Cash Purchases

- This feature is for recording cash purchases.

How to view Cash Purchases

Viewing Cash Purchases

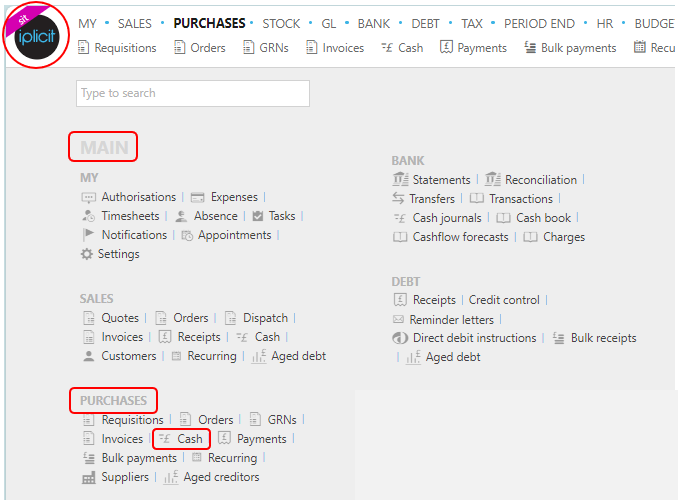

Select Purchases / Cash from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

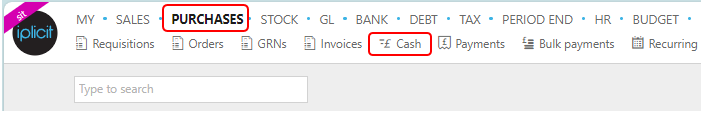

or from the Main Menu select Purchases then Cash -

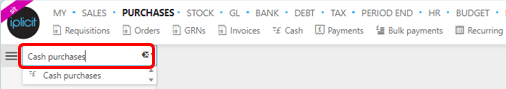

or enter Cash purchases in the Quick Launch Side Menu.

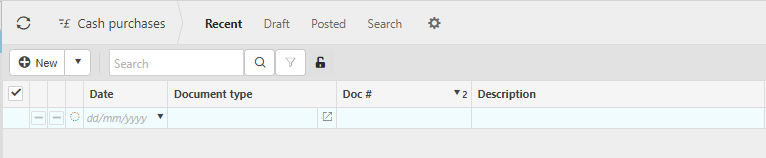

This will then show the Cash purchases on the system where normal customisation of Sets can be used. Also, depending on User roles, the My/All option will be showing.

The icon:

= Approved.

= Approved.  = Error

= ErrorSupplier: This is the supplier of the cash purchase.

Bank: The total amount of the cash purchase.

Last modified and Last modified by: who last edited or created the cash purchase and when.

Tip

To modify the columns displayed, select

on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to create Cash Purchases

Create a Cash Purchase

Select Cash purchases from one of the options as shown above in Viewing a Cash purchase.

Press New.

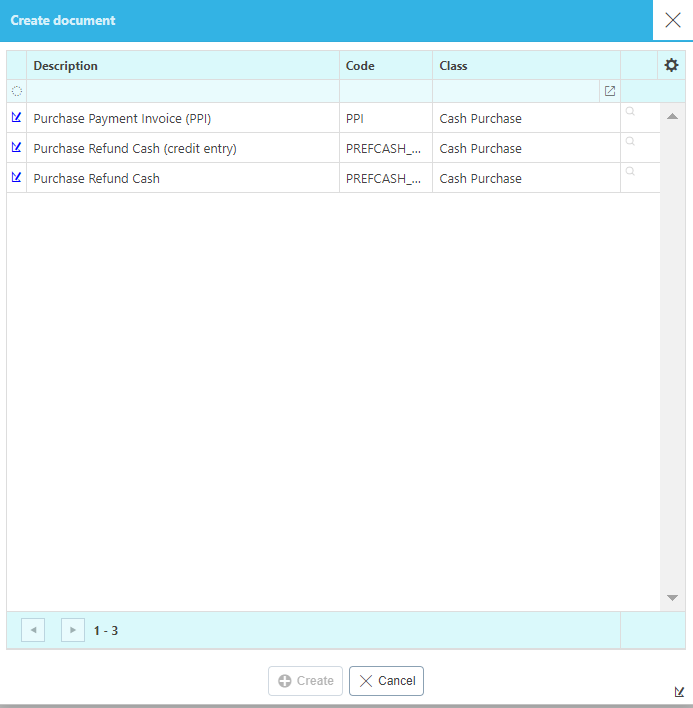

Select the Document type then press Create.

