Bank Accounts

Bank account records must have been created for transaction use for all payments, receipts, direct cashbook receipts & payments and transfers between banks.

This includes the necessity of creating bank accounts for methods that are not necessarily an actual bank account, for instance Credit Cards, Petty Cash, Tills etc.

Each Bank account is assigned to a Legal entity and for bank reconciliation purposes each bank account is linked to a bank posting Attribute.

Bank accounts are accessed via the Quick Launch or the Pulse icon.

Note

If Data Access Control is being utilised on the system only users with access to the relevant legal entity will be able to view, create & use the bank accounts.

Only users with access to the Bank account admin role will be able add or amend the Bank account record.

How to view Bank Accounts

Viewing Bank Accounts

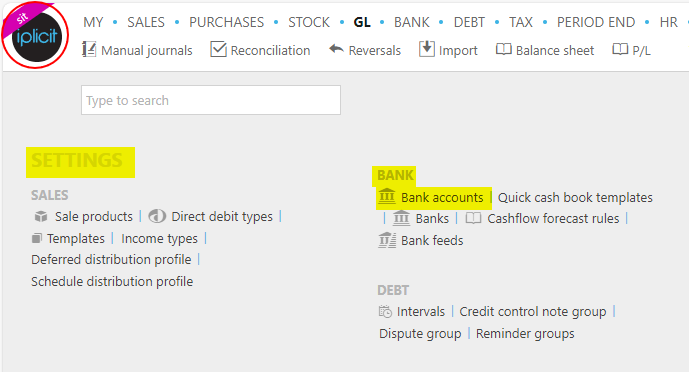

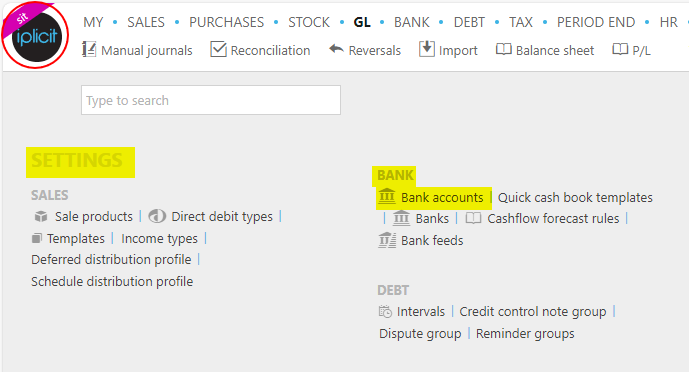

Select Bank / Bank accounts from the Settings section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

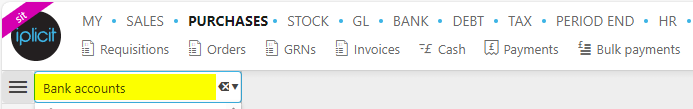

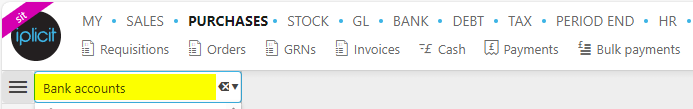

or enter Bank accounts in the Quick Launch Side Menu.

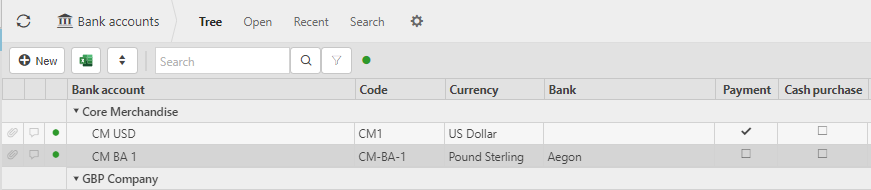

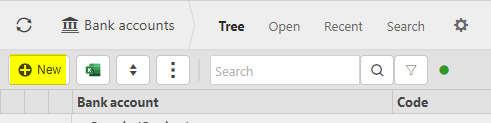

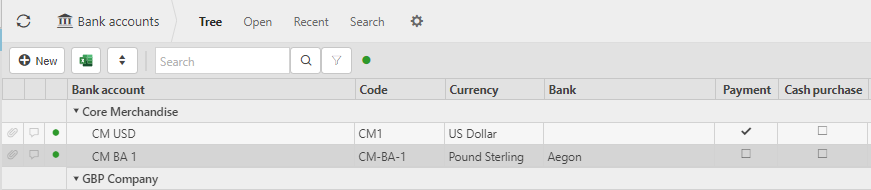

This will then show the Bank accounts on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to create Bank Accounts

Create Bank Account

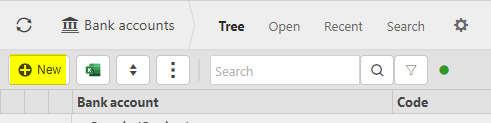

Select Bank accounts from one of the options as shown above in Viewing Bank Accounts

Select New

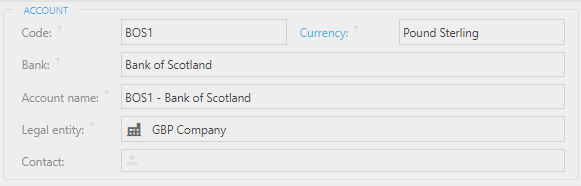

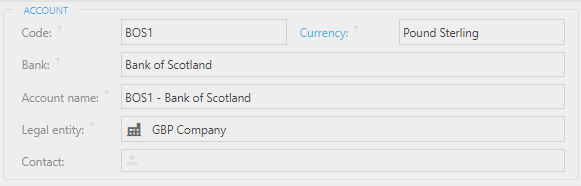

Complete the Account section with the initial details of the bank account.

