VAT Returns

A VAT Return is a form that businesses registered for Value Added Tax (VAT) in the UK must submit to HM Revenue and Customs (HMRC). This form details the amount of VAT a business has charged on its sales (output tax) and the amount of VAT it has paid on its purchases (input tax) during the accounting period.

How to view VAT Returns

Viewing VAT Returns

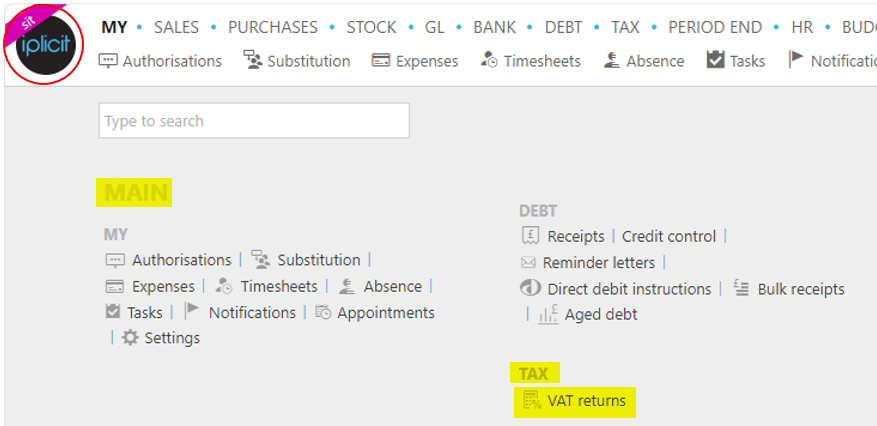

Select Tax / Vat Returns from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

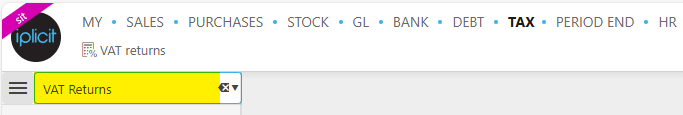

or from the Main Menu select Tax then VAT Returns -

or enter VAT Returns in the Quick Launch Side Menu.

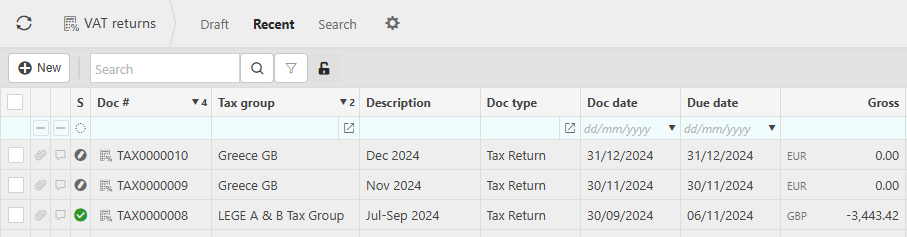

This will then show the VAT Returns on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to create a VAT Return

Create a VAT Return

Select VAT Returns from one of the options as shown above in Viewing VAT Returns.

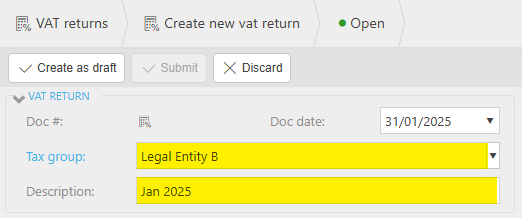

Select New to create a new return.

Note

Multiple VAT returns can be in progress at a time but only one per Tax Group.

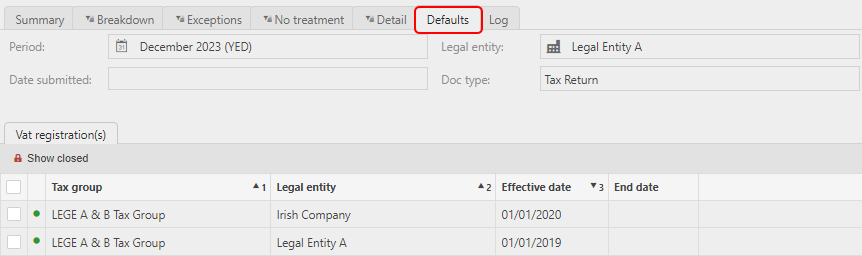

From the

dropdown icon, select the Tax Group and enter a description.

dropdown icon, select the Tax Group and enter a description.

