Asset Setup steps

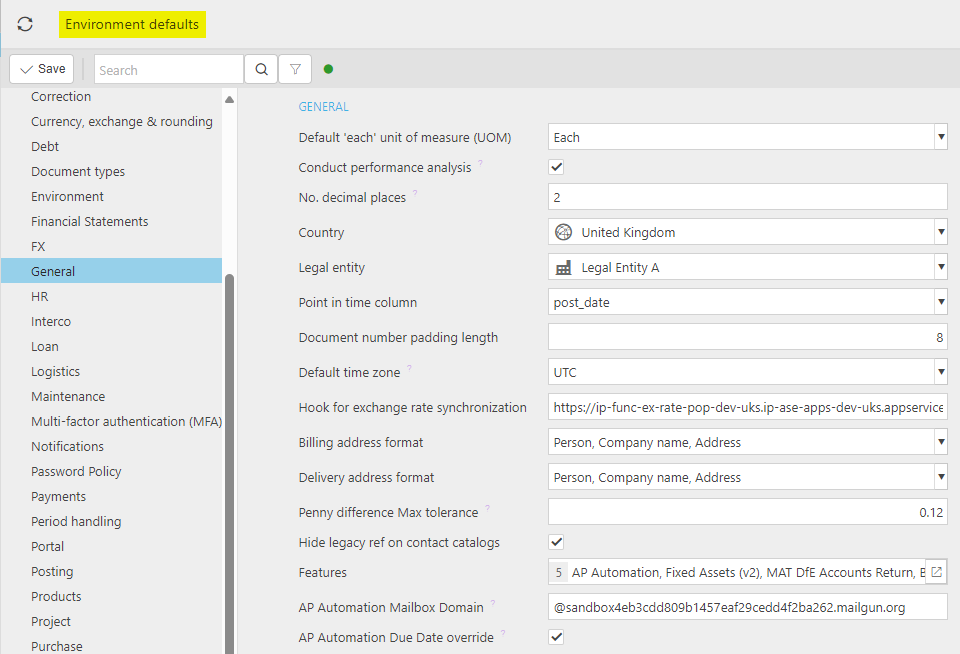

In Environment details, select the General section.

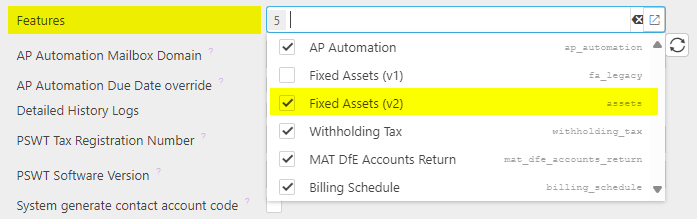

Under Feature, select Fixed Assets(v2).

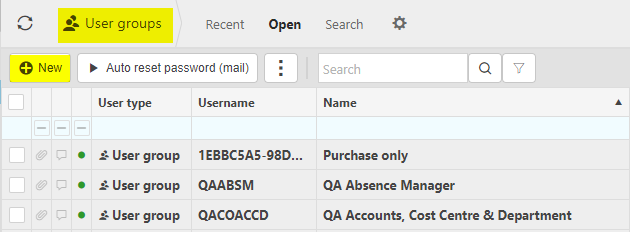

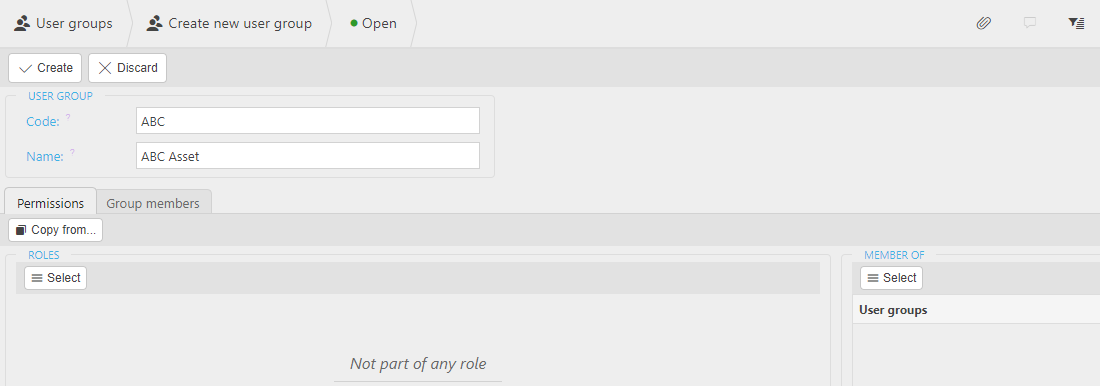

Create Asset User Group via the User Group menu.

Select New.

Code - unique username.

Name - enter name of the user.

