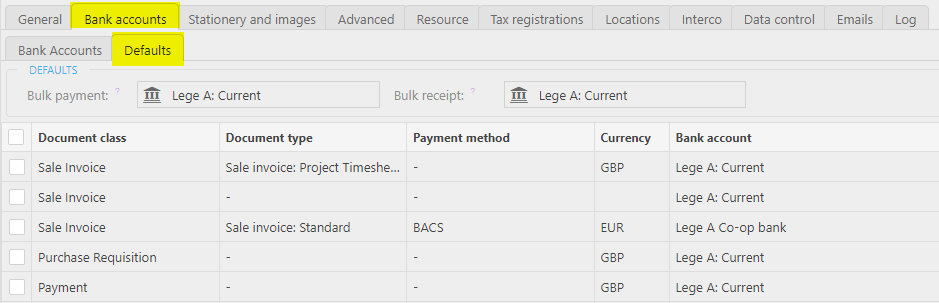

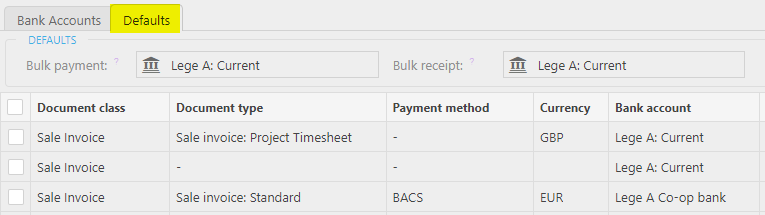

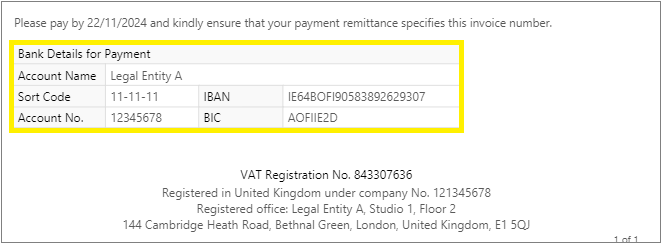

- Bank accounts

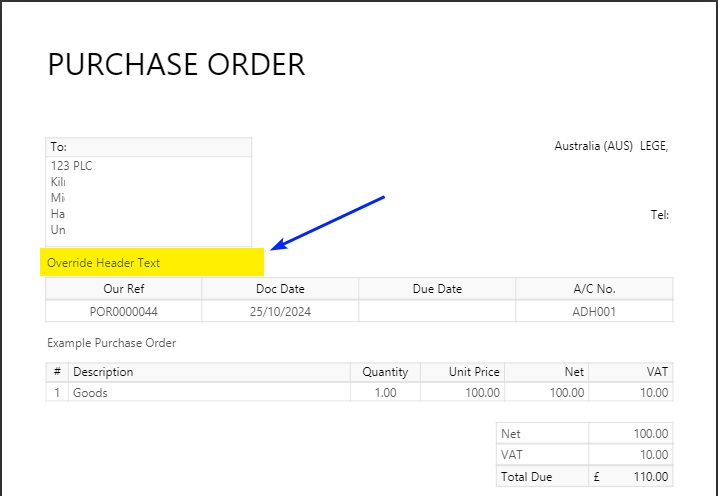

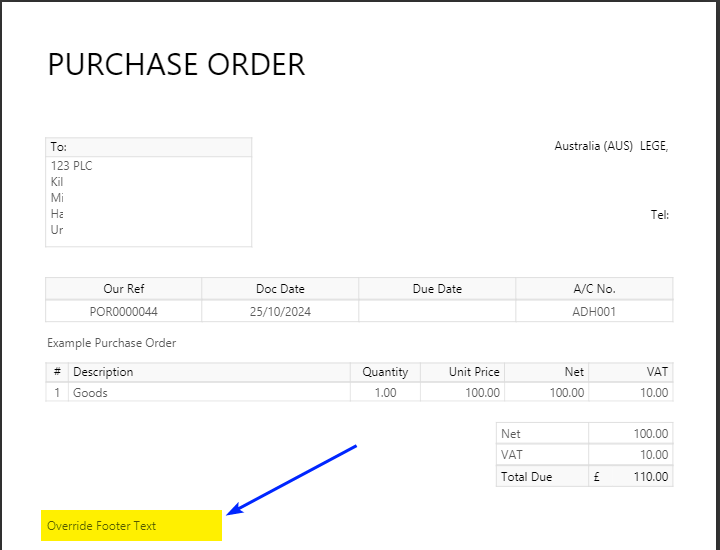

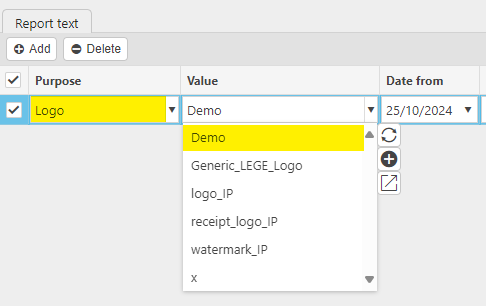

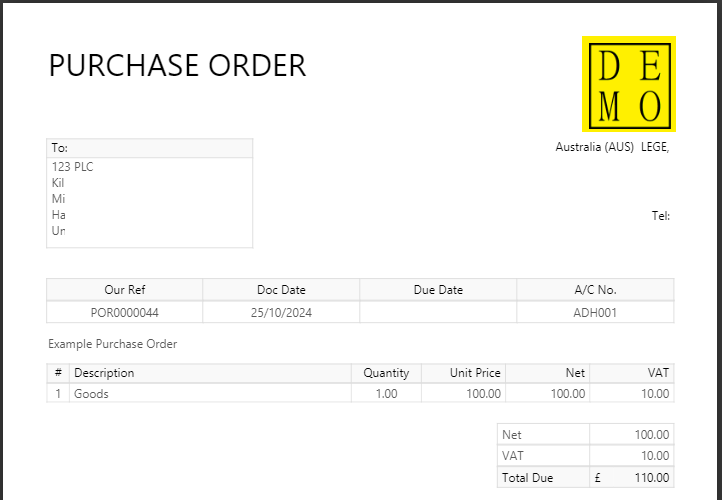

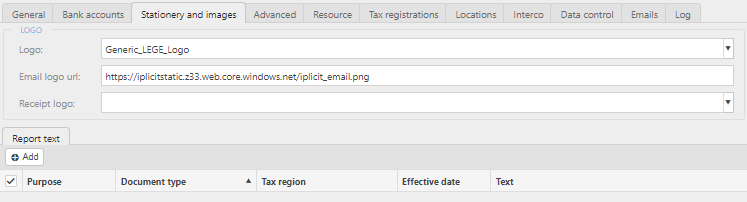