- Code: Code for the bank account (mandatory).

- Currency: Select from list.

- Bank: Select from list.

- Account Name: Name as it appears on bank details (Mandatory).

- Legal Entity: Select from list.

- Contact: Select from list if a resource on the system is the main contact (optional).

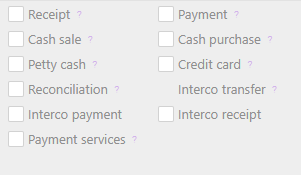

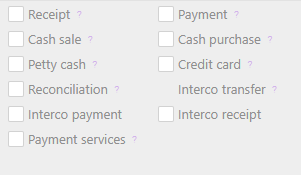

Complete the Flag section

Receipt: Tick if this Bank Account accepts receipts.

Cash sale: Tick if this Bank Account can be used for cash sales.

Petty Cash: Tick if this Bank Account is used for Petty Cash.

Reconciliation: Tick if Bank Reconciliations will be made for this Bank Account.

Interco payment: Tick if this Bank Account is used for Intercompany payments.

Payment: Tick if payments can be made from this Bank Account.

Cash purchase: Tick if this Bank Account can be used for cash purchases.

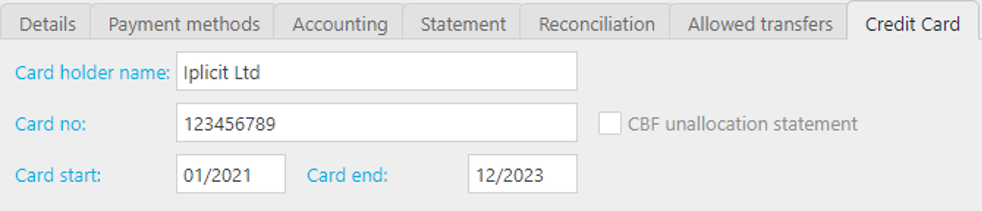

Credit Card: Tick if this Bank can be used as a credit card.

Interco transfer: Tick to allow Interco movements to/from this Bank Account.

Interco receipt: Tick if the Bank Account is used for Intercompany receipts.

Payment services: Tick this option to make this bank account available for recording Payment services transactions.

Note

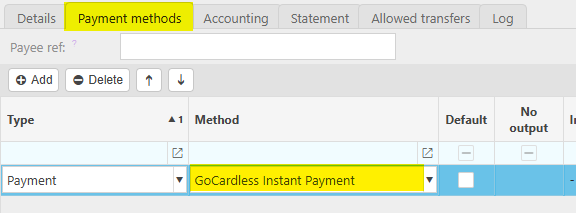

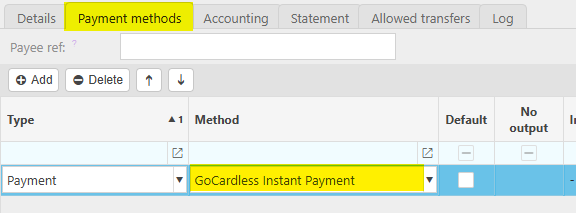

When creating this Bank account to be used as the Payment Service Account to post the receipts to, you will need to ensure that the correct GoCardless payment method is selected when creating the bank account, otherwise the payment method on the receipt is not populated when they're automatically created.

The Tabs

- Account No: Bank account number (mandatory).

- Sort code: Bank sort code (mandatory).

- IBAN: International Bank Account Number.

- Branch: Branch name where the account is held.

- BIC: Bank Identifier Code used for international money transfers.

- Aba/routing: 9-digit number American Bankers Association routing number code.

- OIN: Originators Identification Number (SEPA).

Tip

For Petty Cash etc. where there is no account & sort code just enter random numbers as they will never be used.

