Account defaults

As the name suggests, account defaults are used to default the Chart of account. The default that is used varies according to the type of document being entered.

To assist your navigation of the defaults, select a SET or sub group (e.g. Tax) where defaults are logically grouped together.

Typically, there is only one account default per setting e.g. "Tax: Input VAT" but there are also settings where it may be preferable to have multiple account defaults e.g. Bank account.

Some of the defaults below are optional but initially, the minimum defaults that must be set include Bank, Tax and Control.

In due course, when you wish to process other documents e.g. Accruals or Year End then the Period end defaults must be set. The same is true for e.g. FX documents with settings such as FX realised, etc.

Account defaults can be set either from this form or from many of the related finders/ editors e.g. Bank Account.

Tip

Review all the defaults and consider which processes you will be running as a business and where appropriate, set the appropriate defaults in advance to avoid errors or confusion at a later point.

Note

If the defaults are not set, then certain related documents may fail to be either created or posted.

Sub-groups

- Period end

- Assets

- Interco

- Charges

- Tax

- Sale

- Payroll

- Product

- Stock

- Control

- Foreign Exchange (FX)

- Bank

- Penny correction

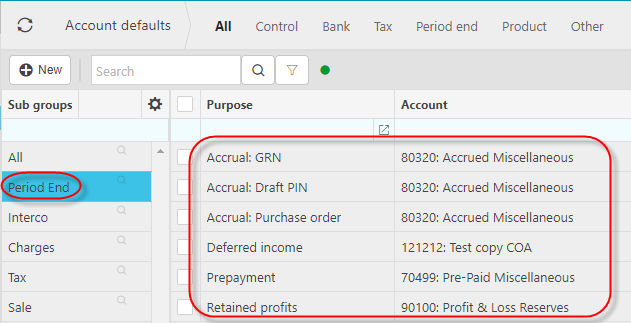

Period End defaults

The following are defaults specifically used for Period End and include Accruals, Deferred income, Prepayment and Retained profits. These are used in such processes such as Accrual Automations and Year end rollover.

With the following selection criteria.

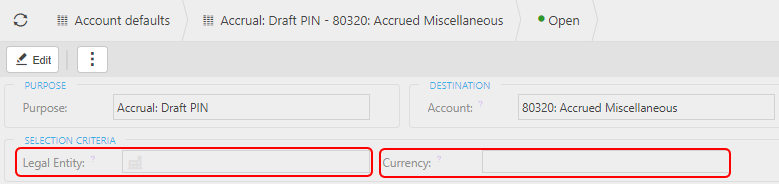

Destination Account: This is the destination Account that will be defaulted from the selection criteria.

Legal Entity: By entering a Legal Entity, this will be used as part of the selection criteria when defaulting the destination account.

Currency: By entering a Currency, this will be used as part of the selection criteria when defaulting the destination account.

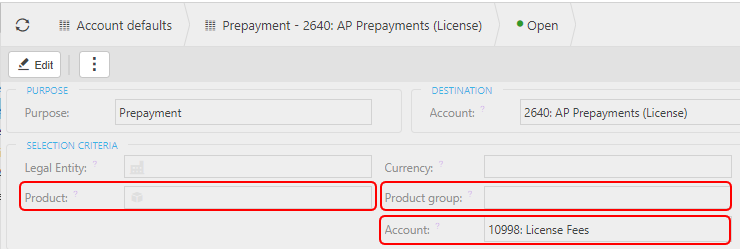

If you select Deferred income or Prepayment, the following additional fields will show.

Product: By entering a Product, this will be used as part of the selection criteria when defaulting the destination account.

Product group: By entering a Product Group, this will be used as part of the selection criteria when defaulting the destination account.

Account: By entering an Account, this will be used as part of the selection criteria when defaulting the destination account.

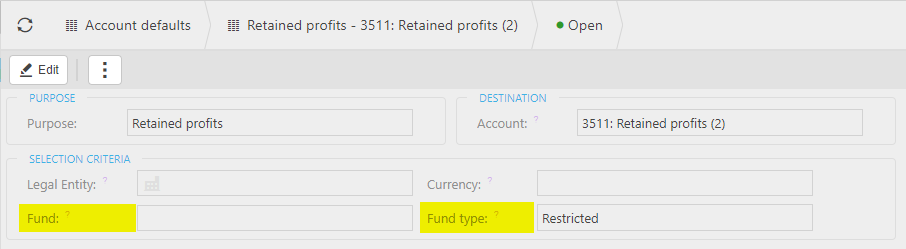

If you select Retained profits, the following additional fields will show.

