Tax (VAT) Setup

The majority of Tax (VAT) setup is pre-configured & author based settings which is protected so much of detail for this topic is for information purposes.

Set up varies from one Tax Authority to another but the Tax Bands & Tax Codes can be shared across multiple tax authorities.

Note

The documentation below uses the England & Wales (EW) tax setup as an example but the system supports equivalent tax setup for multiple other Tax Authorities.

Reverse Charges

Within EW, certain input tax codes stimulate "Reverse Charge" posting lines. The tax postings are handled differently according to whether they are goods or services.

Reverse Charge (Goods example)

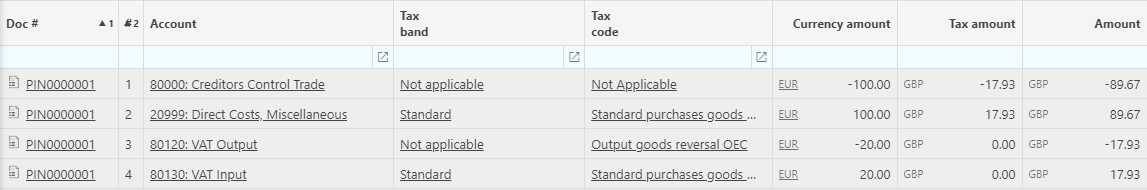

Sample OEC Purchase invoice (goods)

GL posting

VAT Return

Reverse Charge (Services example)

Sample OEC Purchase invoice (Services)

GL posting

VAT Return

Tax Returns

Each Tax Authority has its own specific Tax Return and Tax Codes which apply. The following is the EW VAT return.

Note

iplicit supports tax returns for multiple Tax Authorities.

Product type

In England and Wales (EW), purchases from other EU countries are subject to Reverse Charge but depending on whether the sales are of goods or services will influence the presentation of the net and tax amounts in the EW VAT Return.

Other Tax Authorities will have other product type codes which in turn influence the handling of their respective Tax Return.

In EW, products must be identified as goods or service so that this information is then used to determine the Tax Code selected.

Other product types may apply in other Tax Authorities and contribute to their respective Tax Return handling.

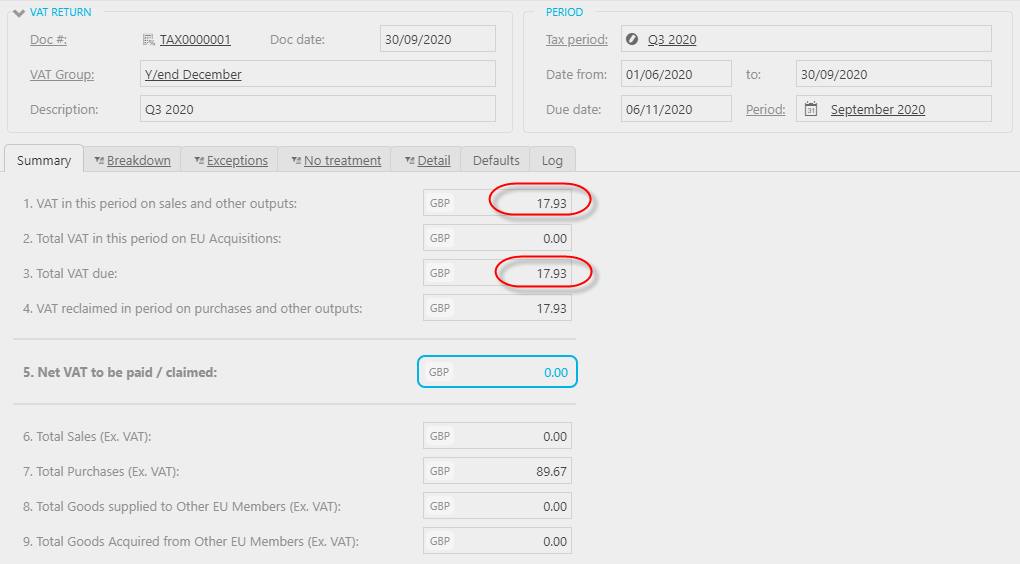

Postponed VAT accounting

VAT changes following BREXIT

The UK has left the EU and following the end of the transition period on the 1st January 2021, VAT returns for the UK and Ireland will be changing.

Both HMRC and Irish Revenue have announced Postponed VAT Accounting (PVA) effective from 1st January 2021 to mitigate potential cashflow issues that businesses might experience from the UK leaving the EU.