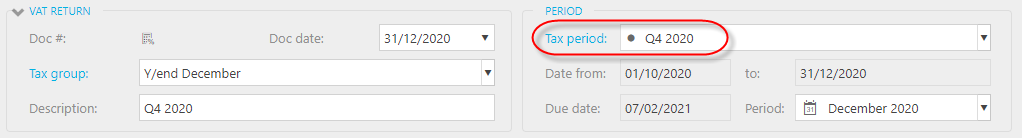

Select the Tax Period.

Note

The Tax Period is not the accounting period, it reflects the date range for which the tax documents refer.

Tax periods are setup based upon the frequency specified on the Tax Group.

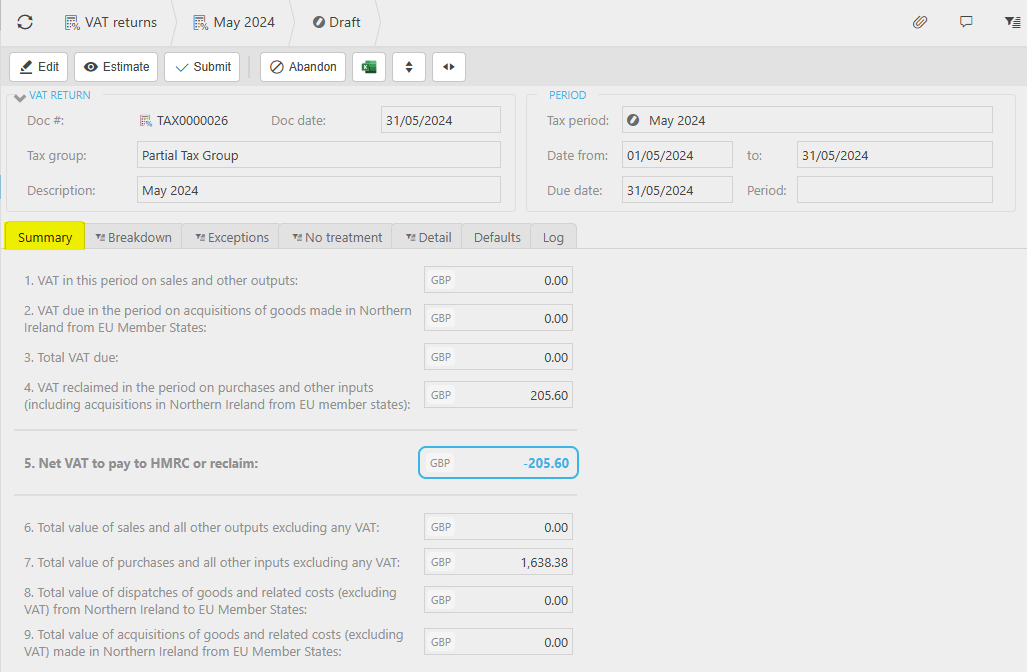

Select Create as Draft.

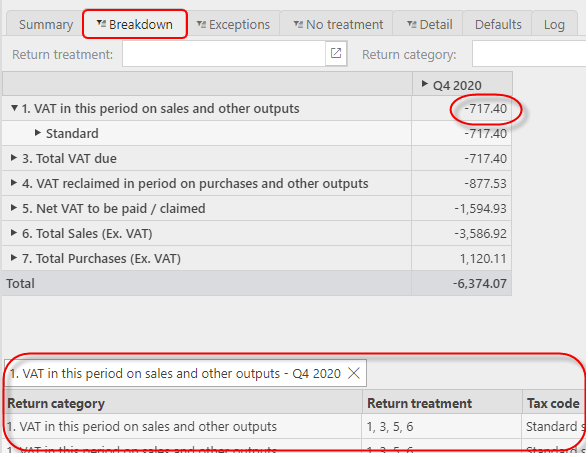

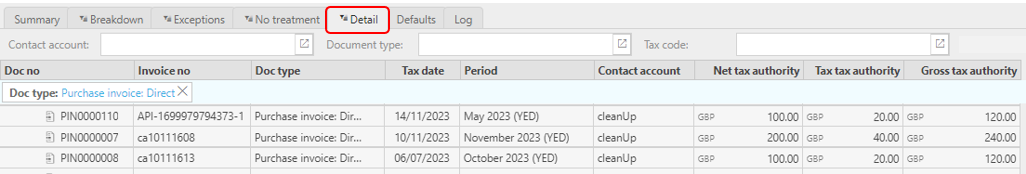

Upon Create as draft, an Estimate will be automatically run and the VAT Return populated as per the vat return type associated with the Tax Authority specified on the Tax Group.

