Cash Sales (SRI)

This feature is used when cash sales are made e.g. receiving credit card payment for goods in a physical store. The payment will automatically be receipted and there will be no need for invoicing.

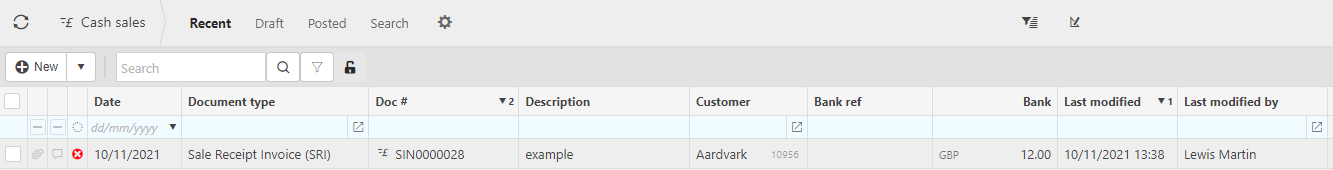

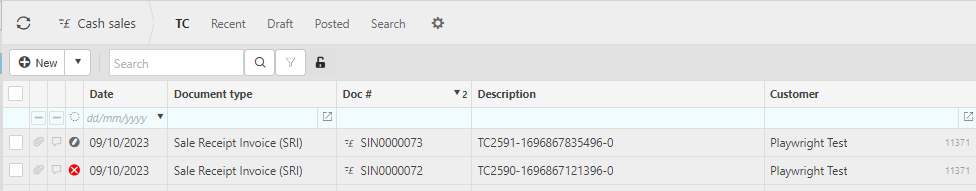

The screenshot below shows a sample grid of the cash sales finder, which includes some key information.

Date: The date the cash sale was created.

Document type:

Doc#: The document code.

Description: The description of the cash sale.

Customer: Who the cash sale is for.

Bank: The cost.

Tip

To modify the columns displayed, select

in the top right of the page, then tick/untick the information you want to see or not.

in the top right of the page, then tick/untick the information you want to see or not.

How to view Cash Sales

Viewing Cash Sales

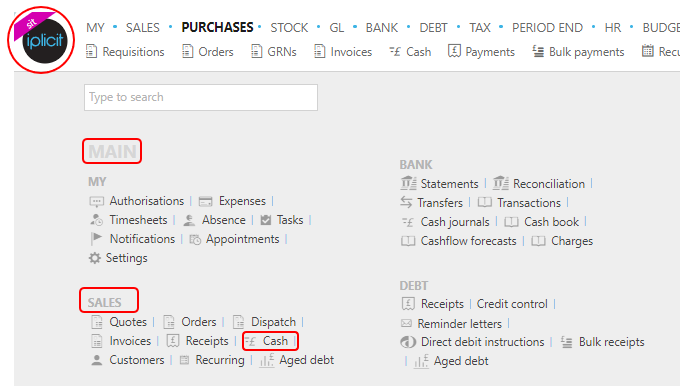

Select Sales / Cash from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

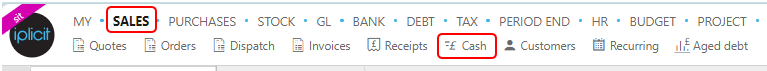

or from the Main Menu select Sales then Cash -

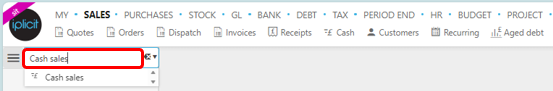

or enter Cash sales in the Quick Launch Side Menu.

This will then show the Cash sales on the system where normal customisation of Sets can be used. Also, depending on User roles, the My/All option will be showing.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to see or not.

on the top right of the page, then tick/untick the information you want to see or not.

