Tax Registrations

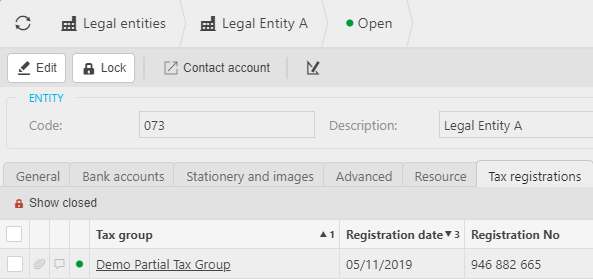

Each Legal Entity that is tax registered must record the respective tax registration details.

Multiple tax registrations

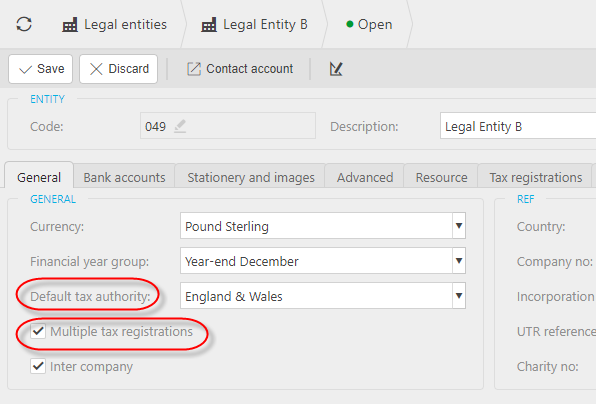

Where a Legal Entity has multiple tax registrations tick the Multiple tax registrations check box.

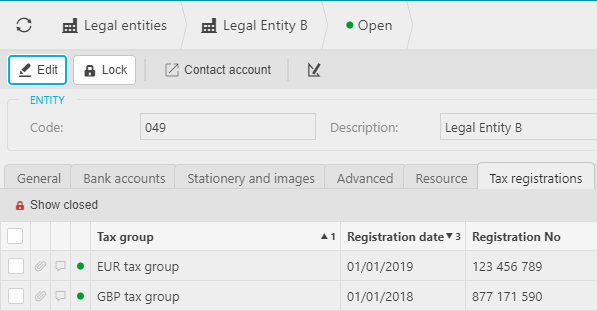

You will also need to record the multiple tax registrations against the Legal Entity.

Where a Legal Entity has multiple tax registrations, each registration is typically linked to separate Tax Groups which in themselves are linked to separate Tax Authorities. This is used where Legal Entity trade in different Tax Authorities and have separate responsibility for completing Tax Returns for those respective Tax Authorities.

For Legal Entity in this situation, upon document entry of e.g. a Sale Invoice where the goods or services are delivered to another Tax Authority, it is possible to select the responsible Tax Authority on the document itself.

Updated September 2024