Tax Bands

There are multiple tax bands available of which only some of them will be used in the England & Wales (EW) VAT return.

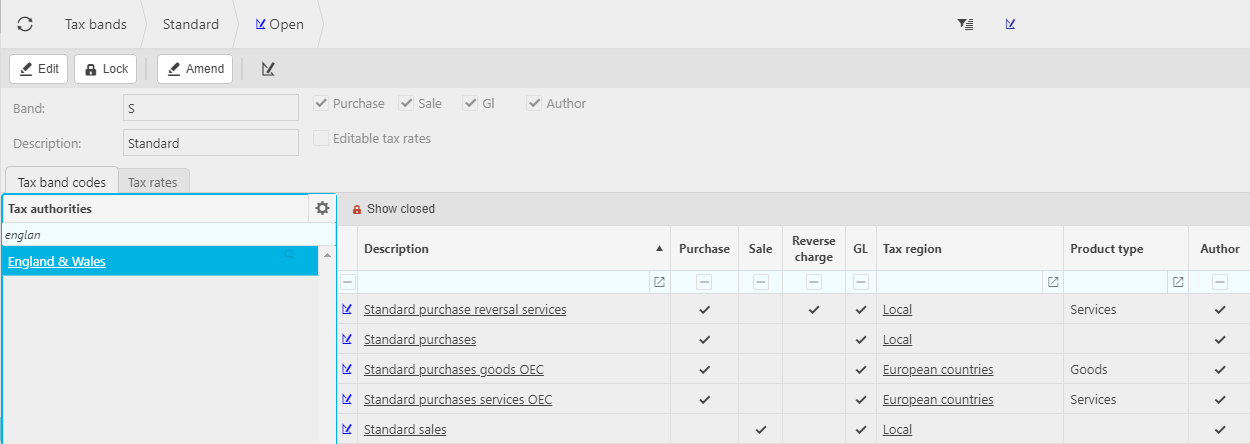

The following example is the "standard" tax band which is available in EW and shows the related Tax Codes and Tax Regions.

The above Tax Codes are the only "Standard" tax codes available in the EW tax authority. There are however many other tax bands and associated tax codes available for use in EW.

