Deferred Income

Deferred income is used for sales documents where the invoice is created in advance of receiving the products or services.

Deferred income can be used on Sales invoices and Cash sales.

Deferred income can be automated, for more information please see Deferred income automation.

To use this feature, the Invoice type and the Chart of account must allow Deferred income.

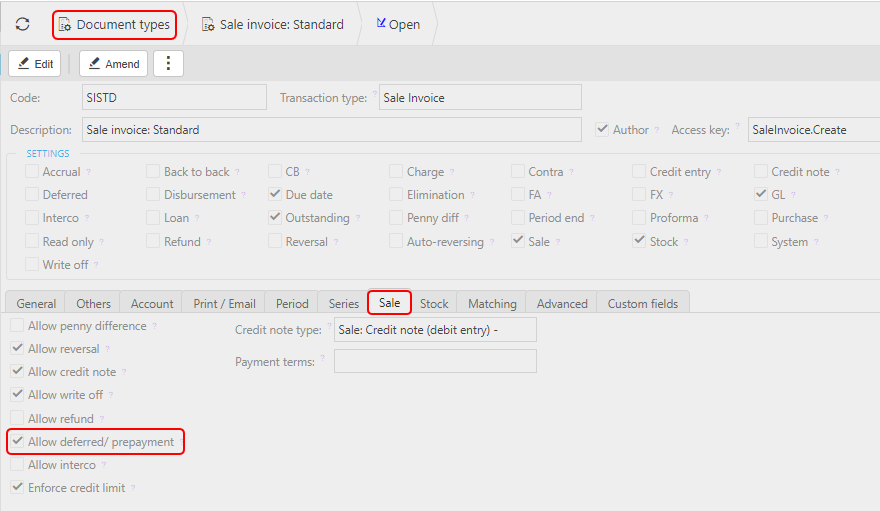

To check Invoice type, go to Document types, go to Sale tab and tick Deferred income option.

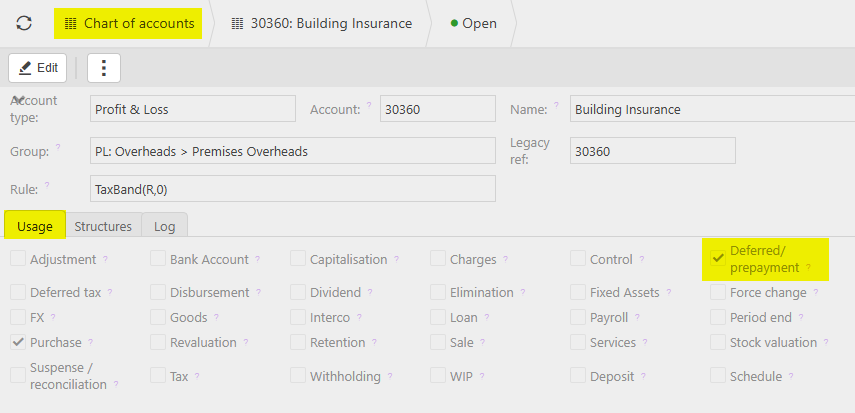

To check Accounts, go to Chart of Accounts, go to Usage tab and tick the Deferred/prepayment option.

Tip

To go to one of the above options directly from the Sale invoice entry screen, hold down the Ctrl button, and then select either Invoice type or Account.

This will task you directly to the appropriate document.

