Purchase Invoices

This feature allows purchase documents to be created including invoices, credit notes and write offs.

Of the multiple types of Purchase invoice you can create, you may find that certain document types are not available because either you don't have permission, or the document type is locked.

There may also be additional setup that you must perform to be able to e.g. setup to process Multi-Company invoices.

How to view Purchase Invoices

Viewing a Purchase Invoice

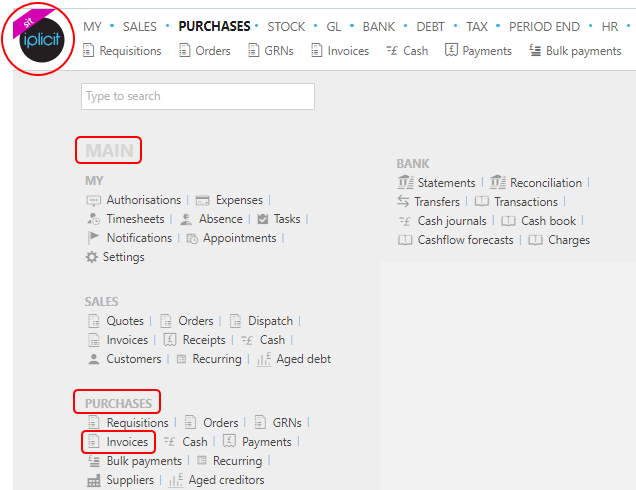

Select Purchases / Invoices from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

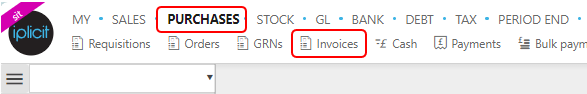

or from the Main Menu select Purchases then Invoices -

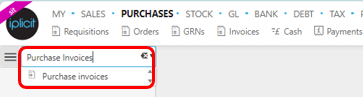

or enter Purchase Invoices in the Quick Launch Side Menu.

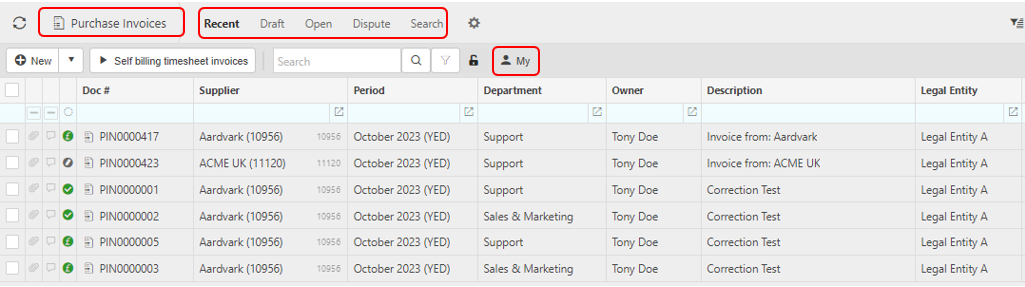

This will then show the Purchase Invoices on the system where normal customisation of Sets can be used. Also, depending on User roles, the My/All option will be showing.

On each displayed column on the header, you can easily filter and sort all the documents - see tip to display other columns.

Status:

- Approved appears after an invoice has been through an authorisation workflow, if the invoice has been successfully authorised, the invoice will be set to approved.

- Posted (Paid) appears when an invoice has been posted and the payment has been made to the supplier.

- Posted appears when the invoice has been recorded but the payment has yet to be made to the supplier.

- Draft appears when the invoice has not been submitted and is subject to further change.

- Pending Payment appears when an invoice has been posted; however, the related payment to the supplier is yet to be approved as the payment has entered an authorisation workflow.

- Pending authorisation status appears when the invoice is yet to be authorised within an authorisation workflow.

- Rejected appears when the invoice has entered an authorisation workflow and the invoice violated rules setup either manually or automatically.

- Reversed appears when an invoice has been reversed, this status appears on the invoice that has been reversed, this is not a separate document.

- Abandoned appears when you have abandoned a drafted document you are no longer happy with.

- Written Off appears when an invoice has been written off. Importantly this is NOT the write off document itself, this is the initial invoice that has been written off.

- Dispute appears on invoices that have been placed into dispute.

- Error appears when there is an issue with the setup or the system, please contact our support team if this appears.

Doc #: This is the unique document code.

Supplier: This is the Supplier that is being purchased from.

Description: This is the description of the invoice.

Invoice type: This is the document type.

Invoice Date: The date of the invoice.

Due Date: The date the invoice is due to be paid.

Gross: The gross cost of the request.

Outstanding: The outstanding amount to be paid.

Period: This is the financial period that the invoice is logged in.

Order no: This will only show if the Invoice type is a Purchase Order Invoice.

Tip

To modify the columns displayed, select

on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to create Purchase Invoices

Create a Purchase Invoice

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

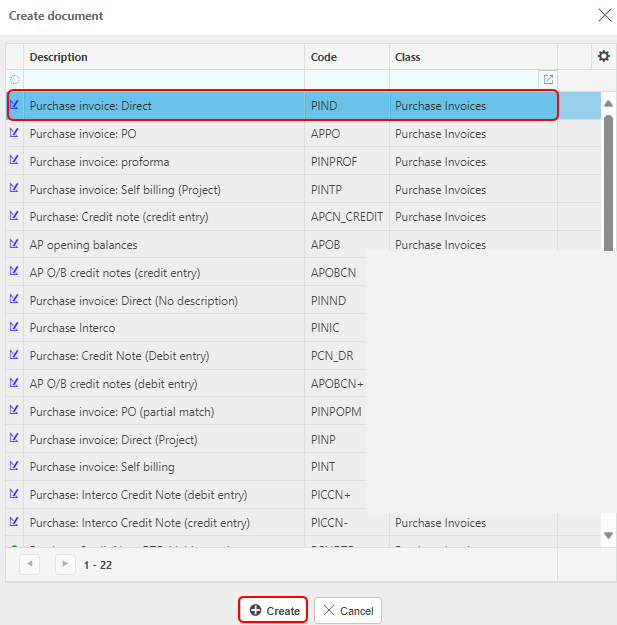

Press New.

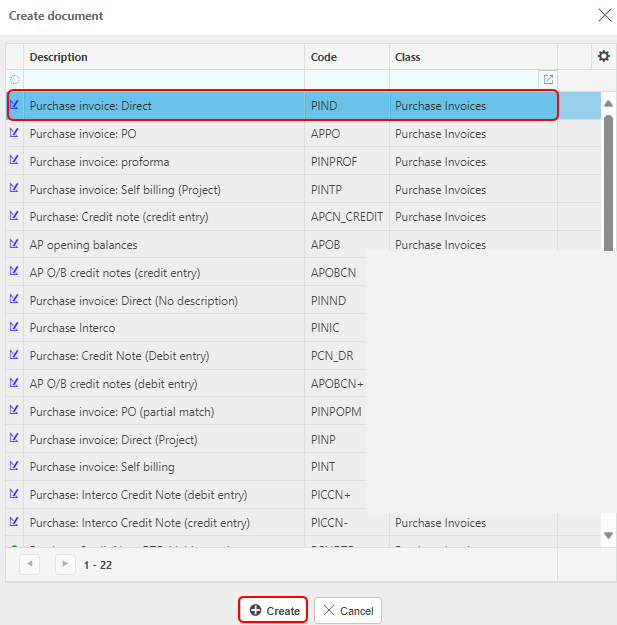

Select the Document type.

Then select Create.

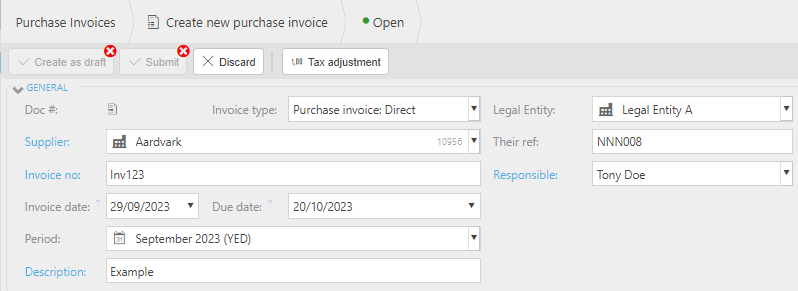

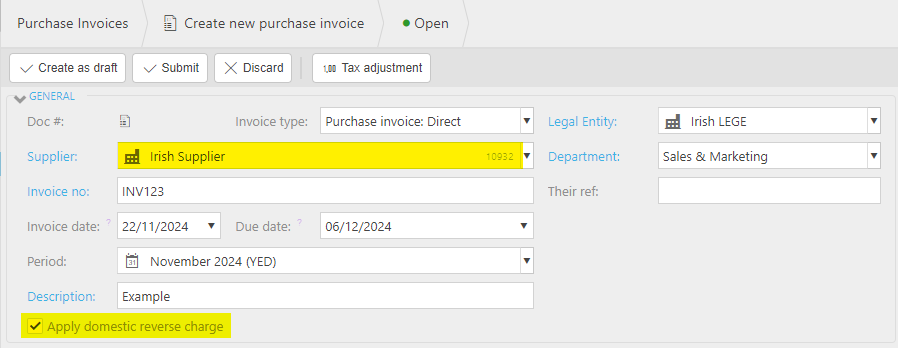

Select a Supplier

Enter an Invoice number.