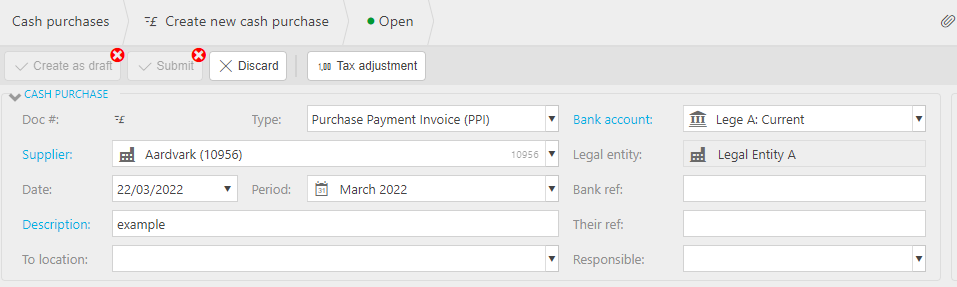

Enter a Supplier.

Enter a description. If Description required option has been ticked in the Document type, then this field will be mandatory. It will be automatically entered if a Default description was entered in the Document type.

Select the Bank account.

Fill in the remaining fields as required.

Type: This will be auto filled with the Document type selected in step 2.

Date: The date of the order.

Note

This date will default to the current date unless the Don't default current date option is ticked in Others tab within the Document type. In this case, when a user creates a new document, this date is left blank.

Period: This is the Financial period that the cash purchase will be logged in.

To location: This is the Stock location that the Purchase products are being bought for.

Legal entity: Select the Legal entity.

Bank Ref: The unique reference given to the cash purchase.

Their Ref: The unique reference given to identify the document. If Their ref required option has been ticked in the Document type, then this field will be mandatory.

Responsible: You can select a Resource to be responsible for the order.

Add Lines and posting attributes.

Lines

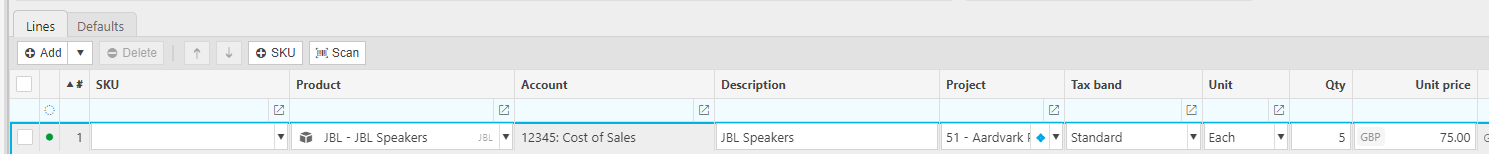

Product: This is the Product being purchased.

Account: If a Product is being used, this will be auto-completed otherwise select an Account from the available list.

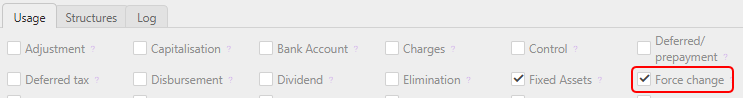

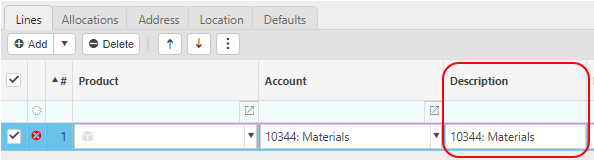

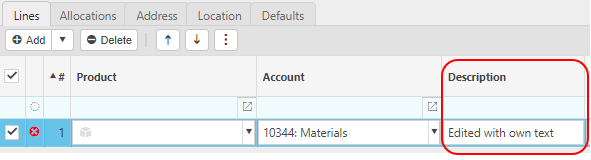

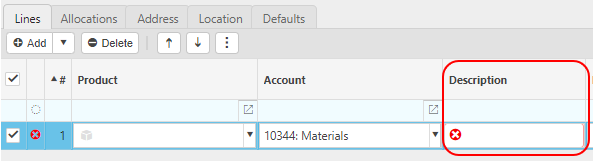

Description: Depending on the Force change setting in Chart of Accounts

If the Force change is not ticked, then the Description field will be auto-filled ...