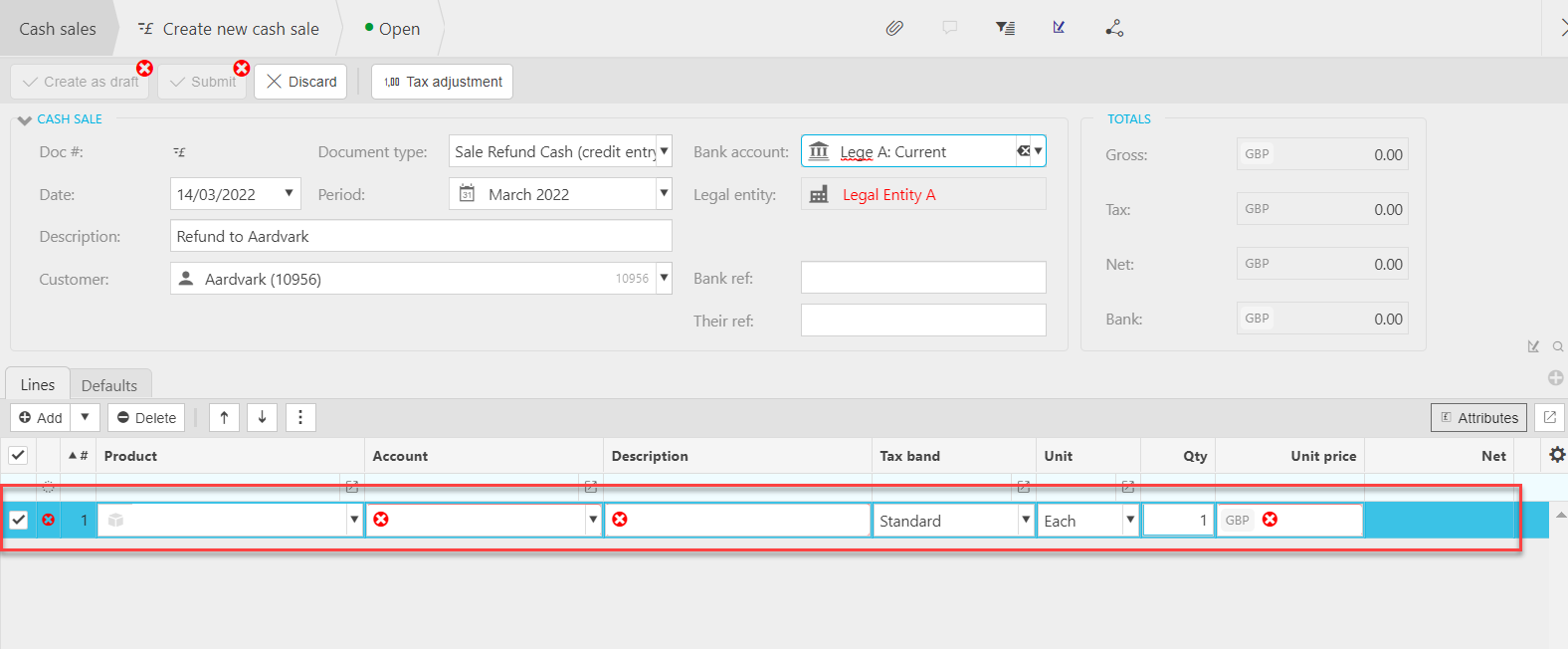

How to create Cash Sales

Create a new Cash Sale

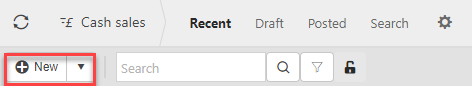

Select Cash sales from one of the options as shown above in Viewing Cash Sales.

Press New or New from Template.

Choose the document type then press Create.

