Reversals

When mistakes are made on a document e.g. tax entered incorrectly on a invoice, a reversal can be made. The reversal will create a opposite document to cancel out the document with an error.

The reversed document will be stored in the reversals finder for auditing purposes.

You can double click on the reversals to expand the details.

How to view Reversals

Viewing Reversals

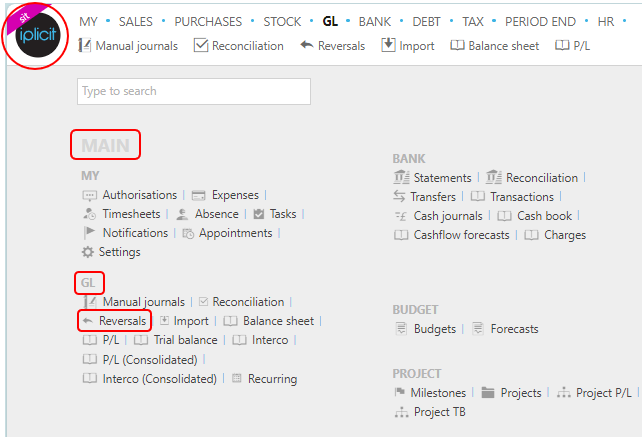

Select GL / Reversals from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

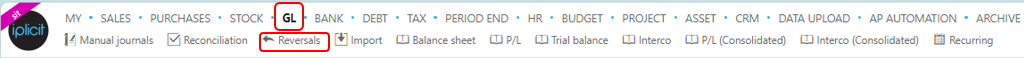

or from the Main Menu select GL then Reversals -

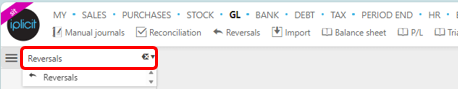

or enter Reversals in the Quick Launch Side Menu.

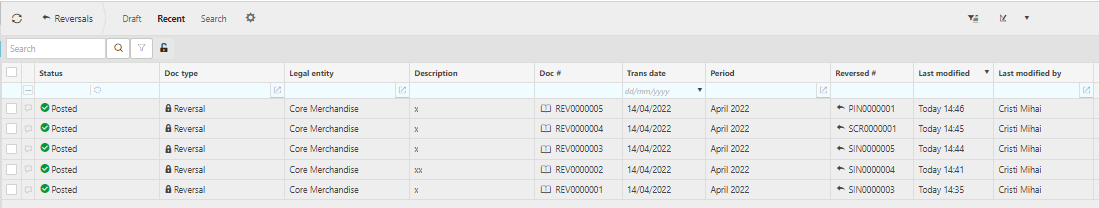

This will then show the Reversals on the system where normal customisation of Sets can be used.

Status: This is the current status of the reversal.

Legal entity: This is the legal entity that the reversal is logged under.

Description: This will describe why the reversal was done e.g. tax entered incorrectly.

Doc# and Reversed #: the original document number and the reversed document number.

Period: This is the period that the document was reversed in e.g. MAY 2022.

Tip

To modify the columns displayed, select

on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to correct an error on a Reversal

Correcting errors

Should the Reversal not be able to be posted for any reason, the Reversal document that is created will show the error reason - and the original document will still be showing as Reversing.

This enables any corrections to be made and then be resubmitted.

In this example, the Account is missing or invalid. Checking this account in Chart of accounts shows it is Closed.

Corrections can be made and then the Reversal document can then be resubmitted by selecting the  option.

option.

Then the Reversal document will post ...

... and the original document will now show as Reversed.

Updated March 2025