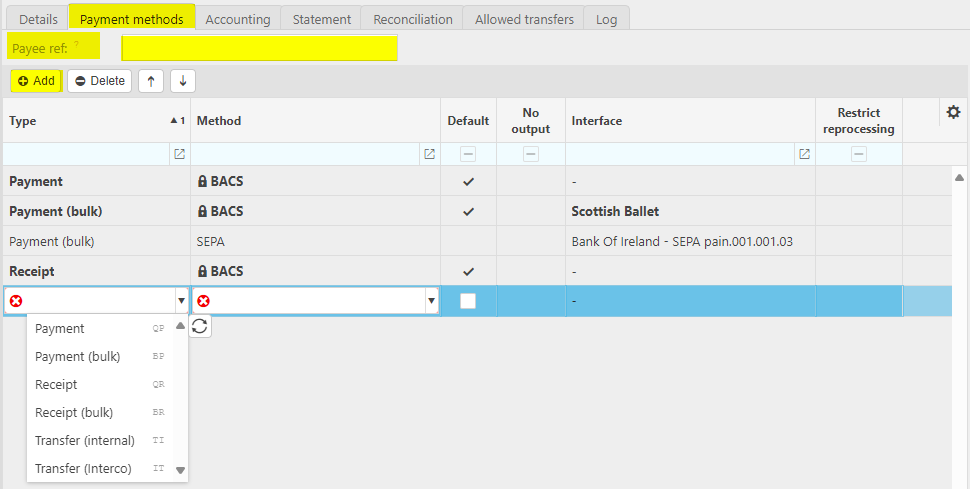

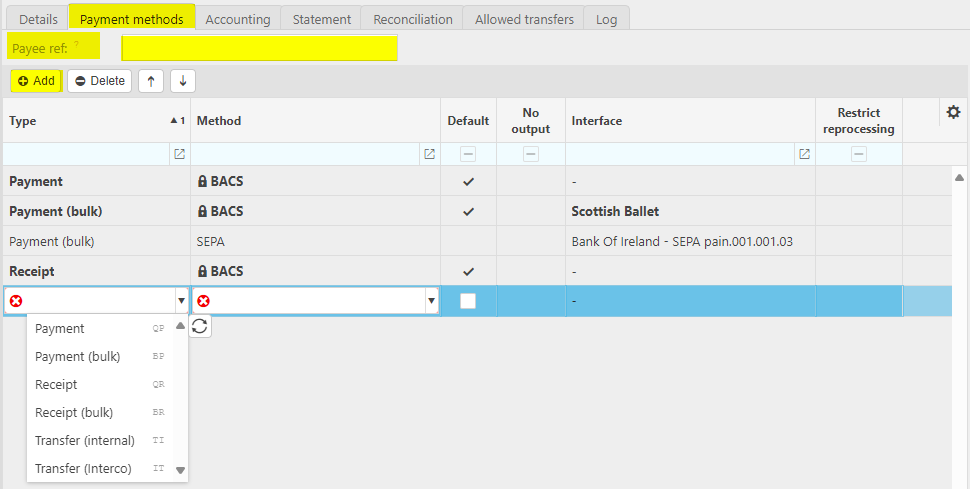

Enter the Payment methods tab.

Add all the types of Payment, Receipts & Transfers used on this bank account, only the payment methods entered in this list will be available at transaction level.

Payee ref: If required, this field should be completed to be used on any interfaces with the bank.

Note

This tab only displays if the Receipt or Payment tick boxes have been selected.

Press Add to display a new line.

Type: In addition to payments & receipts, Internal transfers are used for bank transfers within the same legal entity, Interco transfers are for bank transfers between different legal entities.

Method: Known bank output formats e.g. BACS.

Default: This will default this payment method for the type.

No output: If selected, no output is required (e.g. Bulk payment file output).

Interface: E.g. the payment file that will be produced to send to the bank. Where the payment type is a Batch there is the option to select whether as part of the process an output file should be created. If so, the relevant Interface should be selected from the available list.

Restrict reprocessing: When selected, the output cannot be recreated. If left un-ticked allows the batch file to be re-produced in case of the original file being lost/deleted.

Note

You will not be able to nominate the bank accounts to transfer to without the relevant payment type.

There can be many methods of each type of payment one of which can be set as the default method.

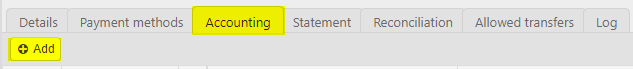

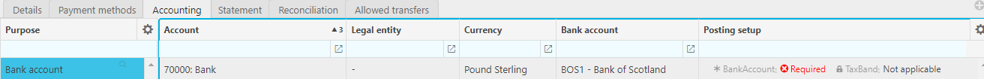

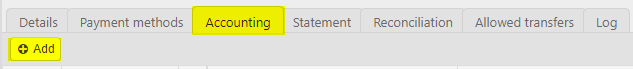

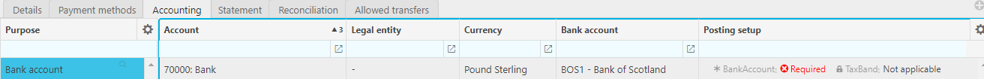

Use this tab to view or set a default Chart of account for this Bank Account on related cashbook postings.

Tip

You can also default a Chart of account to each Bank account from within the account defaults.

The account must be created first to enable the account code to be assigned to it.

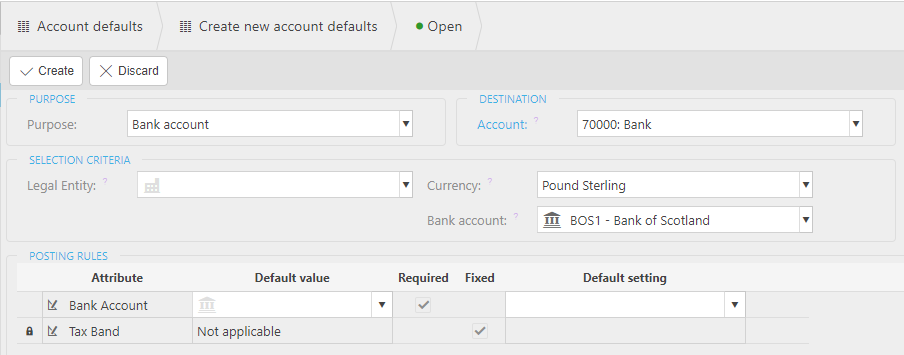

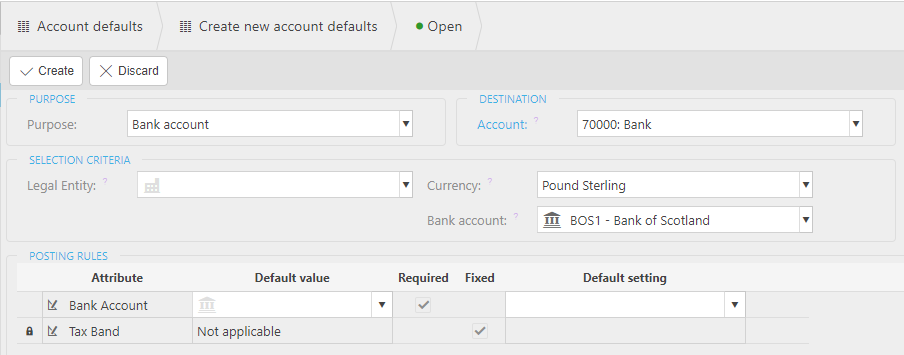

Press Add to display the Account defaults record.