Enter a description. If Description required option has been ticked in the Document type, then this field will be mandatory. It will be automatically entered if a Default description was entered in the Document type.

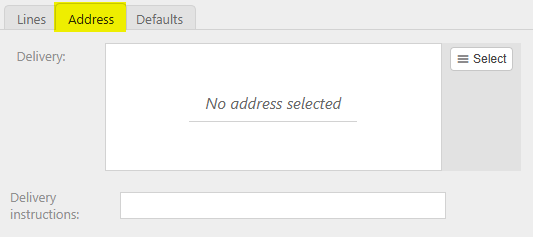

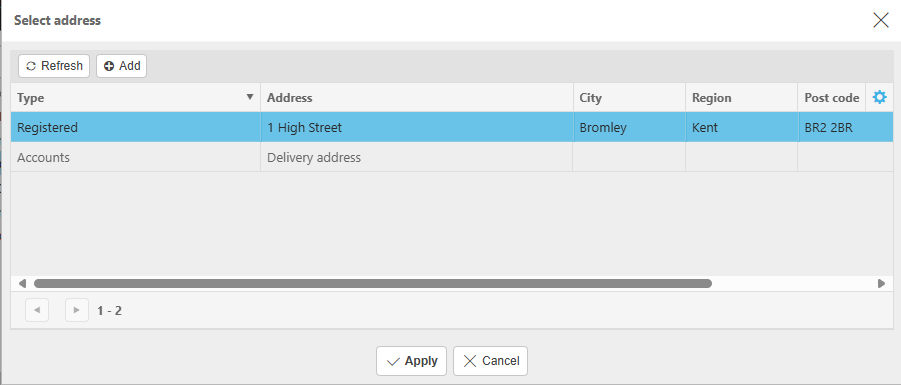

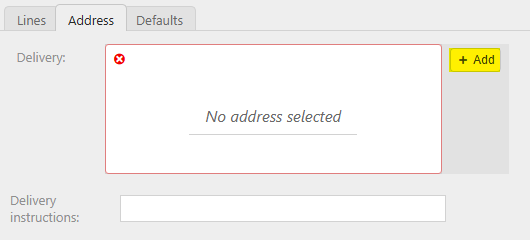

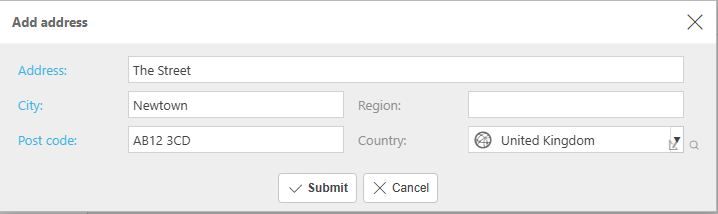

Enter remaining fields in the General section as required - certain fields will only show depending on the Invoice type selected.

Invoice Date: The date of the invoice.

Note

This date will default to the current date unless the Don't default current date option is ticked in Others tab within the Document type. In this case, when a user creates a new document, this date is left blank.

Due date: This date is calculated using the Invoice date and adding the days per the Supplier payment terms.

Period: This is the Financial period that the invoice is being recorded in.

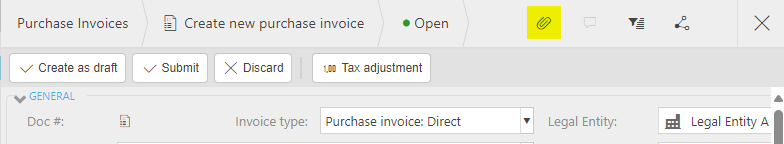

Legal entity: Pre-populated with the default Legal entity set within Document types, but this can be overwritten.

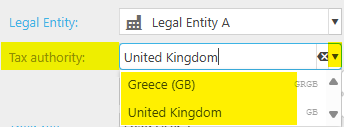

Tax authority: This option will show if the Legal entity has Multiple tax registrations option selected. It is defaulted to the default tax authority on the Legal entity and will have the option to select a different tax authority via the

option.

option.

Department: Select a Department from the dropdown list.

To location: This is the stock location that the goods are being sent to.

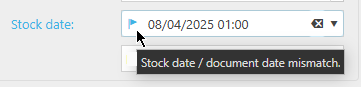

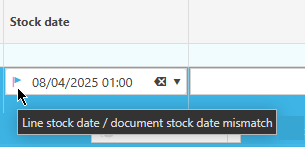

Stock date: This date will default to the Invoice date. It can be changed but will reset to the Invoice date if the latter is changed. If this date differs from the Invoice date, then a

icon will show with a warning message saying Stock date / document date mismatch.

icon will show with a warning message saying Stock date / document date mismatch.

Note

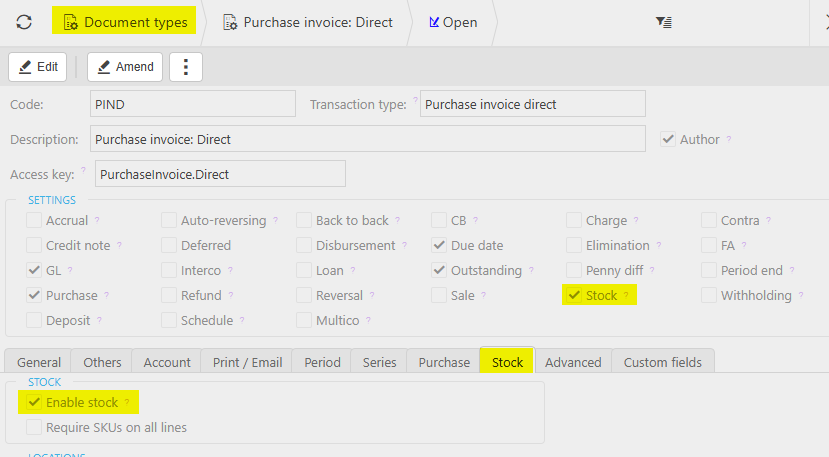

Stock date will only show if the Document type has Stock option selected and Enable stock selected in the resulting Stock tab.

Their Ref: The unique reference given to identify the document. If Their ref required option has been ticked in the Document type, then this field will be mandatory.

Responsible: The Resource responsible for the invoice.

Apply domestic reverse charge: If the Supplier has the Domestic reverse charge enabled, then this option will be displayed

Tip

To modify the columns displayed, select

on the right of this section, then tick/untick the information you want to hide or display.

on the right of this section, then tick/untick the information you want to hide or display.Stock date: If this date differs from the Stock date in the header section, then a

icon will show with a warning message saying Line stock date / document stock date mismatch.

icon will show with a warning message saying Line stock date / document stock date mismatch.

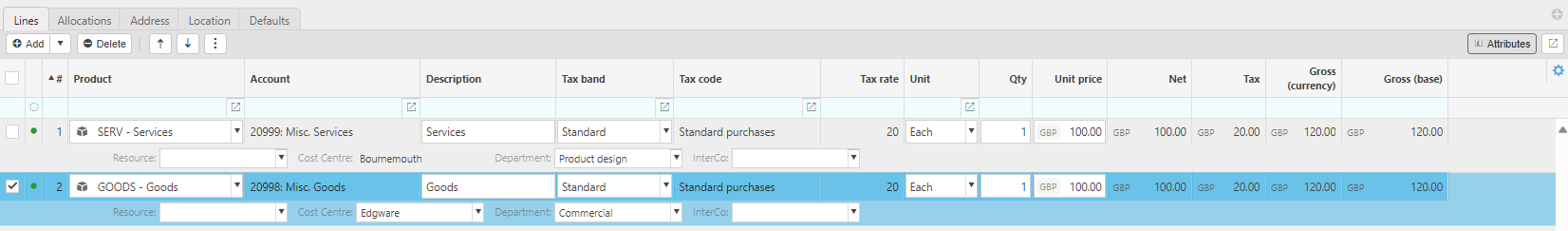

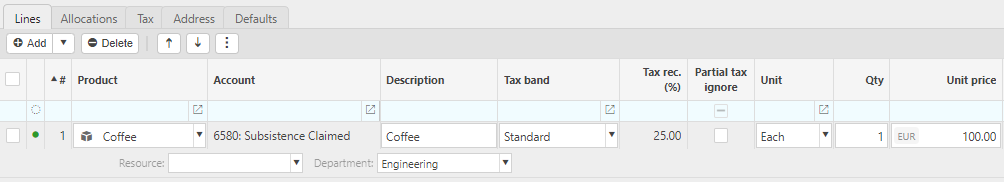

Product: This is the Product being invoiced.

Account: If a Product is being used, this will be auto-completed otherwise select an Account from the available list.