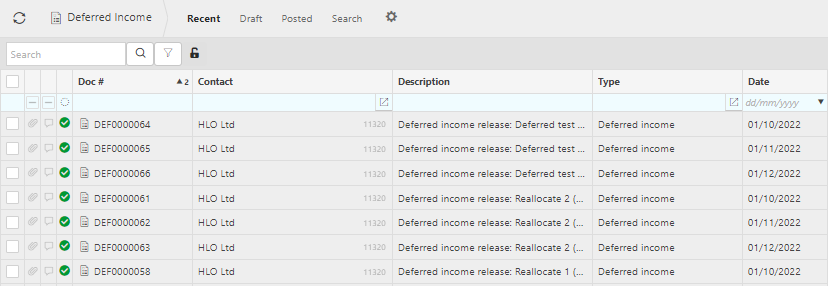

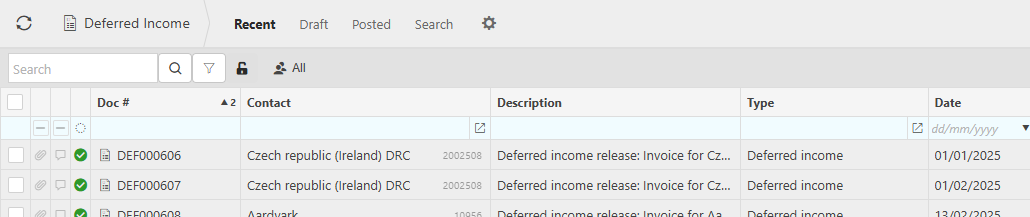

The finder will present all Deferred incomes that have been generated.

You can view the lines associated with the deferred income by double clicking a deferred income in the finder.

How to view Deferred Income

Viewing Deferred Income

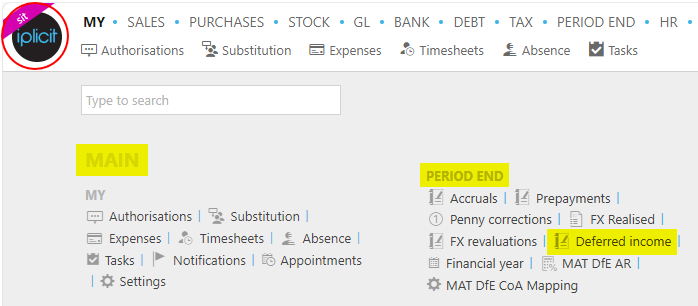

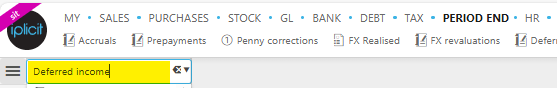

Select Period End / Deferred income from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

or from the Main Menu select Period End then Deferred income -

or enter Deferred income in the Quick Launch Side Menu.

This will then show the Deferred incomes on the system where normal customisation of Sets can be used. Also, depending on User roles, the My/All option will be showing.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to use Deferred income

How to use Deferred income

Following the User Guides for Create a Sales Invoice in Sales Invoice or Create a Sales Order in Sales Order.

Note

The invoice type selected must allow for Deferred income - see notes above.

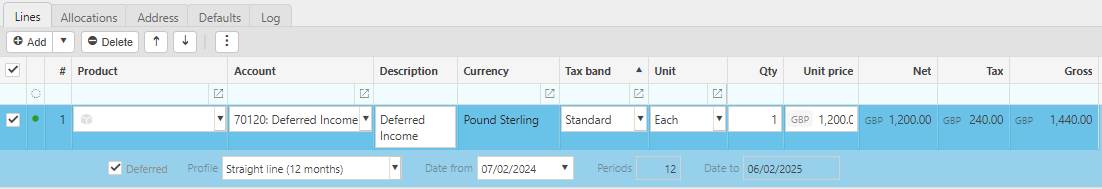

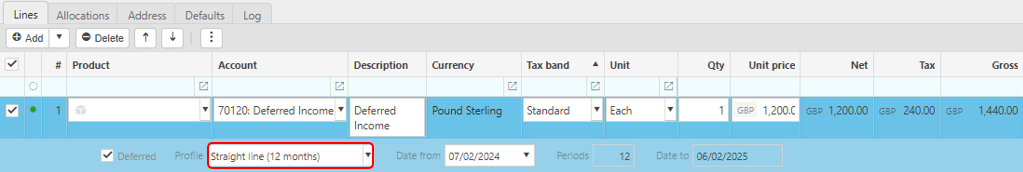

At step 8, add a Line, selecting a Product that allows Deferred income - see notes above.

