Sale returns

The sale returns feature is for recording when stock is returned from a customer, which affects the stock levels.

How to view Sale returns

Viewing Sale Returns

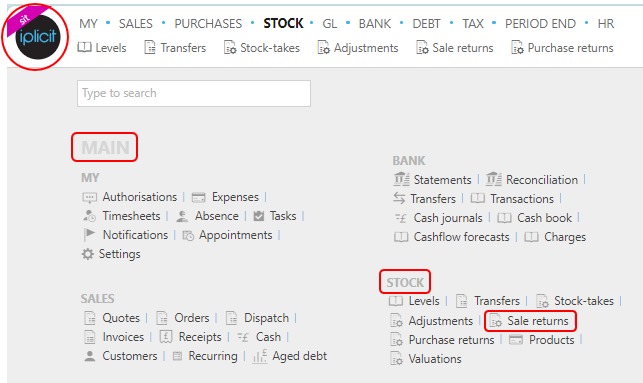

Select Stock / Sale returns from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

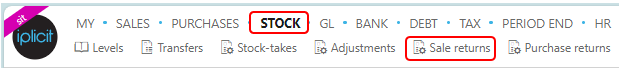

or from the Main Menu select Stock then Sale returns -

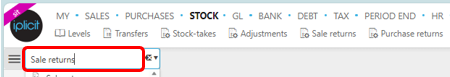

or enter Sales returns in the Quick Launch Side Menu.

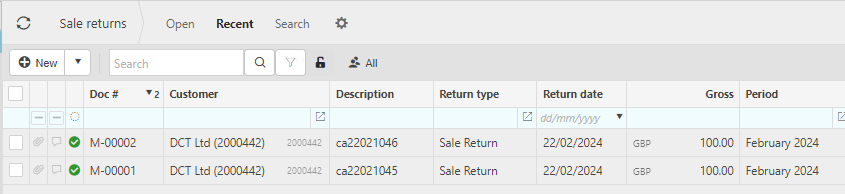

This will then show the Sales returns on the system where normal customisation of Sets can be used. Also, depending on User roles, the My/All option will be showing.

Doc #: The document code.

Customer: The customer returning the stock.

Return Type: This is the document type.

Return date: The date of the return.

Gross: The cost of the stock.

Period: This is the financial period that the return is being logged in.

Tip

To modify the columns displayed, select

on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to create Sale returns

Create a Sale Return

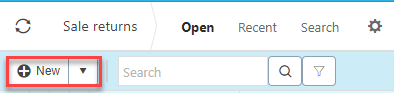

Select Sale returns from one of the options as shown above in Viewing a Sale returns.

Select either New or New (from template) - from the drop down menu.

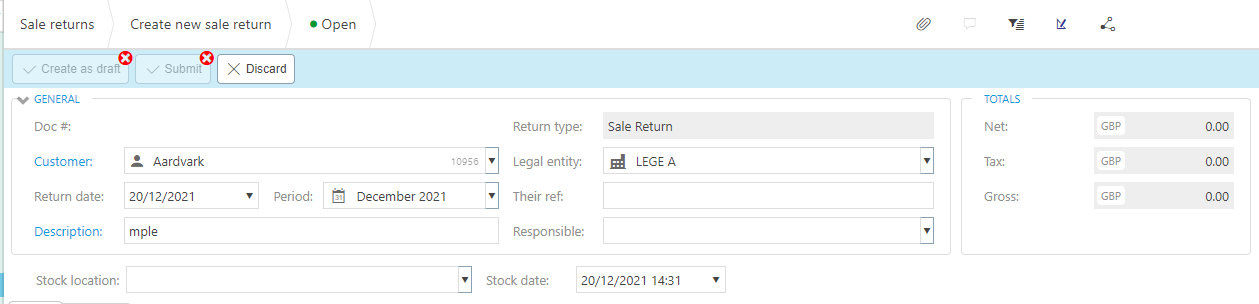

Enter the Customer and a description.

Enter other data.

- Doc Type: This will be auto filled with the document type.

- Return Date: The date of the return.

- Period: This is the financial period that the document will be logged in.

- Legal entity: Select the legal entity.

- Their Ref: This is the unique reference given to the return.

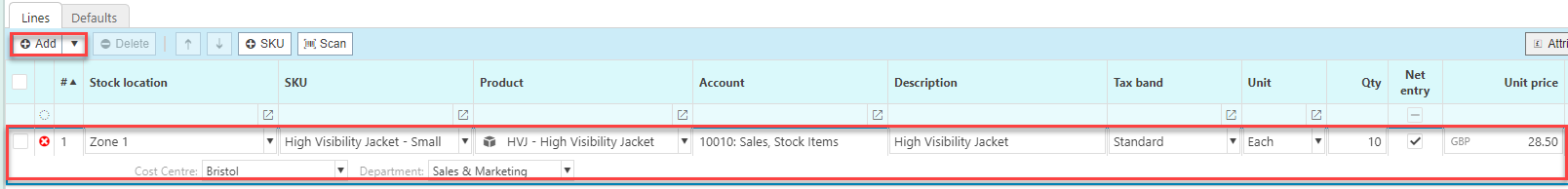

Add Lines and posting attributes.

Lines

SKU: This is the stock keeping unit.

Product: This is the stock product being returned.

Account: this is the chart of account.

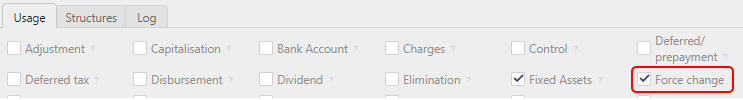

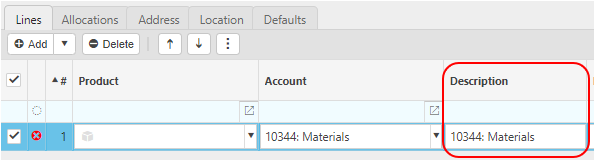

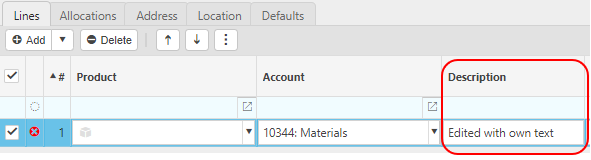

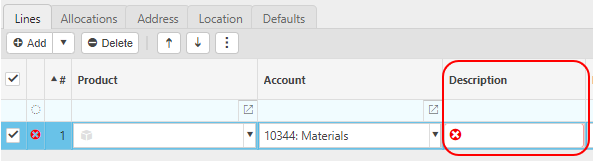

Description: Depending on the Force change setting in Chart of Accounts

If the Force change is not ticked, then the Description field will be auto-filled ...

... however it can be edited.

If the Force change is ticked, then the Description field will be blank and you will be forced to enter a description.

Tax Band: A tax band can be added here.

Unit: This is the unit to measure the product.

Qty: This is the quantity of the stock product being returned.

Unit price: This it the price per unit of the product.

Posting attributes

The posting attributes are derived from the chart of account rules related to the account code. Common attributes include cost centre and department but can also include custom attributes.

Note

Deferred Income

This item will appear depending on the settings for the Invoice type selected - see Deferred income guide for further information.

Also, this item may or may not be ticked, depending on the Customer's Ignore deferred income setting - see the Defaults section on the Customer tab in the Customers guide for further information.

6. Press Submit to complete the creation.

How to copy Sale returns

Copy a Sale Return

If you are regularly repeating a stock take you can copy a pre-existing one rather than creating a new one every time.

To do so, select the stock take that you would like to copy then press Copy.

Updated December 2025