Asset Depreciation methods

What depreciation methods are available

Straight line

This depreciation is calculated as an equal value over a set period to reduce the asset to a residual value.

e.g. Asset costing £2,000 with a residual value of £200 depreciating over 5 years will have depreciation cost of £360/year ((£2,000 - £200) / 5).

Note

The residual value of an asset is based on what a company expects to receive in exchange for selling the asset at the end of a set period. This value could be zero.

Reducing balance

This depreciation is calculated by reducing the asset by a set percentage each year either over a set period or until the asset value is zero (the final depreciation value could be pennies and will probably be written off).

e.g. Asset costing £2,000 with a residual value of £200 with a reducing depreciating rate at 40% will have depreciation cost of (£2,000 - £200) x 40% = £720 in year 1, £1,080 x 40% = £432 in year 2, £648 x 40% = £259.20 in year 3 and so on.

Reducing balance with residual value

This depreciation is calculated by reducing the asset by a set percentage each year either over a set period or until the asset value is zero (the final depreciation value could be pennies and will probably be written off).

This method deducts the residual value at the start before calculation the depreciation in each financial year.

e.g. With a fixed asset price of £11,000, scrap value of £1,000, and the depreciation percentage factor is 30.

Using the Reducing balance method, 30% of the depreciation base (net book value minus scrap value) is calculated at the end of the previous depreciation period. Depreciation for the first three years is shown in the following table.

| Period | Calculation of yearly depression amount | Net book value at the end of the year |

|---|---|---|

| Year 1 | (£11,000 - £1,000) * 30% = £3,000 | (£11,000 - £1,000) - £3,000 = £7,000 |

| Year 2 | (£7,000 - £1,000) * 30% = £1,800 | (£7,000 -£1,800) = £5,200 |

| Year 3 | (£,200 - £1,000) * 30% = £1,260 | (£5,200 - £1,260) = £3,940 |

Double declining

This depreciation is an accelerated depreciation method that charges twice the rate of reducing balance depreciation on the asset. It is more suited to Asset's with a higher degree of wear and tear or higher usage.

Non depreciation

This depreciation is where the asset does NOT depreciate, and value will always show the same on the balance sheet.

Non-capital

These Assets do NOT depreciate as they are not worth enough money to capitalise, but you still wish to show them in the Asset Register. As they won't be capitalised, they will not show on the balance sheet. e.g. Headphones worth £20.00.

Note

Assets are only capitalised automatically above a set value, e.g. £500. If they don't get capitalised, they don't appear in the balance sheet as an Asset.

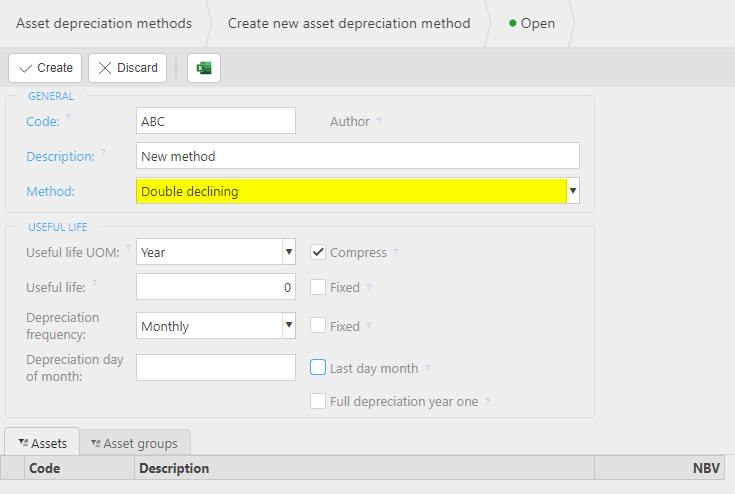

How to view Asset Depreciation Methods

View Asset Depreciation Methods

To view all the Asset depreciation methods that are available, select Asset depreciation methods option either from the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

or enter Asset depreciation methods in the Quick Launch Side Menu

This will then show the Asset depreciation methods on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select

on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.Note

A default set of Depreciation Methods will already be created. The Customer will be able to amend individual methods, create new ones or delete obsolete ones.