- Stationery and images

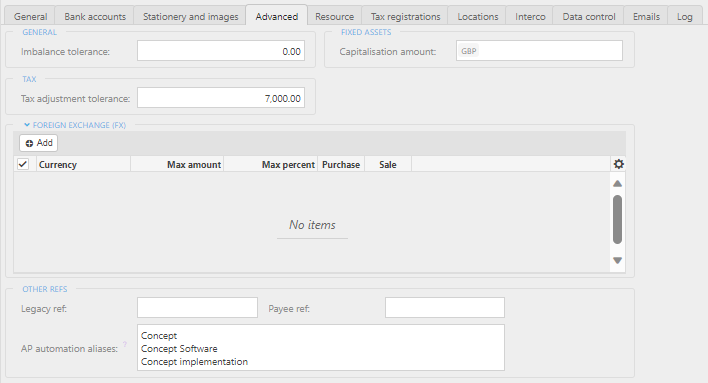

- Advanced

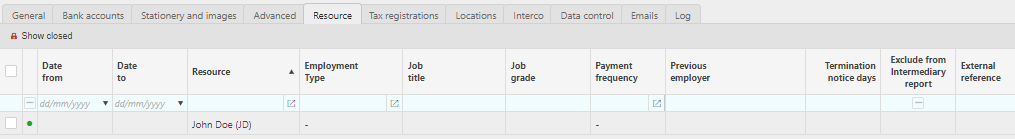

- Resource

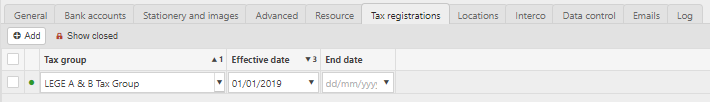

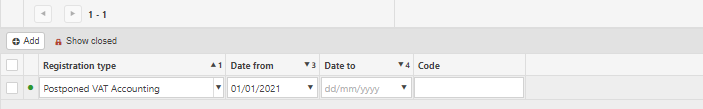

- Tax Registrations

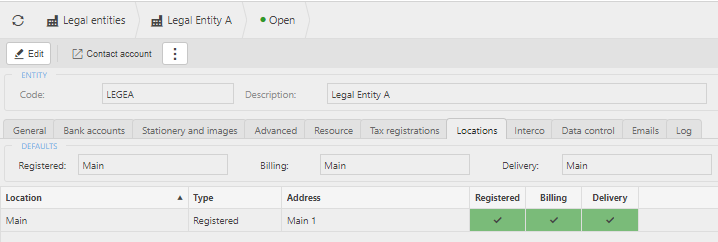

- Locations

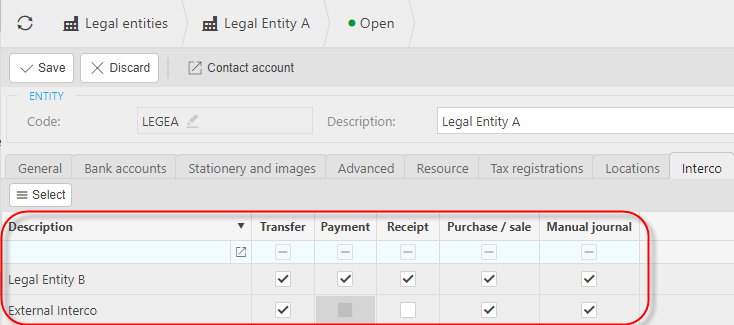