Guidance on the PVA procedure can be found here:

UK overview

From the 1st January 2021, purchases from EU members will no-longer use the reverse charge VAT mechanism

PVA can be applied to purchases of goods from non-local suppliers (i.e. EU and non-EU countries)

PVA means that UK VAT registered companies can account for import VAT on goods imported into the UK on their VAT returns

Both the input and output VAT are recorded at the same time (in a similar manner to the EU reverse charge process)

The population of the boxes on the VAT return will change for transactions involving non-local suppliers & customers

There are separate rules for Northern Ireland

- Purchases/sales to EU remain the same as prior to 1st January 2021.

- Purchases/sales to non-EU countries treated as per the rest of the UK.

Ireland overview

From the 1st January 2021 purchases from the UK will no-longer use the reverse charge VAT mechanism.

PVA can be applied to purchases of goods from the UK and non-EU countries.

PVA means that Irish VAT registered companies can account for import VAT on goods imported into Ireland on their VAT returns.

Both the input and output VAT are recorded at the same time (in a similar manner to the EU reverse charge process).

The population of the boxes on the VAT return will change for transactions involving the UK and non-EU countries.

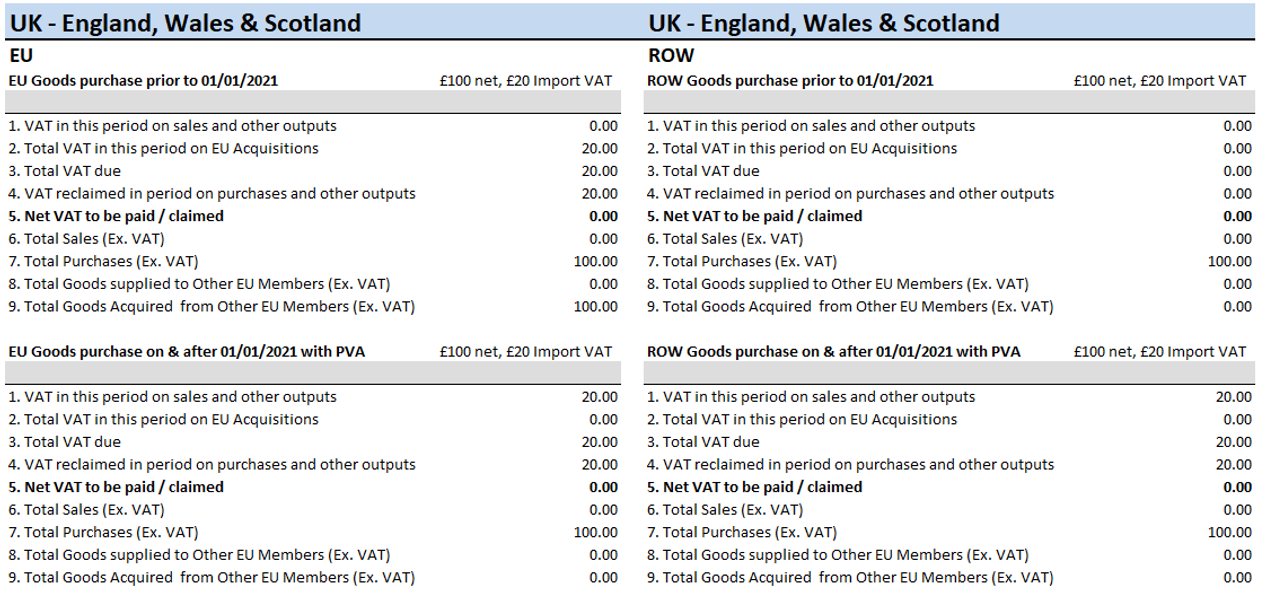

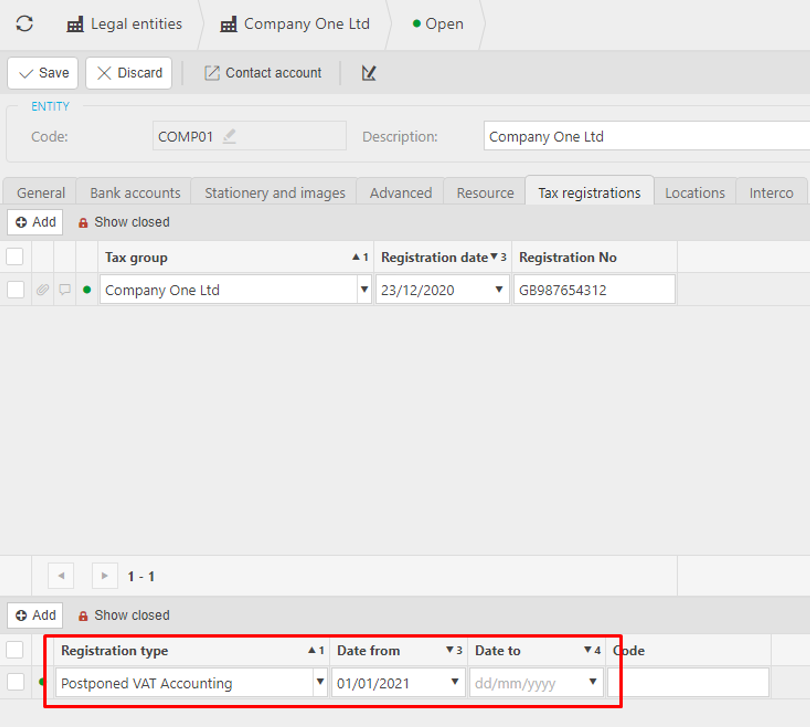

Setup

An Economic Operator Registration and Identification Number (EORI) can be recorded on the Legal Entity record.