How to create Asset Depreciation Methods

Create Asset Depreciation Method

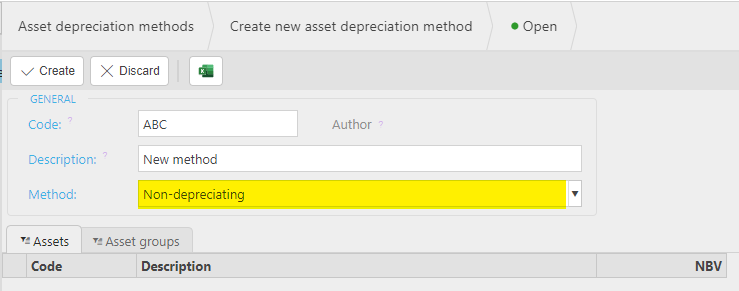

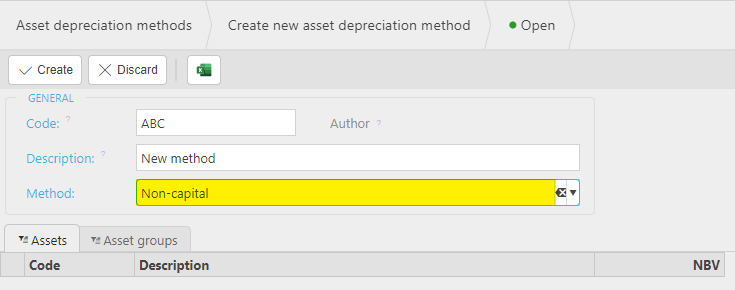

Select Asset depreciation methods from one of the options as shown above in Viewing Asset depreciation methods.

Press New.

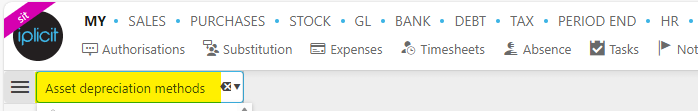

Enter the details as required -

- Code: Unique code for depreciation method.

- Description: Meaningful text for the Method.

- Method: Enter a valid depreciation method from the dropdown list.

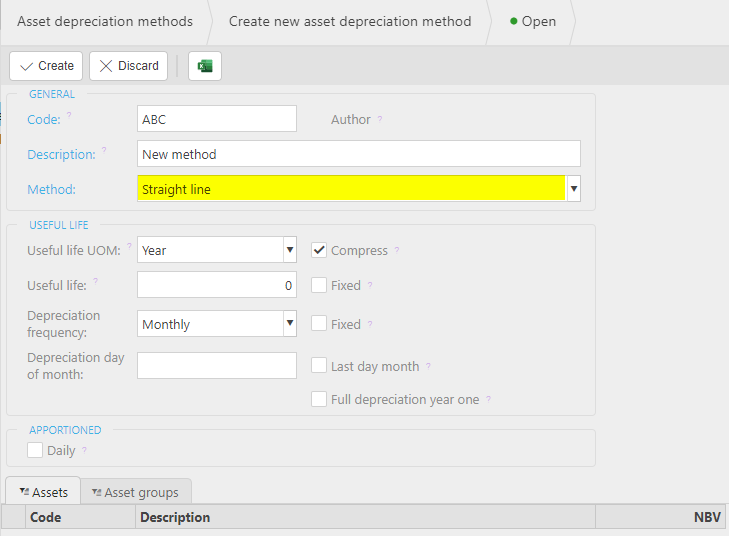

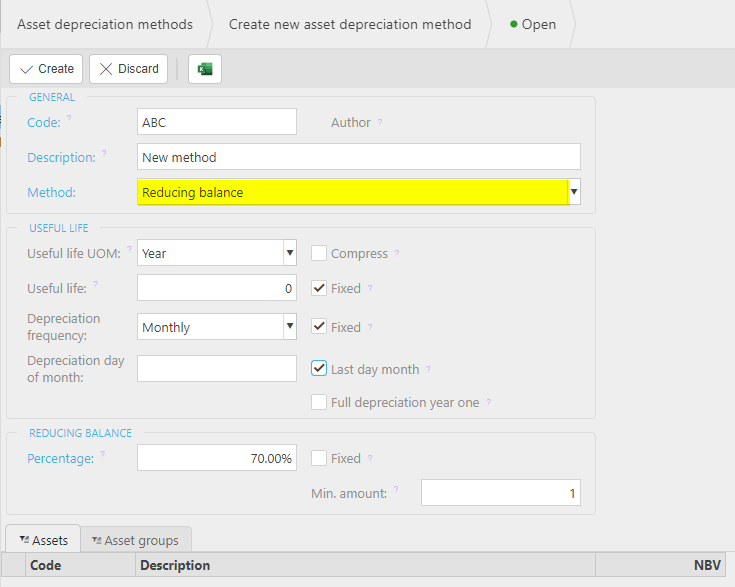

Depending on the Method selected, different screens will appear for information appropriate to the Method.