- Interco

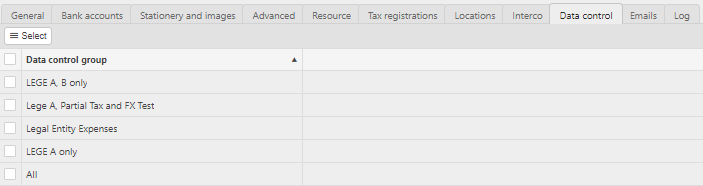

- Data Control

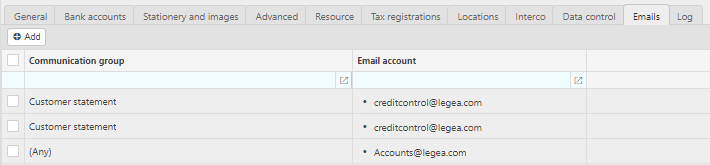

- Emails

- Log

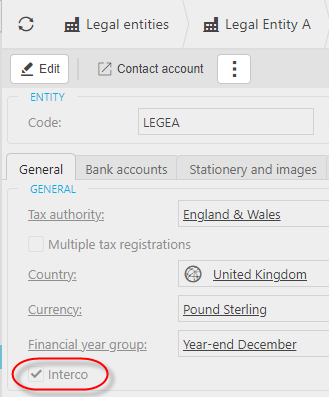

General

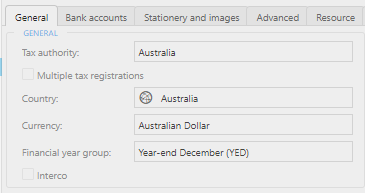

Tax Authority: Tax authority that the Legal Entity is registered with. This determines tax treatments.