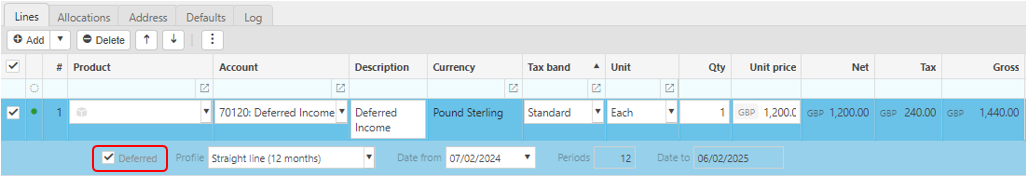

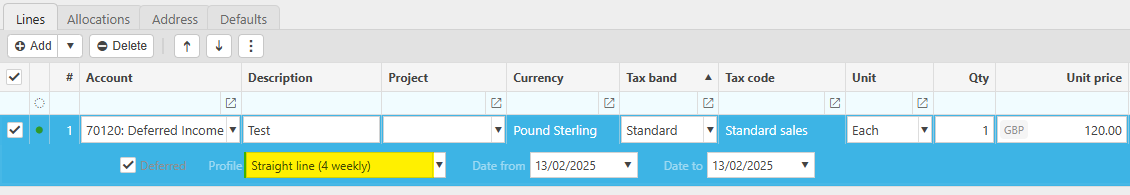

If it's not already selected, tick the Deferred option on the Posting attributes line.

If not already populated, select the appropriate Distribution profile in the Profile option.

Note

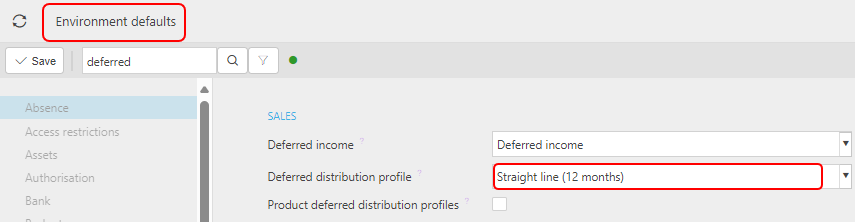

The default value can be saved in Environment defaults.

The Date from will default, depending on what profile you enter e.g. if you enter English Quarter Day Q1, the Date from defaults to 25/12/YYYY.

The Periods and Date to fields are not always editable.

If a Weekly profile is selected e.g. Straight line (4 weekly), then the Periods option will not show.

Press Submit.

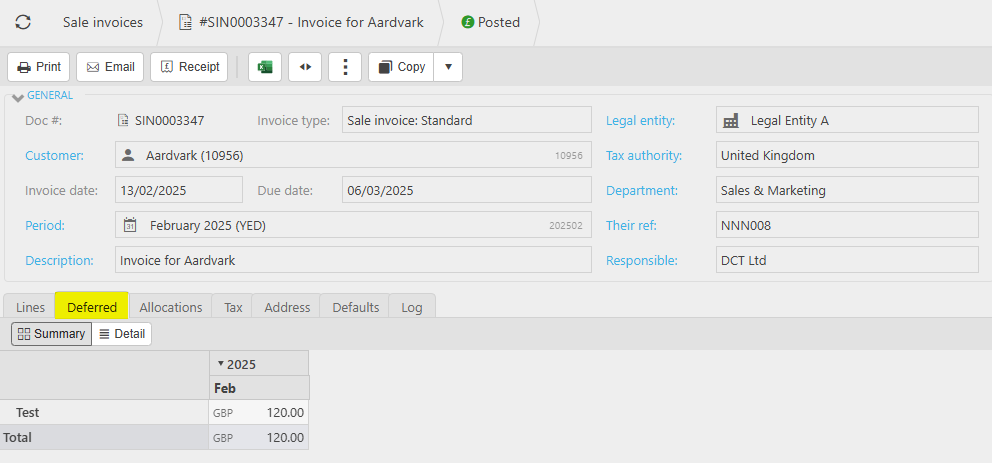

The new Sales invoice or Sales order will now have a Deferred tab.