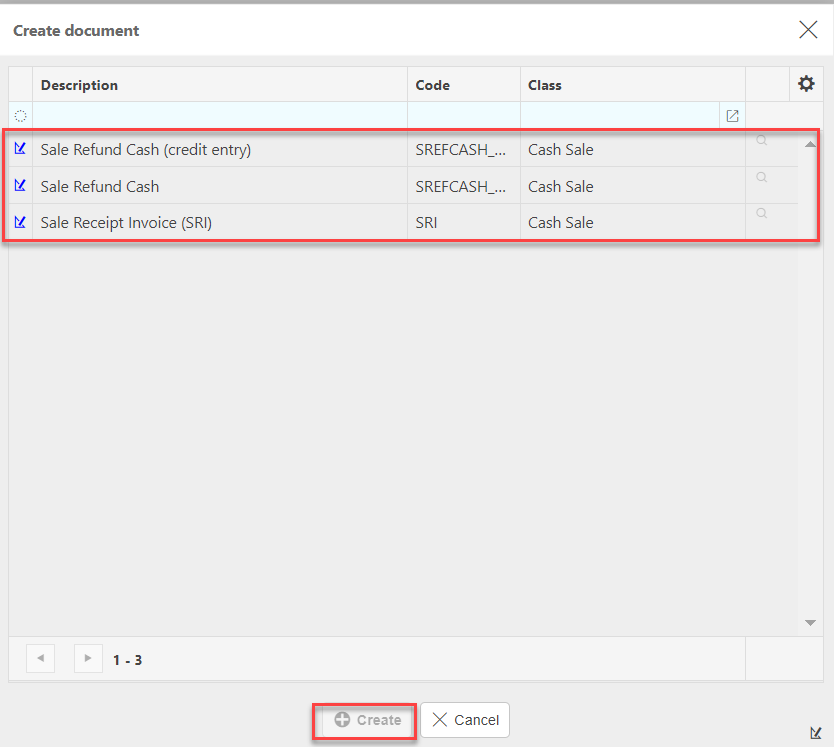

Enter the Bank account that will be receiving the payment.

Enter the Customer.

Tip

If you need to create a Customer press

then fill out the Customer details.

then fill out the Customer details.Fill in the remaining fields.

Cash sale type: This will be auto filled with the document type selected in step 2.

Date: This will be auto filled but this can be changed.

Note

This date will default to the current date unless the Don't default current date option is ticked in Others tab within the Document type. In this case, when a user creates a new document this date is left blank.

Period: Enter the financial period.

Description: If Description required option has been ticked in the Document type, then this field will be mandatory. It will be automatically entered if a Default description was entered in the Document type.

Bank ref: This will be used to identify the cash sale in your bank account.

Their Ref: The unique reference given to identify the document. If Their ref required option has been ticked in the Document type, then this field will be mandatory.

Add Lines and posting attributes.

Note

Multiple Lines can be added for more Products.

For addition lines that are added for other Legal Entities, see further User Guides on Multico Cash Sales.

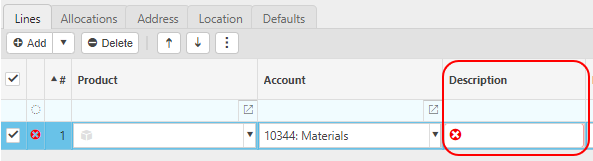

Lines and posting attributes explained

Lines

Product: This is the product being sold.

Account: If a product is being used, this will be auto-completed and read only otherwise select an account from available list.

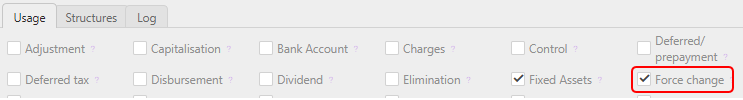

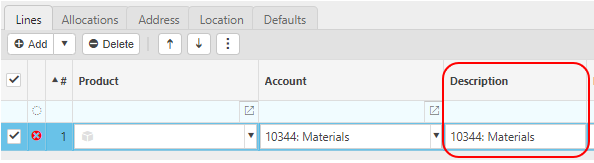

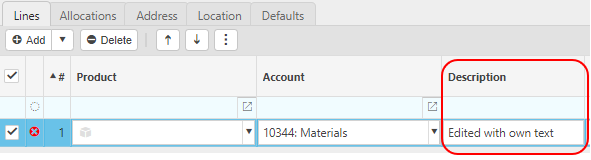

Description: Depending on the Force change setting in Chart of Accounts.

If the Force change is not ticked, then the Description field will be auto-filled ...

... however it can be edited.

If the Force change is ticked, then the Description field will be blank and you will be forced to enter a description.

Unit: This is the unit to measure the product.

Qty: This is the quantity of the product you have sold.

Unit price: This it the price per unit of the product.

Posting attributes

The posting attributes are derived from the chart of account rules related to the account code. Common attributes include cost centre and department but can also include custom attributes.