To enable PVA, add a registration record to the Tax Registration record, with an appropriate date from.

Usage examples

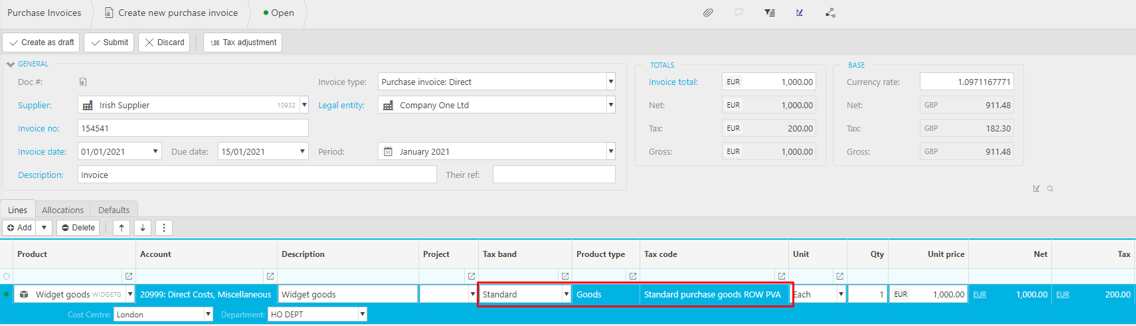

When using PVA, entering a purchase invoice for goods from a non-local supplier with the Standard Tax Band will automatically select the tax code Standard purchase goods ROW PVA.

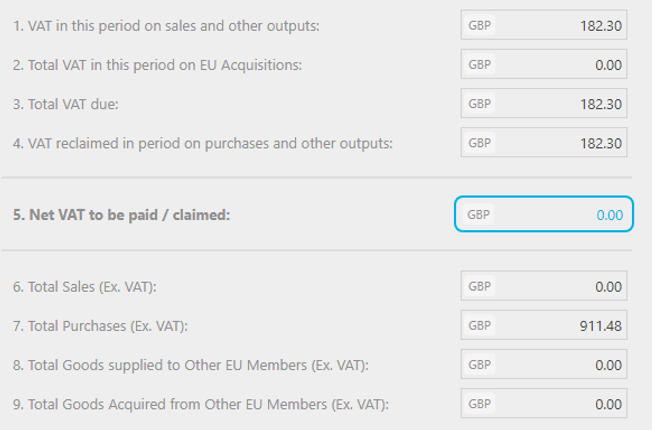

Once this invoice is posted it will populate the VAT return as follows:

Note

When entering the same purchase invoice as above but with an invoice date prior to the 1st January 2021, it will result in the invoice being processed with EU reverse charge and will populate the appropriate EU boxes on the VAT return.

As PVA only applies to goods, the system will prevent the usage of the Standard tax band when entering purchase invoices for Services from a non-local supplier (when PVA is enabled on the tax registration). The appropriate tax band (Zero rated) should be used for these purchases

Note

When entering the same purchase invoice as above but with an invoice date prior to the 1st January 2021, it will result in the invoice being processed with EU reverse charge and will populate the appropriate EU boxes on the VAT return.

When entering an invoice from a non-local supplier with an invoice date on or after the 1st January 2021, the system will prevent all use of the Standard tax band if PVA has not been configured on the tax registration.

