MY Expenses

MY expenses allow you to view and create expense claims.

You can enter a personal expense claim OR a business credit card claim.

A personal expense claim will be paid to the Resource directly whereas a business credit card expense will be logged for bank reconciliation to the credit card bank account.

Note

For users to input their expense claims they will need to be a Resource. Their user account will need to be updated with the resource, bank account and payment terms.

Expense products will need to be created and accessible for the Resource entering the expense claim.

Authorisation Workflows will need to be created if you want there to be an authorisation process.

Document types for a personal expense and/or a credit card expense will need to be available.

User Roles for Credit Card entry will need to be assigned to the user.

How to view My Expenses

Viewing My Expenses

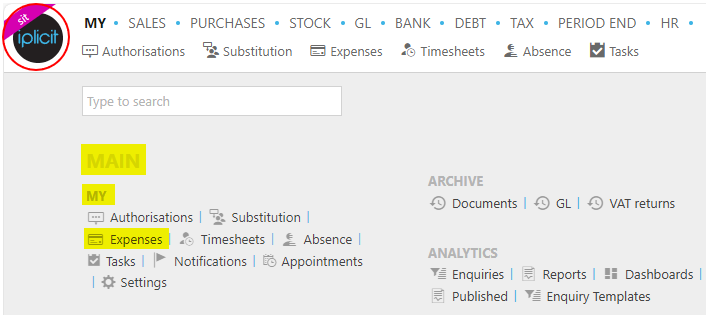

Select My / Expenses from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

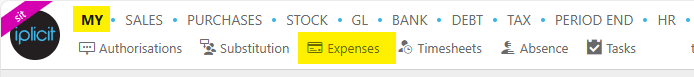

or from the Main Menu select My then Expenses -

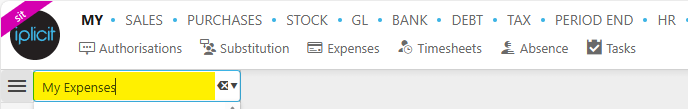

or enter Ex Expenses in the Quick Launch Side Menu.

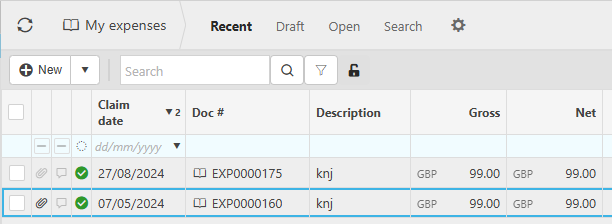

This will then show My Expenses on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to create an Expense claim

Create an Expense Claim

Select My Expenses from one of the options as shown above in Viewing My Expenses.

Select New.

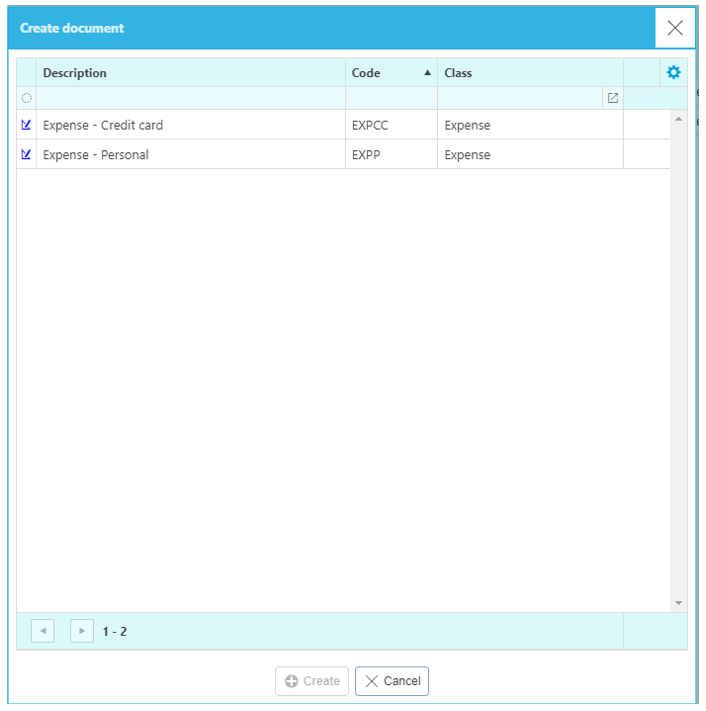

This will display the available Document types as per the systems settings. Highlight the chosen type (Personal expense or credit card expense) and select Create.

