August, 2023

- Release: 782 Check my version

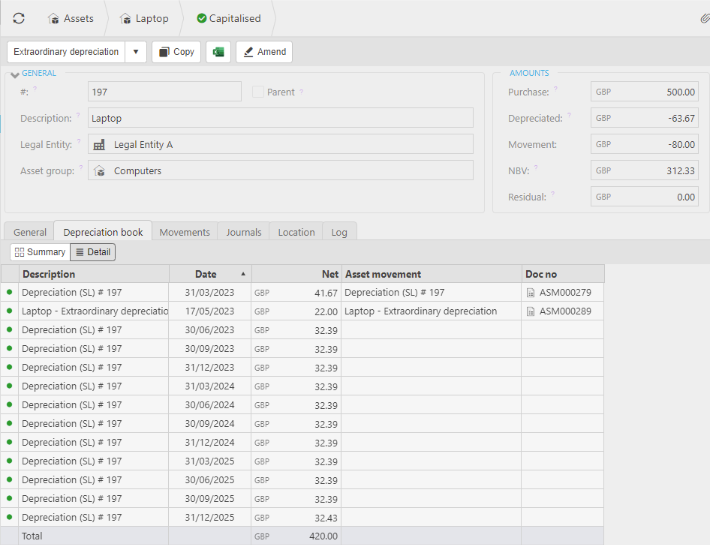

Advanced Fixed Assets

We are introducing a new Fixed Assets module, currently in beta testing, which offers a range of new features:

Multiple depreciation methods including Straight Line, Reducing Balance, Sum of Digits, and Double-Declining.

Depreciation Book: The depreciation book is automatically updated based on factors such as depreciation methods, useful life, previous depreciation, residual value, and more.

Automatic Depreciation and Amortisation: Depreciation and amortisation can be processed manually or automatically through the Scheduler.

Automatic Capitalisation: Assets can be automatically created using auto-capitalisation rules. For example, computer purchases over £500 can be automatically capitalised. Additionally, potential Asset Capitalisations can be identified and individually capitalised as required.

Non-capital assets: Non-capital assets, which are maintained within an asset register but not capitalised, can also be auto-created using auto-capitalisation rules. For instance, computer monitors under £500 will have assets created without capitalising the expense.

The Fixed Assets feature supports various functions, including: Capitalisation, Depreciation, Amortisation, Impairment, Revaluation, Extraordinary Depreciation/Amortisation and Write-off. NB. Disposal and Transfer will form part of a future release.

If you are interested in participating in this beta program, please contact our Customer Services team for further information.

Please note the Advanced Fixed Asset module is a chargeable feature and will attract additional licence and configuration setup/training charges. The previous Fixed Asset feature was essentially just a catalogue of Fixed Assets and this will be phased out in future releases.

Archive data

We are continuing to improve the support for accessing legacy finance systems data, including Exchequer, Sage 50 and Access Dimensions.

Please note that support for additional legacy products including Xero, PS Financials, Quick Books and others will form part of future releases.

We offer this as a one-time import process to give you access to your legacy data, which will be in parallel to the iplicit GL and does not require the data to exist in iplicit:

Speak to your commercial contact if you wish to explore this option.

NB. This new archive import and transformation process supports the import of Archive data for further Legacy products. Watch this space as we continuously add to the list of supported Legacy Products.

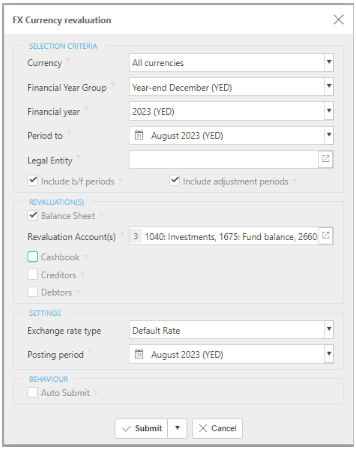

Balance Sheet Revaluation

The Balance Sheet Account Revaluation feature allows for efficient adjustment and reporting of nominated balance sheet accounts. With this update, users can revalue accounts based on specific account and posting attributes, such as loans or investments (REVX), accommodating multiple currencies for each revaluation.

The tool offers the flexibility to select account(s) and attribute(s) for revaluation aggregation, enabling accurate and detailed reporting. Revaluations can be executed in the base currency, reflecting the aggregation at the revaluation date and optionally identifying revaluations in multiple currencies. Unlike Cashbook, Debtor and Creditor revaluations, Balance Sheet revaluations do not reverse in the following period and subsequent revaluations reflect the difference since the previous revaluation.