Note

Deferred Income

This item will appear depending on the settings for the Invoice type selected - see Deferred income guide for further information.

Also, this item may or may not be ticked, depending on the Customer's Ignore deferred income setting - see the Defaults section on the Customer tab in the Customers guide for further information.

If there is a requirement to sell to a Customer and have the goods delivered where the tax authority treatment is different, then set the Customer up as a Multi Tax Authority Customer.

Select either Submit once happy with details or Create as draft to be able to edit further before submitting.

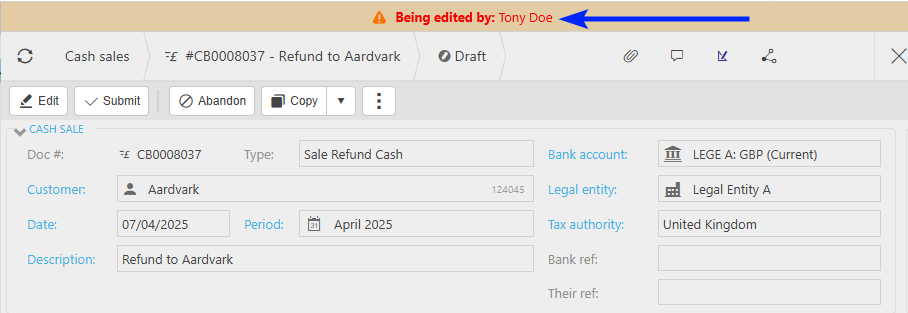

Note

Returning to this document via the Edit option will notify other users viewing the same document that it is being edited.

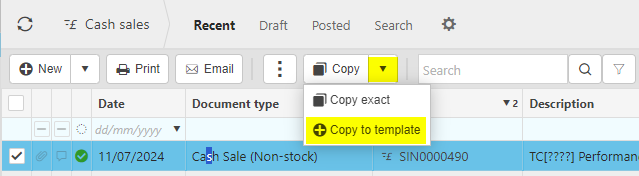

Tip

If you are going to be creating the same cash sale on a regular basis Copy to template.

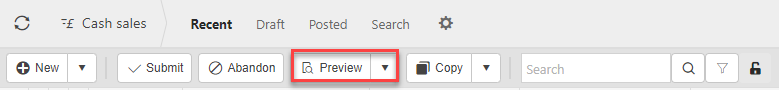

How to preview Cash Sales

Preview Cash Sales

Select the cash sale that you would like to preview.

Press Preview.

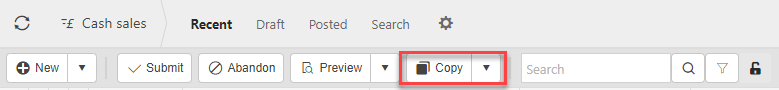

How to copy a Cash Sale

Copy a Cash Sale

If you are regularly creating the same cash sale you can create a draft, then Copy exact to recreate the same sale with the same information.

To do so, create the draft cash sale.

Select the sale.

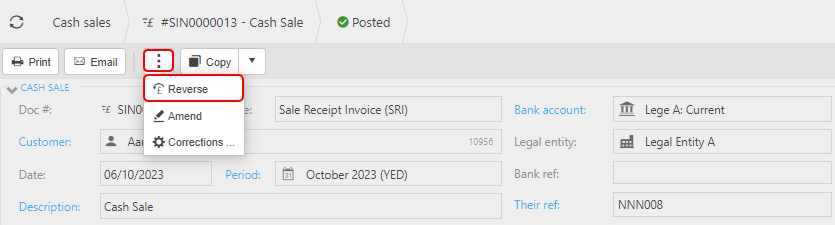

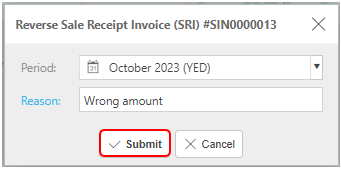

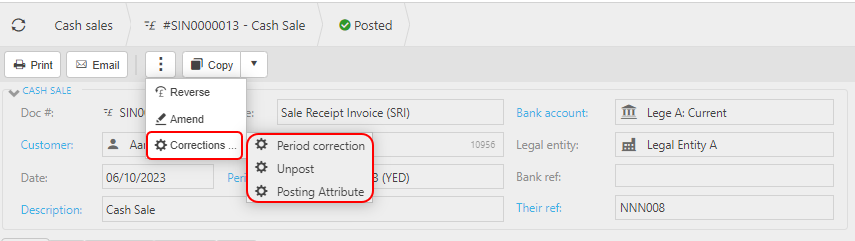

How to reverse Cash Sales

Reverse a Cash Sale

Select and open the Cash Sale (either highlighted on the list or open the Payment), then select the

button and select Reverse.