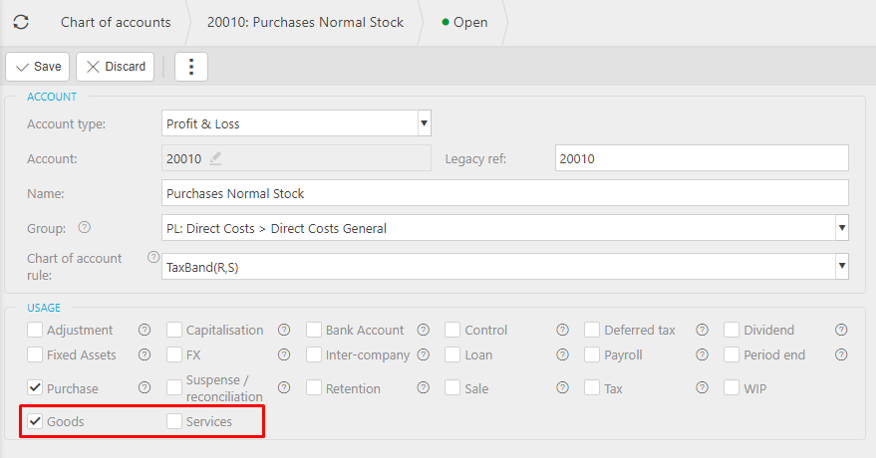

Differentiating between Goods & Services

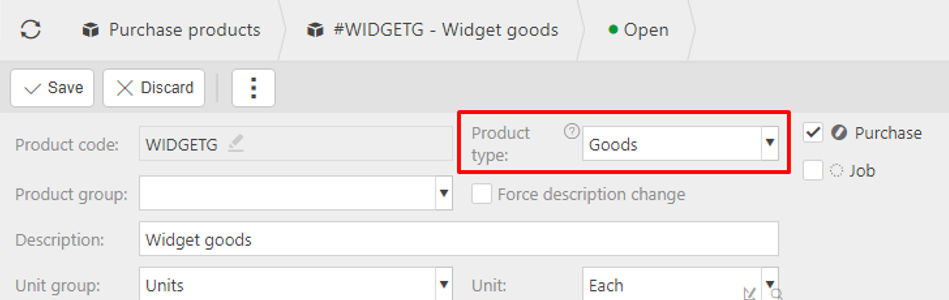

When using purchase products, the product type determines whether it will be treated as goods or services when calculating the tax code.

When coding using just chart of account codes, two new tick boxes on the chart of account code determine whether it will be treated as a Good or Service when calculating the tax code.

If both Goods and Services are ticked on a chart of account code, a new column Product type will be displayed when entering a transaction line. This field is mandatory, and a value must be entered.

Note

If both Goods and Services are left unticked, the code will be treated as Services.

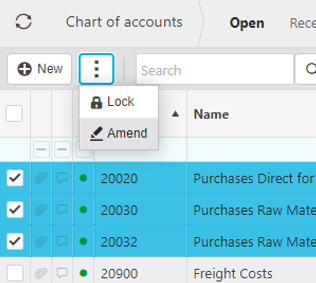

You can use the multi-amend on the chart of account finder to set these new tick boxes in bulk.

Domestic Reverse Charge VAT

HMRC changes for the Construction Industry Scheme from 1st March 2021

In the UK, HMRC are introducing domestic reverse charge (DRC) for supplies of building and construction services effective from 1st March 2021. This applies to transactions between UK VAT registered contractors and sub-contractors who are reported within the Construction Industry Scheme (CIS).

This process means that sub-contractors will no longer account for VAT. The customer (contractor) will account for both the input and output VAT. The sub-contractor will be paid net of any VAT (and other CIS deductions).

DRC is applicable on invoices between UK VAT registered contractors and sub-contractors who are reported within the Construction Industry Scheme (CIS) where:

The invoice is for labour only.

The invoice is for labour and materials.

It does not apply to:

- Invoices for materials only.

Note

DRC only applies to Standard & Reduced Rate VAT.

There are also exclusions for various types of labour services. Please refer to HMRC guidance which can be found here:

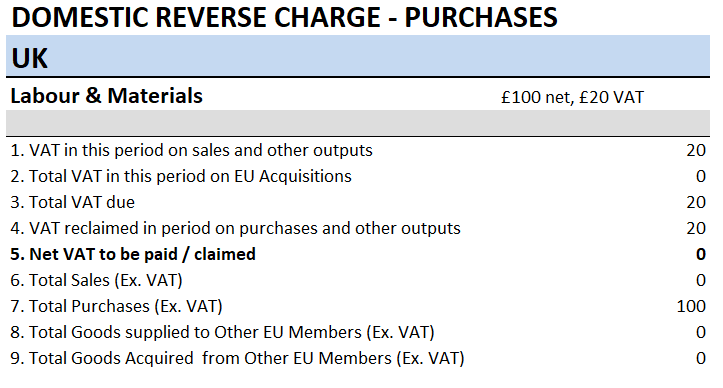

Purchases

VAT will be shown on an invoice subject to domestic reverse charge, but the invoice will clearly state that domestic reverse charge applies and that the customer is required to account for the VAT. The VAT should not be paid to the supplier.