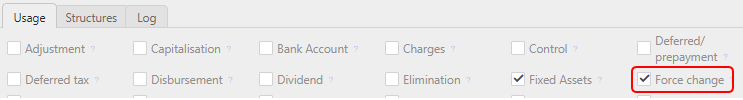

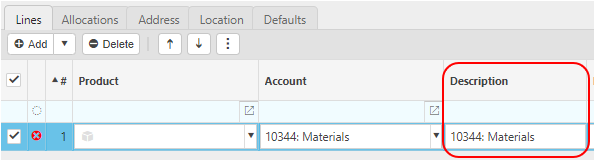

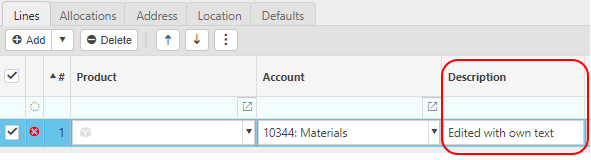

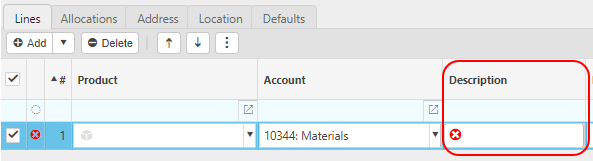

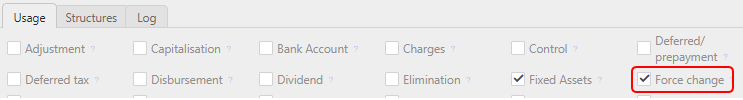

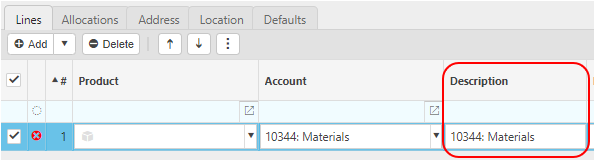

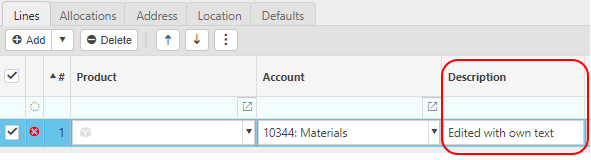

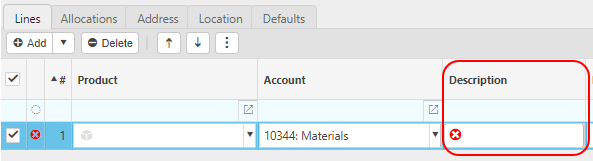

Description: Depending on the Force change setting in Chart of Accounts - using 10344: Materials as an example.

If the Force change is not ticked, then the Description field will be auto filled ...

... however, it can be edited.

If the Force change is ticked, then the Description field will be blank, and you will be forced to enter a description.

Tax Band: The Tax band can be selected here.

Non recoverable: Tick this checkbox if there is tax on the line but it is non-recoverable.

Partial tax ignore: Tick this checkbox if a partial tax rate is being applied but you wish to ignore it and use the prevalent tax rate for the tax code/date combination.

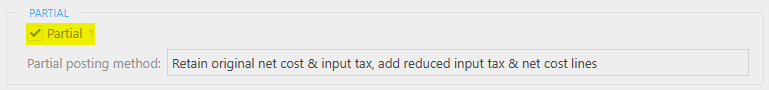

Note

Partial tax ignore will only show if the Tax group on the Legal entity's Tax registrations tab has the Partial option selected.

Unit: This is the unit to measure the Product.

Qty: This is the quantity of the Product.

Unit price: This is the price per unit of the Product.

Posting attributes

The posting attributes are derived from the chart of account rules related to the account code. Common attributes include cost centre and department but can also include custom attributes.

Note

See further information in Custom Data Access Control for Department entry.

If there is a requirement to buy from a Supplier and have the goods delivered where the tax authority treatment is different, then set the Supplier up as a Multi Tax Authority Supplier.

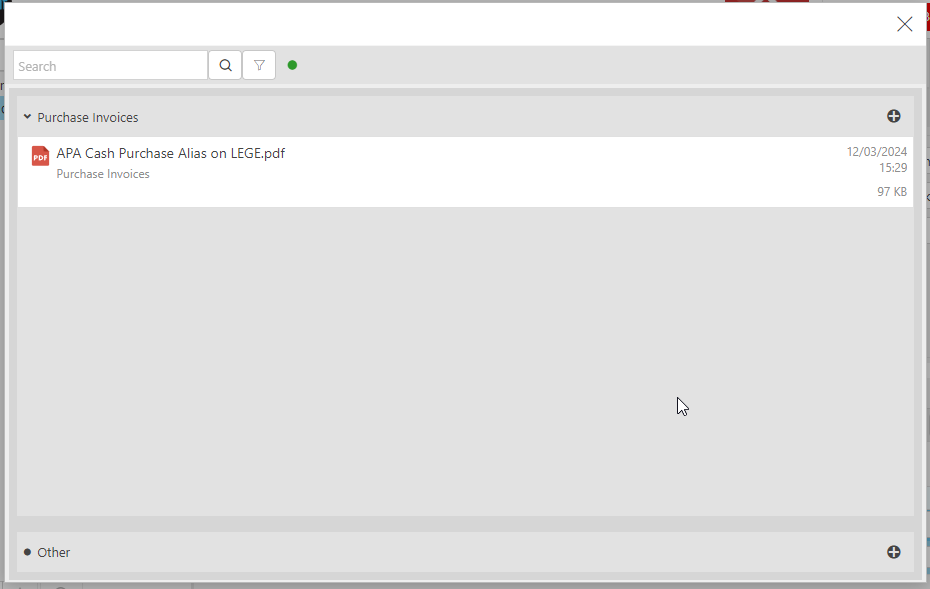

Selecting the

icon enables documents to be attached to the Invoice to provide further evidence.

icon enables documents to be attached to the Invoice to provide further evidence.

Selecting the

icon allows the addition of Purchase Invoices or Other files from external sources.

icon allows the addition of Purchase Invoices or Other files from external sources.

Important

The maximum file size for attachments is 16MB.

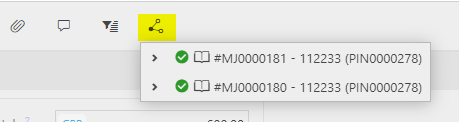

Selecting the

icon will show any documents linked to the invoice.

icon will show any documents linked to the invoice.

Select either Submit once happy with details or Create as draft to be able to edit further before submitting.

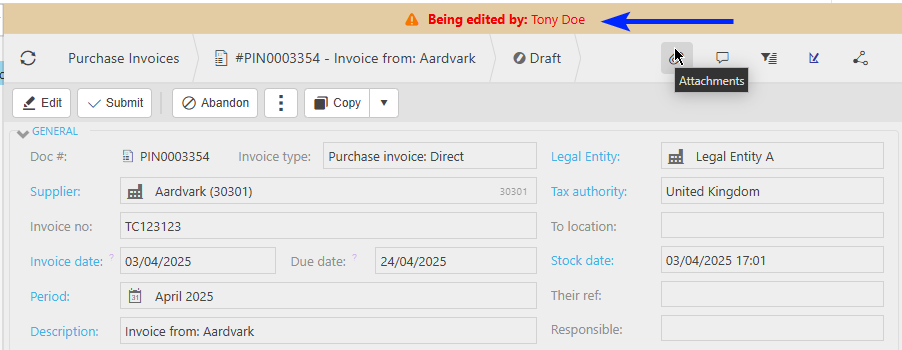

Note

Returning to this document via the Edit option will notify other users viewing the same document that it is being edited.

If no Authorisation Workflow has been setup, then this Invoice will be Authorised - see sections below for further changes etc. Also, the Invoice can now be paid - see How to pay a Purchase Invoice below.