Selecting this tab will display the following options -

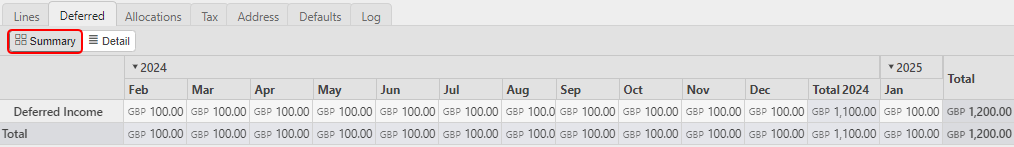

Summary: This shows the Deferred income totals broken down over the total period. e.g. Even split over 12 months.

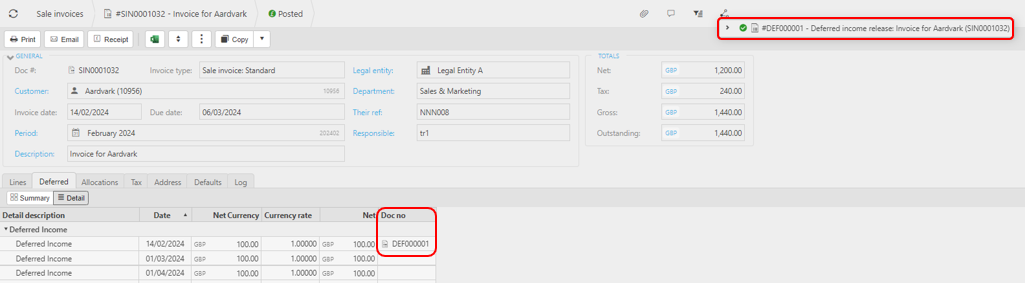

Detail: When the Deferred journals get created, the doc numbers appear in the Doc no column and these are linked to the SIN, as seen when selecting the

link icon on the top right corner.

link icon on the top right corner.

Status: Status of the document that has been created to show whether it has been posted, still in draft or abandoned.

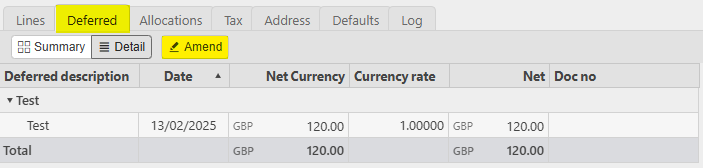

Amend: This gives the User the option to edit the dates and amounts in the Deferred schedule so that the User can use a non-standard period for these values to coincide with business accounting rules.

Note

Amend will only show while the Invoice is in a Draft state.

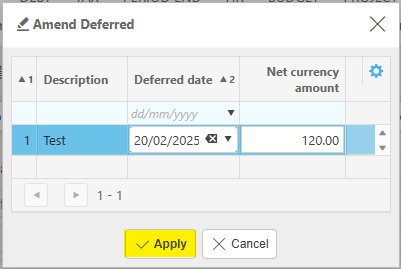

Selecting Amend presents the Date and Net Currency editable fields.

There is a Total on this screen which is the total of the amounts above and will update as any amount is changed. This is to check that the total agrees to the total on the document line for the deferred income. This will show whether these changes will be accepted - as the total on this screen needs to agree to the total on the document line before it can be accepted.

Make any updates, then select Apply.

Warning

You cannot Amend a date to be earlier than the Start date.

The total has to match the value on the line item.

Negative amounts are not allowed.

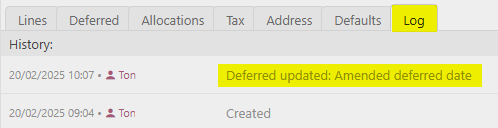

Any amendments made will show in the Log tab showing details of who made the amendments and the time and date of the change.

Updated April 2025