Some of the fields may be pre-populated based on where the account defaults are created.

Purpose: This is type of role for this default. If created directly on the bank account this will be pre-populated, if created from the account defaults this should always be Bank account.

Bank Account: If created directly on the bank account this will be pre-populated, if created from the account defaults the relevant bank account should be selected.

Legal entity: The legal entity this account belongs to; this should only be completed if the account used is specific for just this legal entity. For instance, there could be one General Ledger code that is used by all legal entities therefore this should be left blank.

Account: The General Ledger code to be used for transactions when this bank account is used.

Tip

The same General Ledger code can be used for multiple bank accounts.

Once selected the Attributes associated to the General Ledger code display in the section below, which can be over-written if required or defaulted back using the Reset from rule button.

Currency: Select Bank Account currency.

Once completed select Create, or Discard if not required.

Tip

The details will display on the accounting tab which can be edited if required.

Each bank account needs an interface to accommodate the layout of the bank statement.

Note

iplicit has a library of bank statement layouts, but new layouts can be created if there is no existing layout to suit the format needed.

Complete the Statement interface, frequency & day when the statement is received.

Note

Statements can be scheduled to run based on these settings via the Scheduler, but statements can be manually imported at any time by the user.

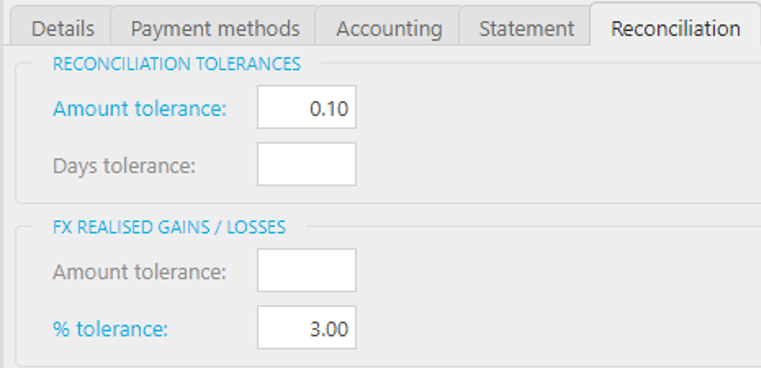

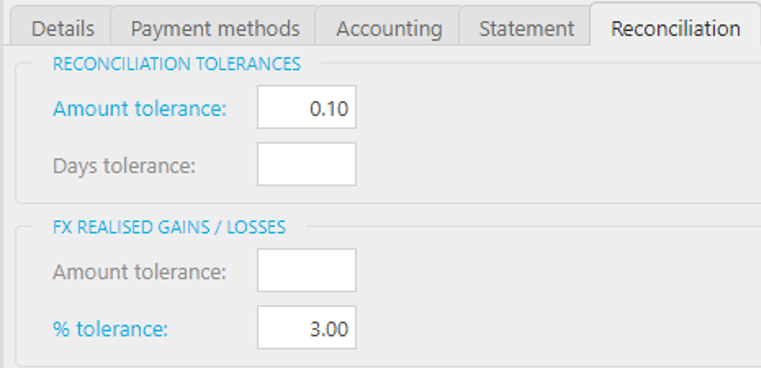

This tab is only visible if the Reconciliation check box has been ticked.

Tip

There will be instances on a bank reconciliation where the amount in the bank is different to the entry in the cash book thus requiring an amending transaction for the reconciliation to be able to balance. If the value is small rather than manually creating the amending transaction the system will create a Cash book entry to the nominated Penny Difference or FX Realised General ledger control account.

Note

This does not automatically create any transaction; it simply displays the option if the difference between the bank and the cashbook values are attempted to be Matched allowing the user to proceed or cancel the Match.

Add tolerance percentages and amounts

Reconciliation tolerances

- Amount tolerance: This is the acceptable amount to be used when matching transactions in the bank currency.

- Days tolerance: This is where the number of days between the bank transaction and the system transaction must be within range.

FX Realised Gains/Losses

Amount Tolerance: If the transaction being matched is in anything other than the bank currency this would be the acceptable amount to be written off as a currency gain/loss.

% Tolerance: If the transaction being matched is in anything other than the bank currency this would be the acceptable percentage value of the transaction to be written off as a currency gain/loss.

Tip

The percentage tolerance has a greater level of flexibility than a fixed amount, for instance £5 is large tolerance of a £10 transaction but too small to have limitations of a £10K transaction. Whereas the percentage would apply according to the value.