Note

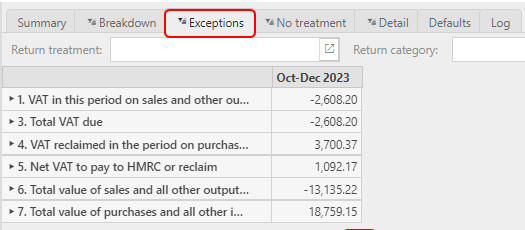

Estimate will find and link all tax posting documents which are <= the VAT return 'date to'. This includes any documents which could be prior to this VAT Return but were not included on a previous return e.g. owing to late document entry after previous VAT Return has been Submitted - see Exceptions tab.

Tip

A Estimate can be manually run at any time and can also be set to auto run by the Scheduler.

Note

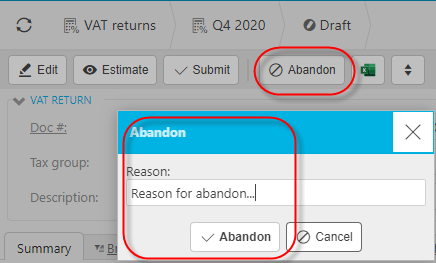

Abandon a VAT Return

Whilst a return is still in draft mode, it can be abandoned.

An abandoned return will deallocate any documents linked to the return.

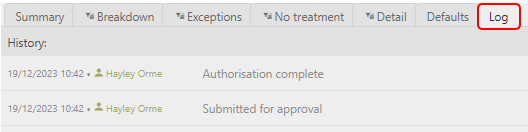

Select Submit to send the VAT Return for authorisation.

Run a fresh Estimate before selecting Submit to ensure all documents at this point are included.

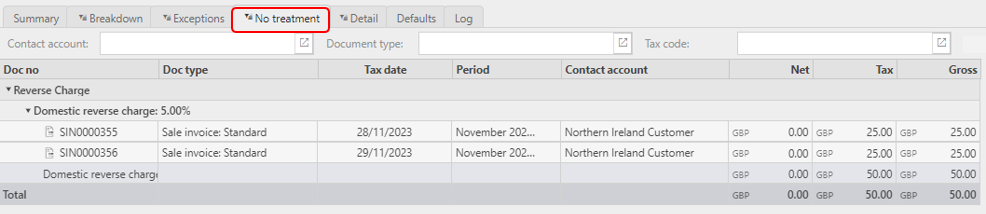

If there are any tax documents which are not entered in time to be picked up in this return, they will be selected and linked in the following return.

If an error occurs, then a banner will show advising the User of the details of the error so that the issue can be rectified without having to contact support.

Following authorisation, unlike e.g. Purchase invoices, the return needs to be Processed and Posted.

Tip

Workflow authorisation is available for VAT returns.

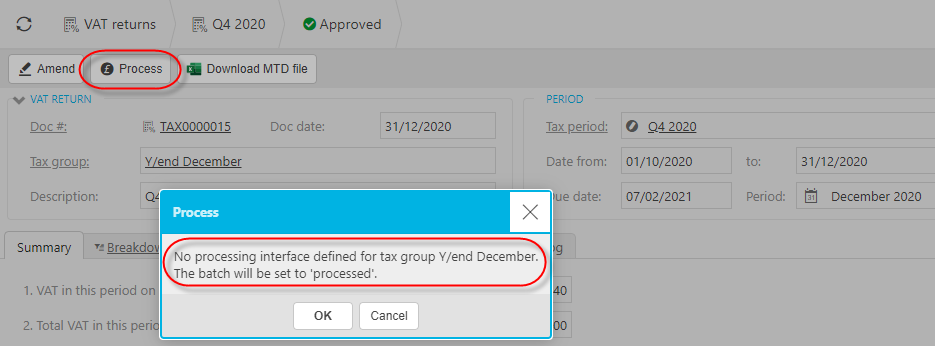

Select Process

The relevant interface as per the Tax Group will be run.

Note

Each Tax Authority may have its' own equivalent MTD then this would be used instead.

