Tax Codes

- Tax codes (AKA VAT code) are used on document lines, an Example of which is shown below.

- Upon document entry, the tax code(s) that are available for selection vary according to a wide number of factors including Tax Authority, Tax Bands, Product, Chart of account code (via Chart of account rule), Customers and Suppliers defaults, Document type, etc.

- Tax codes are 'Author' based which means they are distributed as part of releases.

- When documents are entered, the prevalent Tax rate is derived from a combination of the documents' details including Tax Authority, Tax date and Tax code. Despite there being a tax rate applied, the tax amount can vary according to factors including Partial tax which is set on the Tax Group and the non recoverable status of the document line which can be set on the Tax Authority and even manually overridden on documents.

- Tax codes cannot be added or deleted but they can locked to stop them being selectable. Locked tax codes can also be unlocked.

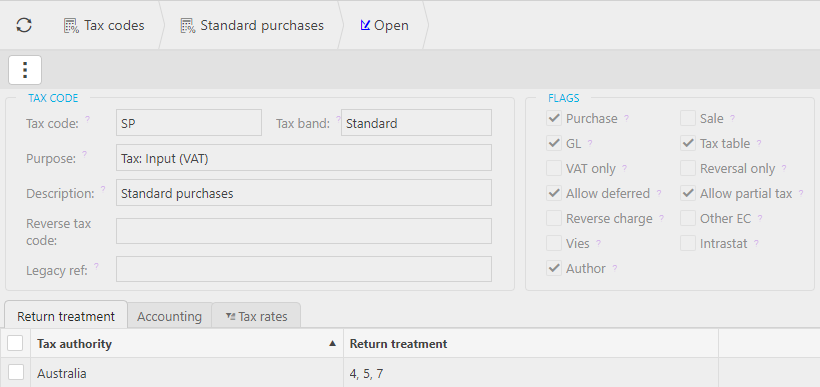

Tax Code example

The following example describes the Standard Purchase tax code and the meaning of all the cells.

Tax Code: Unique code for the Tax code.

Tax Band: This is the Tax Band that the Tax code is related to.

Purpose: The Purpose describes the purpose of the Tax code (input/ output) and is used to get the Chart of account code from account defaults.

Description: Unique description for the Tax code.

Reverse Tax Code: When "Reverse charge" is ticked, this is the default tax code that will be used for the reverse charge line.

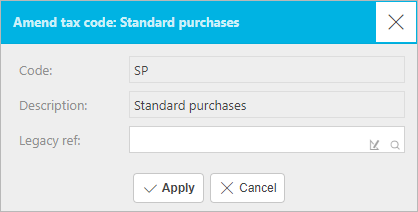

Legacy ref: The Legacy ref is used to describe what the Tax code was referred to in a Legacy finance system.

Purchase: When ticked, this Tax code is available for Purchase documents.

Sale: When ticked, this Tax code is available for Sales documents.

GL: When ticked, this Tax code is available for Journal documents.

Tax table: When ticked, document lines using this tax code will populate GL tax ledger (e.g. The "Not applicable" Tax code is unticked and therefore doesn't populate GL Tax).

Tax only: When ticked, this Tax code is only available on Tax only posting lines.

Reversal only: When ticked, this Tax code is for use for reversals only.

Allow deferred: When ticked, this Tax code is available for deferred tax handling.

Allow partial tax: When ticked, this Tax code is available for Partial tax handling.

Reverse charge: When ticked, this Tax code is subject to reverse charge.

Other EC: When ticked, this Tax code is specifically used for OEC tax movements e.g. sales output reversal.

Vies: When this checked is ticked, document lines posted with this tax code will be shown on VIES (EU VAT information exchange system) reports.

Intrastat: When ticked, this Tax code is appropriate for Intrastat declaration, used when trading goods within the EU.

Author: When ticked, this Tax code is author defined and included in releases.

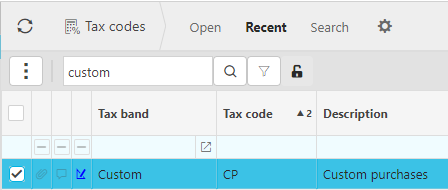

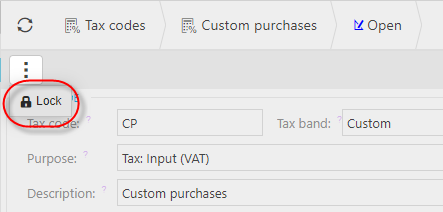

Locking a Tax Code

- This should be done with caution as locking a Tax Code makes it unavailable throughout.

Search to find the Tax Code you wish to lock

Select Lock - either from the finder or editor

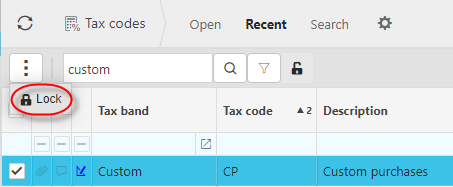

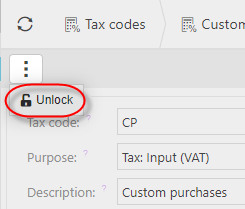

Unlocking a Tax Code

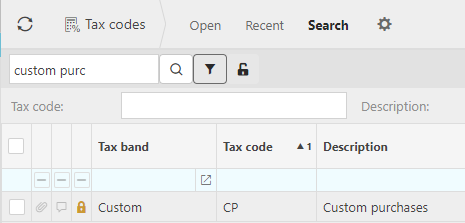

Search to find the Tax Code you wish to unlock

Tip

You must use either the Recent or Search sets to find locked tax codes and ensure Show locked is selected.

Select Unlock - either from the finder or editor

Amend a Tax Code

- This has limited scope in that only the Legacy reference can be changed.

The Legacy ref is used to describe what the Tax code was referred to in a prior/ Legacy finance system.

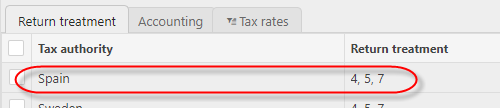

Return treatment

This grid shows where the Tax Code is used on Tax Return types.

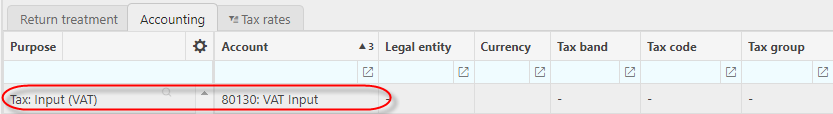

Accounting

This grid shows the default Account defaults used for the Tax Code.

Note

There is an Account default for the purpose but an override can be created specifically for the Tax Code.

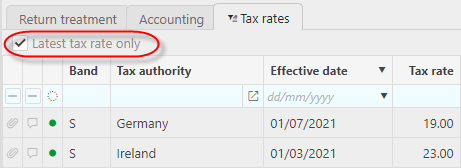

Tax rates

This grid shows the tax rates related to the Tax Code. Tax rates are set per Tax Authority and can only be viewed here.