How to Import Bank Details

Import Bank Details

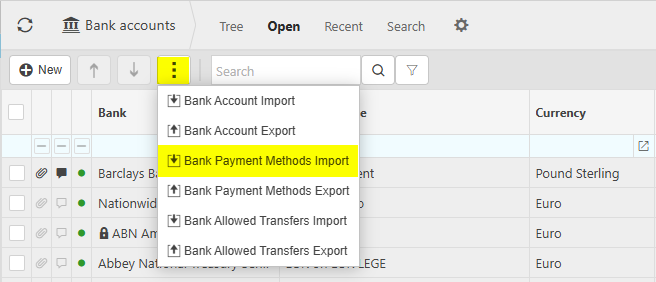

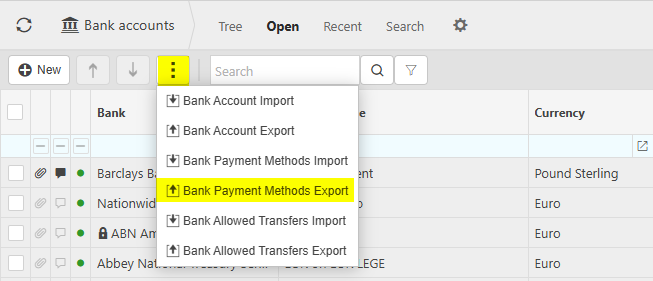

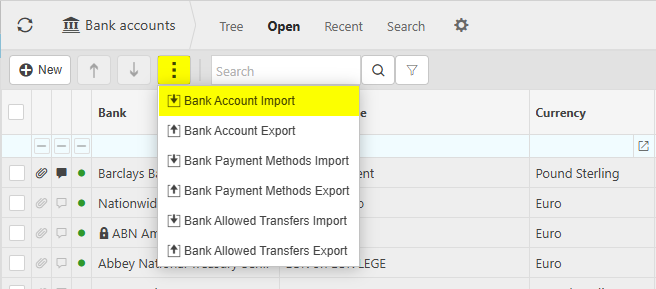

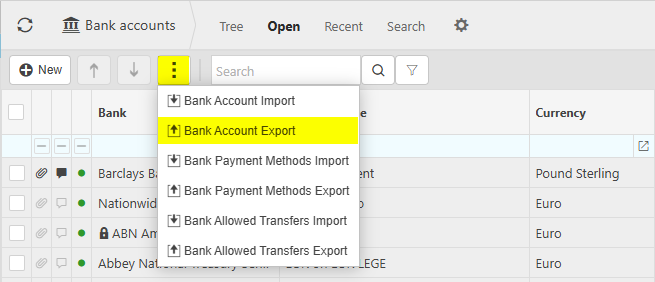

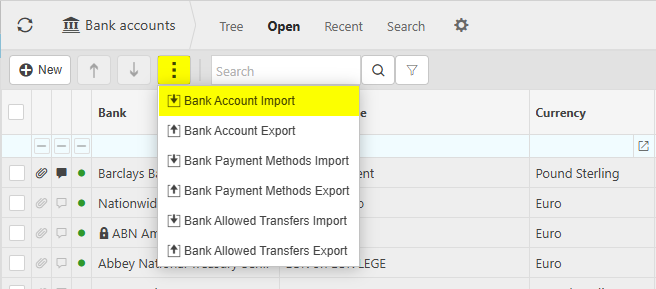

Select Bank accounts from one of the options as shown above in Viewing Bank Accounts.

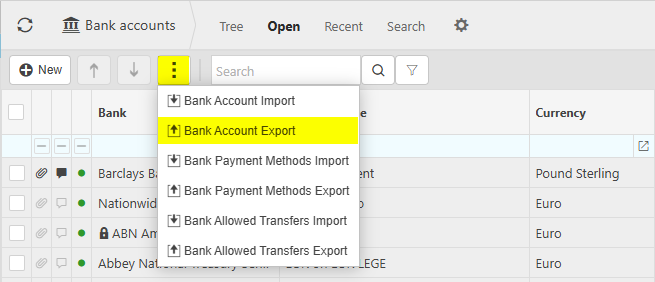

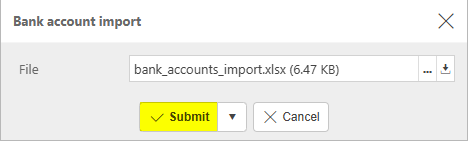

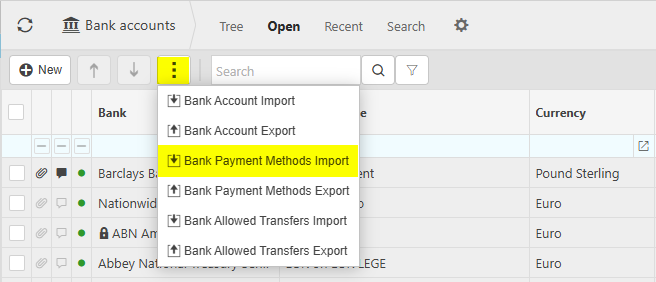

Select Bank Account Import from the  icon.

icon.

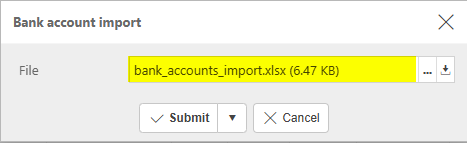

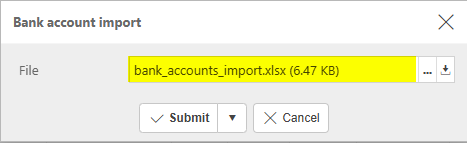

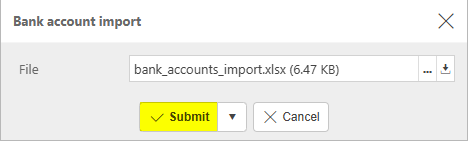

Enter the filename to Import.