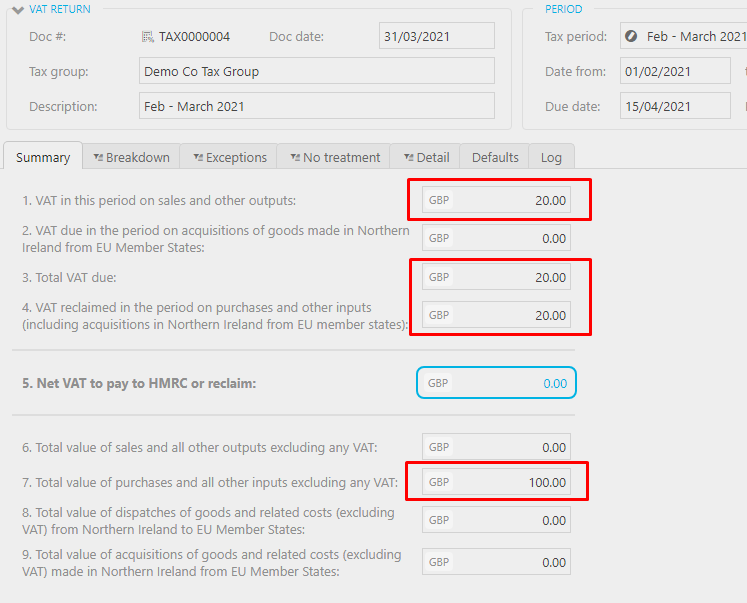

The VAT return will be populated as follows:

BOX 1: Output (reversal of input VAT).

BOX 4: Input VAT.

BOX 7: Net value of purchases.

Example:

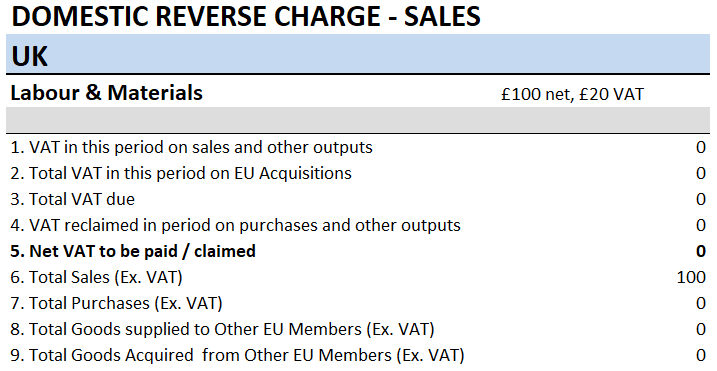

Sales

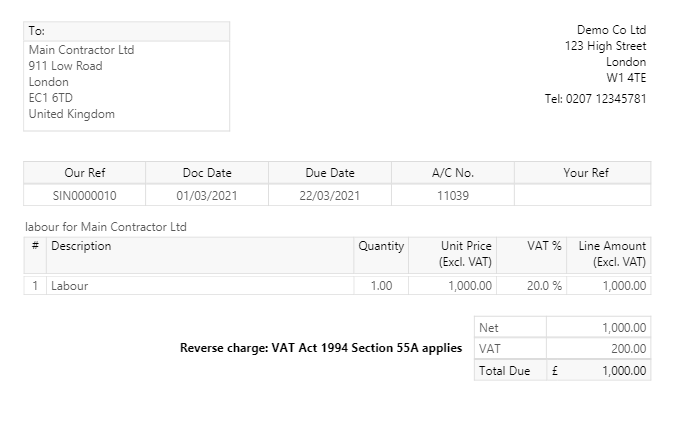

Where a sale is subject to DRC, the invoice produced must comply with HMRC guidelines (see link above). This includes showing that the VAT is subject to reverse charge and specific text to identify that the customer is required to account for the VAT.

Note

Please speak to the support team if your customised sales invoice output needs to be updated for domestic reverse charge

The VAT return will be populated as follows:

- BOX 6: Net value of sale.

Example:

Usage examples

The system is pre-configured to apply DRC to both purchases and sales. Settings on the supplier and customer record enables the functionality and there is the ability to override the treatment on individual invoices.

Usage for purchases

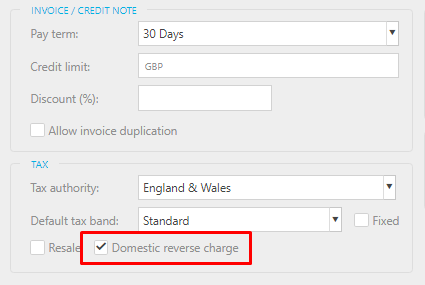

This check box on the supplier record defines whether DRC will be applied by default on purchase invoices from the supplier.

Note

You will not be able to apply DRC to a purchase invoice unless this box is checked on the supplier record.