This feature ensures clear differentiation between original account movements and revaluations, while also offering support for selecting exchange rate types. Additionally, considerations like year-end handling, reversals, and reversing accounts are addressed for comprehensive functionality.

With improved Excel functions and financial statement inclusion/exclusion capabilities, this feature empowers users to make informed financial decisions by offering clarity and precision in reporting.

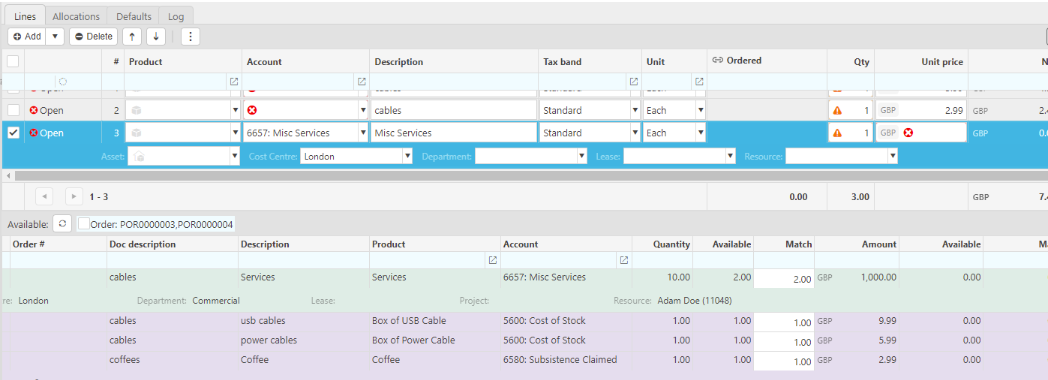

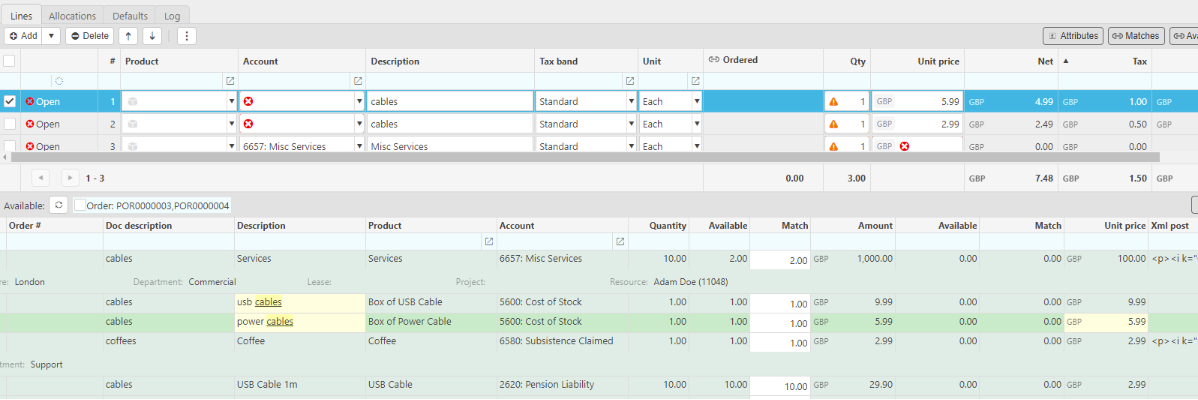

Document matching improvements

Match compatibility highlight: Understanding compatibility between available match lines is now simpler. This update introduces a visual aid that categorises matches with precision:

Green lines indicate a compatible match.

Purple lines represent mismatched items with relaxed matching enabled.

Orange lines highlight mismatched items when relaxed matching is disabled, helping you focus on key disparities.

Description & price highlight: Locating critical information within matched documents is now effortless. Our improved highlighting feature emphasises the description and unit price of items. This ensures that you can swiftly identify and compare essential details:

