Multi Tax Authority

There is the requirement to buy and sell from the same Customer or Supplier with tax authority treatment different to that on the supplier/customer records.

Example:

LEGE tax authority: Germany Customer tax authority: Germany

Sale 1 - Goods delivered in Germany - Standard tax should be applied

Sale 2 - to the same customer Goods delivered in France - EU Sales tax (0%) should be applied

Note

The following Guides will use a Purchase Invoice as an example, but the process is similar for other Documents using a Customer / Supplier that has ticked multi tax authority.

How to selecting Multi Tax Supplier

Selecting Multi Tax Supplier

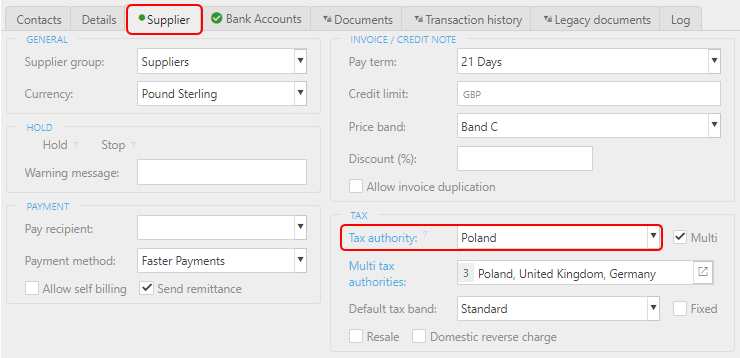

On creating a new document, select a Supplier that has had Multi Tax Authority ticked when being created in Suppliers on the Tax section in the Suppliers tab.

View of the Supplier tab in Suppliers -

Note

Remember, Multi tax authorities field, allowing for multiple tax authorities to be entered, will only appear when Multi is ticked.

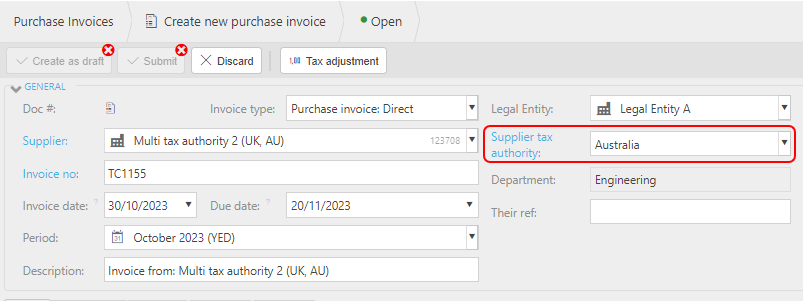

Once the Supplier has been selected, a new Supplier tax authority field will appear.

The default value will be the Tax authority entered in Suppliers on the Tax section in the Suppliers tab.

View of the Supplier tab in Suppliers -

The other Supplier tax authorities options available from the dropdown will be those entered in the Multi tax authorities field when the Supplier was created.

View of the Supplier tab in Suppliers -

When you now add Lines, the Tax region will automatically be assigned dependent on the Multi tax authorities selected above. This Tax region will then determines the Tax code.

Tip

If Tax region and Tax code columns are not showing, modify the columns displayed by selecting the

on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

Updated February 2025