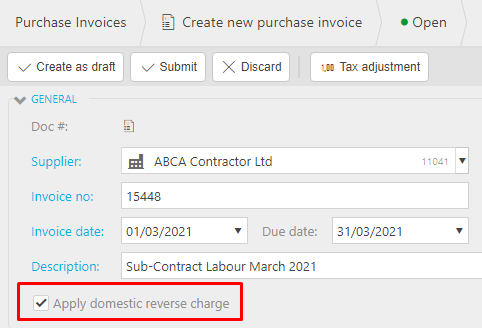

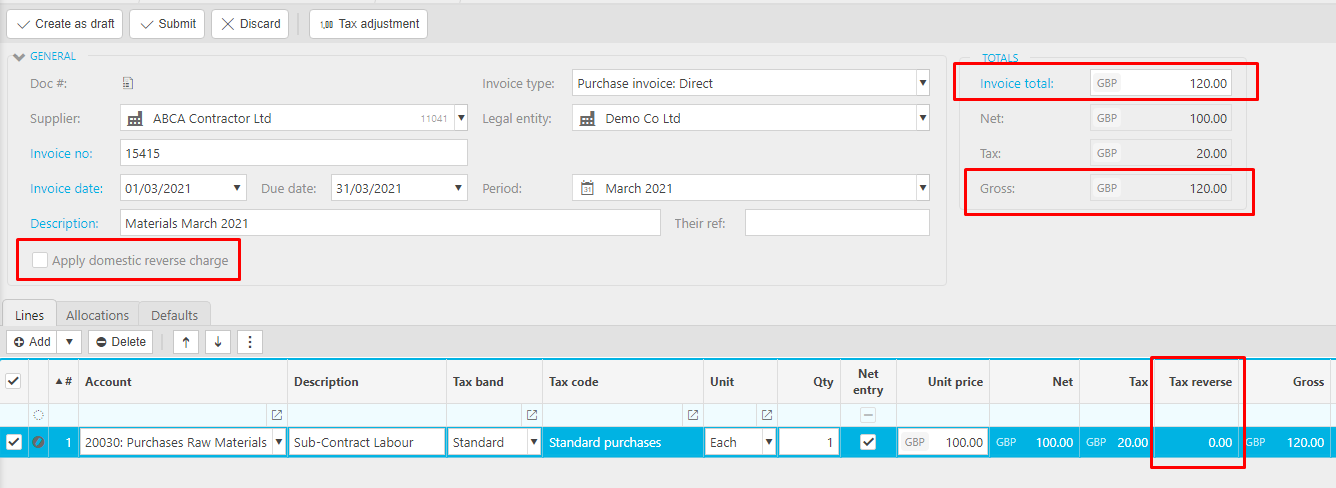

When entering a purchase invoice for a supplier with the DRC setting ticked, a check box will be shown in the header of the invoice. By default, this box will be checked and DRC will be applied to the invoice.

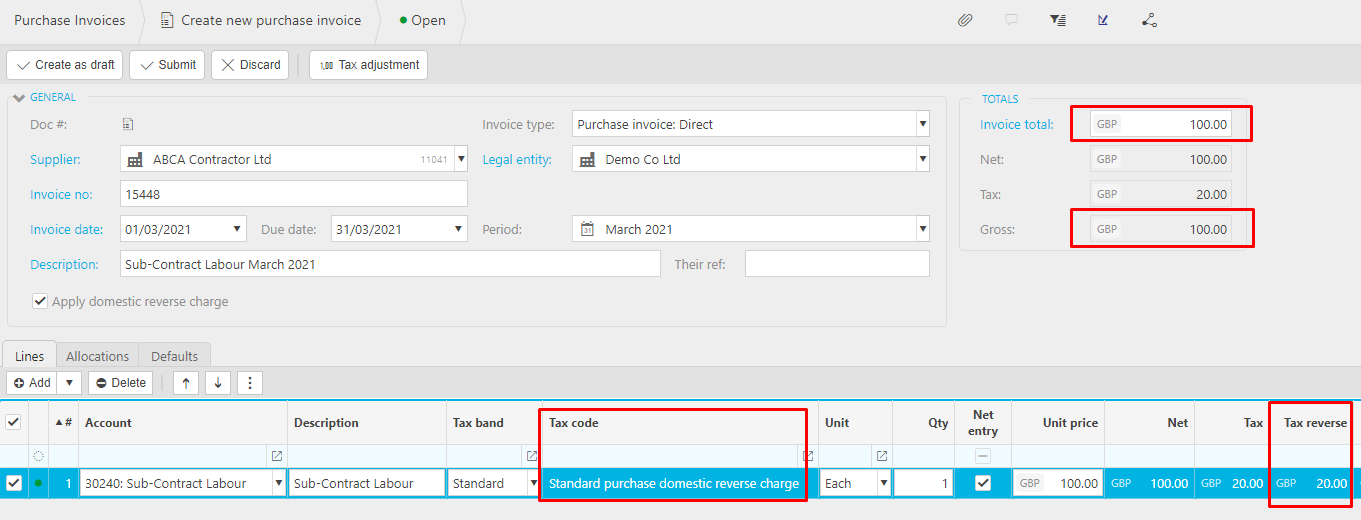

When invoice lines are entered with DRC applied, the Standard and Reduced Rate Tax Bands will derive a reverse charge Tax Code. VAT will be calculated at the appropriate rate, but also reversed out leaving the Gross and Invoice total excluding the VAT.