... however, it can be edited.

If the Force change is ticked, then the Description field will be blank, and you will be forced to enter a description.

Tax Band: The Tax band can be selected here.

Unit: This is the Unit to measure the Product.

Qty: This is the quantity of the Product.

Unit price: This is the price per unit of the Product.

Posting attributes

- The posting attributes are derived from the Chart of account rules related to the Account code. Common attributes include Cost centre and Department but can also include custom attributes.

If there is a requirement to buy from a Supplier and have the goods delivered where the tax authority treatment is different, then set the Supplier up as a Multi Tax Authority Supplier.

Select either Submit once happy with details or Create as draft to be able to edit further before submitting.

Note

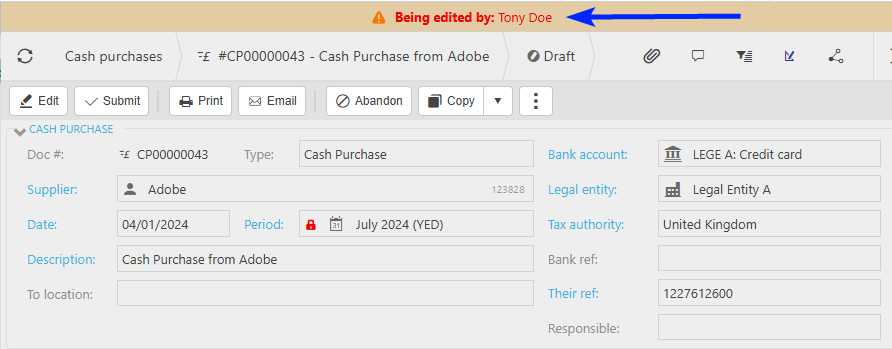

Returning to this document via the Edit option will notify other users viewing the same document that it is being edited.

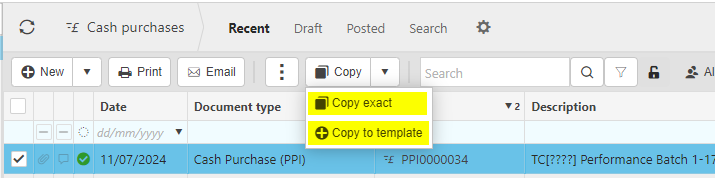

How to copy Cash Purchases

Copy a Cash Purchase

Rather than filling out a new cash purchase you can copy a pre-existing one to speed up the process. This is particularly useful when you are creating the same cash purchase frequently.

Select the pre-existing cash purchase that you would like to copy.

Press either Copy exact or Copy to template.

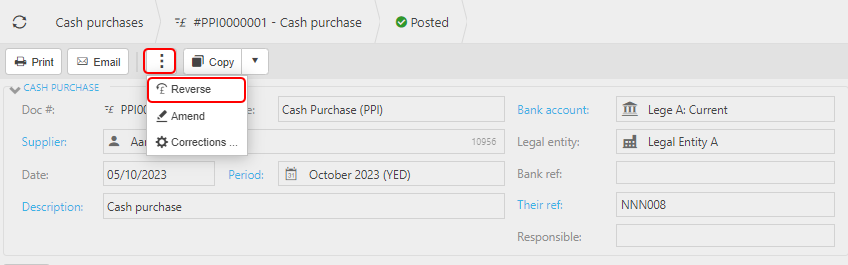

How to reverse Cash Purchases

Reverse a Cash Purchase

Select and open the Cash Purchase (either highlighted on the list or open the Payment), then select the

button and select Reverse.

button and select Reverse.

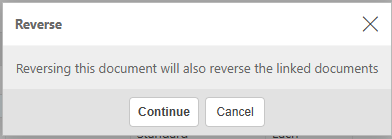

Note

If this is a Multi-co or Inter-co document and there are linked documents, then a warning that reversing will also reverse all linked documents.