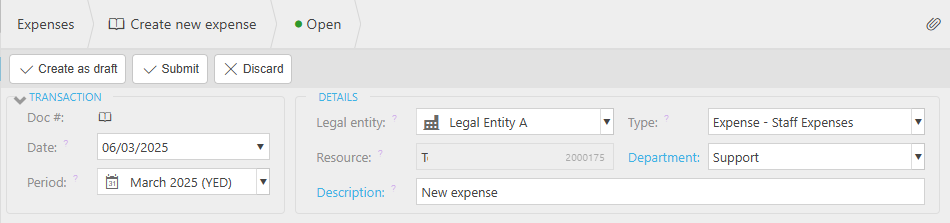

Fill in the required fields.

Transaction Date will default to today’s date which can be over-written.

Due Date will automatically calculate according to the Resource payment terms.

Period: The accounting period for the order (available for reporting filters).

Legal entity mandatory field that may be pre-populated depending on settings.

Type will be populated with Expense – Personal.

Resource will be defaults to the resource linked to the user account.

Description is used for a summary description for the expense claim. This is a mandatory field.

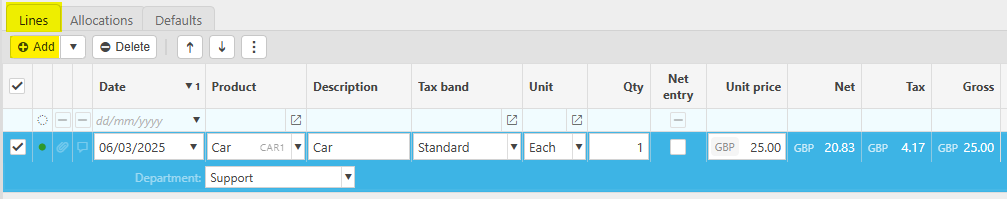

Select Add to create a new expense line(s) then fill out the required fields.

Date: Of the expense

Product: Select from the validation list.

Account: Mandatory field which will be pre-populated from the product .

Description: Mandatory field which will be pre-populated from either the product or Account record, either of which can be amended.

Tax Band: Mandatory field which will be pre-populated from either the product or Account record, depending on settings this may/may not be available for amending.

Non recoverable: Tick this checkbox if there is VAT on the expense but there isn't a tax receipt attached.

Unit: Defaulted from the system settings or the product which can be amended.

Quantity: Determines the number of units being ordered per unit.

Unit Price: May be pre-populated from product price on the product or manually entered.

Note

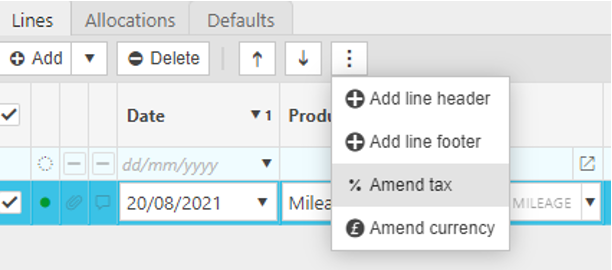

Line Headers and footers can be added to group expense lines. Tax and Currency can also be amended if required.

Tip

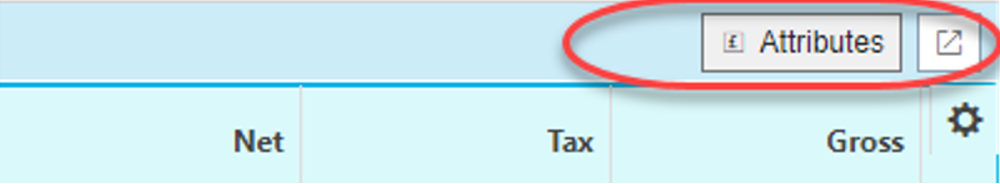

In addition to the standard line fields, additional Attributes may be needed.

These could be optional or mandatory fields based on the setting of the product.

Display of these fields is optional based on the Attributes toggle button.

Clicking on the

icon alongside the Attributes button changes the display to only show the lines, which is useful for documents with multiple lines.

icon alongside the Attributes button changes the display to only show the lines, which is useful for documents with multiple lines.

Attach receipts if required.

Select the

icon.

icon.To upload from an external source, select the

icon.

icon.Locate the file you wish to upload and select open.

Note

You can upload receipts by dragging a file from the location and dropping this into the relevant attachment sub section.

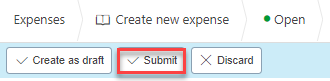

When you are happy with the expense press Submit.

- If you have not setup an Authorisation Workflows the expense will automatically convert to an approved status.

Updated March 2025