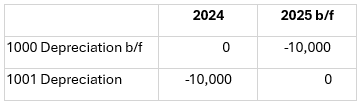

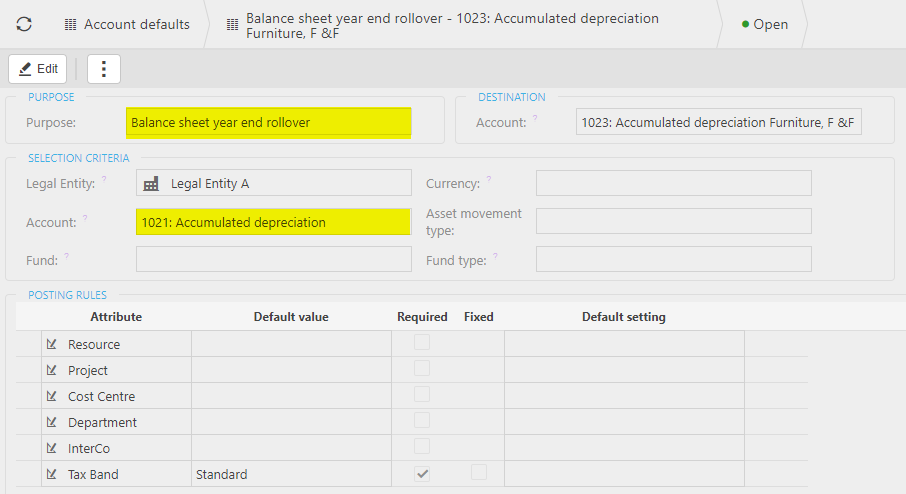

Selecting Balance sheet year end rollover.

This allows the ability for the year end rollover process to roll forward a balance to a specific account - so you can see balances brought forward from prior years in separate nominal codes.

For example:

- Account: By entering an Account, this will be used as part of the selection criteria when defaulting the destination account.

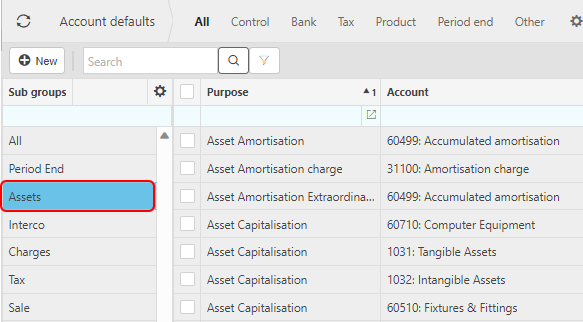

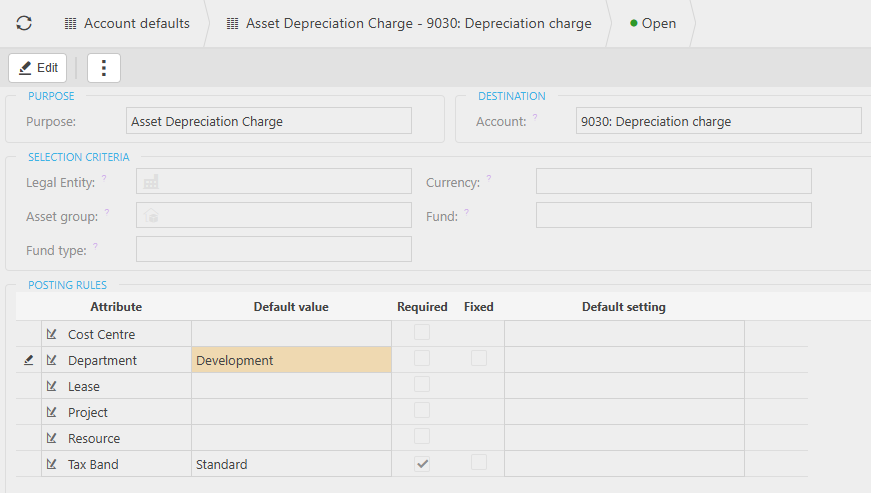

Assets defaults

These defaults are specifically related to Assets

Select an Account default or select New.

- Entering data into Legal entity, Currency, Asset group, Fund or Fund type from their individual dropdown options, will use these values as part of the selection criteria when defaulting the destination account.