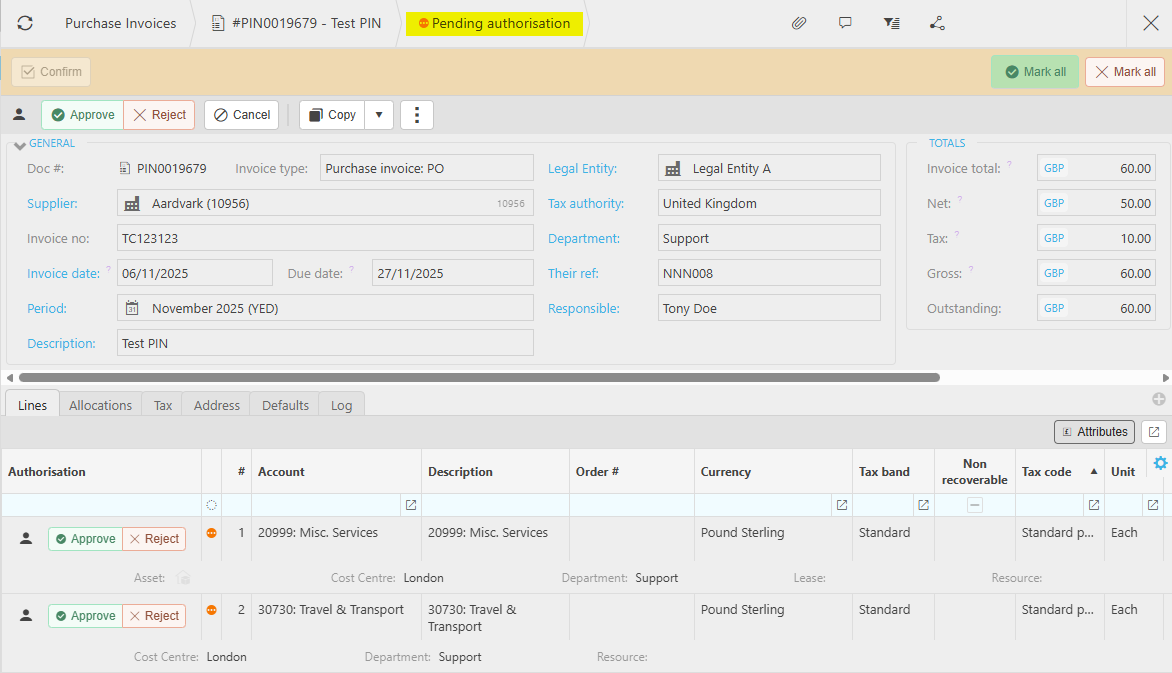

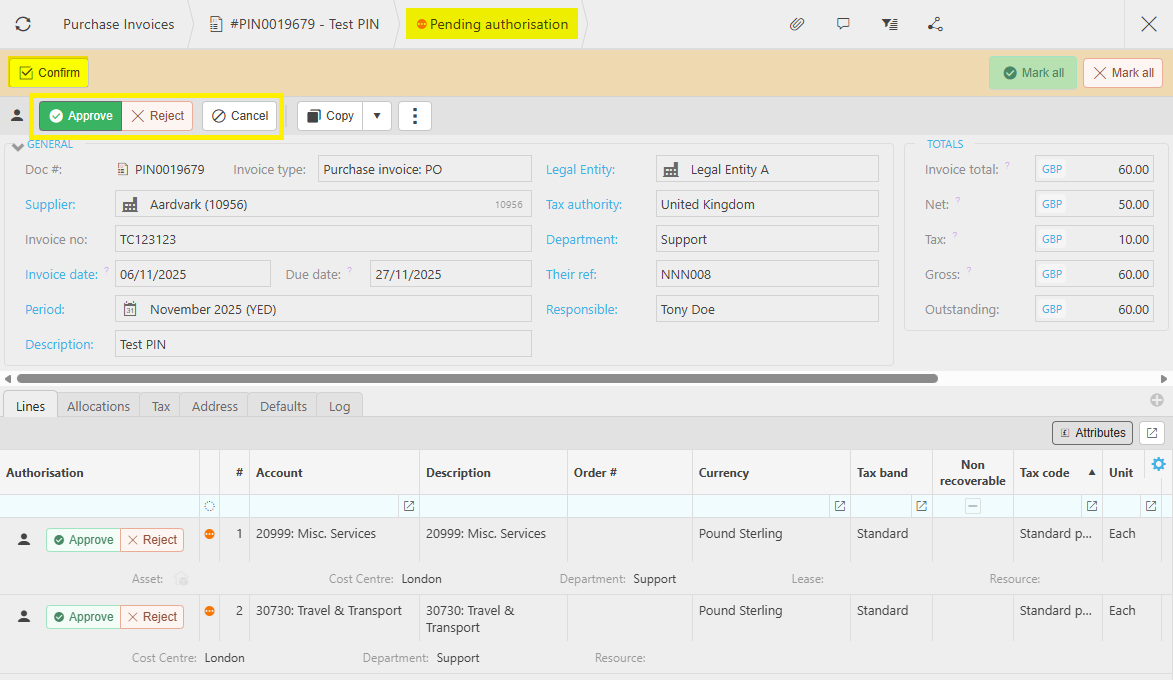

If an Authorisation Workflow has been setup, then the Invoice will be submitted Pending authorisation.

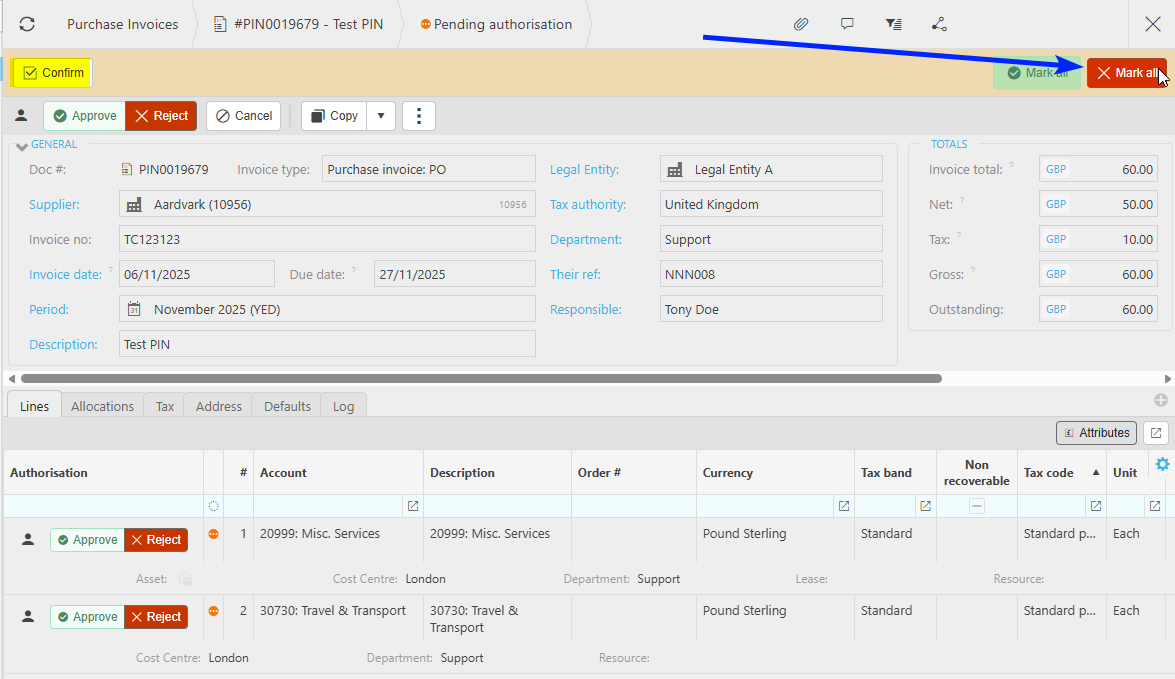

The authoriser will then need to Approve, Reject or Cancel the Invoice, Select Approve or Reject for the general details, then select Confirm.

Individual lines can also be independently Approved or Rejected, and each selection will need Confirming.

To Approve the whole Invoice, select

option, then select Confirm.

option, then select Confirm.

To Reject the whole Invoice, select

option, then select Confirm.

option, then select Confirm.

How to create Purchase Invoices with Withholding Tax

Create a Purchase Invoice with Withholding Tax

Note

Withholding Tax option is a process where the User can withhold the Tax element of a payment to a Irish Supplier, so they can pay that tax to the revenue body separately.

Certain Prerequisite settings need to be set to allow this process to work.

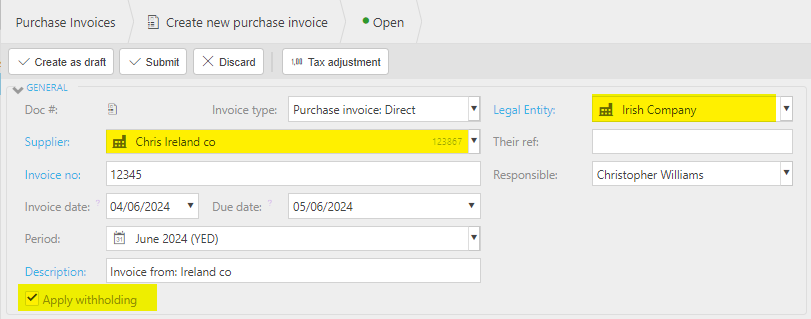

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

Press New.

Select the Document type.

Then select Create.

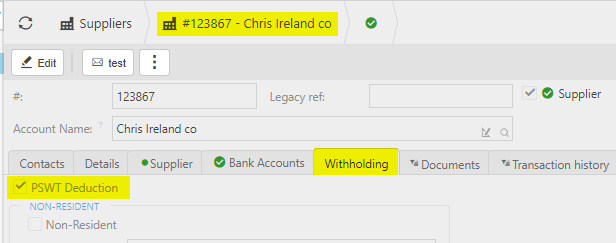

Select an Irish Supplier - the Supplier must have the PSWT deduction flag ticked on the withholding tab.

Enter an Invoice number.

Enter a description. If Description required option has been ticked in the Document type, then this field will be mandatory. It will be automatically entered if a Default description was entered in the Document type.

Select an Irish Legal entity. Once a Supplier that has PSWT set and an Irish Legal entity, then the Apply withholding attribute will display already ticked, as default.

Enter remaining fields in the General section as required.

Invoice Date: The date of the invoice.

Due date: This date is calculated using the Invoice date and adding the days per the Supplier payment terms.

Period: This is the Financial period that the invoice is being recorded in.

To location: This is the stock location that the goods are being sent to.

Their Ref: The unique reference given to identify the document. If Their ref required option has been ticked in the Document type, then this field will be mandatory.

Responsible: The Resource responsible for the invoice.

Add Lines and posting attributes.