button and select Reverse.

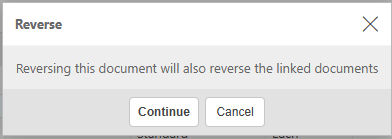

Note

If this is a Multi-co or Inter-co document and there are linked documents, then a warning that reversing will also reverse all linked documents.

Enter the reason then press Submit.

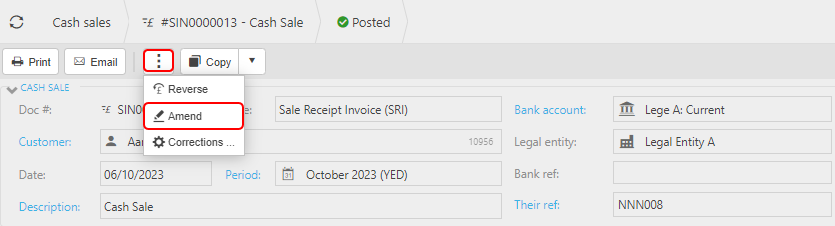

How to amend Cash Sales

Amend a Cash Sale

Select and open the posted Cash sale (either highlighted on the list or open the Payment), then press Amend option from the

dropdown button.

dropdown button.

You can now make non-monetary changes to the document details without having to Unpost first. These amendments will not have any effect on any of the Accounts.

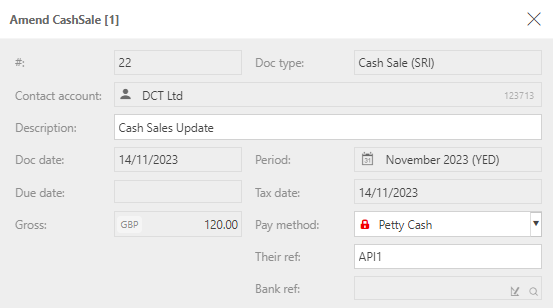

You can also make changes to Custom fields, which have previously been defined on the Custom fields tab when defining the Document type -

Note

User will need Attribute.Amend permissions.

Once complete, press Apply.

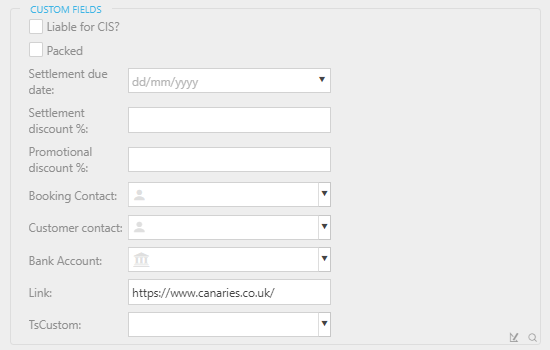

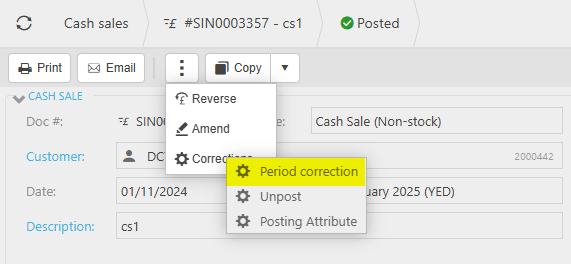

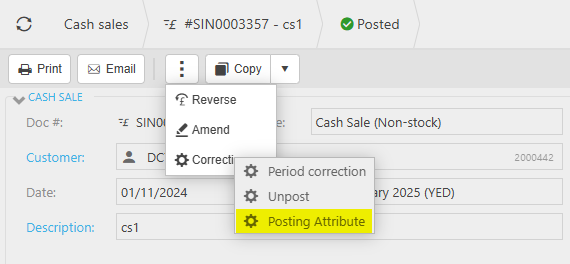

How to make corrections to Cash Sales

Make corrections to a Cash Sale

Select and open the Payment (either highlighted on the list or open the Payment), then select the

button and select Corrections.

button and select Corrections.