Depreciation day of month: This is used to calculate the dates of depreciation. If Depreciation day of month is null, then Last day month option will be used (also used for existing setups.)

Straight line

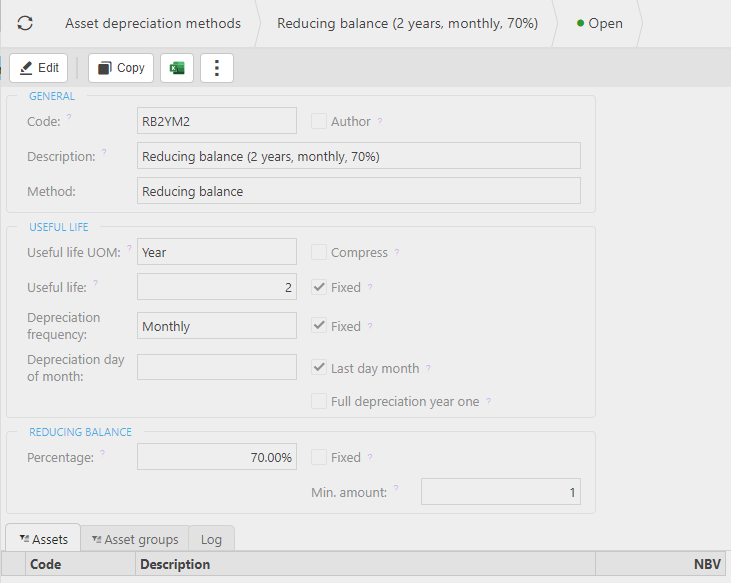

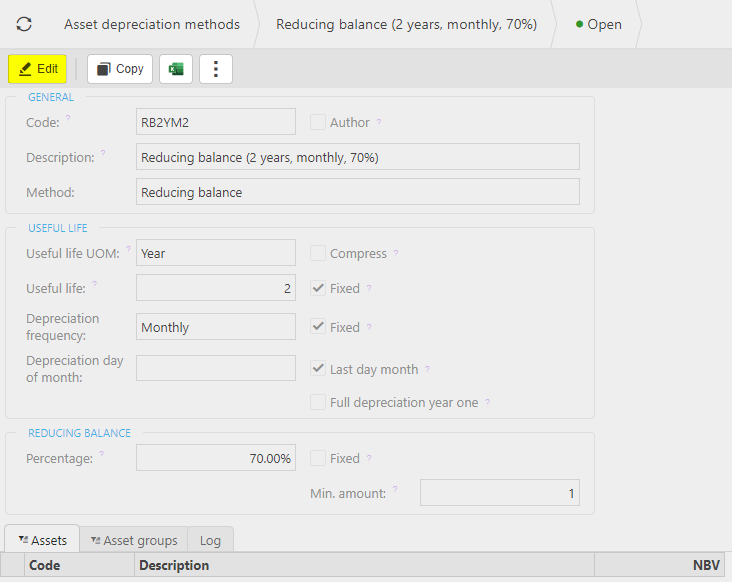

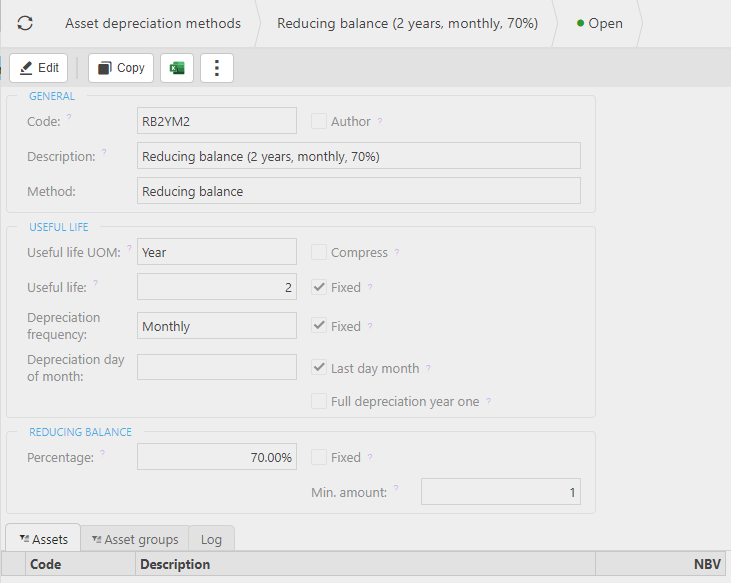

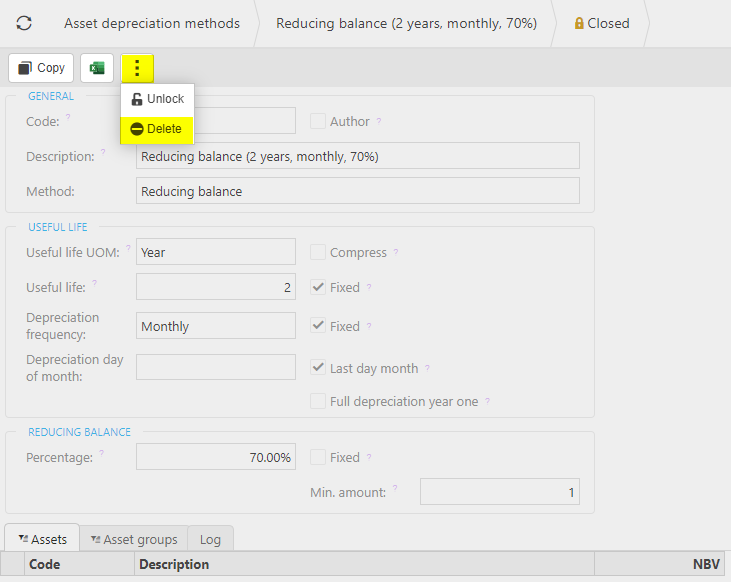

Reducing balance

Enter the Useful life fields as required and the percentage in the Reducing balance.

Double declining

Enter the Useful life fields as required.

Non-depreciating

No further fields to enter.

Non-capital

No further fields to enter.

Useful life section -

Useful life UOM: The Unit of measure for the useful life. This will be the default for Assetsthat use this Depreciation method.

- Compress:

Useful life: This the default value fro the Useful Life orf related Assets.

- Fixed: If ticked, then Useful life is inherited and cannot be amendedon the related Asset Group(s) and Asset(s).

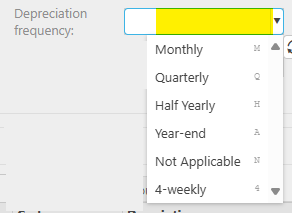

Depreciation frequency: The frequency of the depreciation.

This also includes 4-weekly which will result in 13 equal periods during a year.

- Fixed: If ticked, the Depreciation frequency will be fixed and cannot be changed on related Assets.

Depreciation day of month: If entered, depreciation will be on the entered day of each month.

- Last day of month: If ticked, the date of depreciation with be the last day of the month, otherwise it will be the first day of the month.

Full depreciation year one: If ticked, the full years' depreciation will be taken equally across the periods for the current financial year.

Select Create to save Asset Depreciation Method

How to edit Asset Depreciation Methods

Edit Asset Depreciation Method

Select Asset depreciation methods from one of the options as shown above in Viewing Asset depreciation methods.

Select and open the Method you wish to edit.

Note

Only non Author methods can be edited.

Select Edit.

See explanation above for the fields in the Useful lifesection.

Make changes and then select Save.