Tip

To modify the columns displayed, select

in the top right of the page, then tick/untick the information you want to see or not.

in the top right of the page, then tick/untick the information you want to see or not.Lines and posting attributes explained

Lines

Product: This is the Product being invoiced.

Account: If a Product is being used, this will be auto-completed otherwise select an Account from the available list.

Description: Depending on the Force change setting in Chart of Accounts.

If the Force change is not ticked, then the Description field will be auto filled ...

... however, it can be edited.

If the Force change is ticked, then the Description field will be blank, and you will be forced to enter a description.

Tax Band: The Tax band can be selected here.

Unit: This is the unit to measure the Product.

Qty: This is the quantity of the Product.

Unit price: This it the price per unit of the Product.

Posting attributes

- The posting attributes are derived from the chart of account rules related to the account code. Common attributes include cost centre and department but can also include custom attributes.

- Once you are happy with the Invoice press Submit.

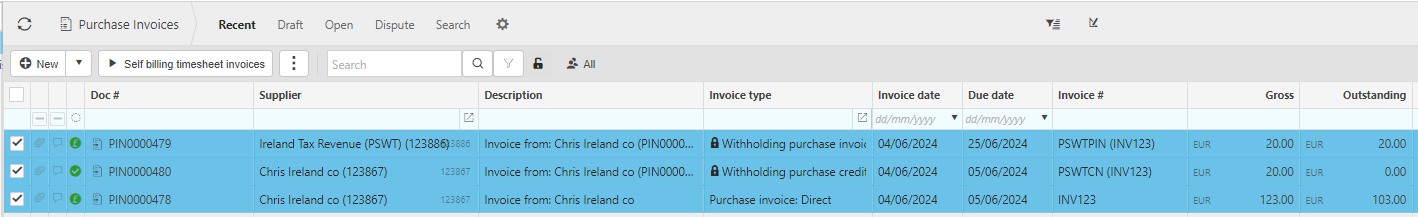

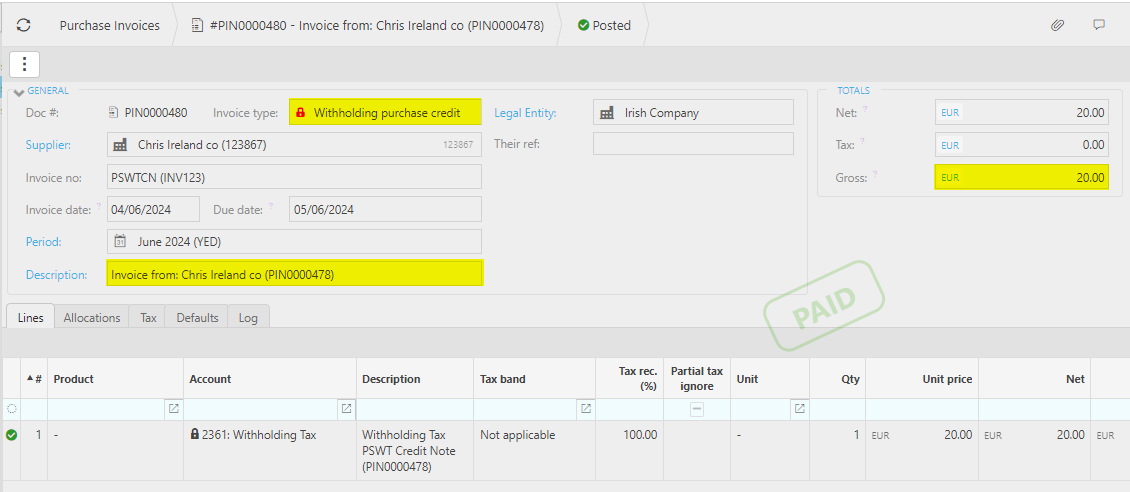

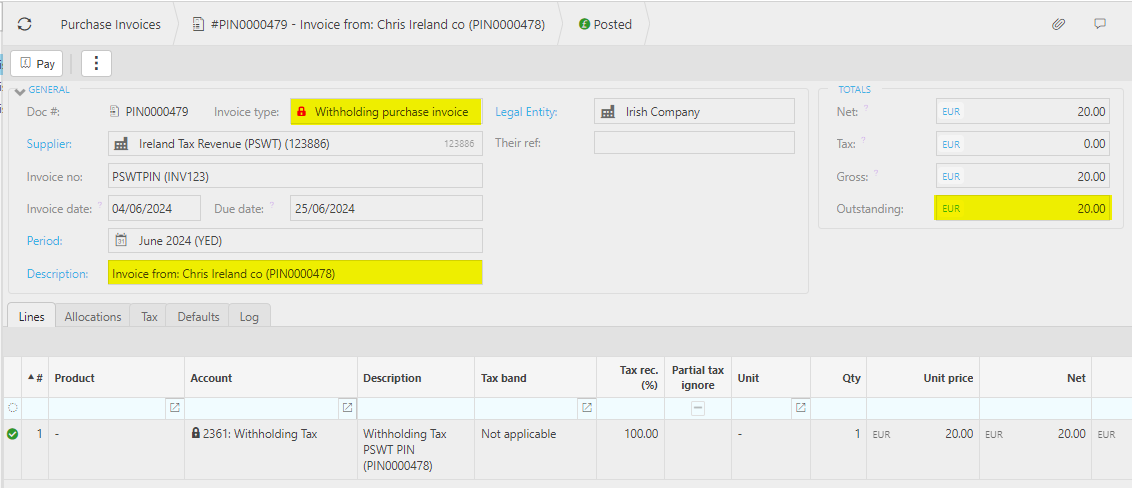

Refreshing the Purchase Invoice screen will show the new PIN document just created along with 2 additional documents – the Withholding credit note and the Withholding purchase invoice.

The Withholding Credit Note will be to the same supplier as your original PIN, with the account details you created in the Chart of Accounts setup stage. The amount of the document should be the Withhold rate you set on the Tax authority. The descriptions should refer to the Doc No of the PIN you created.

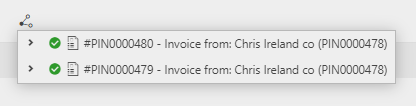

The Credit note will also be linked to the original PIN.

The Withholding Purchase Invoice will have the Tax Revenue Body supplier with the Account details created in the Chart of Accounts setup in the Prerequisite settings. The amount of the document should be the Withhold rate you set on the Tax authority with the net amount of the PIN created. Descriptions will refer to the Doc No of the PIN created.

The Purchase invoice will also be linked to the original PIN.

How to setup to process multi-company Purchase Invoices

Setup to process multi-company Purchase Invoices

An example of when this would be used is a Multi-academy Trust (Legal Entity A) which has multiple Academies (Legal Entity A & Legal Entity B). Imagine a Lift Maintenance Supplier has serviced the lifts at many of the Academies but only sends one invoice which relates to the work at the various Academies.

Using the above example, the Supplier purchase invoice is entered against Legal Entity A and each line of the invoice identifies the work at another Academy (Legal Entity B).

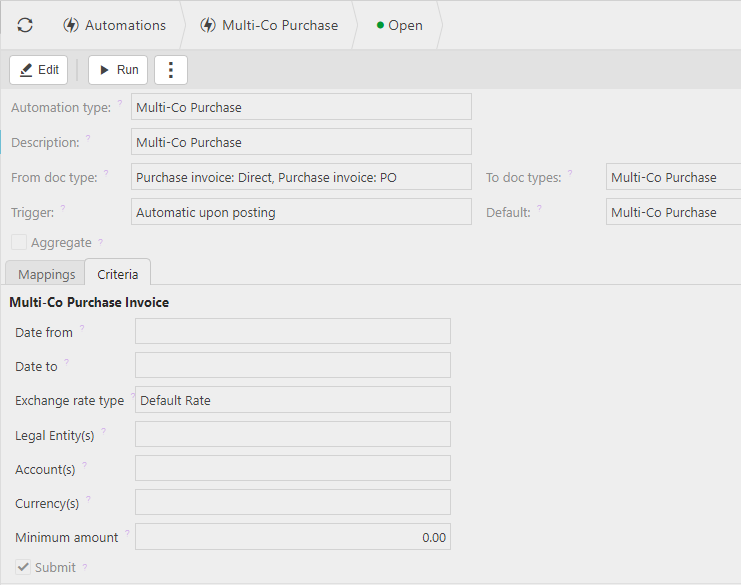

If the Interco attribute is on the posting line (optional) and the following setup is complete, Multi-Co Purchase manual journals will be automatically created upon posting of the Purchase Invoice.

