Asset Capitalisation Rules

Capitalisation Rules are set by the Customer so that Assets can be Capitalised correctly. Generally, a customer will set Capitalisation rules as appropriate to them as thresholds will vary by Customer size and industry.

How to view Asset Capitalisation Rules

Viewing Asset Capitalisation Rules

Either select Asset capitalisation rules from the Asset part of the Settings section in the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

or enter Assets capitalisation rules in the Quick Launch Side Menu.

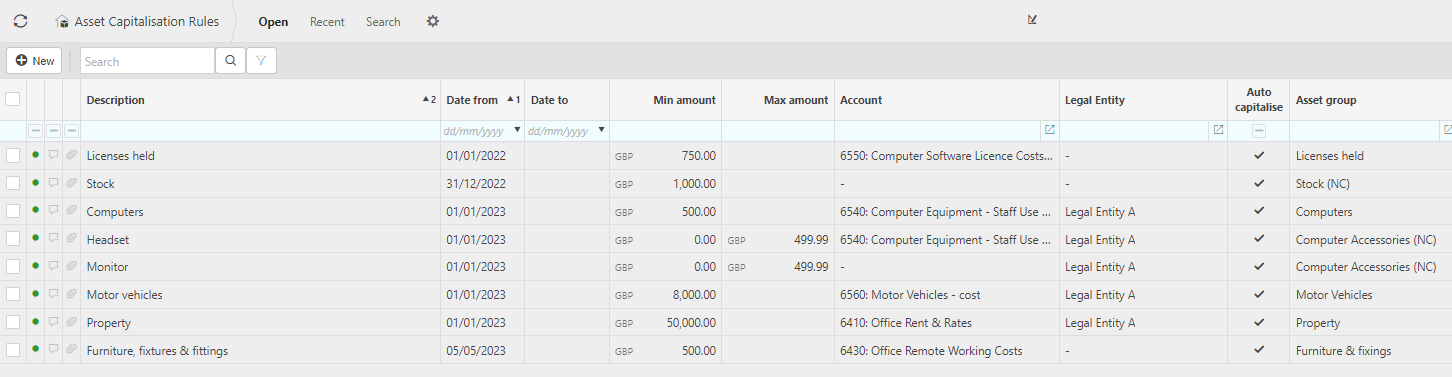

This gives you a list of all the Asset capitalisation rules.

How to create Asset Capitalisation Rules

Creating Asset Capitalisation Rules

Select Asset capitalisation rules from one of the options as shown above in Viewing Asset Capitalisation Rules.

Press New.