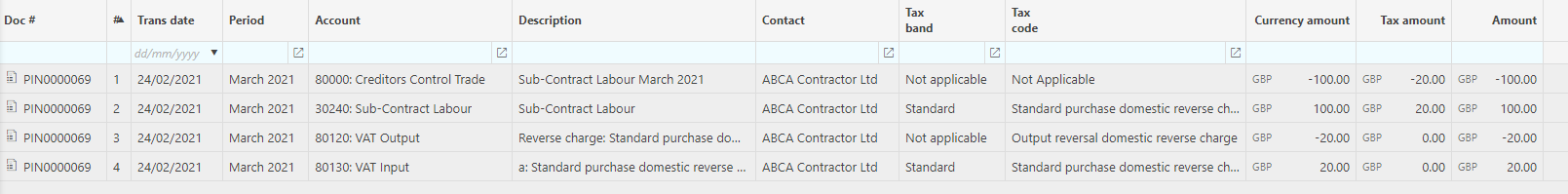

Once posted, the double entry in the General Ledger includes a line for the input VAT which is reversed out by a line for output VAT:

The invoice will appear on the VAT return as follows:

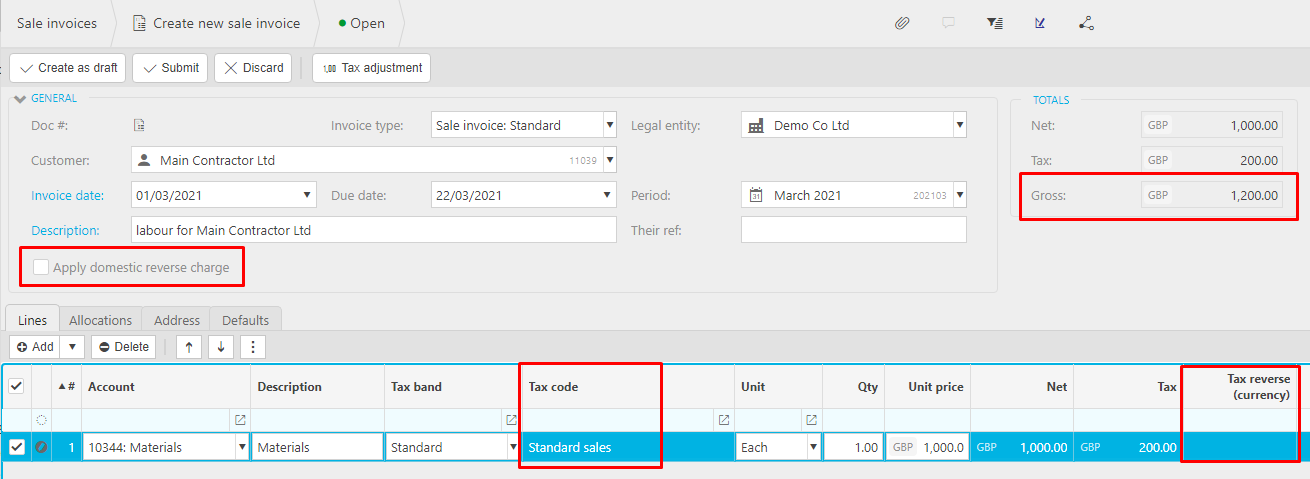

To override the default setting on the supplier record (for example a materials only invoice), untick "Apply domestic reverse charge". Standard VAT will be applied to the invoice.

Usage for sales

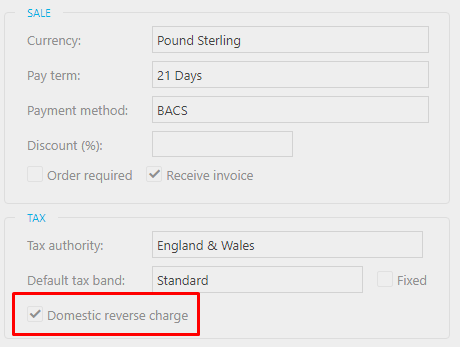

This check box on the customer record defines whether DRC will be applied by default on sales invoices to the customer.

Note

You will not be able to apply DRC to a sales invoice unless this box is checked on the customer record.

