Partial Tax

Partial tax is used where a specific arrangement has been made with the relevant Tax Authority to be able to make a partial reclaim of input tax. Common usage is in Not for Profit and Educational establishments (Legal Entities).

Note

Within each environment, each Legal Entity can have distinct treatment for partial tax. This is setup in the Tax Group related to the Legal Entity.

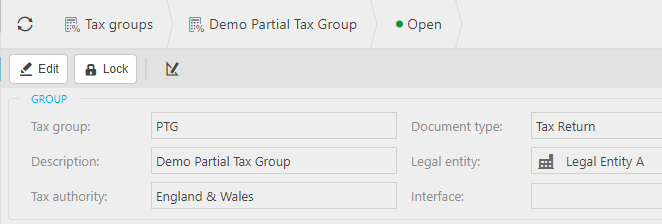

Tax Group - partial tax

Each Legal Entity must have a minimum of one Tax Group but the Tax Group can be related to many Legal Entities as appropriate. In this context, each Tax registration in the Group should share the common Tax / VAT Return periodicity and partial tax handling.

Partial tax posting

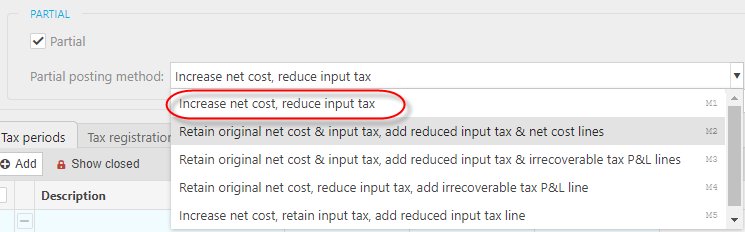

Tick the Partial check box and select the posting method.

The method selected determines how the partial tax is posted to the General Ledger (GL).

Partial tax rates

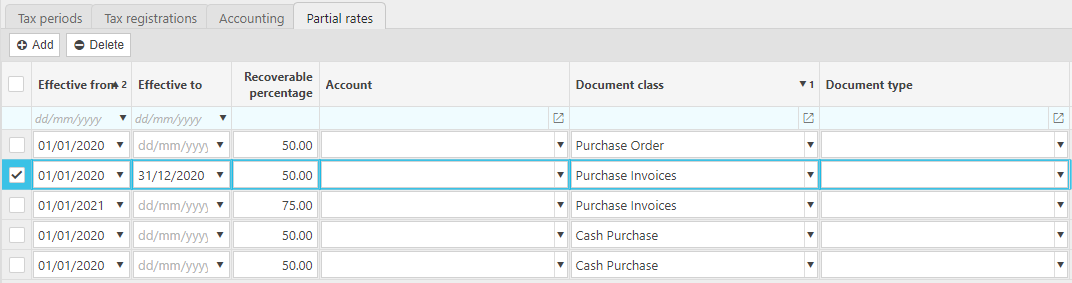

Partial Tax recoverable percentage rates can be set with an effective date to reflect the changing rate applicable. It is also possible to restrict and / or apply different rates to different types of document and chart of accounts. In the example below, the recoverable percentage on Purchase Invoices changes from 50% in 2020 to 75% in 2021.

Note

The recoverable percentage is a percentage of the tax amount derived from the tax rate applicable at the tax date for the tax authority & tax band. This applies distinctly to each individual invoice line (e.g. 20% VAT in England & Wales on 31/07/2020)