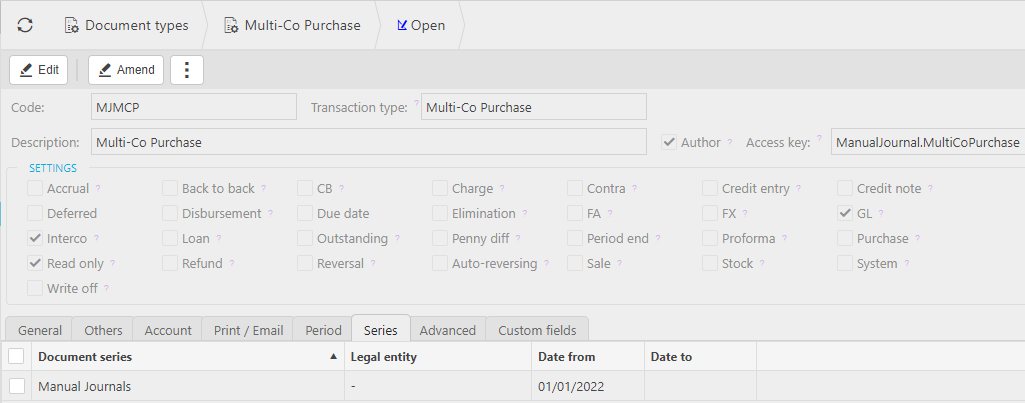

Unlock the Multi-Co Purchase document type and relate to document series.

Setup Multi-Co Purchase automation

Review Multi-Co Purchase automation for more information.

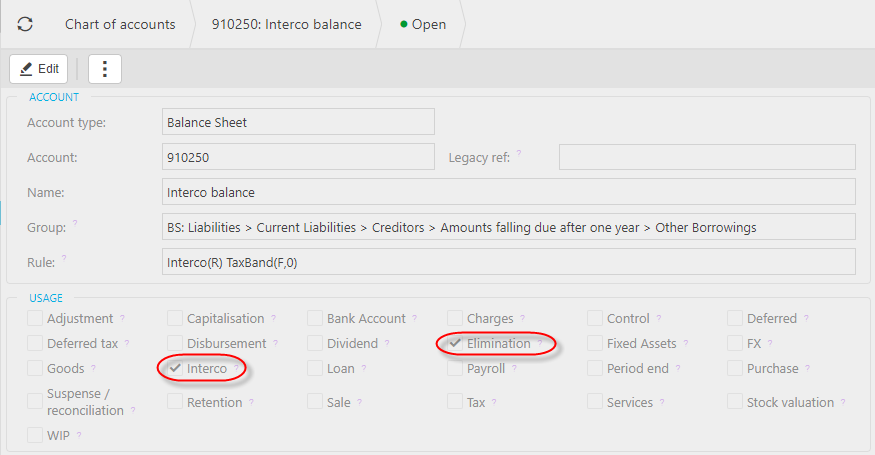

Setup Interco chart of Account (if applicable)

The Interco checkbox must be ticked.

The Elimination checkbox should also be ticked if you wish to take advantage of this when viewing financial statements.

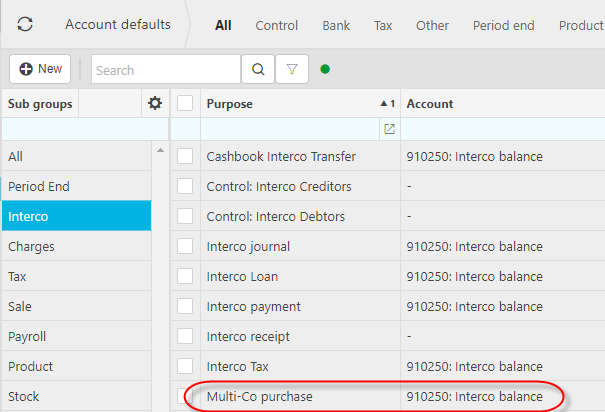

Setup the account default for Multi-Co Purchase.

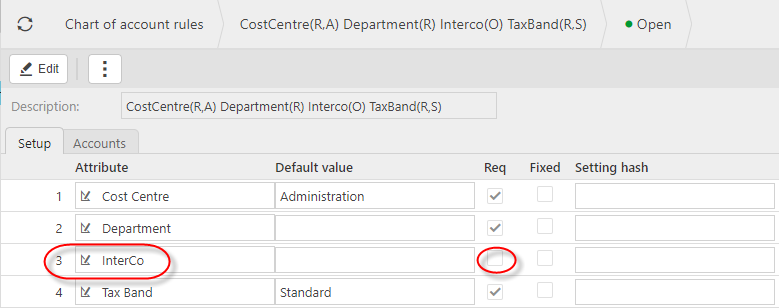

Add the Interco attribute to the Chart of Account Rules for the accounts.

Make this an optional attribute.

How to pay Purchase Invoices

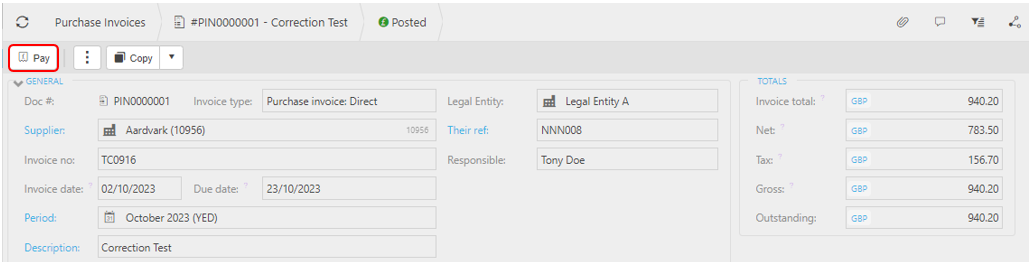

Pay a Purchase Invoice

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

Select and open the Invoice that you want to pay, and press Pay.

This will show an Allocations tab, showing outstanding payments. Select which payments to pay.

Note

Project: This shows the Project from the header of the Purchase invoice if it has been entered.

If the Project field is not displayed, select the

icon on the right of this tab section, then tick the Project field to display on the tab list.

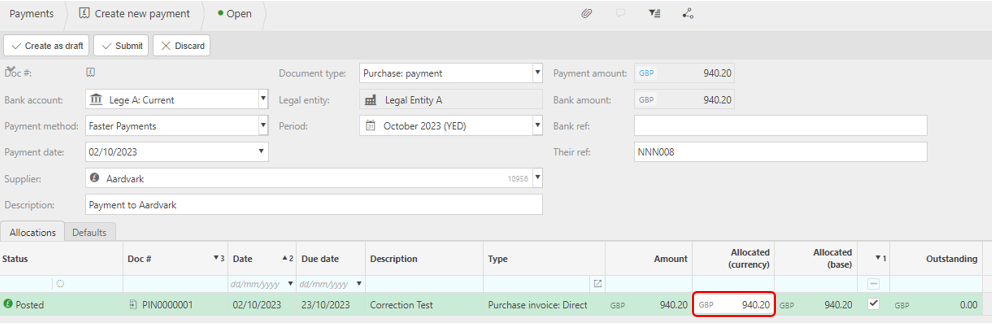

icon on the right of this tab section, then tick the Project field to display on the tab list.If paying the full outstanding amount, leave this amount in the Allocated (currency) field -

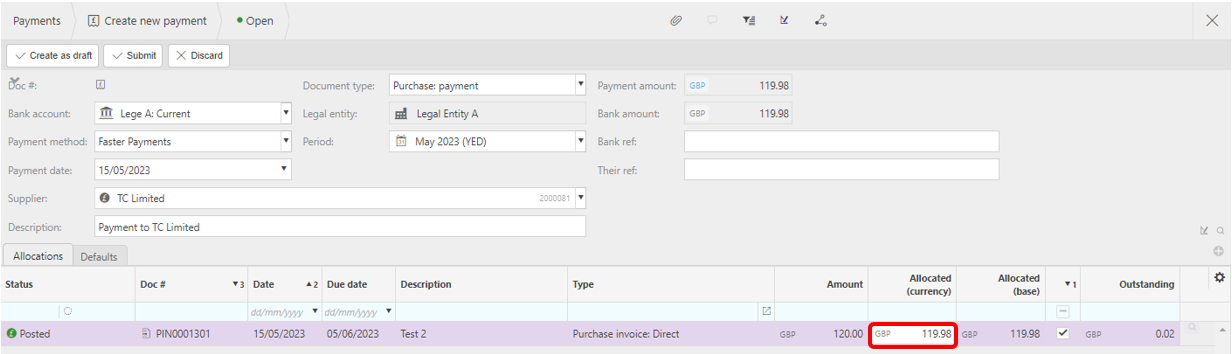

This amount can be any amount. If the amount is within pennies of the full outstanding amount, then the Penny Correction Automation (if the trigger setting is Automatic upon posting) will process the amount entered and a correction amount of a few pennies.

Further details - Penny Correction Automation.

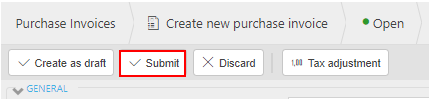

Once Payment amount has been entered, select Submit to process the payment.