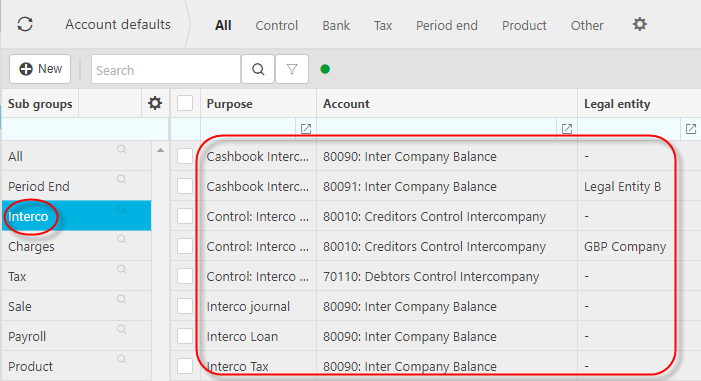

Interco defaults

The following are defaults specifically used for Interco related defaults.

Tip

Interco chart of accounts must have "Interco" ticked on the account and the attribute must be included on the related Chart of Account rule.

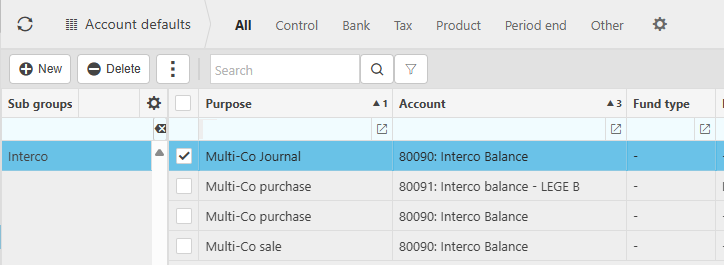

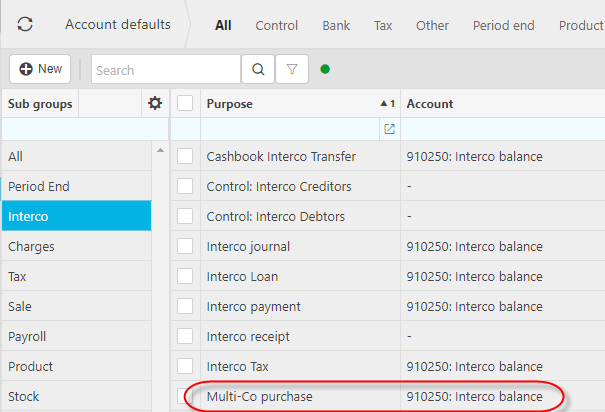

Multi-Co Journal

This is required for intercompany balances when using the Multi-Co Journal automation.

Multi-Co Purchase

This is required if the processing of Multi-Co Purchase invoices is used.

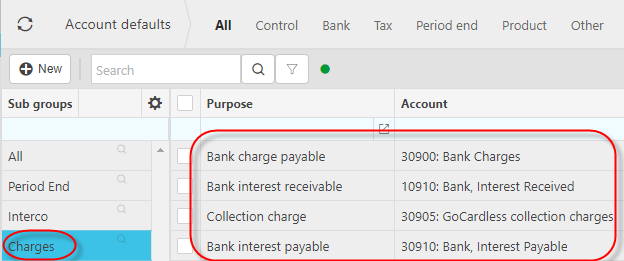

Charges defaults

These defaults are specifically related to charges.

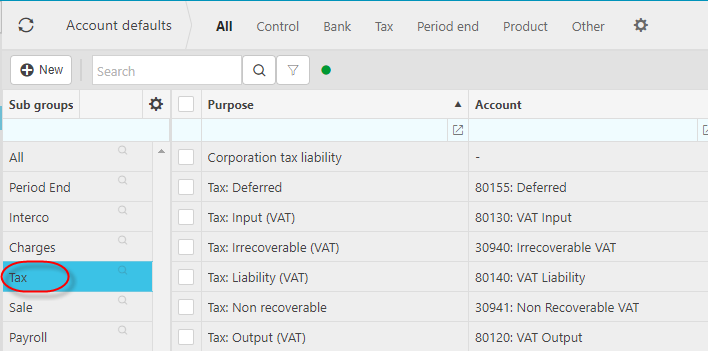

Tax defaults

The following are defaults specifically used for Tax related defaults.

As a minimum, the "Tax: Input (VAT)" and "Tax: Output (VAT) defaults must be set. Additionally, to be able to perform a Tax Return (AKA VAT return), the "Tax: Liability (VAT)" must be set.

The "Tax: Non-recoverable" default is only appropriate if you are processing Non-recoverable tax. A separate Chart of account code is commonly used to distinguish tax lines of this type.