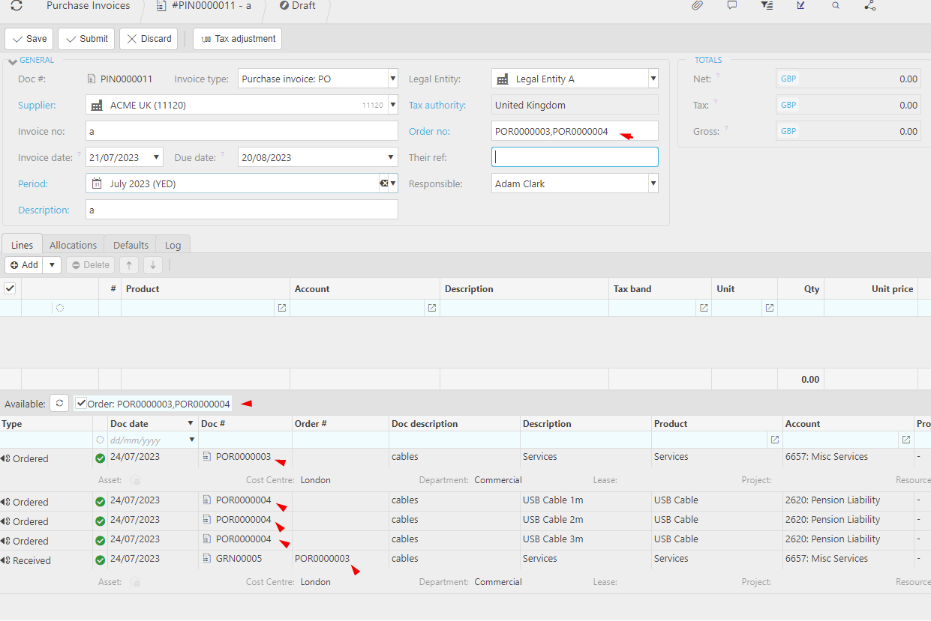

Order Number filters: A new Order number field can now be enabled on document types. When order number fields are enabled, you can easily filter and sort documents based on order numbers. This is especially useful when matching GRNs based on their order number.

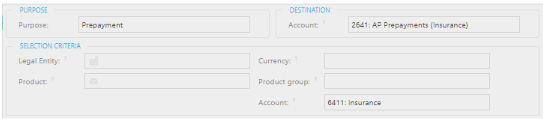

Account defaults: We have extended the defaults to include the source account when defaulting the Prepayments & deferred income account.

Order number fields

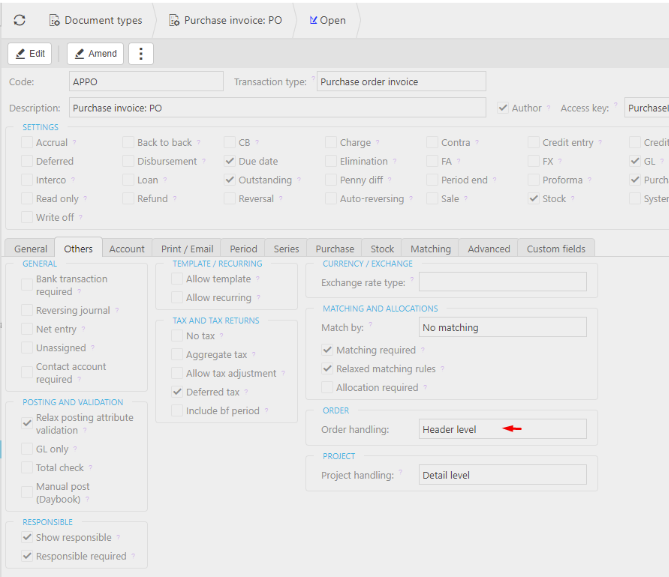

You can now choose to keep track of order numbers at the header, on a per transaction line, or not at all. Additionally, when an order number is set, automatic match filters will be applied to ensure efficient document matching. These filters can also be cleared if needed. This enhancement streamlines your document management and simplifies matching processes, contributing to a more effective workflow.

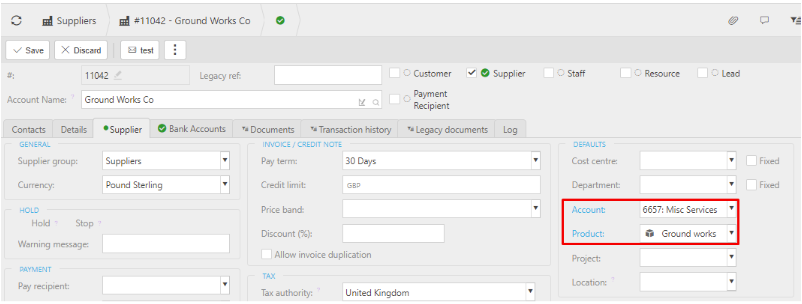

Supplier defaults: Account, Product, Cost Centre, Department

In this release, we're introducing an enhancement that allows you to set default supplier products and/or account codes.

When creating new documents for a specific supplier, these defaults will be applied to invoice lines automatically. This streamlines the process, reducing manual input and maintaining consistency in your documentation.

Other changes

Deferred income/prepayment: Account defaults can now specify overrides at account level.

Cash Journals, Cash Purchases, Cash Sales: now show base amounts, for foreign currency documents.

Accounts: new flag for Revaluation.

Document types -

- New: Revaluation: Balance Sheet

- New flag: Payment term override - support overriding the customer/supplier's default payment terms.