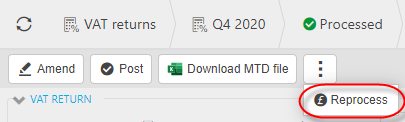

Reprocess

Reprocess is available (with the appropriate permissions) if for whatever reason the first Process needs to be rerun.

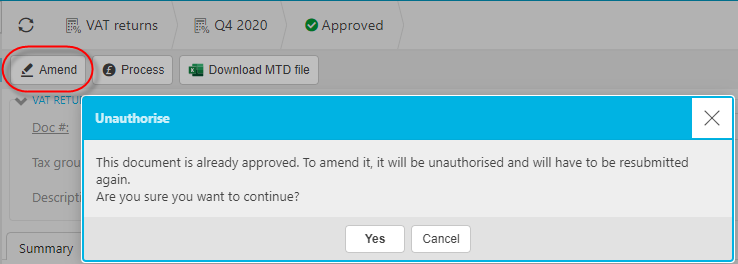

Amend an approved but unposted return

You can amend the content of a VAT Return before it is posted.

Select Amend.

The VAT Return will be changed to a draft state, and the submission will have to be repeated as above.

Either select Download MTD file or Process if MTD registered

Download MTD file

This process is only required (and available) for non MTD registered customers. If the MTD interface is specified on the Tax Group, this button will not be available for selection.

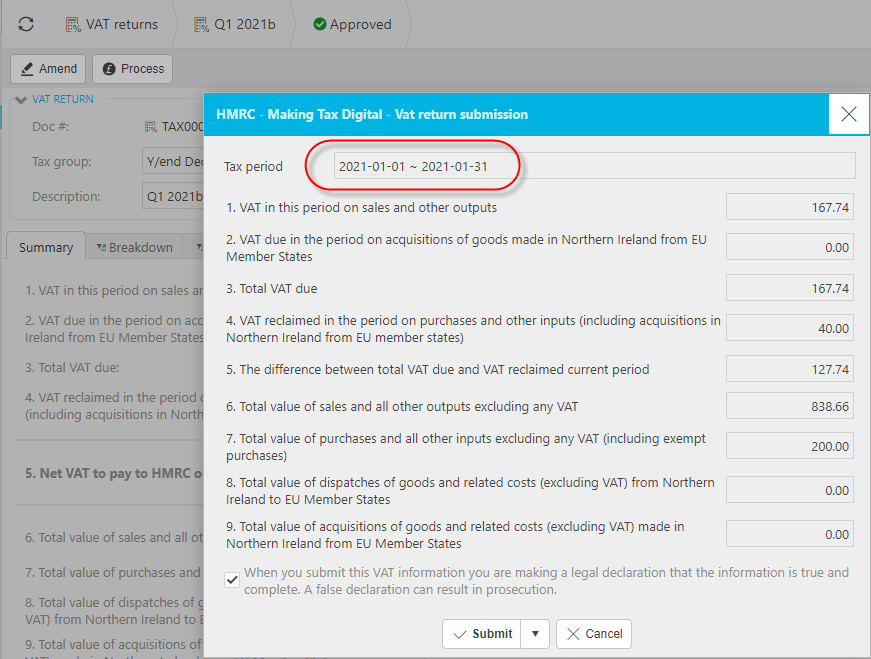

MTD

If the MTD interface is specified on the Tax Group then Process will pop-up a window like the following and upon Submit, the VAT return submission will be automatically sent to HMRC via the MTD interface.