Multiple tax registrations: When ticked, this Legal Entity will be capable of having multiple tax registrations. An example of this would be a Legal Entity having separate tax registrations (and responsibility) in both England and Ireland.

Country: Country in which the Legal Entity is registered.

Currency: Default currency for the Legal Entity.

Financial Year Group: Financial year group which is used to define the accountancy periods, financial year start and end, etc.

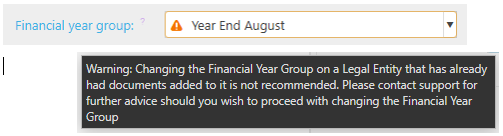

Warning

Once a Legal Entity has been created and had documents added to it, trying to edit Financial Year Group will present the following message.

This is just a warning message; the Financial Year Group can still be changed if the Customer wishes.

Interco: Tick this check box if you also wish to use this Legal Entity for Interco documents. This will create an additional Tab - see Interco Tab.

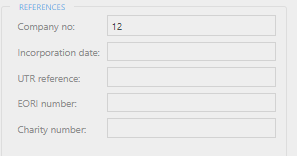

References

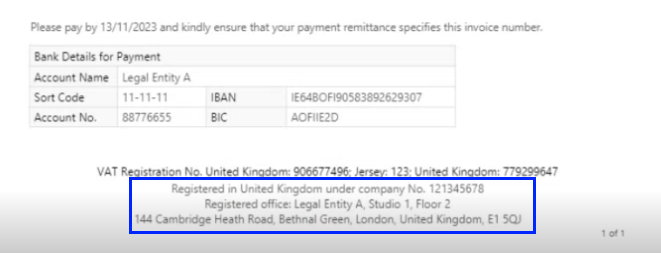

Company No: Unique Company number assigned to the Legal Entity.

Incorporation date:

UTR reference: Unique Tax Reference (used in England and Wales) Tax Authority

EORI number:

Charity No:

Updated December 2024

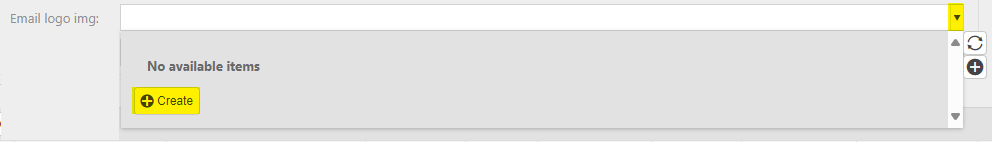

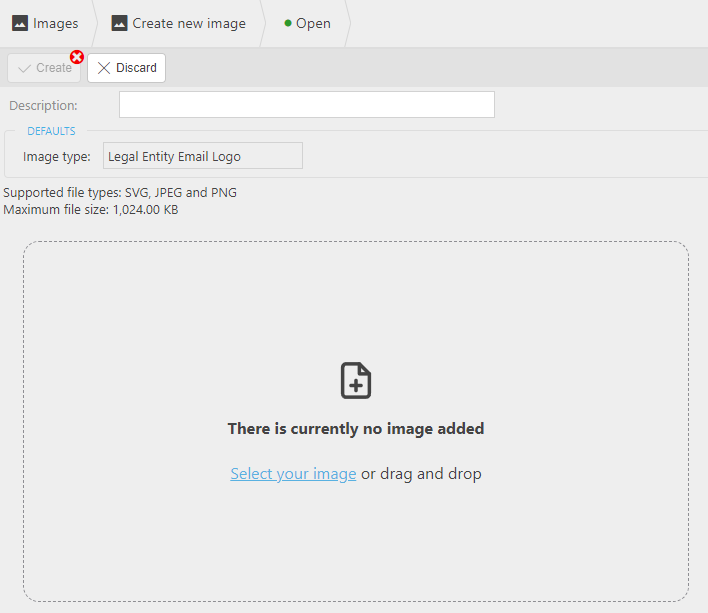

icon to add or create image.

icon to add or create image.