Asset Capitalisation

Capitalisation is an accounting method in which the cost of an Asset appears on the balance sheet, split over the useful life of that asset, as per the Asset depreciation methods.

The way that Assets are Capitalised will follow company rules as set up in the Asset Capitalisation Rules.

What are the Prerequisite settings for Asset Capitalisation

Prerequisite settings for Asset Capitalisation

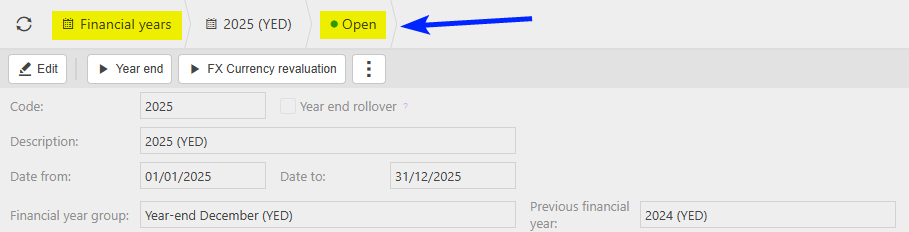

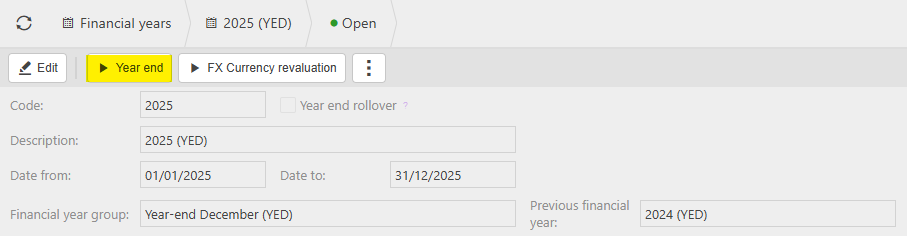

The Financial year should be open.

The Year end has NOT been run for the Financial year.

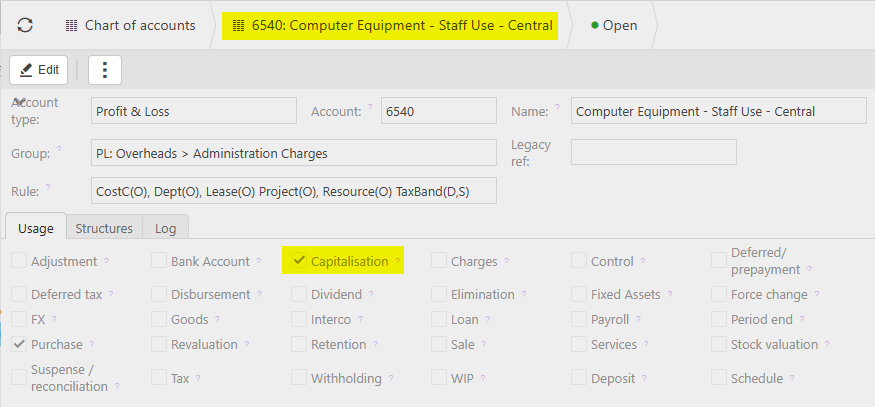

The G/L Accounts used on the document should have the Asset capitalisation box ticked.

The G/L Accounts used on the document should be included in an Asset capitalisation rule.

The Document class needs to be Cash Purchase, Purchase invoice or Expense.

How to view Asset Capitalisation

Viewing Asset Capitalisation

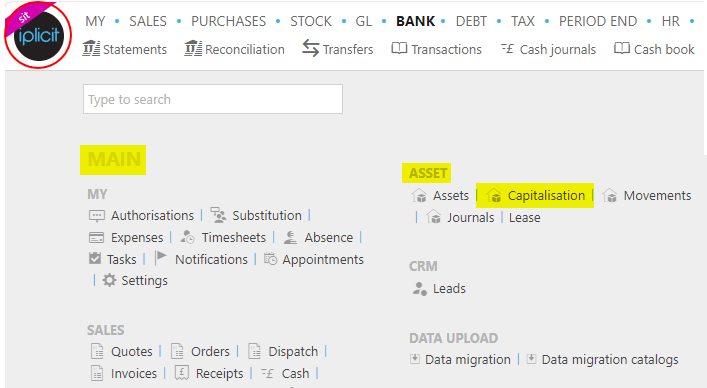

Either select Asset capitalisation from the Asset part of the Settings section in the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

or from the Main Menu select Asset then Assets -

or enter Assets capitalisation in the Quick Launch Side Menu.