Tip

To create an Import file with the correct formatting, Export a file first and save to your external source. Then use this file to add updated bank details.

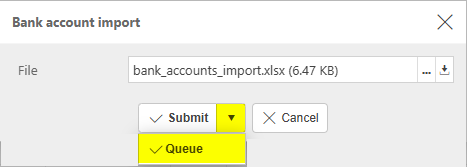

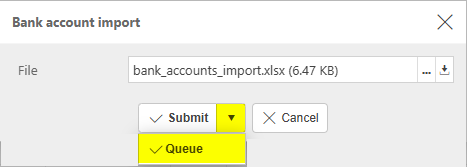

Select Submit.

Selecting Queue from the dropdown option will queue the import process until other actions in iplicit are completed.

Warning

iplicit allows a maximum of 5,000 rows in a single Import.

If your Import is too large, an error message will tell you that the Import cannot be processed and will advise you to create smaller Import files.

If the latter is not possible, please contact Customer support.

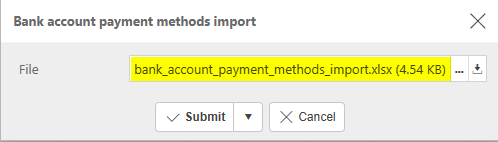

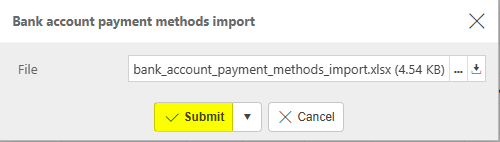

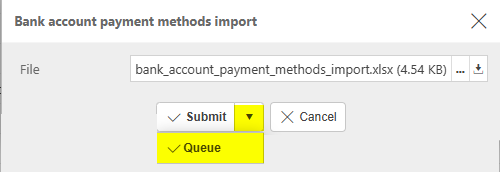

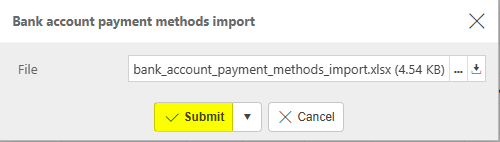

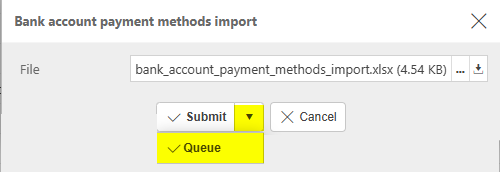

Select Bank accounts from one of the options as shown above in Viewing Bank Accounts.

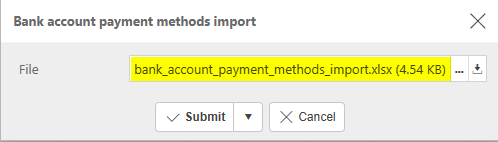

Select Bank Payment Methods Import from the  icon.

icon.

Enter the filename to Import.

Tip

To create an Import file with the correct formatting, Export a file first and save to your external source. Then use this file to add updated bank details.

Select Submit.

Selecting Queue from the dropdown option will queue the import process until other actions in iplicit are completed.

Warning

iplicit allows a maximum of 5,000 rows in a single Import.

If your Import is too large, an error message will tell you that the Import cannot be processed and will advise you to create smaller Import files.

If the latter is not possible, please contact Customer support.

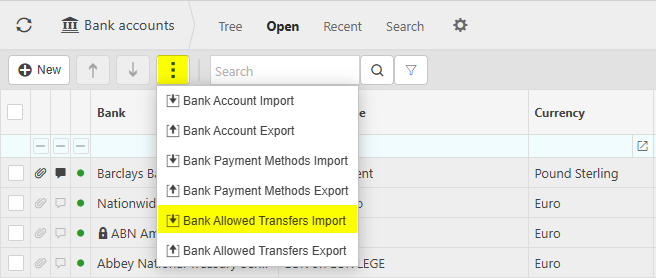

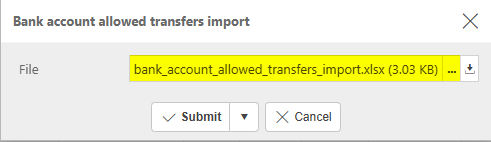

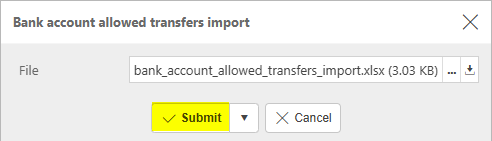

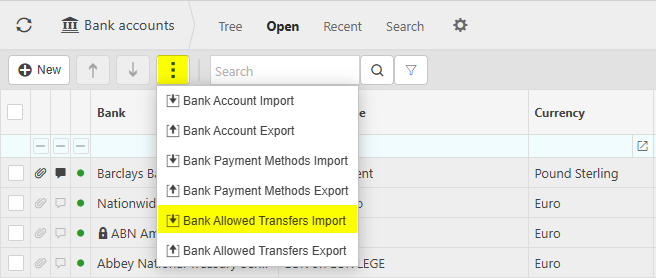

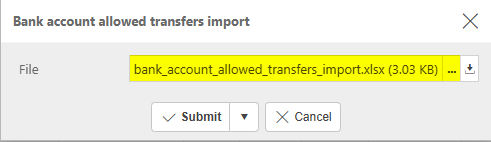

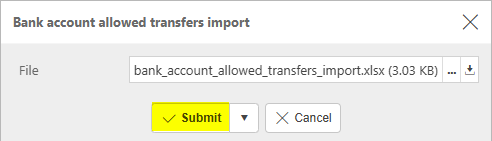

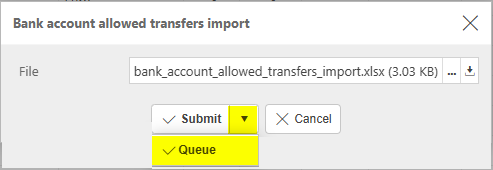

Select Bank accounts from one of the options as shown above in Viewing Bank Accounts.