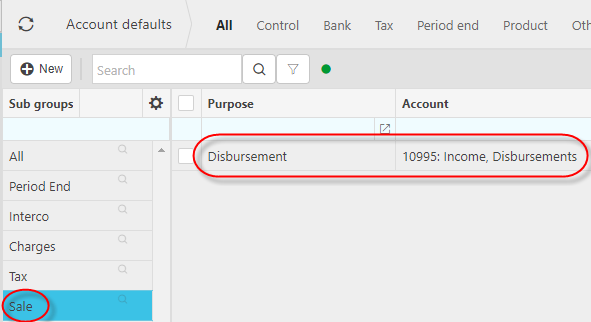

Sale defaults

These defaults are specifically related to Sales.

Sale disbursements for example are a semi-automated process either from a Sale Invoice or via the Scheduler. This process relies upon this setting to be able to create the income line.

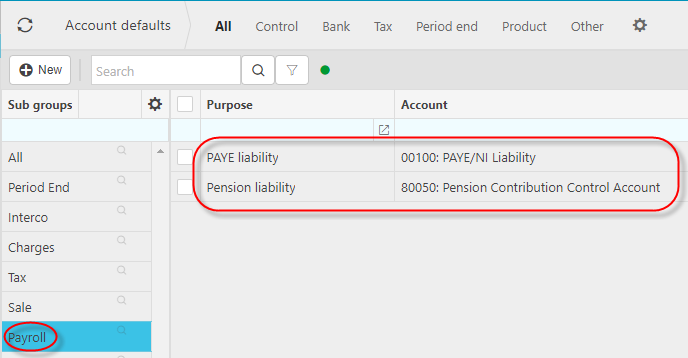

Payroll defaults

These defaults are specifically related to Payroll.

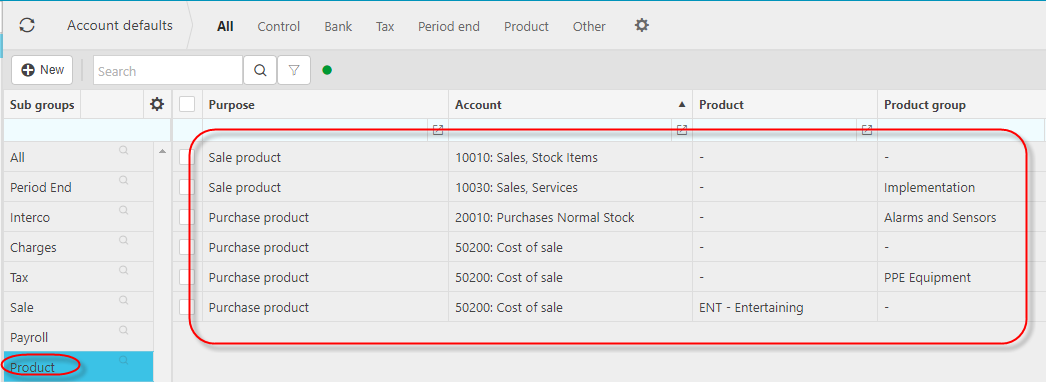

Product defaults

These defaults are used for products (Sale Products, Purchase Products, Expense Products, Timesheet Products, etc).

Tip

Product Group is an effective method of assigning accounts defaults for related products.

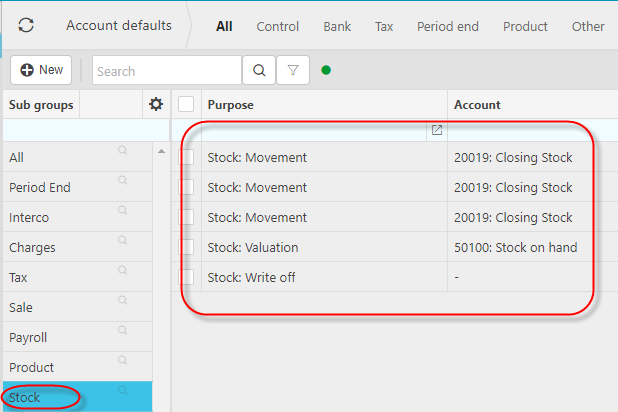

Stock defaults

These defaults are used for stock.

