Withholding Tax Prerequisites

Withholding Tax option is a process where the User can withhold the Tax element of a payment to a Supplier, so they can pay that tax to the revenue body separately.

This withheld tax is known as Professional Services Withholding Tax (PSWT) and is an option available to payments made by Irish Users initially.

The User is then required to submit a PSWT returns to the tax authorities and pay the deducted PSWT.

To be able to use the Withholding Tax option, the following requirements need to be set.

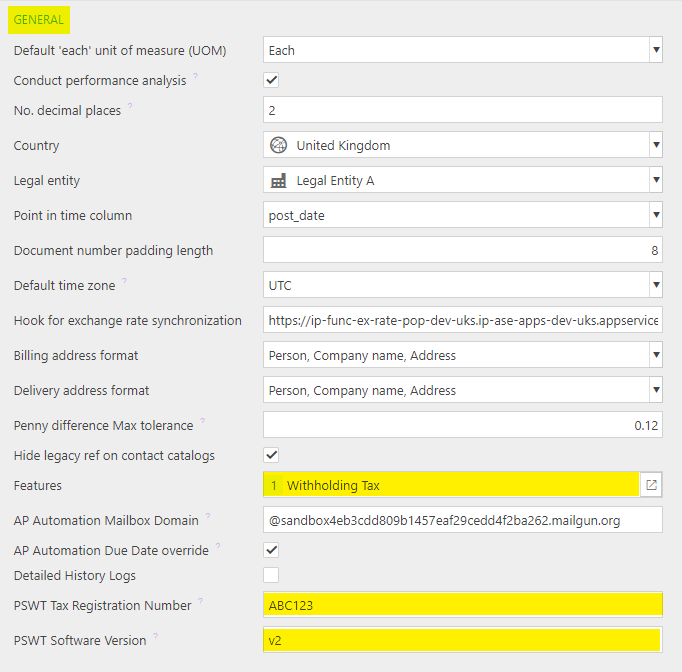

Environment Settings

On the General tab in Environment defaults, add Withholding Tax to Features. This will then display two mandatory Professional Services Withholding Tax (PSWT) fields that will be required in order to populate ePSWT submissions.

Note

Without this setting, many of the following steps won't be available. So best practice is to make this setting first.

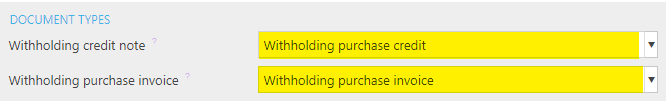

On the Document Types tab, enter the defaults for Withholding credit note and Withholding purchase invoice.

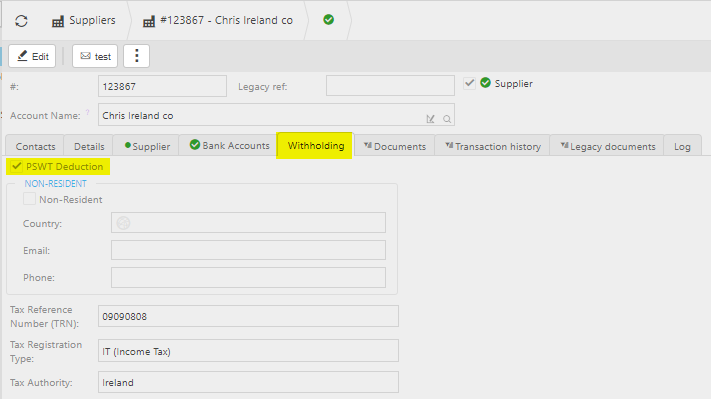

Suppliers

Depending on your environment, Suppliers might already be created.