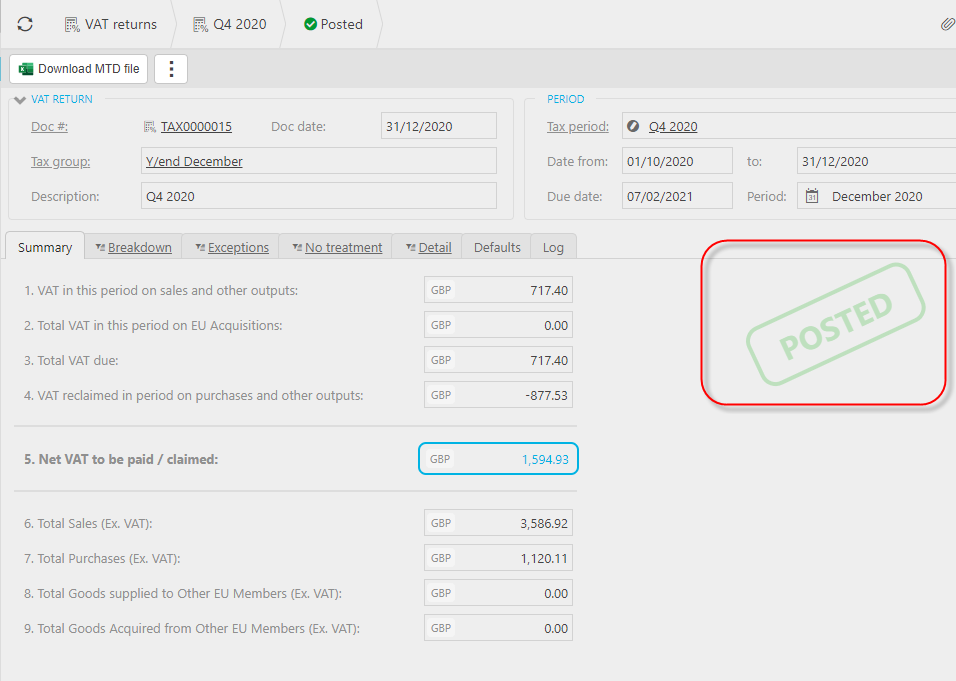

Select Post to enter the completed VAT Return to the general ledger.

Account defaults must be set up correctly before you can post to the GL.

Upon successful post, the return will be stamped with Posted.

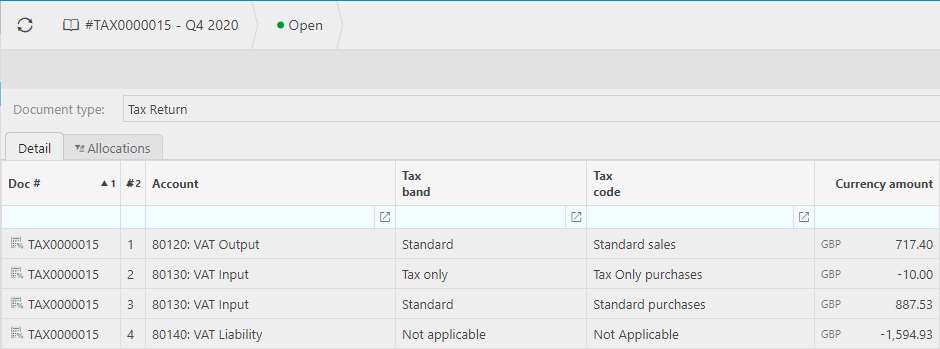

Select General Ledger (GL) to see the posting

The GL posting reverses the input & output tax for each Tax Code included in the VAT Return and creates a VAT liability posting line for the balance.