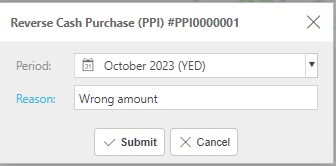

Enter the reason then press Submit.

How to amend Cash Purchases

Amend a Cash Purchase

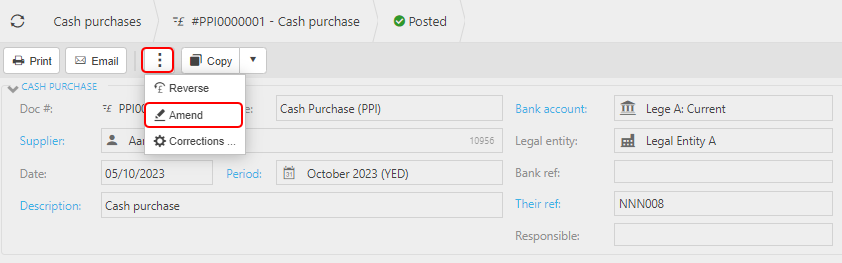

Select and open the posted Cash purchase (either highlighted on the list or open the Payment) to amend, then press Amend option from the

dropdown button.

dropdown button.

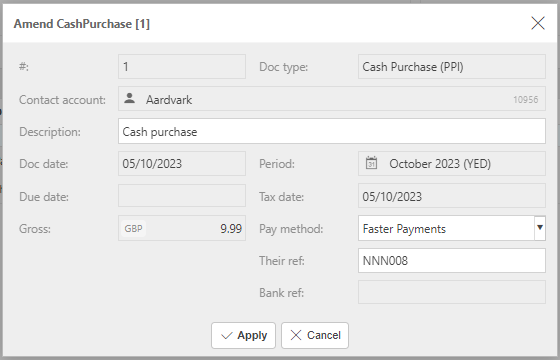

You can now make non-monetary changes to the document details without having to Unpost first. These amendments will not have any effect on any of the Accounts.

You can also make changes to Custom fields, which have previously been defined on the Custom fields tab when defining the Document type -

Note

User will need Attribute.Amend permissions.

Once complete, press Apply.

How to correct Cash Purchases

Make corrections to a Cash Payment

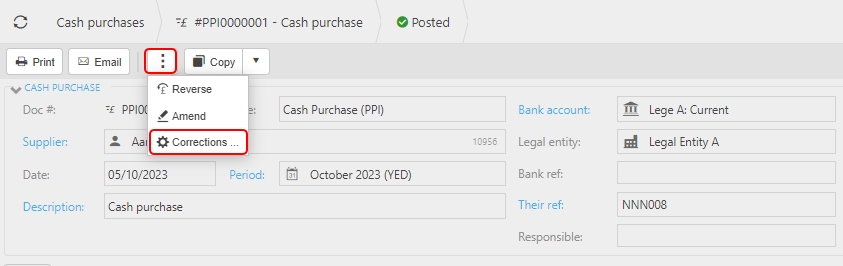

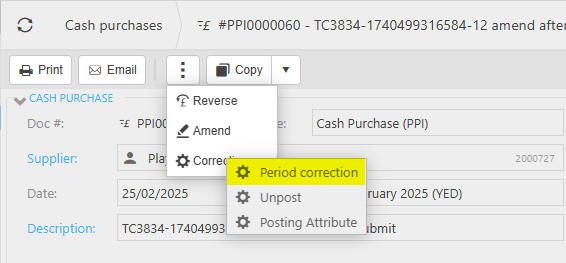

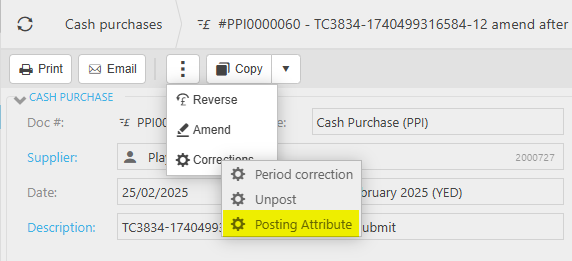

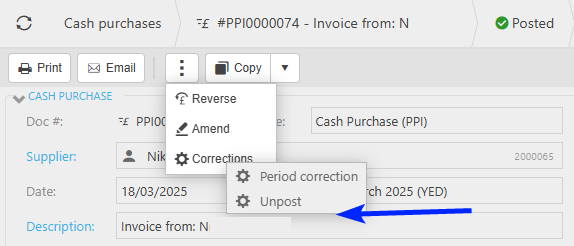

Select and open the Payment (either highlighted on the list or open the Payment), then select the

button and select Corrections.

button and select Corrections.