How to lock Asset Depreciation Methods

Lock Asset Depreciation Method

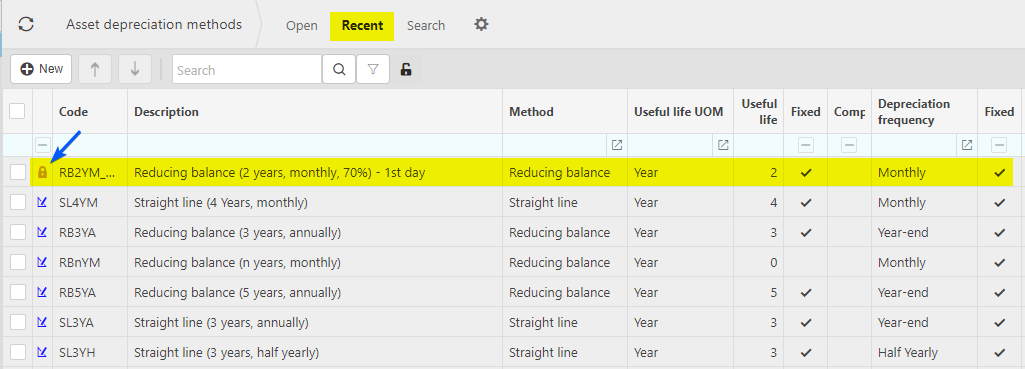

If you wish to reduce the list of available Asset Depreciation Methods, you can Lock the method. As a default, all 4 Weekly depreciation methods will be locked and will need to be unlocked if required.

Select Asset depreciation methods from one of the options as shown above in Viewing Asset depreciation methods.

Select and open the Method you wish to lock.

From the

button, select Lock.

button, select Lock.

The Asset Depreciation Method just locked, will no longer show on the refreshed Open view.

On the Recent view, the Asset Depreciation Method just locked, will show with a

padlock symbol.

padlock symbol.

When creating a new Asset or Asset Group, the locked Depreciation methods will not be visible in the dropdown list.

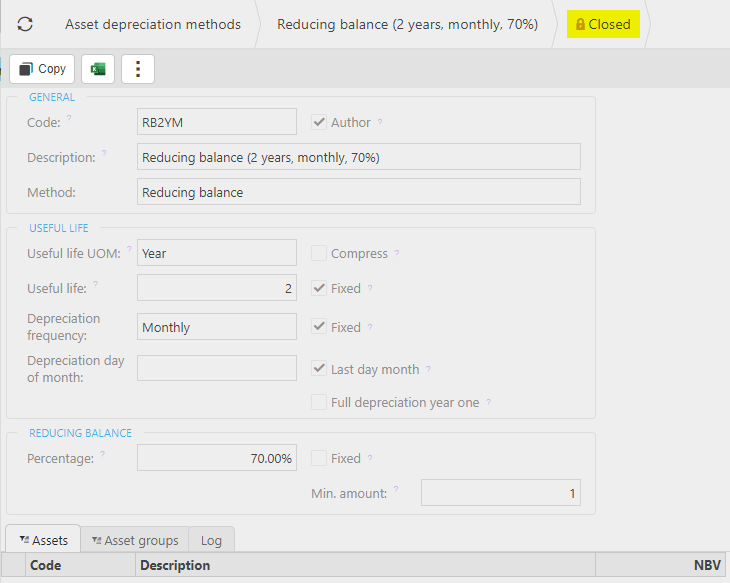

How to unlock Asset Depreciation Methods

Unlock Asset Depreciation Method

To see the locked Asset Depreciation Method in the available list again, you can Unlock the group.

Select Asset depreciation methods from one of the options as shown above in Viewing Asset depreciation methods.

Select and open the Closed Method you wish to unlock.

From the

button, select Unlock.

button, select Unlock.

The Asset Depreciation Method just unlocked, will now show on the refreshed Open/Recent view, and the padlock now shows as a

blue open symbol.

blue open symbol.When creating a new Asset Group, the Depreciation method unlocked will now be visible in the dropdown list.

How to delete Asset Depreciation Methods

Delete Asset Depreciation Method

To remove the locked Asset Depreciation Method completely so it is no longer available - The Asset Depreciation Method must be locked before it can be deleted.

Select Asset depreciation methods from one of the options as shown above in Viewing Asset depreciation methods.

Select and open the Method you wish to delete from the recent view.

From the

button, select Delete.

button, select Delete.

A confirmation screen appears for you to agree to delete the Asset Group.

The Asset Depreciation Method just deleted, will not show on the refreshed Open/Recent view.

When creating a new Asset Group, the Depreciation method deleted will not be an available option in the dropdown list.

Updated January 2025