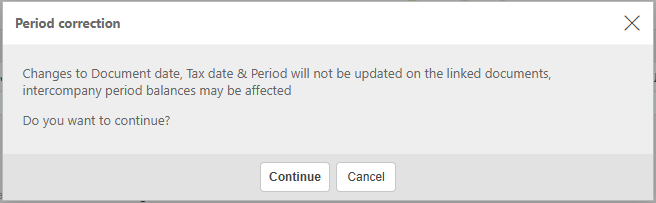

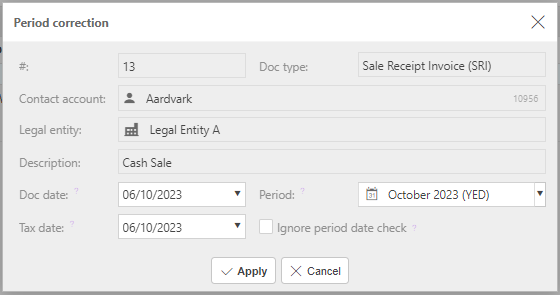

Period correction to make corrections to the Period.

Note

If the document has any linked documents, then a warning will show informing that changes will not be updated on any linked documents, and asking if you wish to continue.

Make correction then select Apply.

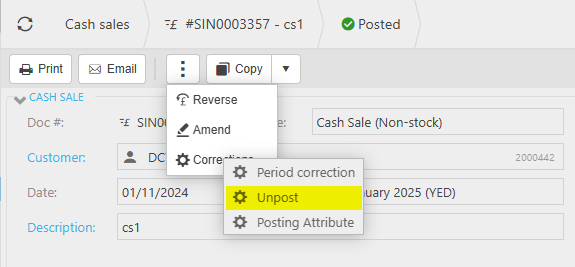

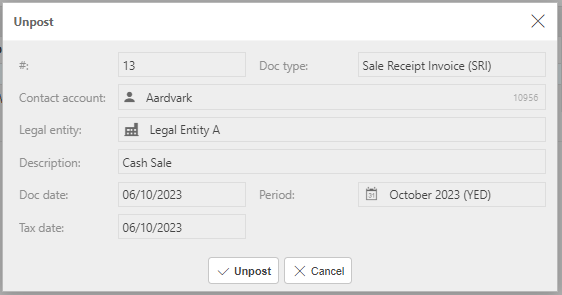

Unpost to retract the Cash sale from the General Ledger

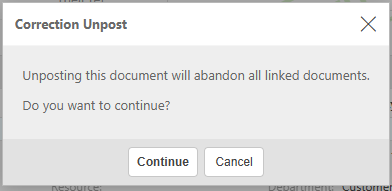

Note

If this is a Multi-co or Inter-co document and there are linked documents, then a warning that unposting will abandon all linked documents.

Select Unpost to proceed.

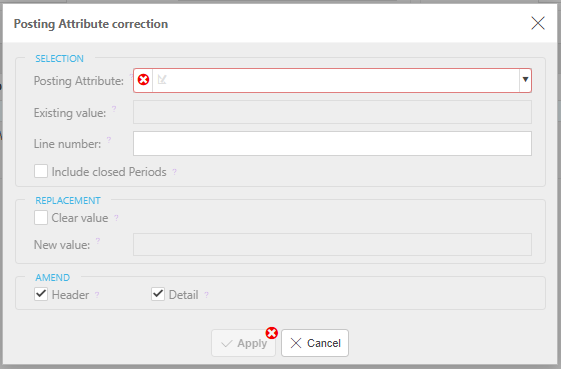

Posting Attribute to make corrections to individual attribute values on the Payment.

See Correcting Posting Attributes for further details.

Updated April 2025