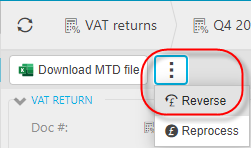

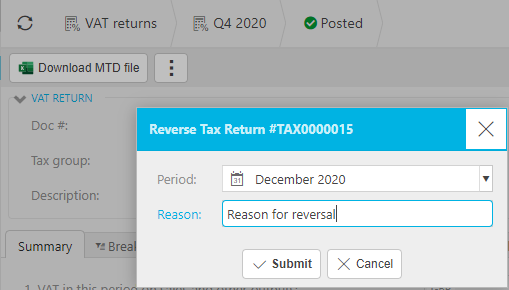

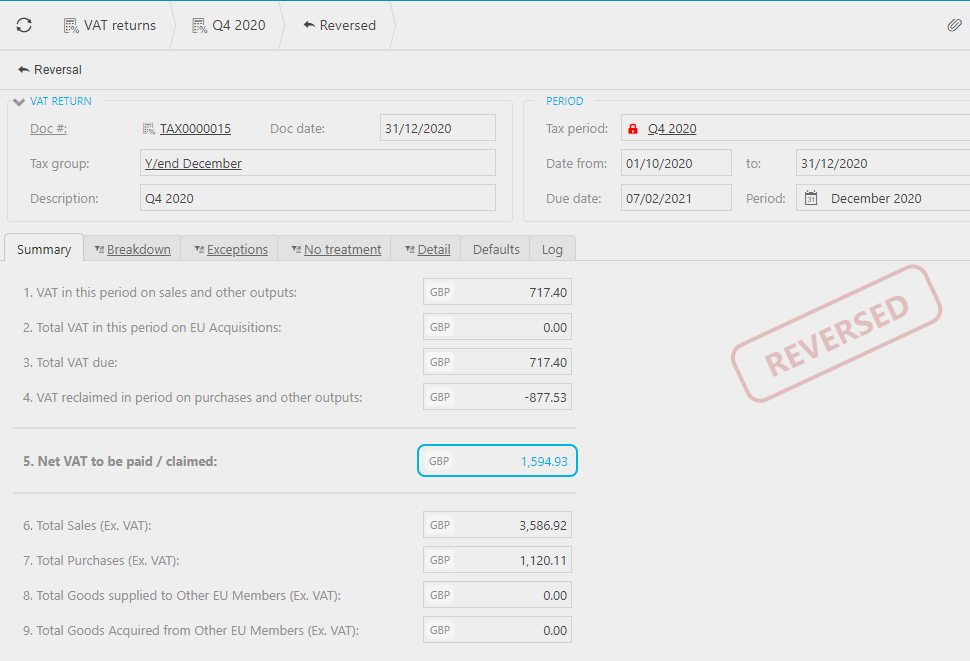

VAT Return reversal

Following posting to the General Ledger, it may be necessary to reverse the VAT return.

Select Reverse.

Enter a reason for the reversal

The posted VAT Return will then be reversed and the documents previously associated with the return will be deallocated and available for selection on another return.

Note

Reversal cannot be performed on VAT Returns submitted via the MTD interface.