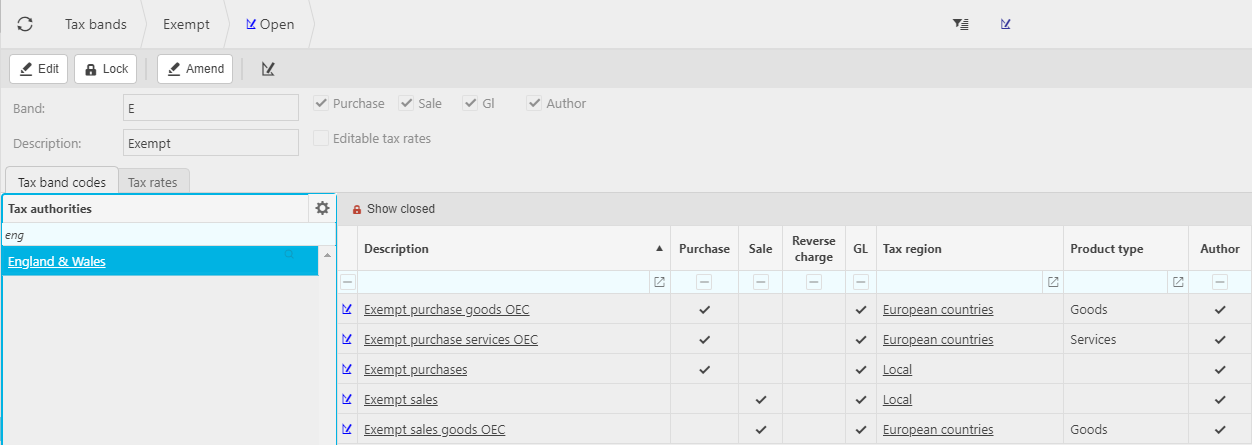

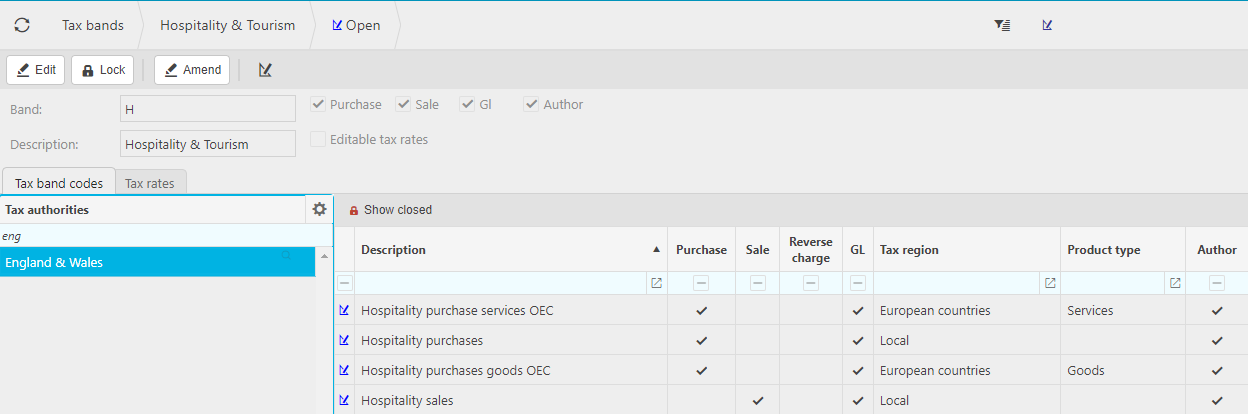

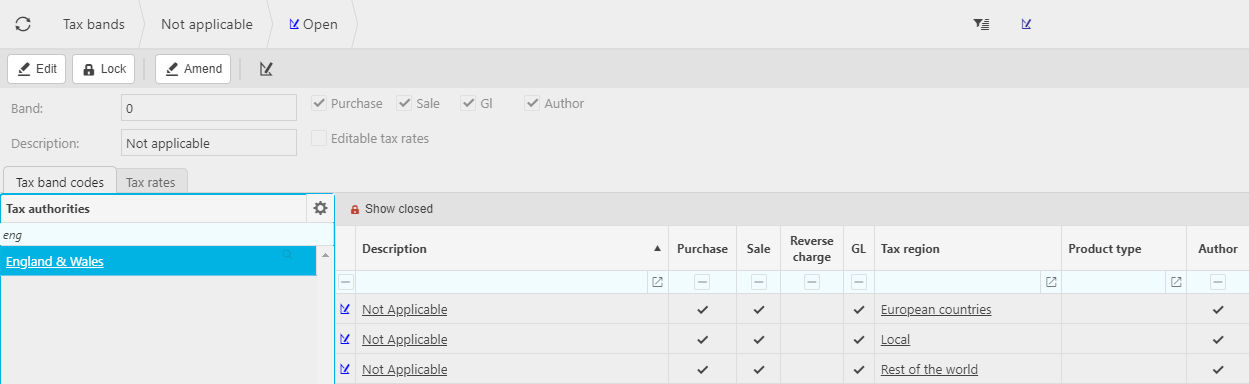

Examples of other tax bands used in EW:

EC Sales

Exempt

Hospitality & Tourism

Not Applicable

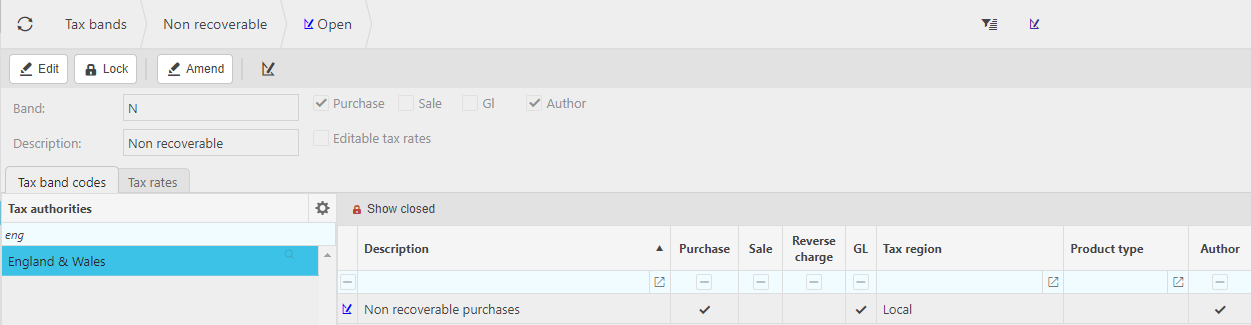

Non Recoverable

Outside scope

Partial

- Using this tax band is an simplified alternative to using the full partial tax solution and has considerably less control of the entry and postings of documents. It is recommended to use the full partial tax solution.

