Deferred Income Automation

Deferred income is used for sales documents where the invoice is created in advance of receiving the products or services.

Deferred income can be used on Sales invoices and Cash sales.

For more information on setting up Deferred Income please see Deferred income.

How to view Deferred Income

Viewing Deferred Income

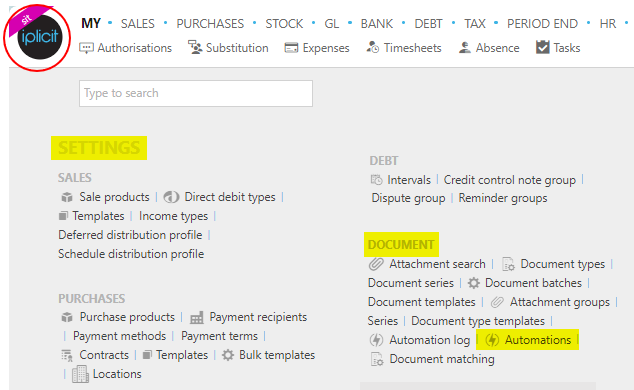

Select Document / Automations from the Settings section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

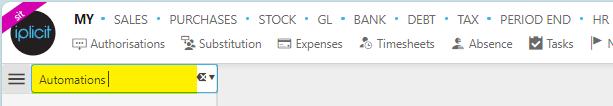

or enter Automations in the Quick Launch Side Menu.

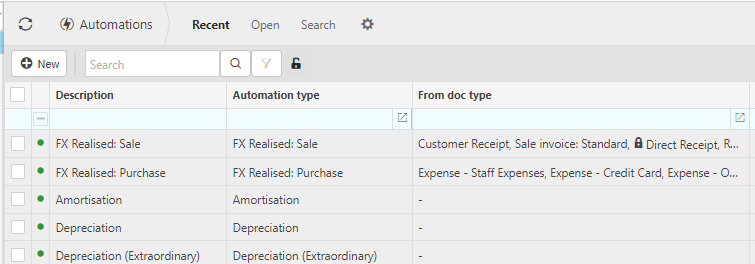

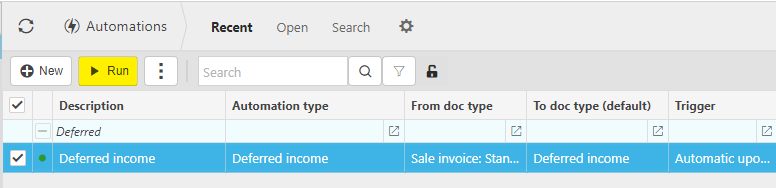

This will then show the Automations on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select  in the top right of the page, then tick/untick the information you want to see or not.

in the top right of the page, then tick/untick the information you want to see or not.

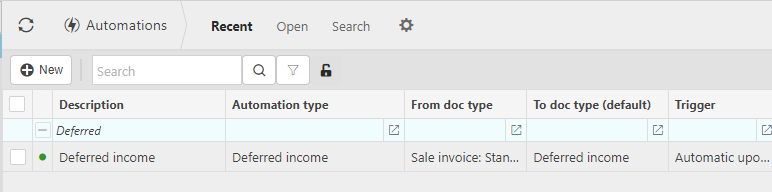

Select Deferred Income from the list of Automations.

Double click on the Deferred income to open up the details.

The criteria tab allows you to set some default criteria. Alternatively, you can enter the criteria when you run the deferred income automation.

Note

The deferred income automation can be scheduled to run in the Scheduler.

How to run Deferred Income

How to run Deferred income

Select Deferred Income from Viewing Deferred Income above.

Select, or Select and open, the Deferred Income then press Run.

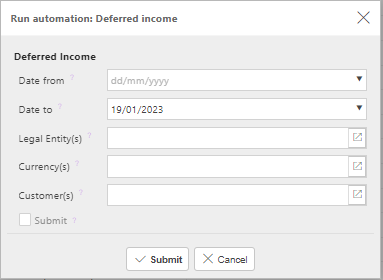

Enter the automation criteria.

Date from: Select the earliest Document date that you wish to include.

Date to: Select the latest Document date that you wish to include.

Legal Entities: By filling this out the document automation will process the correct Document for the correct Legal Entity.

Currency: Select the correct Currency.

Customer: leave black to select all or select Customer(s) to restrict the deferred income automation.

'Submit' tick box: If this is ticked the automation will create the Deferred income and submit upon pressing Submit.

Tip

If needed, multiple document automations can be made.

When you are happy with the selected criteria and setup, press Submit.

Note

The deferred income document(s) created can now be viewed in the Deferred income finder.

Select OK to continue working. Automation progress will show on the bottom left of the screen showing either In progress or Complete - see details in step 5 of How to run Automations.

Updated August 2025