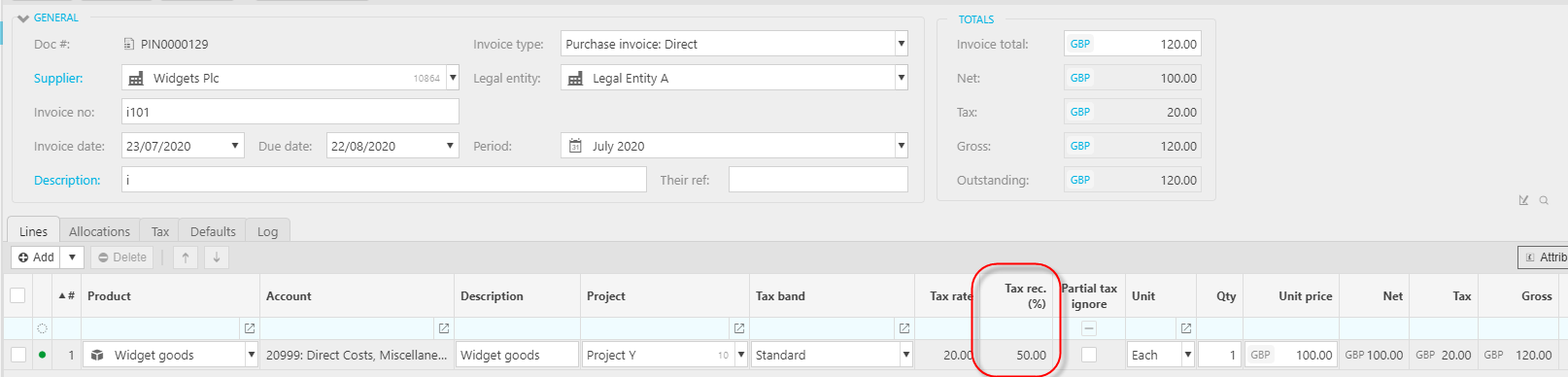

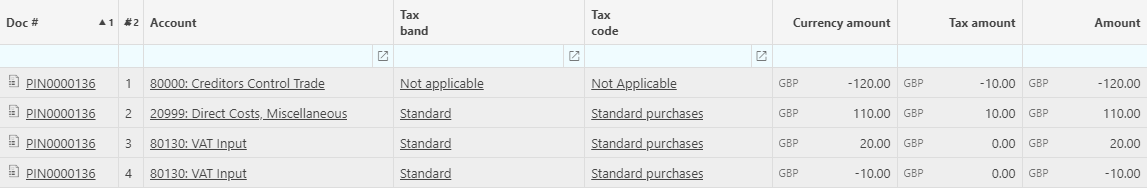

Sample Purchase invoice

In this example, Purchase invoices for the (Legal Entity are subject to 50% recoverable VAT for the invoice date.

Tip

There may be some instances where partial tax is not applicable for a particular invoice line. Where this is the case, tick the check box "Partial Tax Ignore" and the 100% of the tax rate will be applied.

Warning

Restrict access to "Partial tax ignore" via user access.

Partial tax posting method example GL postings

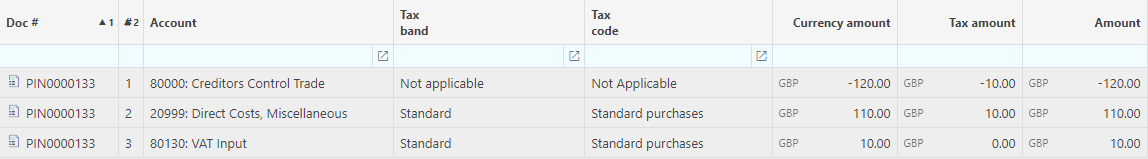

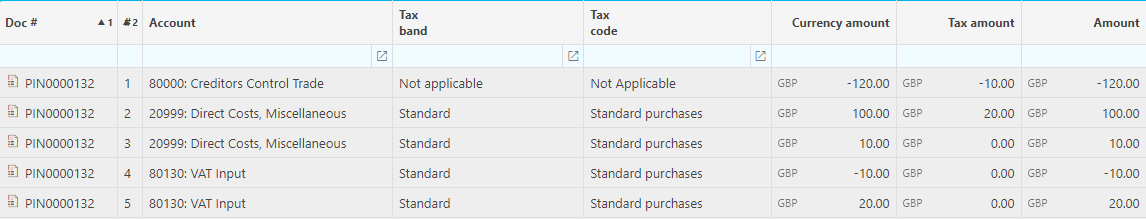

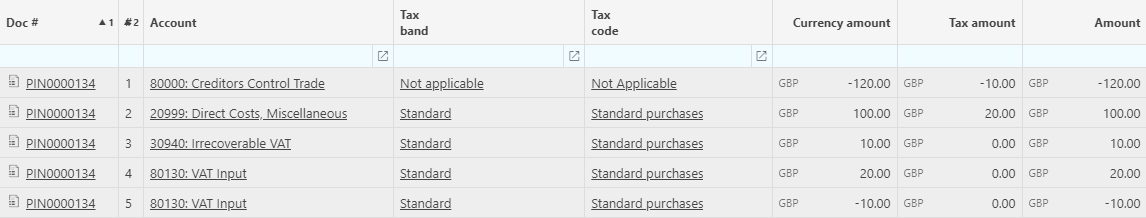

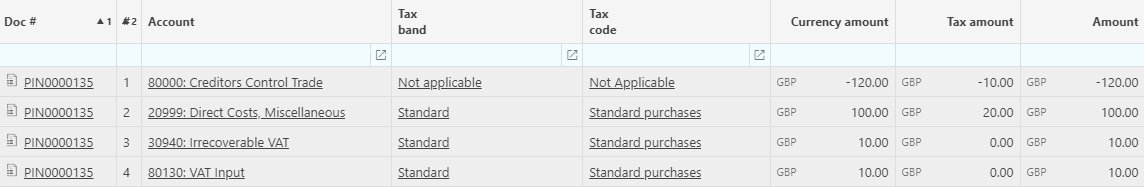

Using the above example of a Supplier invoice which is £120 gross, £100 net, £20 input tax, 50% recoverable; the following examples demonstrate how each of the methods would post to the GL.

Increase net cost, reduce input tax

Retain original net cost & input tax, add reduced input tax & net cost lines

Retain original net cost & input tax, add reduced input tax & irrecoverable tax P&L lines

Retain original net cost, reduce input tax, add irrecoverable tax P&L line

Increase net cost, retain input tax, add reduced input tax line

Updated January 2024