How view Asset Capitalisation Sets

Asset Capitalisation Sets

This will then give the following lists -

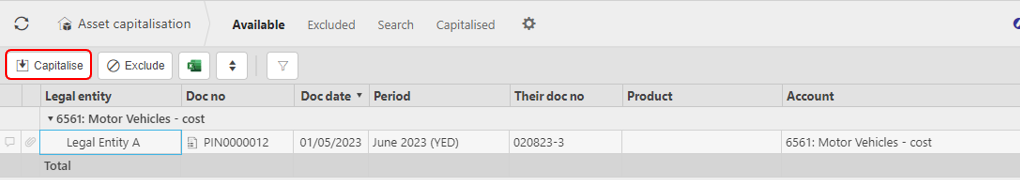

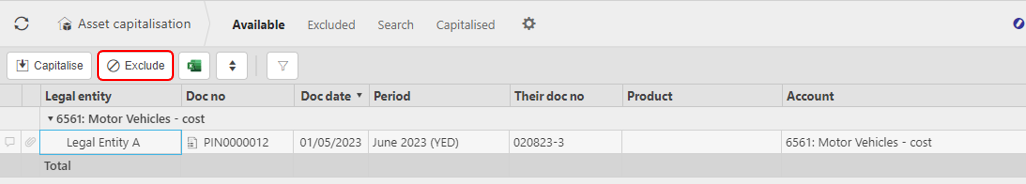

a list of Assets created by an Invoice but were not Auto capitalised.

If you are now happy for an Asset in this list to be Capitalised, highlight the Asset and then select the Capitalise button. The Asset will now transfer to the Capitalised list.

Alternatively, if you wish you exclude the Asset from being Capitalised, then highlight the Asset and select the Exclude button. The Asset will now transfer to the Excluded list.

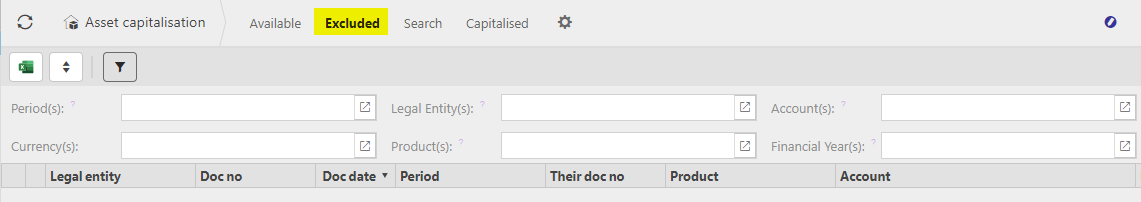

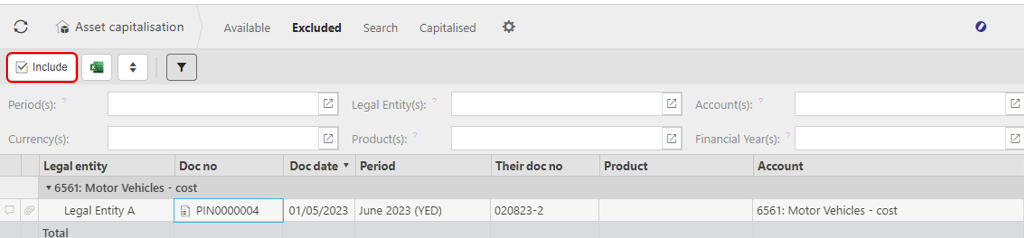

a list of Assets that have been excluded from being capitalised.

If you now decide you want one of these Assets in this list to be Capitalised, highlight the Asset and then select the Include button. The Asset will now transfer back to the Available list.

Then go to the Available list, highlight the Asset you just transferred and select the Capitalise button. The Asset will now transfer to the Capitalised list.

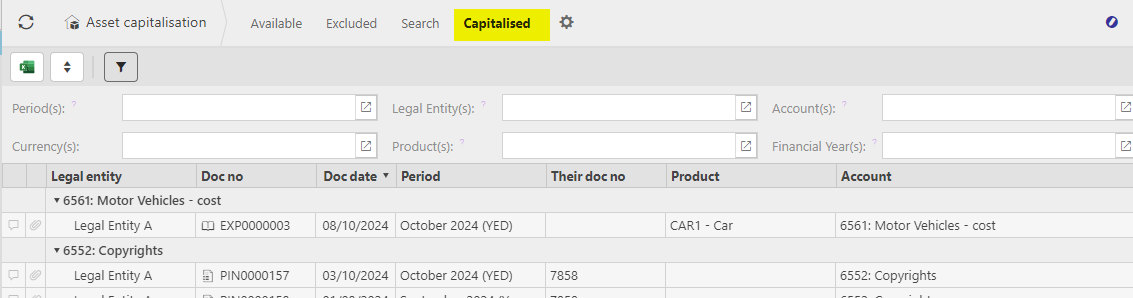

a list of Assets that have been capitalised, either via the Auto capitalised option or the Manual capitalised option.

Updated February 2025