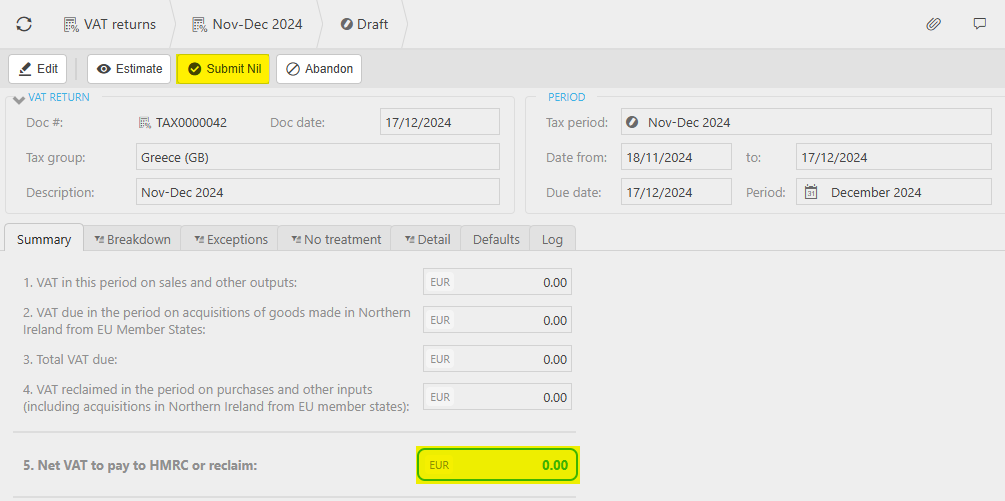

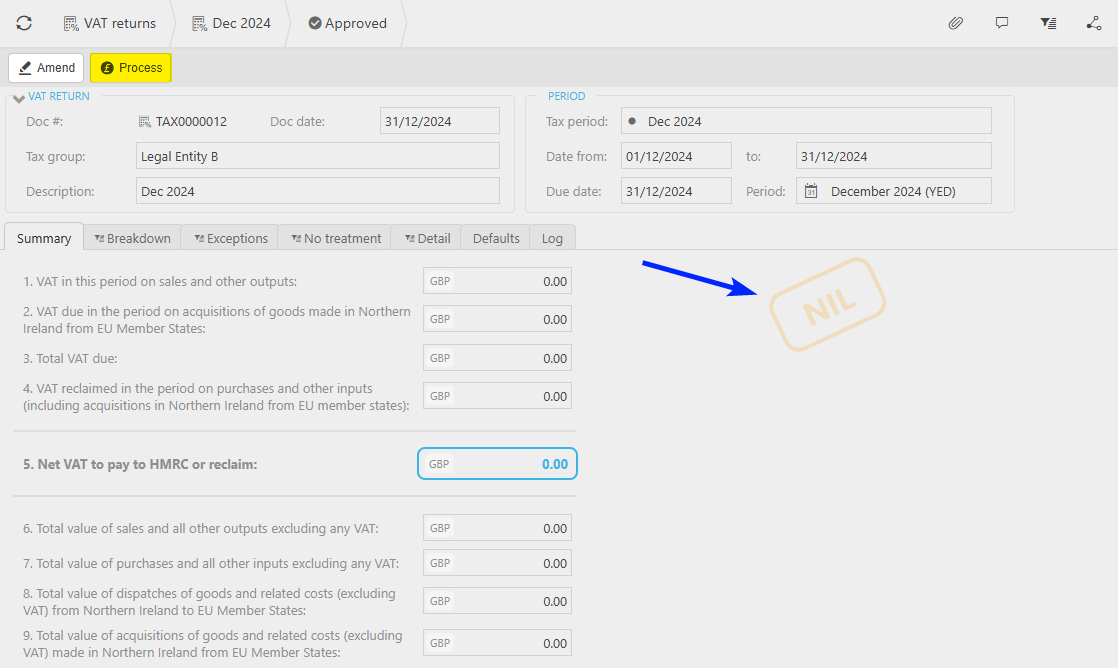

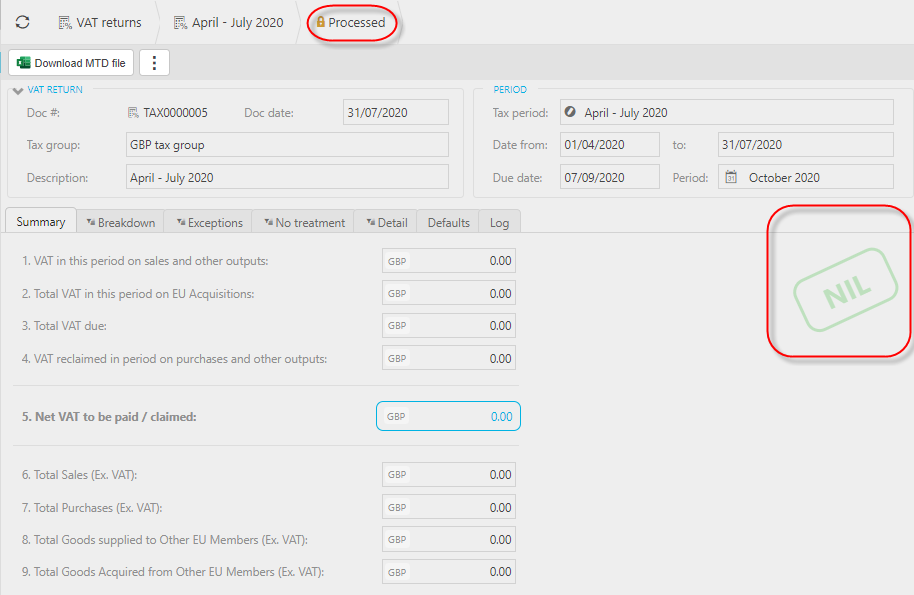

How to Submit a NIL VAT Return

Submitting a NIL VAT Return

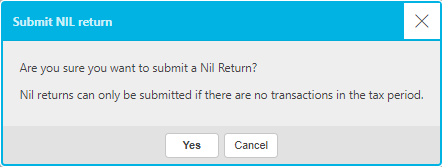

There may be occasions where you wish to submit a **NIL VAT Return**. This is only available where the amount to be paid / claimed is zero (0). In these circumstances, a **Submit Nil** button will be available. You will be presented with the following confirmation dialog.

Select Yes to continue. The Nil return will not be submitted for authorisation, and you can now Process the Nil VAT return.

The return will be locked and stamped with Nil.

How to shorten Tax (VAT) period

Shortening a Tax (VAT) period

There may be instances where you wish to shorten a Tax Period e.g. where you wish to make an early submission to realise a significant claim amount.

To do this you will need to change the date to on the tax period in question and the date from in the subsequent tax period.

Note

If you are using HMRC MTD integration, whilst it is allowable to shorten a period, the date from and date to are also recorded by HMRC so you also will need to coordinate this date change via HMRC.

If you don't do this and attempt to submit a return early, you will get an error like the following "The remote endpoint has indicated that the submission is for a tax period that has not ended”.

Updated January 2026