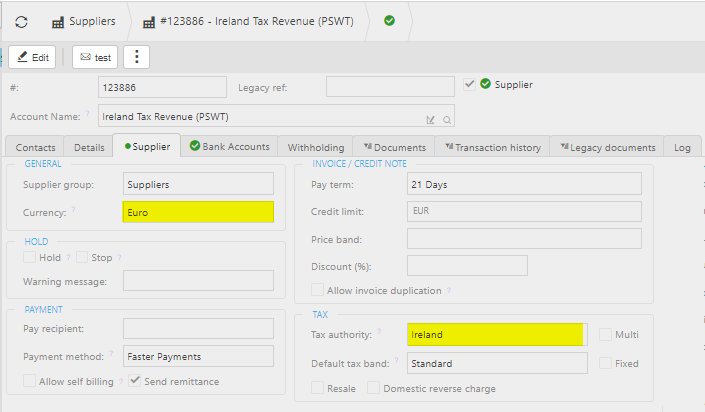

A new Supplier needs to be created that represents the Tax revenue body that's going to be collecting this tax. e.g. for an Irish supplier, set correct currency, country, tax authority for Ireland etc.

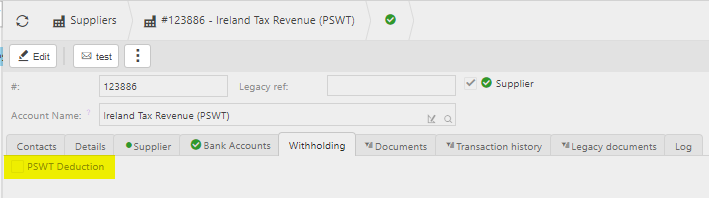

Professional Services Withholding Tax (PSWT) deduction for this supplier is OFF, as this is where the tax is paid to.

Any Irish Supplier in your environment that is going to use the PWST option, the PSWT deduction flag must be ticked.

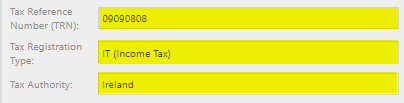

Fill in the mandatory fields -

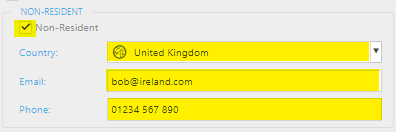

For Non-Resident option, the fill in following mandatory fields -

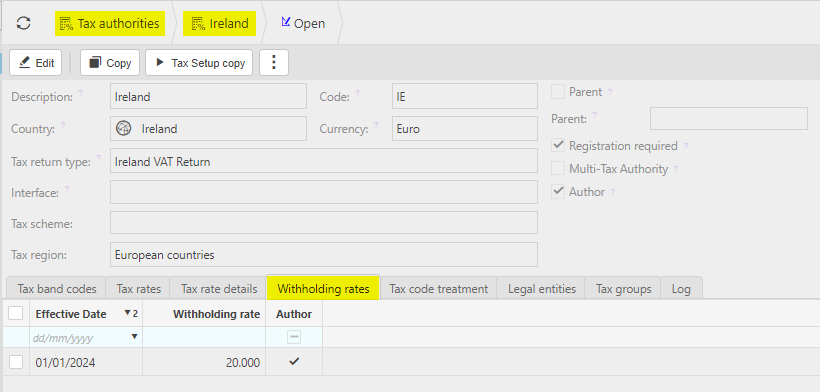

Tax Authorities

The Withholding rates tab on Ireland's Tax Authority will be preset. This rate represents how much will be deducted from the payment to the Supplier and paid to the Tax revenue body.