Select Bank Allowed Transfers Import from the  icon.

icon.

Enter the filename to Import.

Tip

To create an Import file with the correct formatting, Export a file first and save to your external source. Then use this file to add updated bank details.

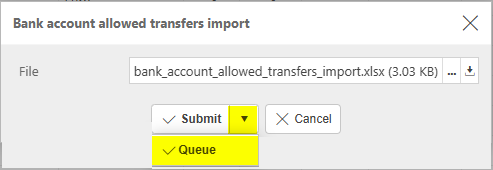

Select Submit.

Selecting Queue from the dropdown option will queue the import process until other actions in iplicit are completed.

Warning

iplicit allows a maximum of 5,000 rows in a single Import.

If your Import is too large, an error message will tell you that the Import cannot be processed and will advise you to create smaller Import files.

If the latter is not possible, please contact Customer support.

How to Export Bank Details

Export Bank Details

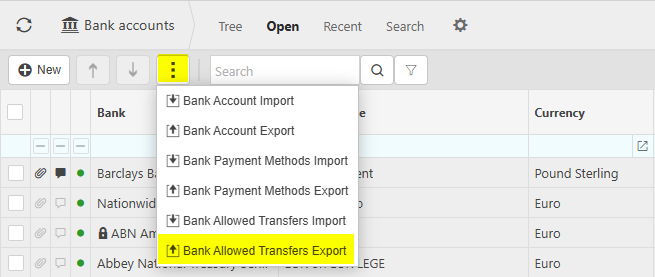

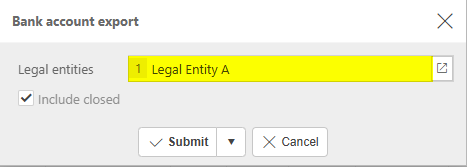

Select Bank accounts from one of the options as shown above in Viewing Bank Accounts.

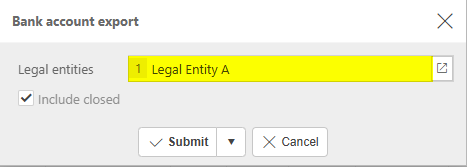

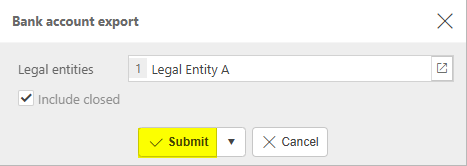

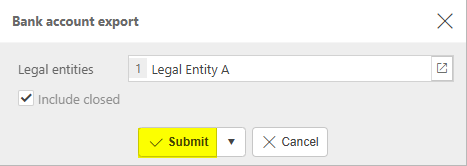

Select Bank Account Export from the  icon.

icon.

Enter the options for exporting.

- Legal entities: Enter Legal Entities to export from the dropdown list.

- Include closed: Tick to include closed bank accounts.

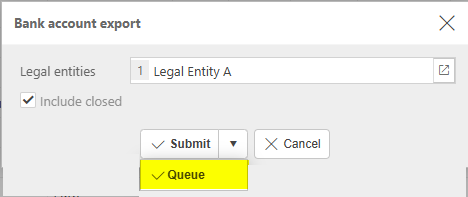

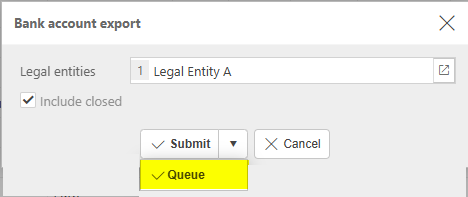

Select Submit.

Selecting Queue from the dropdown option will queue the export process until other actions in iplicit are completed.

The Export file is created as an Excel spreadsheet on your local data source.