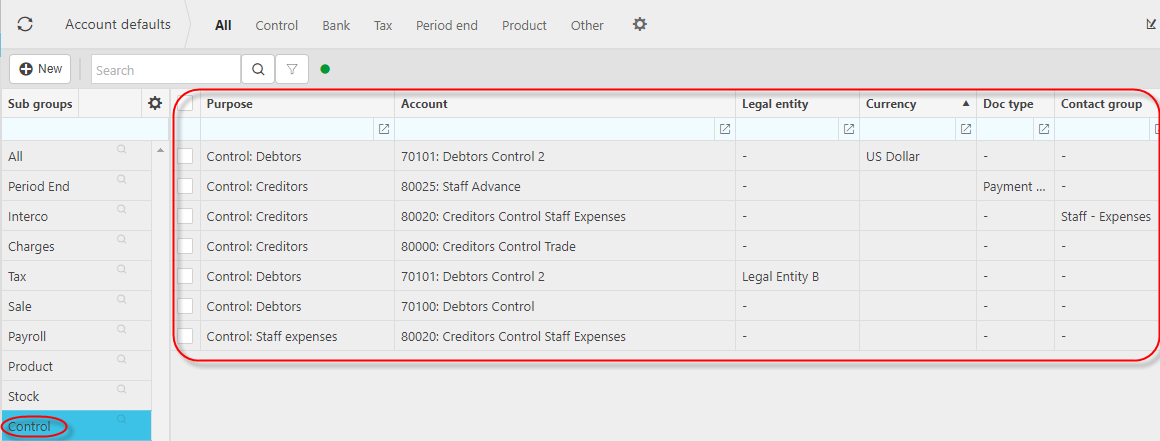

Control defaults

These defaults are used for the assigning of the Control account for Sale and Purchase documents as well as expenses.

Tip

Multiple control account defaults can be used e.g. to distinguish Debtors (AKA Customers) for different currencies or perhaps between Suppliers and Staff expenses.

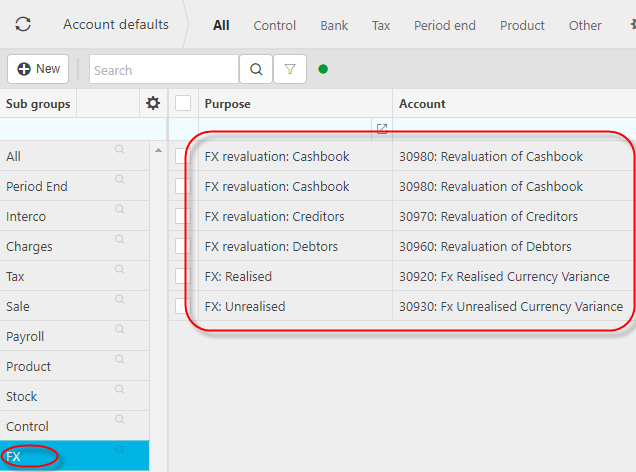

Foreign Exchange (FX) defaults

These defaults are specifically related to Foreign Exchange documents.

Bank defaults

Where all Bank Accounts share the same Chart of account code, only one setting is needed but it is also possible to create a separate account default value e.g. per Bank Account or per Currency.

- Other options to default the Chart of account code related to the Bank Account include Legal Entity, Document type , Contact Group, Contact Account Customers or Supplier, Tax Band, Tax Code, Tax Group.

The example below shows sample defaults determined by Currency, specific Bank Account, and Legal Entity.

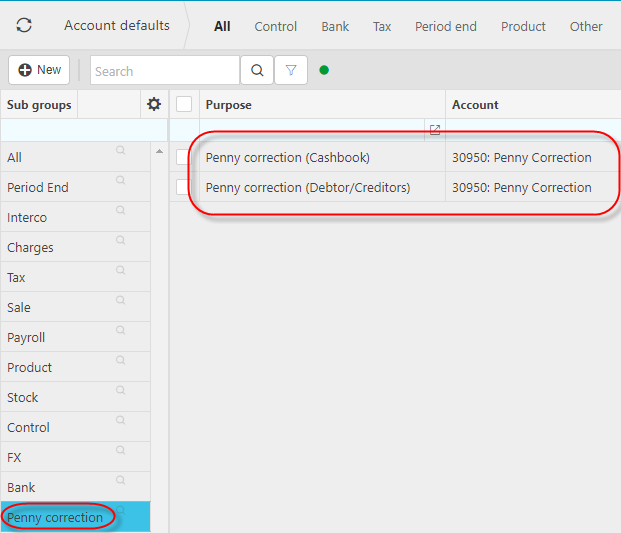

Penny correction defaults

These defaults are used if you wish to perform Penny corrections, either manually or as an automation.

Updated April 2025