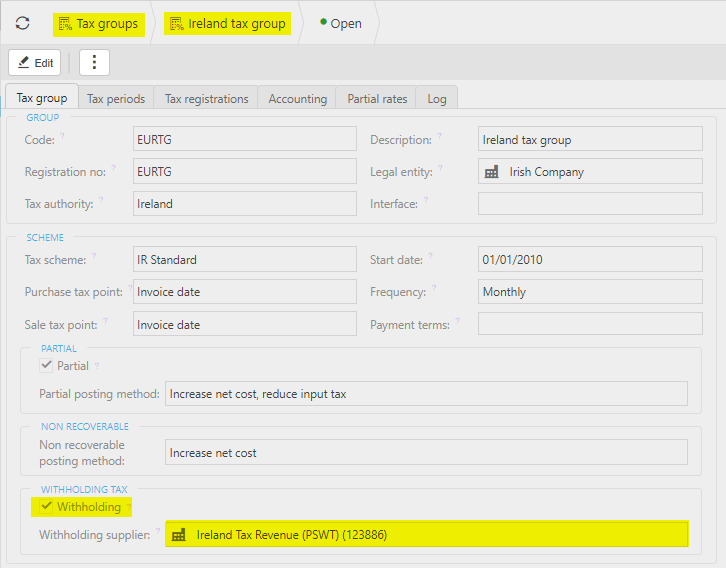

Tax Groups

Tick the Withholding Tax option in Ireland tax group. Set the Withholding supplier to the Tax revenue body supplier that was setup above.

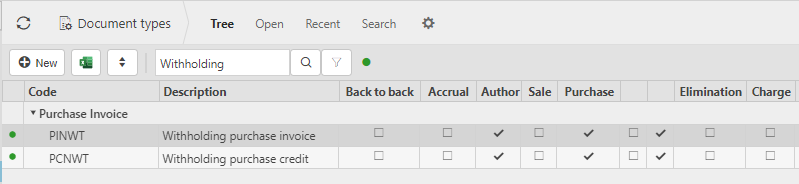

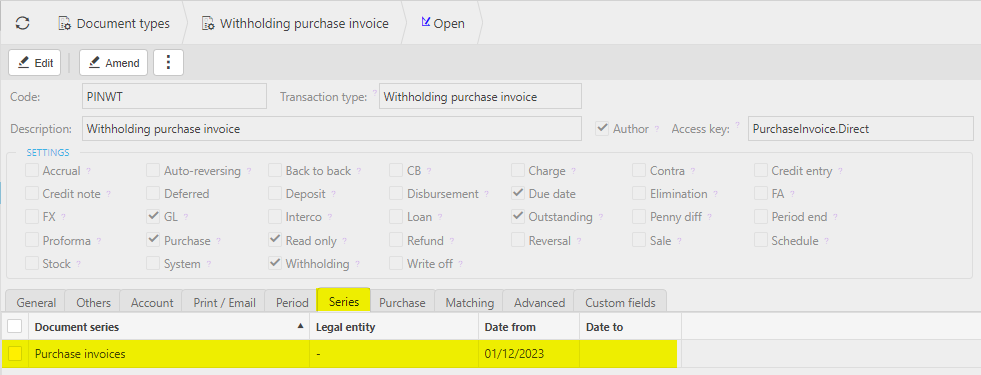

Document Types

Check that following document types - Withholding purchase credit and Withholding purchase invoice.

Ensure that a valid document series (Purchase invoices) is added to each and that a valid date is entered.

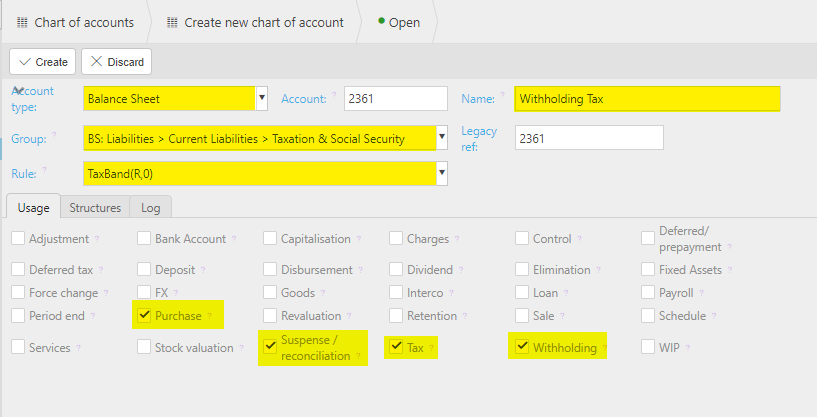

Chart of Accounts

Create a new Chart of Accounts with the following -

- Type – Balance Sheet.

- Name – Something that is easy to find i.e. Withholding Tax (PSWT).

- Group – BS: Liabilities > Current Liabilities > Taxation & Social Security.

- Rule – TaxBand(R,0).