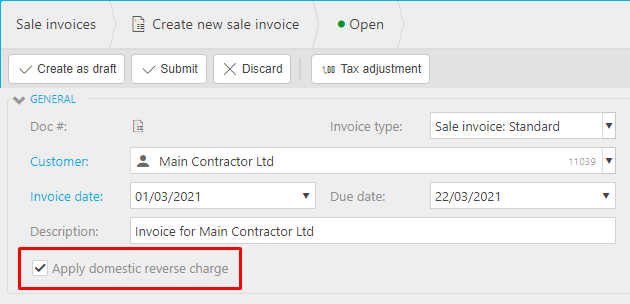

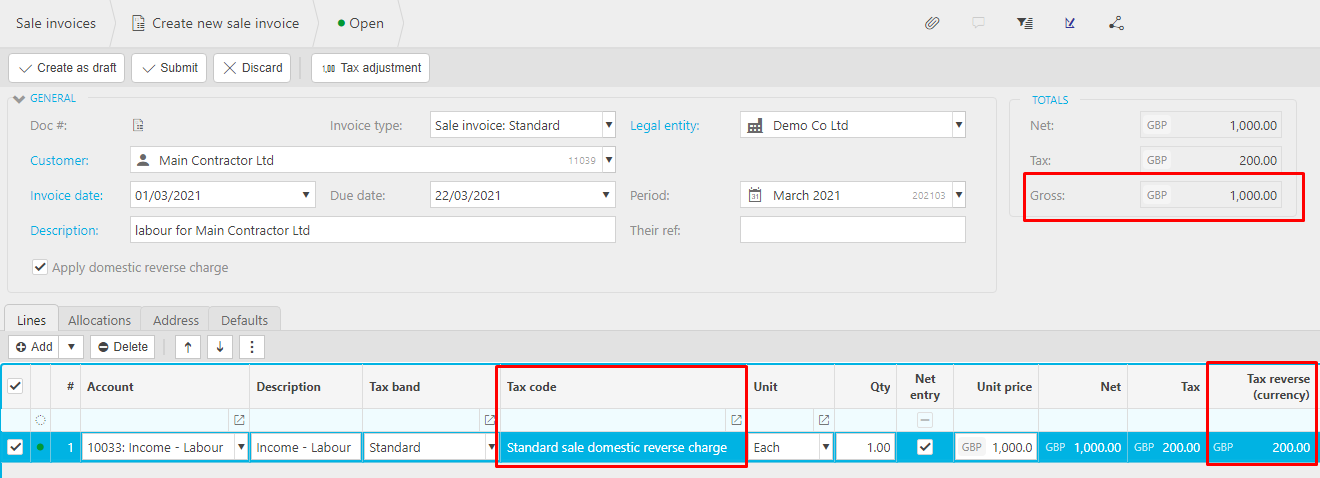

When entering a sale invoice for a customer with the DRC setting ticked, a check box will be shown in the header of the invoice. By default, this box will be checked and DRC will be applied to the invoice.

When invoice lines are entered with DRC applied, the Standard and Reduced Rate Tax Bands will derive a reverse charge Tax Code. VAT will be calculated at the appropriate rate and shown on the lines, but not included on the invoice total.

Sales invoice must be produced in a format that meets HMRC requirements.

Note

Please speak to the support team if your customised sales invoice output needs to be updated for domestic reverse charge.

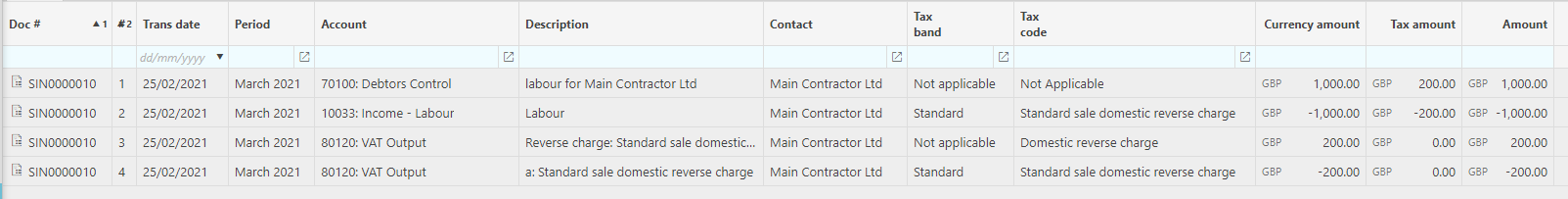

Once posted, the double entry in the General Ledger includes lines that reverse the output VAT that would have been applied without DRC:

The invoice will appear on the VAT return as follows:

To override the default setting on the customer record (for example a materials only invoice), untick "Apply domestic reverse charge". Standard VAT will be applied to the invoice.

Updated September 2024