- New flag: Order type handling

Bank reconciliation finder: new columns: Created date, Created by, Last modified, Last modified by.

Receipts finder: new columns: Created by.

User account finder: new columns: Created by, Created date.

User session finder: new columns: Authentication method.

Shift-clicking multiple rows in a grid no longer selects the text.

Support for navigating grid links on touch devices / improved accessibility. Clicking the [...] button that appears while hovering the rows allows navigation.

Inter-company Bulk Payments/Receipts now apply Legal Entity Data Access Control - A user must have access to all allocated legal entities to be able to see the Bulk Payment / Receipt.

SAML is now supported for Single Sign On (SSO).

Debtor Revaluation

This process has been enhanced to encapsulate point in time. As an example, if a USD Sale invoice was created in January 2023 and part receipted in February 2023, upon revaluation at the end of January, the full value of the invoice will be revalued. In the February revaluation, the partial receipt will be taken account of.

Interfaces

- New: Natwest International Payment (SEPA)

- New: Triodos Bank Bulk Payment

- New: Spendesk Bank Statement Import

- Updated: SEPA Bulk Payment Interface: The payer name is now added to EndToEndID to improve the recipients bank reference description.

- Updated: HSBC Bacs Standard 18: Support for ignoring the 3 day BACS payment cycle validation.

- Bank statement imports: Merchant name mapping is now supported on select interfaces.

- Contact import: support for bank account name in bank details.

Environment settings:

- Assets: Default capitalisation amount from.

- Document types: Revaluation: Balance sheet.

- FX: Revaluation: Balance Sheet.

- Single sign-on (SSO): Saml Metadata Url.

Menu links:

Archive:

- Accounts

- Batches

- Currencies

- Document types

- Legal entities

- Upload: Account Groups

- Upload: Accounts

- Upload: Documents

- VAT returns

- Catalogs

- Customers & suppliers

- Documents

- GL

Asset:

- Asset movement types (Legacy)

- Capitalisation, Lease

GL:

- Dynamic Structure Group.

Tax

- Updated tax authority band codes:

- Dubai

- Ireland

- UAE

Enquiries, Reports & Dashboards

New enquiries

- Budget vs actual

- Budget vs actual (YTD)

- Budget vs actual (YTD) Consolidated

- Budget vs actual - Consolidated

- Base budget vs latest forecast

- Allowed bank account transfers

Updated enquiries:

- Balance sheet: fixed Post date display format.

- Balance Sheet (Local & consolidation): added Eliminations parameter.

- P/L: fixed Post date displayed as date; fixed Amount (No decimal places) uses currency amount instead of base amount when Reverse PL sign setting is on.

- P/L (Local & consolidation): added Eliminations parameter.

- Trial Balance (TB): fixed Post date display format.

- Trial balance (Local & consolidation): added Eliminations parameter.

- Document detail: Fixes Irrecoverable tax amount display format.

- Interco: added Currency filter.

- VAT Return - Detail: Added Legal entity filter.

- VAT Return - Exceptions: Added Legal entity filter.

- VAT Return - Breakdown: Added Legal entity filter.

- VAT Return - No treatment: Added Legal entity filter.

- Part of the Archive feature update, the archive enquiries have been updated:

- Archive Contact Accounts.

- Archive import summary.

- Archive Accounts.

- Archive GL.

- Archive documents.

Updated reports:

- Bank Reconciliation Summary: added Created by.

- Customer Statement: UK1: As at date field format.

User roles

Updated roles:

- Archive: Admin (Legacy), Read Only (Legacy), View (Legacy).

- Dynamic Account Structure: View, Admin, Read Only.

- GL reconciliation: Read Only, Draft Entry, Entry, Admin, Delete.

New user roles:

- Archive: Export & Upload, Read Only.

- Archive: View, Delete, Admin.

- Series: Admin, Read Only.

- Tax: View.

Other fixes

- Allow reversal document type was not working. The feature has been fixed in this release and all documents have been reverted to allow reversals to prevent unexpected behaviour post upgrade.

- Bank reconciliation Close Date was not cleared when unlocking locked bank reconciliations.

- Bulk receipt authorisation incorrectly displays "Bulk payment authorisation".

- Totals in certain enquiries are displayed with incorrect number of decimals / precision.

- Delete customer / supplier from Finder displays errors.

- User account admin change password not displaying "special characters" rules.

- Posted Bulk Payments incorrectly displaying "Bulk payment not posted" when printing remittances (8070).

- Updates to Data Entry Control queries not taking effect until re-activation.

- Partial Rate not indicated when creating document for overseas supplier.

Note

Get in touch to find out more about the features in this release or how to get even more out of the system.