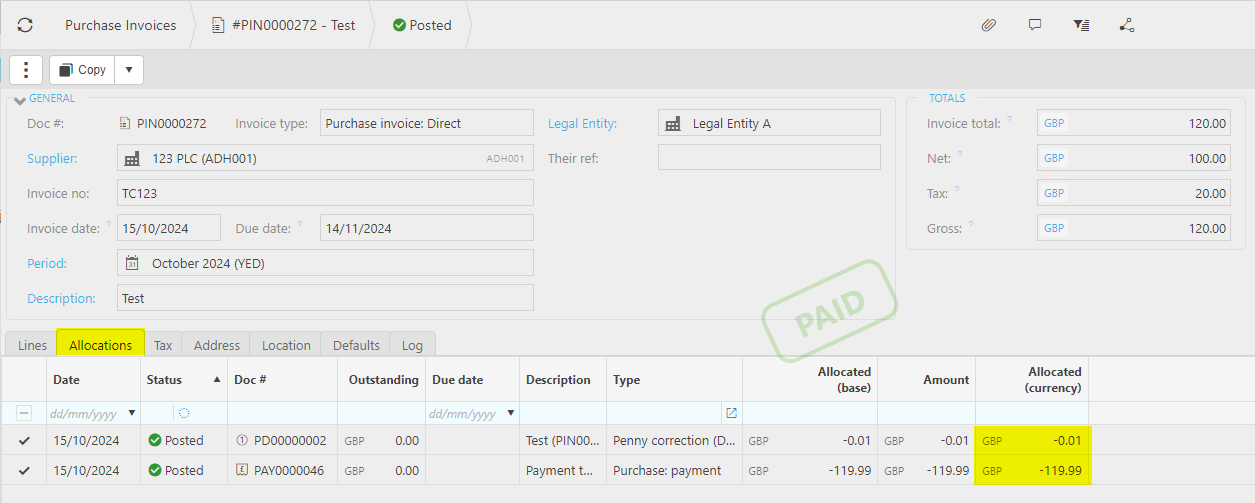

Opening the Purchase Invoice again, if the full outstanding amount was entered then it will now show as Paid.

If the amount was only pennies different, then the Purchase Invoice will also show as Paid and the Allocations tab will show with two transactions - one with the payment amount entered and one with the penny correction payment.

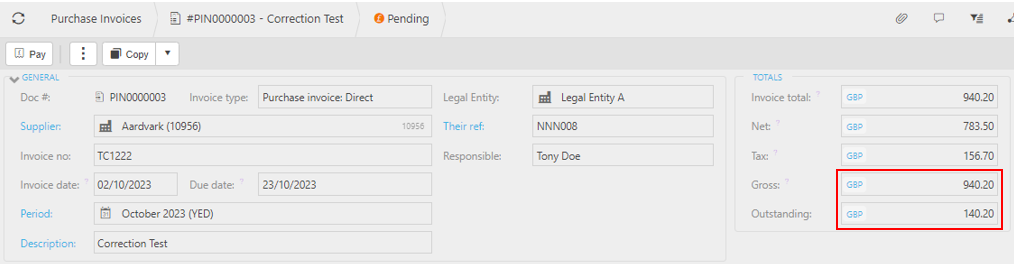

If only a part Payment amount was entered, then the Purchase Invoice will show the outstanding balance as the Gross less the amount on the payment -

How to reallocate Purchase Invoices

Reallocate a Purchase Invoice

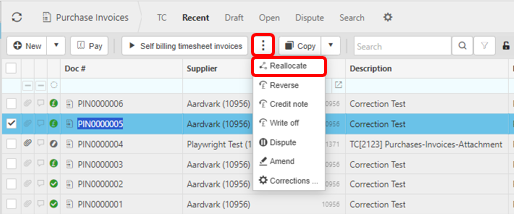

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

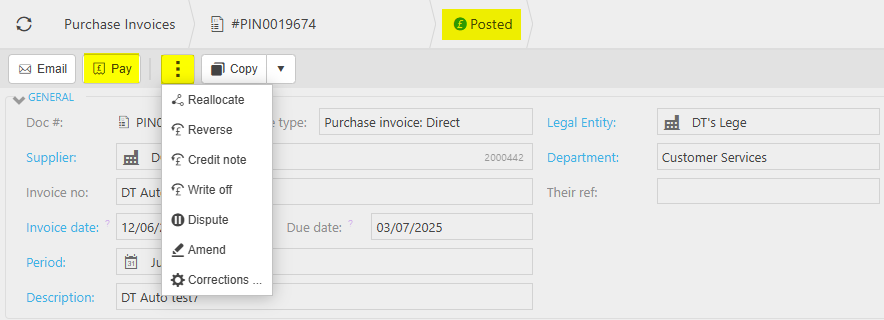

Select and open the Purchase invoice, then select the

button and select Reallocate.

button and select Reallocate.

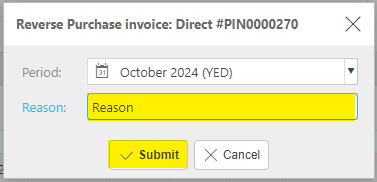

How to reverse Purchase Invoices

Reverse a Purchase Invoice

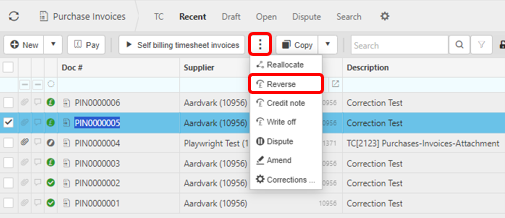

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

Select and open the Purchase invoice, then select the

button and select Reverse.

button and select Reverse.

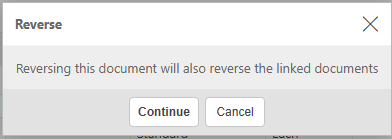

Note

If this is a Multi-co or Inter-co document and there are linked documents, then a warning that reversing will also reverse all linked documents.

Enter the reason then press Submit.

Note

Should the Reversal not be able to be posted for any reason, the document will remain showing as Reversing and the Reversal document that is created will show the error reason and have a Submit option. This enables any corrections to be made and then resubmitted. Then the Reversal document will post.

See Reversals for further details.

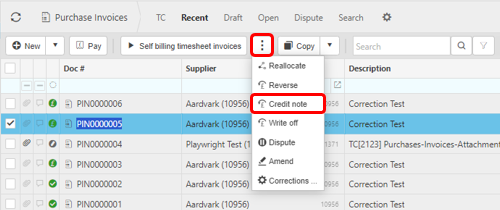

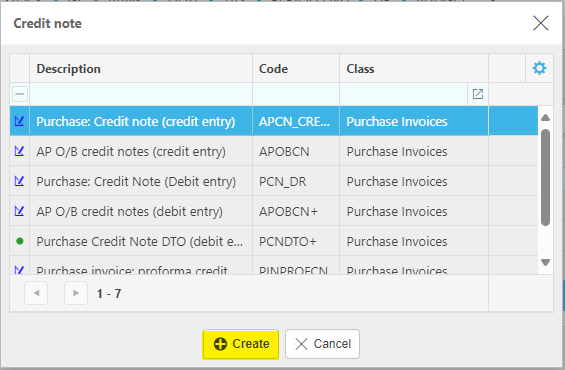

How to create a Credit Note

Creating a Credit note

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

Select the Purchase invoice (either highlighted on the list or open the Invoice), then select the

button and select Credit note.

button and select Credit note.

Select the credit type, then press Create.

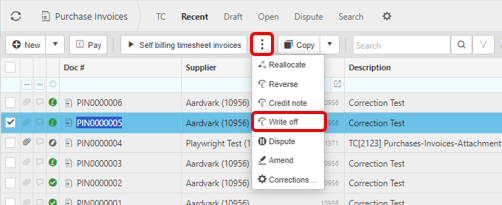

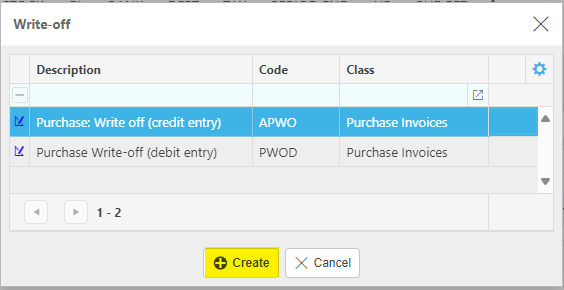

How to write-off Purchase Invoices

Write-off a Purchase Invoice

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

Select the Purchase invoice (either highlighted on the list or open the Invoice), then select the

button and select Write-off.

button and select Write-off.

Select the write-off type, then press Create.

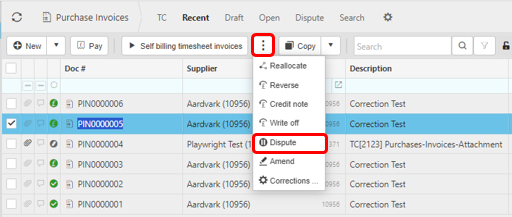

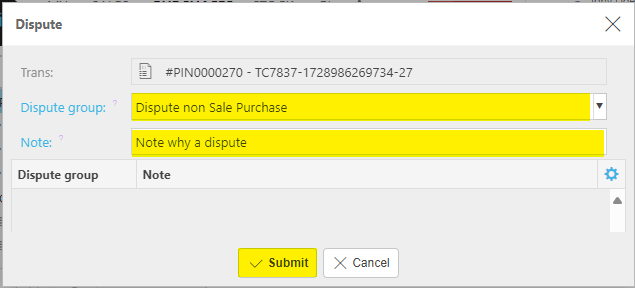

How to dispute Purchase Invoices

Dispute a Purchase Invoice

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

Select the Purchase invoice (either highlighted on the list or open the Invoice), then select the

button and select Dispute.

button and select Dispute.

