May, 2023

- Release: 771 Check my version

Lightyear purchase invoice integration

We are excited to announce our collaboration with Lightyear to offer seamless integration with their accounts payable automation system - iplicit and lightyear intro v1.

The integration allows for the automatic creation of purchase documents in iplicit from documents that have been processed in Lightyear, such as supplier invoice PDF files.

This feature can drastically cut the time and costs involved in the manual accounts payable process.

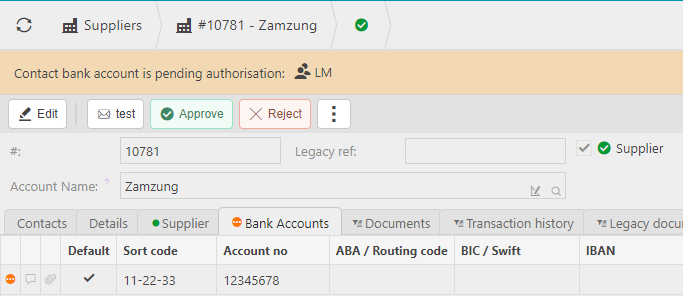

Supplier bank account authorisation

Upon the entry or update of Supplier Bank Accounts, you can now use Authorisation Workflows to distribute these changes for authorisation. Audit logs are retained for these submissions and approvals.

Intercompany bulk receipts

We are introducing an extension to the existing bulk receipting feature that allows for the receipting of sales documents for multiple legal entities in a single batch.

When posting the batch to the general ledger, the system automatically generates Interco movement documents to accurately reflect the intercompany postings.

These intercompany postings also support the elimination handling feature available on financial statements, ensuring accurate and comprehensive financial reporting.

For further details see Bulk receipts

Domestic Reverse Charge

We now support Domestic Reverse Charge on Irish sales documents.

Password Strengthening

In our ongoing commitment to enhancing security, we want to inform you about an important update regarding password policies. As previously communicated, we have increased the strength and complexity requirements for passwords.

Starting at the end of this release cycle, we will be enforcing the heightened password policies for all existing passwords. If your current password does not meet the new requirements, you will be prompted to change it during your next login after the release.

Other changes

- Uploading attachments: 16Mb max file size validation applied

- Web accessibility statement

- Product stock import

- Bank accounts: log tab

- Dynamic account structures: support for including/excluding BS/PL roots

- Workflow authorisation rules: support for customer, supplier, resource navigation from a contact account.

Fixed issues

- Long reply chains on notes are hard to read.

- Report designer session might expire while editing reports.

- Print attachment dialog not shown in certain situations.

- Extra spaces handling in CSV file uploads.

- Budget import does not show progress indicator.

- Incorrect VAT return validation with multiple drafts but closed.

- Dynamic Account Structures: cannot edit account mapping.

- Czech Republic tax authority using EUR currency incorrectly.

- Payment method on Expenses where contact account is both Supplier and Resource.

- Multi-currency Bulk Payment currency rates and FX realised differences.

- Stock transfer does not calculate stock movement costs correctly.

- Expenses credit card: validate bank account type.

- Document import: Expense handling, currency rounding fixes.

- Budget import increased timeout to 5 minutes.

- Excel function GLGroupYtpBaseAmounts include special periods parameter.

Detailed changes

Interfaces

- Handelsbanken - Faster Payments

- Barclays - SIF

Dashboards:

- Updated:

Enquiries:

Updated: P/L, Stock levels, Stock movements analysis, P/L - Cash basis, P/L (Draft), Project - P/L, Trial Balance (TB), P/L by project, Budget vs actual (Consolidation), P/L by department, P/L (Consolidated), Aged debt, Budget vs actual, Contact account bank account changes, P/L (Local & consolidation), Archive documents, Balance sheet, Supplier turnover

Optimized: P/L, Stock levels, Stock movements analysis, P/L - Cash basis, P/L (Draft), Project - P/L, Trial Balance (TB), P/L by project, Budget vs actual (Consolidation), P/L by department, P/L (Consolidated), Aged debt, Budget vs actual, Contact account bank account changes, P/L (Local & consolidation), Archive documents, Balance sheet, Supplier turnover

New: Trial Balance (Audit), Legal entity purchase tax rates, Legal entity purchase tax rates all, P/L by fund, Balance sheet rolling (Local & Consolidation), Authorisation log, Bank Reconciliation Future GL Documents

Menu

- Debt: Bulk receipts

Form changes

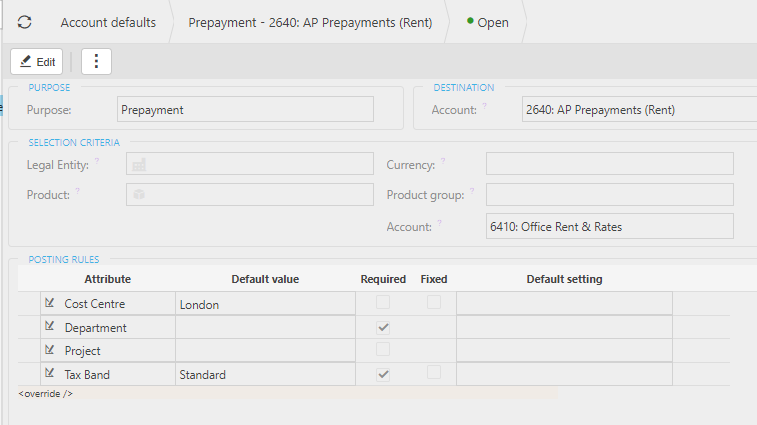

Account defaults: more fields available contextually

Reports:

- New: VAT 126 Report

Tax

- Germany tax authority & setup;

- Tax codes:

- Marked inactive:

- Hospitality purchases goods OEC,

- Reduced purchase reversal services

Tax code treatment:

Australia

- Tax only sales: G1 added

new: Germany (GB)

Tax rates:

- Germany

Tax returns:

- Germany

User roles:

New:

Bulk Receipt: Correction Unpost

Contact Account: Full Access,

Property: View, Read only,Delete,

Quick Cashbook: Partial Tax Ignore,

Authorisation Workflow: Read Only,

Interfaces

Updated:

NatWest Standard Domestic Bulk Payment, NatWest Adhoc Bulk Payment,

Product - simple import

New:

HSBC CSV (Multi account)

Barclays.Net SIF

Handelsbanken Payment

Product - Generic import, Stock valuation import Instruction ASCII

Note

Get in touch to find out more about the features in this release or how to get even more out of the system.