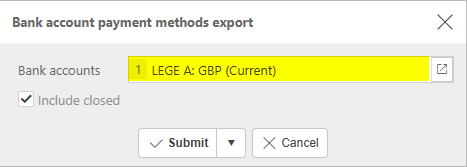

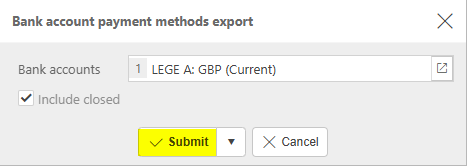

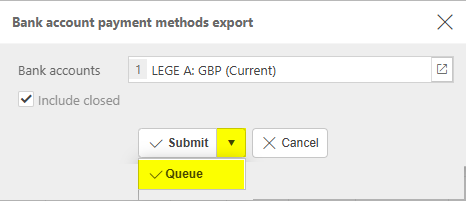

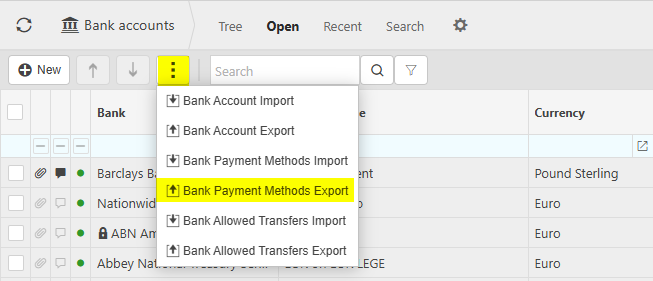

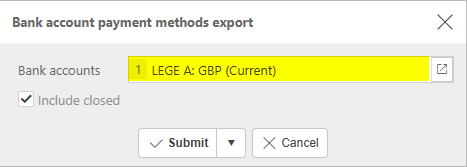

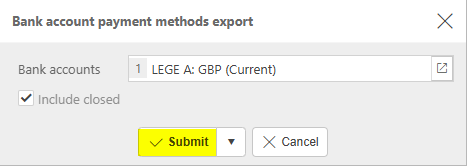

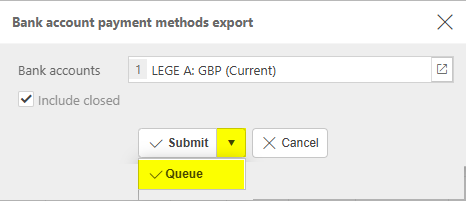

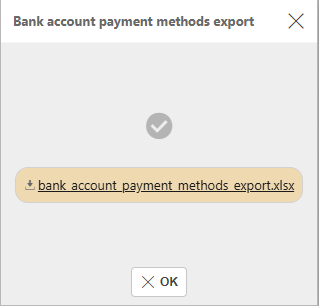

Select Bank accounts from one of the options as shown above in Viewing Bank Accounts.

Select Bank Payment Methods Export from the  icon.

icon.

Enter the options for exporting.

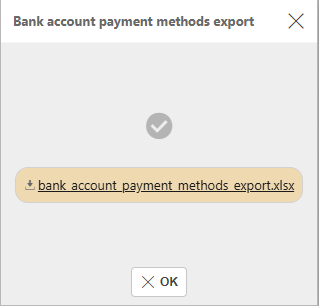

Select Submit.

Selecting Queue from the dropdown option will queue the export process until other actions in iplicit are completed.

The Export file is created as an Excel spreadsheet on your local data source.

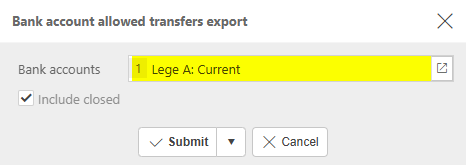

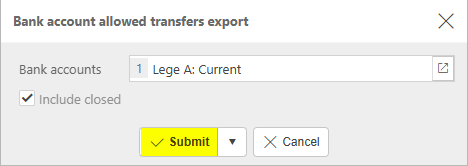

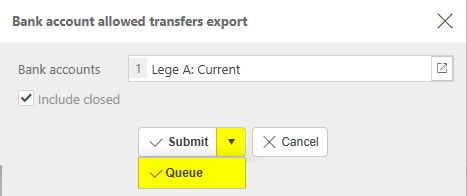

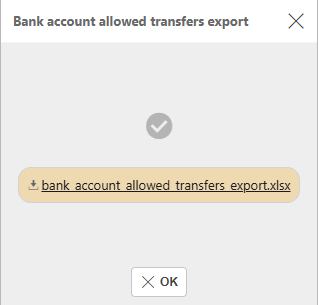

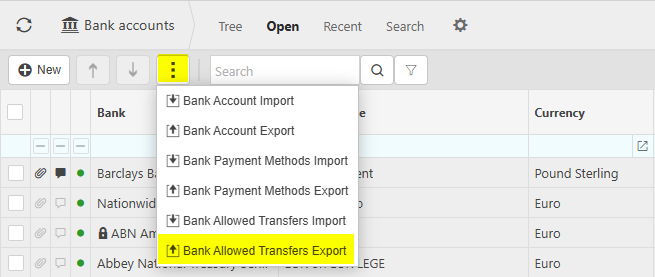

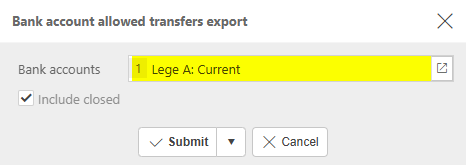

Select Bank accounts from one of the options as shown above in Viewing Bank Accounts.

Select Bank Allowed Transfers Export from the  icon.

icon.

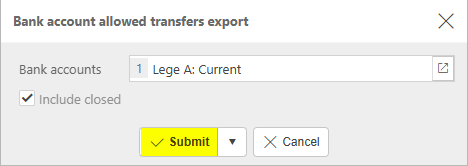

Enter the options for exporting.

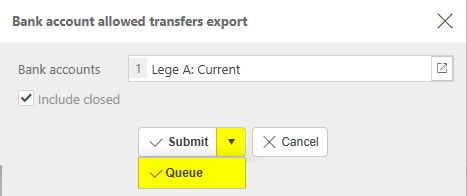

Select Submit.

Selecting Queue from the dropdown option will queue the export process until other actions in iplicit are completed.

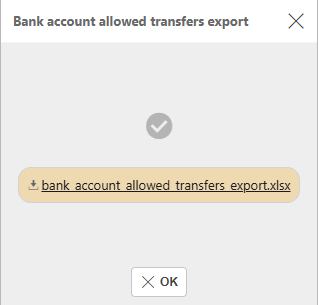

The Export file is created as an Excel spreadsheet on your local data source.

Updated December 2025

on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

icon.

icon.

icon.

icon.