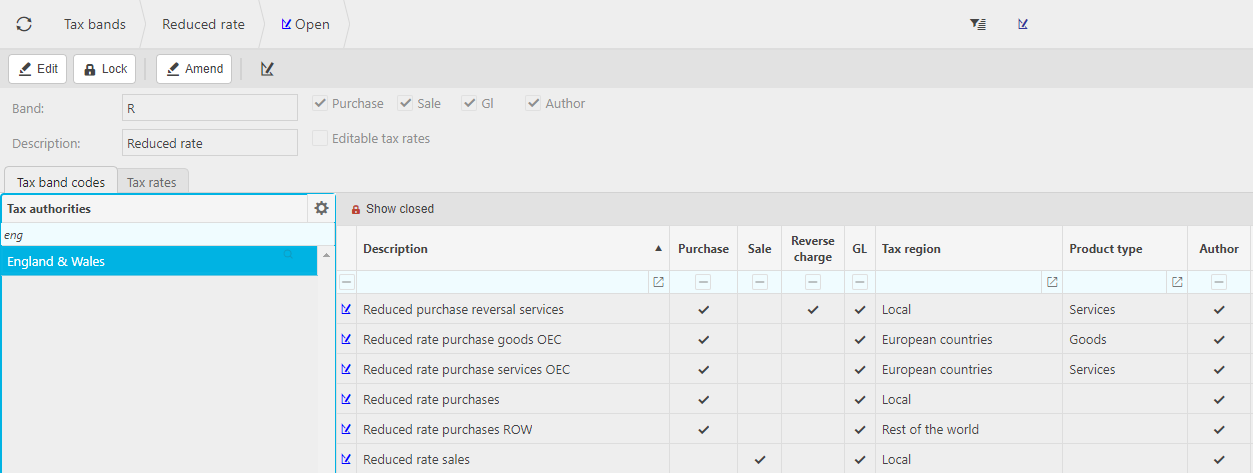

Reduced rate

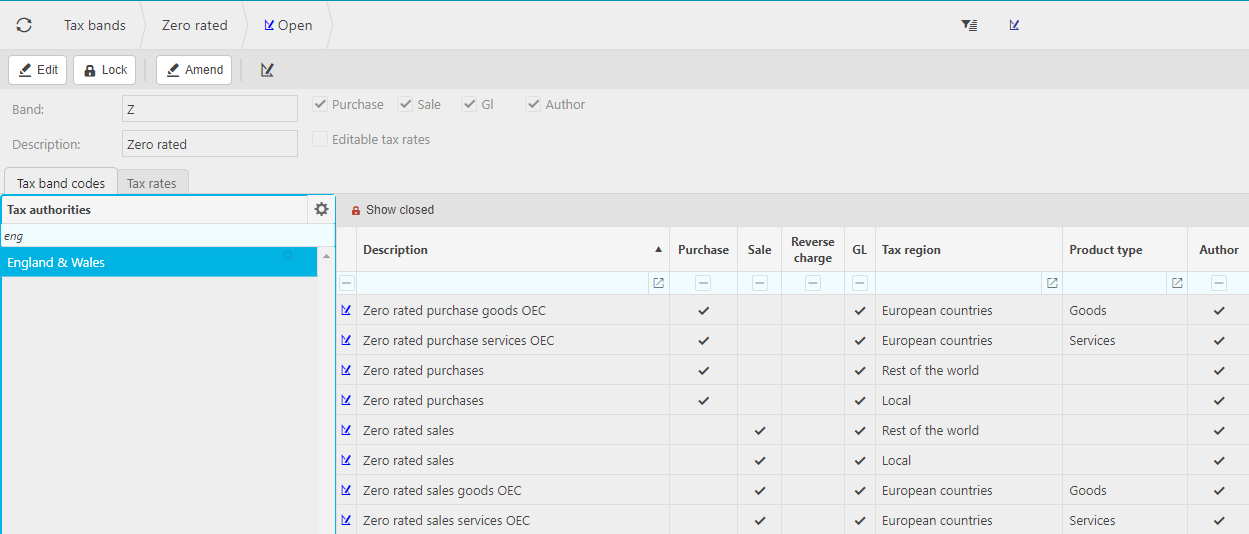

Zero rated

Tax Rates

Each Tax Authority sets it's own tax rates and these are recorded per Tax Band. All tax rates and their respective effective dates are recorded in the system. This enables postings to be made for documents in the past, present or future and the prevalent tax rate for the tax date to be automatically selected.

Tip

Tick the Latest tax rate only check box to restrict the rates shown to be the latest only.

The are instances where a Tax Band, codes and rates have a known limited lifespan e.g. EW introduced a Hospitality & Tourism Tax rate to assist these struggling industries during the COVID-19 pandemic.

The system has a tax band, code and rate to manage this short-term requirement. The related EW tax rates for Hospitality & Tourism are as follows:

Updated October 2024