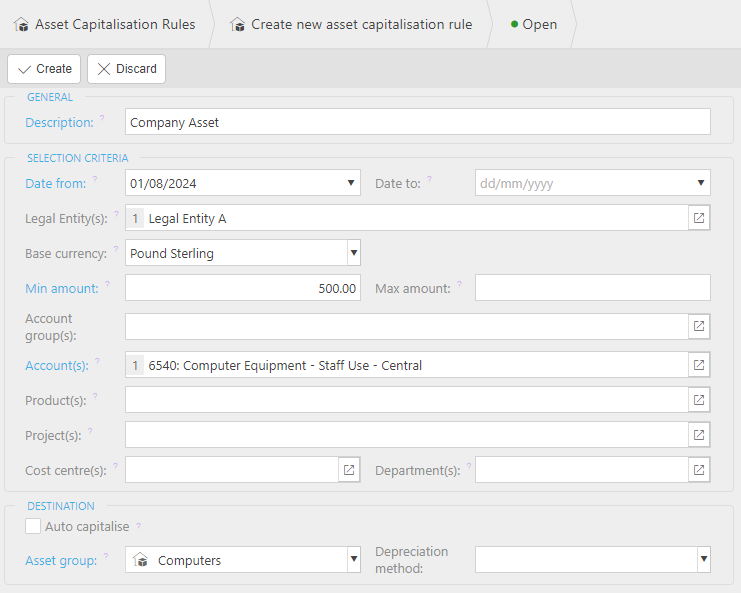

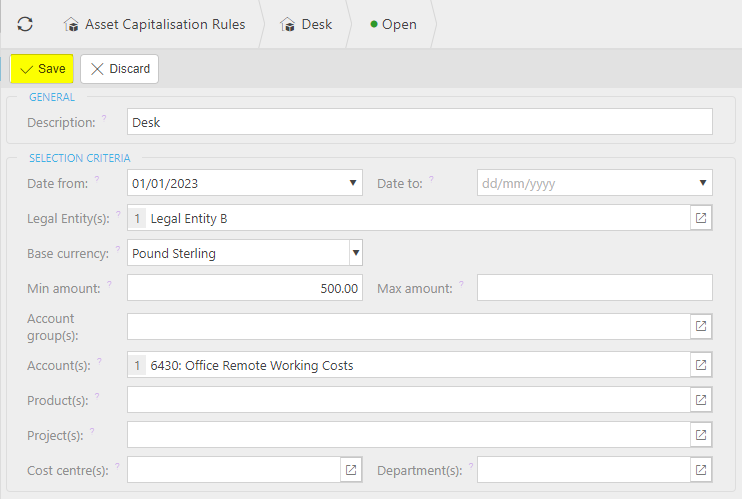

Enter the Asset capitalisation rules details as required -

Note

For fields,

denotes a single entry,

denotes a single entry,  denotes possible multiple entries.

denotes possible multiple entries.Description - add a unique description for the rule.

Date from - enter a date that the Capitalisation rule is effective from. This will be compared to the document date and any documents before this date will be ignored.

Date to - enter a date that the capitation rule is effective to. This will be compared to the document date and any documents before this date will be ignored.

Legal Entity(s) - enter Legal Entity only if you wish to restrict the rule to a specific Legal Entity.

Base currency - select Legal entity base currency.

Min Amount - enter minimum base amount, leave blank if no minimum.

Max amount - enter maximum base amount, leave blank if no maximum.

Account group(s) - select Account group(s) if you want to restrict this rule to only work for specific Account Group(s), an alternative to choosing individual Account(s) or Product(s).

Account(s) - select Account(s) if you want to restrict this rule to only work for specific Account(s), an alternative to choosing individual Account groups(s) or Product(s).

Product(s) - select Product(s) if you want to restrict this rule to only work for specific Product(s), an alternative to choosing individual Account groups(s) or Group(s).

Note

Account group(s), Account(s) and Product(s) will all be initially marked

as mandatory fields, but only one of the fields needs to be entered.

as mandatory fields, but only one of the fields needs to be entered.Cost centre(s) - select Cost Centre(s) if you want to restrict this rule to only work for specific Cost Centre(s).

Department(s) - select Department(s) if you want to restrict this rule to only work for specific Departments(s).

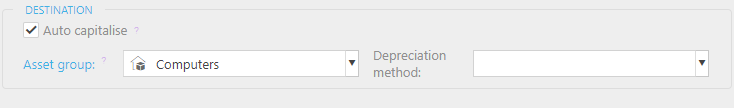

Auto capitalise

When this box is ticked, an Asset will automatically be created (including non-capital Assets), using the Asset Group and Depreciation Method specified. For Capital Assets, Asset Journals(s) will be created to capitalise the expense.

Asset group - specify the default Asset Group to be used upon capitalisation of postings which match this rule.

Depreciation Method - specify the Depreciation method to be used upon capitalisation of postings which match this rule. Leaving this field blank will mean the default Depreciation method from the specified Asset Group will be used.

How to edit Asset Capitalisation Rules

Editing Asset Capitalisation Rules

Select Asset capitalisation rules from one of the options as shown above in Viewing Asset Capitalisation Rules.

Select and open Asset capitalisation rule that is to be edited.

Select Edit button.

Make changes (refer to field explanations above) and then Save.

Updated September 2024