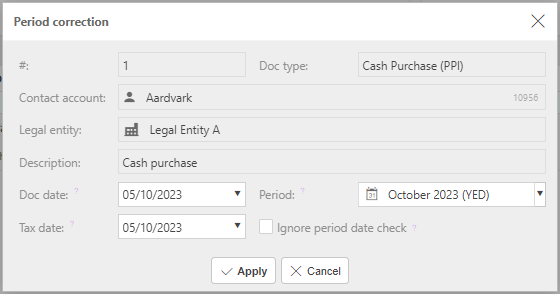

Period correction to make corrections to the Period.

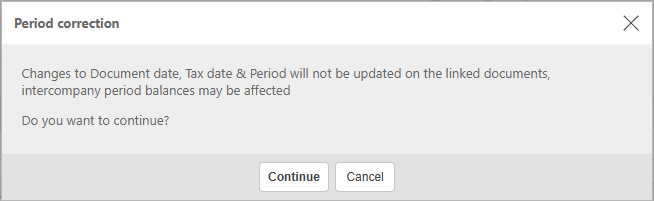

Note

If the document has any linked documents, then a warning will show informing that changes will not be updated on any linked documents, and asking if you wish to continue.

Make correction then select Apply.

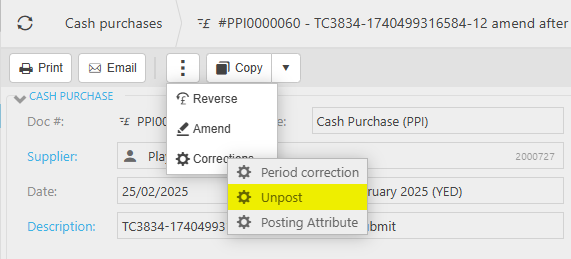

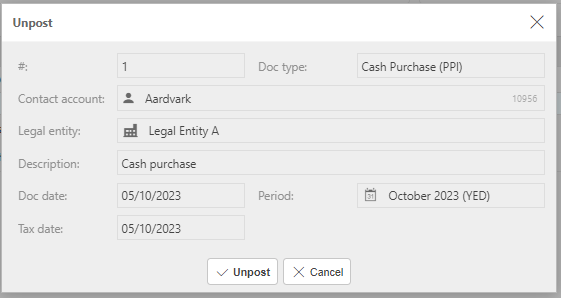

Unpost to retract the Cash Purchase from the General Ledger.

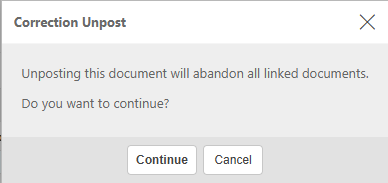

Note

If this is a Multi-co or Inter-co document and there are linked documents, then a warning that unposting will abandon all linked documents.

Select Unpost to proceed.

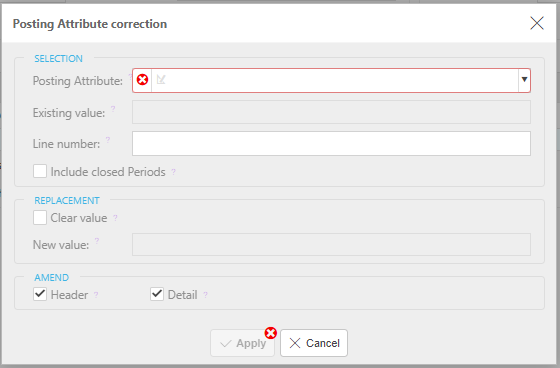

Posting Attribute to make corrections to individual attribute values on the Payment.

Note

If the document is a Multi-co Cash Purchase, then correcting the Posting attribute will not be an option.

See Correcting Posting Attributes for further details.

Updated April 2025