Select the Dispute group and if required, a note.

- Press Submit.

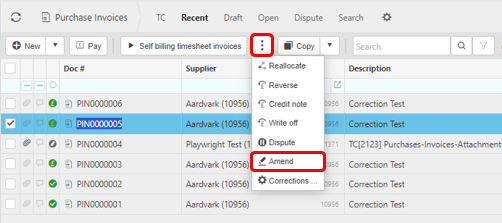

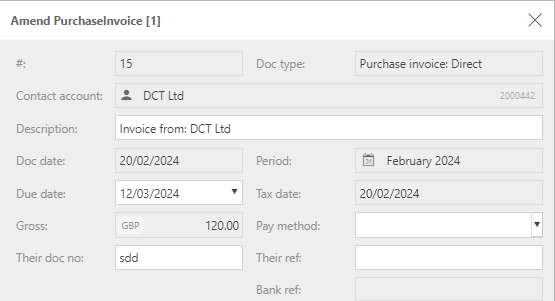

How to amend Purchase Invoices

Amend a Purchase Invoice

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

Select and open the posted Purchase invoice (either highlighted on the list or open the Invoice) to amend, then press Amend option from the

dropdown button.

dropdown button.

You can now make non-monetary changes to the Invoice details without having to Unpost first. These amendments will not have any effect on any of the Accounts.

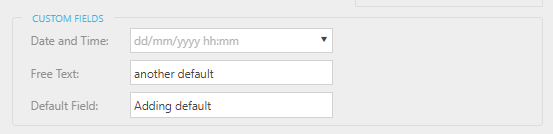

You can also make changes to Custom fields, which have previously been defined on the Custom fields tab when defining the Document type -

Note

User will need Attribute.Amend permissions.

Once complete, press Apply.

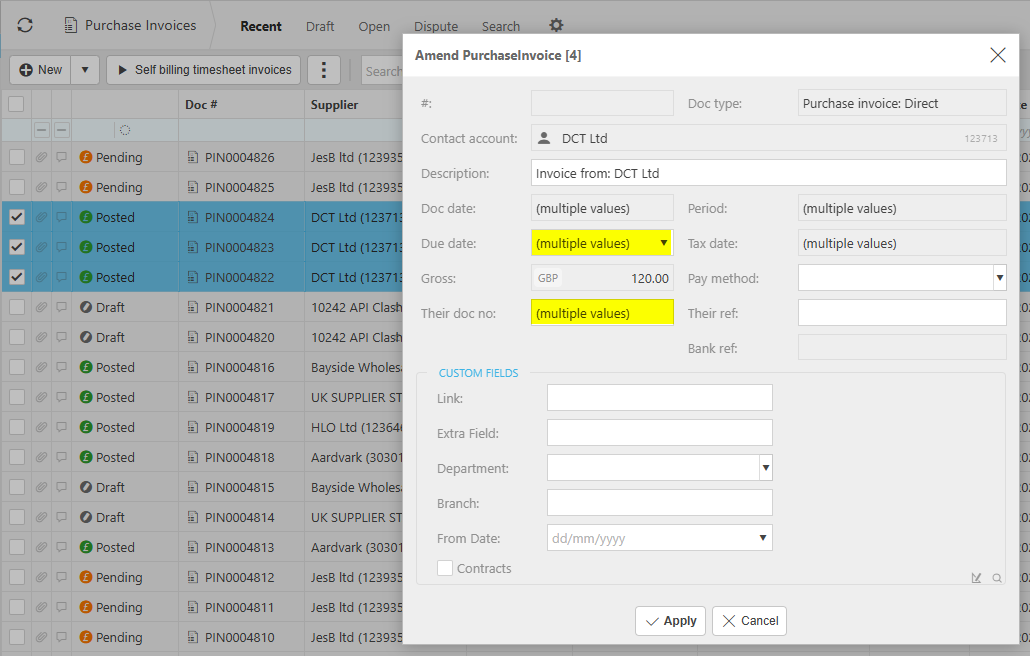

When Amend multiple records at once.

- If a field has the same value across all records: Displays that value.

- If a field has no value across all records: Leaves the field blank.

- If a field has mixed values across records: Displays (multiple values).

When the user edits the field, the new value overwrites all selected records.

For checkbox fields that are in mixed state: Displays as undefined.

How to make corrections on Purchase Invoices

Make corrections to a Purchase Invoice

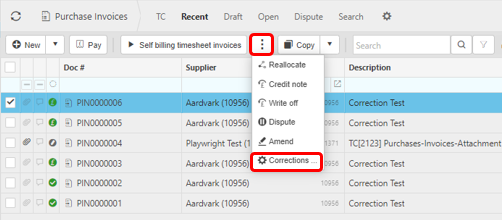

Select Purchase Invoices from one of the options as shown above in Viewing a Purchase Invoice.

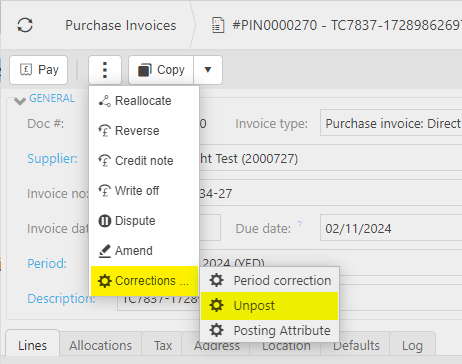

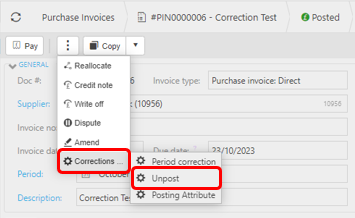

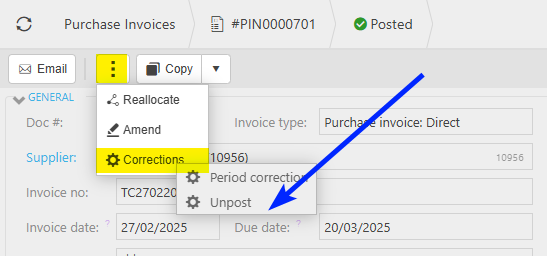

Select the Purchase invoice (either highlighted on the list or open the Invoice), then select the

button and select Corrections.

button and select Corrections.

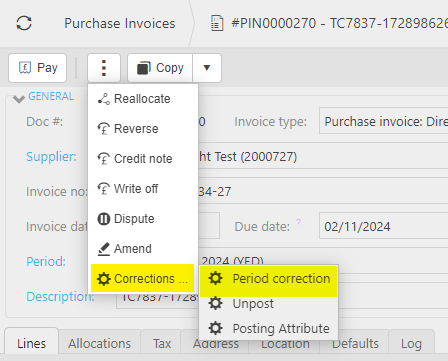

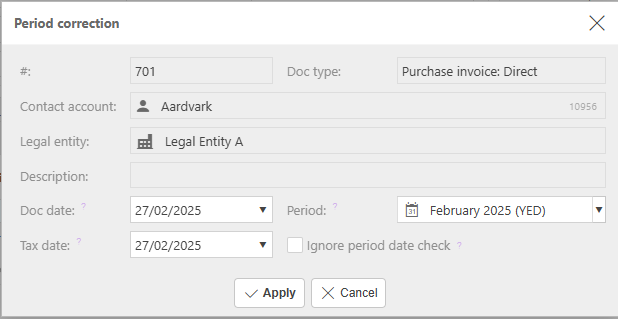

Period correction to make corrections to the Period.

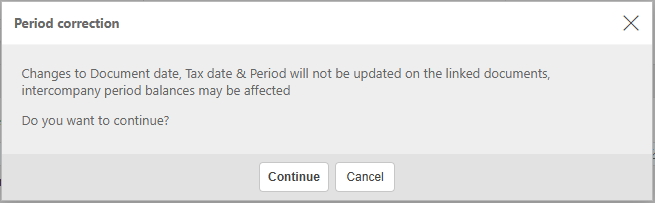

Note

If the document has any linked documents, then a warning will show informing that changes will not be updated on any linked documents and asking if you wish to continue.

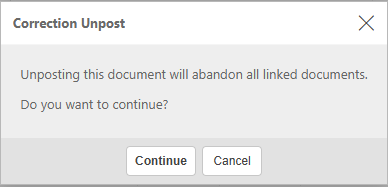

Unpost to retract the Purchase Invoice from the General Ledger.

Note

If this is a Multi-co or Inter-co document and there are linked documents, then a warning that unposting will abandon all linked documents.

Note

Any Manual Journals that were linked to this invoice will also be returned to draft state.

If the invoice is then Abandoned, then the linked documents will also be Abandoned.

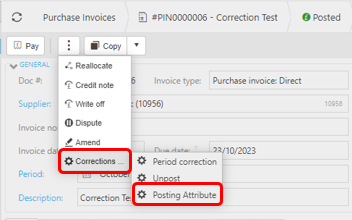

Posting Attribute to make corrections to individual attribute values on the Purchase Invoice.

Warning

If the document has linked documents created via automation, then the corrections to the Posting Attributes will not be possible.

The option Posting Attribute will no longer show under Corrections.

See Correcting Posting Attributes for further details.

Updated November 2025