- Usage – Purchase, Suspense/reconciliation, Tax, Withholding.

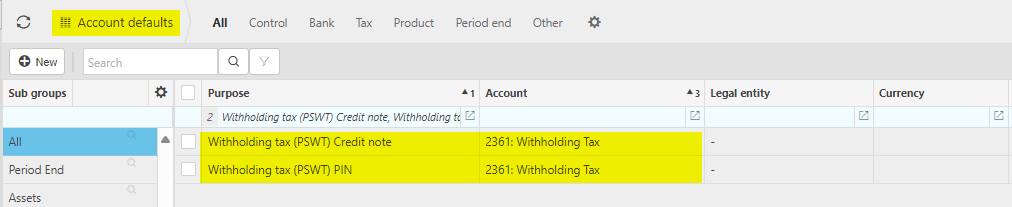

Account Defaults

Create Account defaults for the Withholding tax (PSWT) Credit note and Withholding tax (PSWT) PIN purposes. These need to be linked to the account you setup in the Chart of accounts step above.

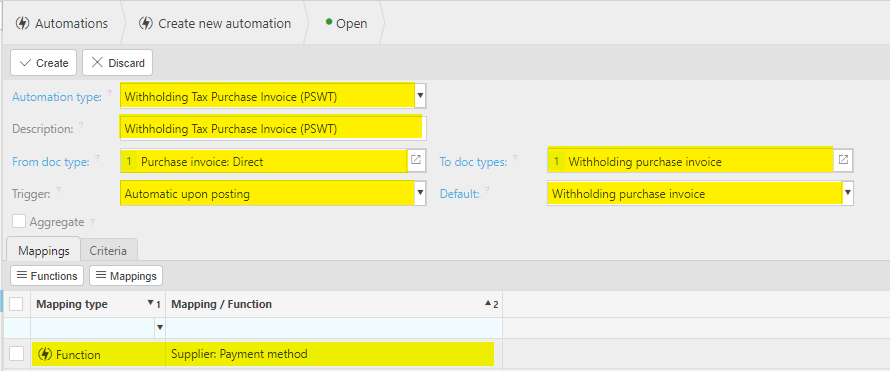

Automations

Create two new Automations.

Withholding Tax Purchase Invoice (PSWT) -

- Automation type - Withholding Tax Purchase Invoice (PSWT).

- Description - Withholding Tax Purchase Invoice (PSWT).

- From doc type – Purchase invoice: Direct.

- To doc types – Withholding purchase invoice.

- Trigger – Automatic upon posting.

- Default – Withholding purchase invoice.

- Mappings tab - these will be automatically populated.

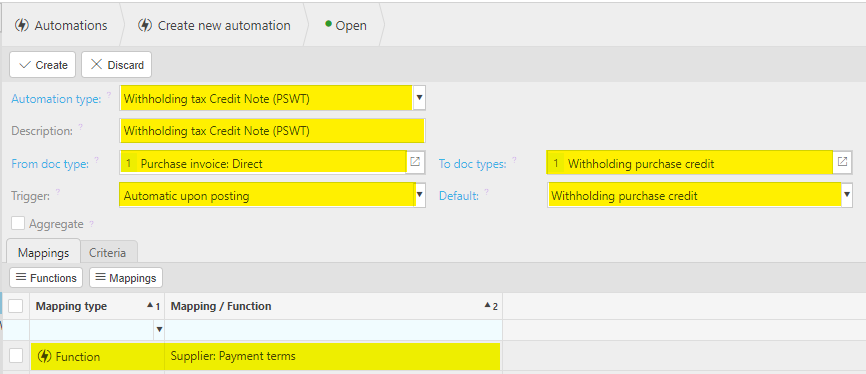

Withholding tax Credit Note (PSWT) -

- Automation type - Withholding tax Credit Note (PSWT).

- Description - Withholding tax Credit Note (PSWT).

- From doc type – Purchase invoice: Direct.

- To doc types – Withholding purchase credit.

- Trigger – Automatic upon posting.

- Default – Withholding purchase credit.

- Mappings tab - these will be automatically populated.

Updated June 2024