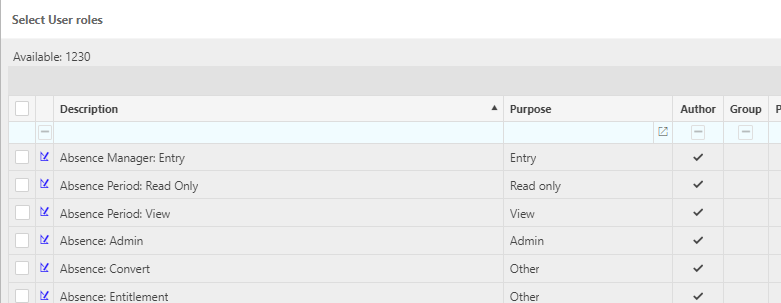

Permissions - enter Roles and Member of - you can use the

button.

button.Example user roles -

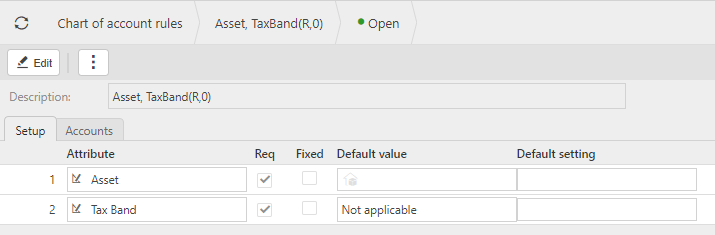

As Asset Register attribute is legacy only, check any existing Chart of Account Rules associated with Assets and replace Asset Register with Asset attribute.

Note

Asset rules are required when creating auto capitalised assets from documents such as PIN's, but when you create them manually, via the assets finder, you do not need a rule.

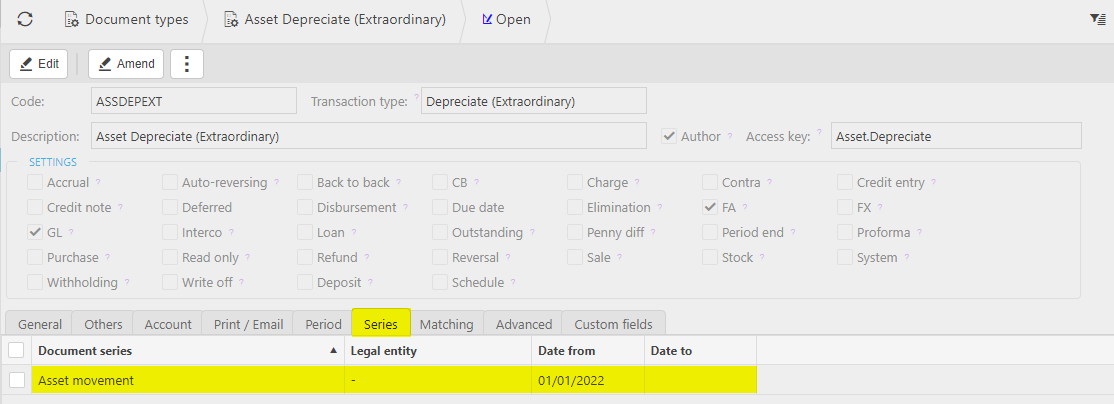

Load Document types, filter by Asset and check that they are all Active.

Still within Document types, open each Asset document type and, via the Series tab, check that each one is related to a Document series e.g. Asset movement as shown below

Ensure that the Series "from date" is a valid date e.g. 01/01/23.

Check any legacy Asset Register documents in Document types and lock them.

Tip

The New Asset Register will replace the Old Asset Register

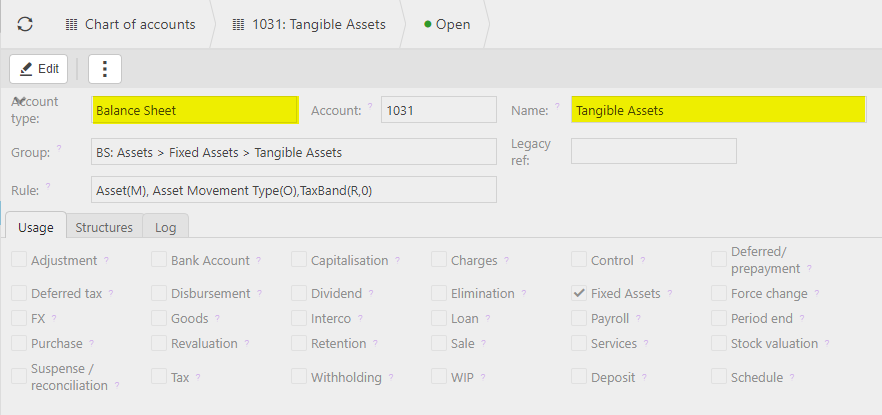

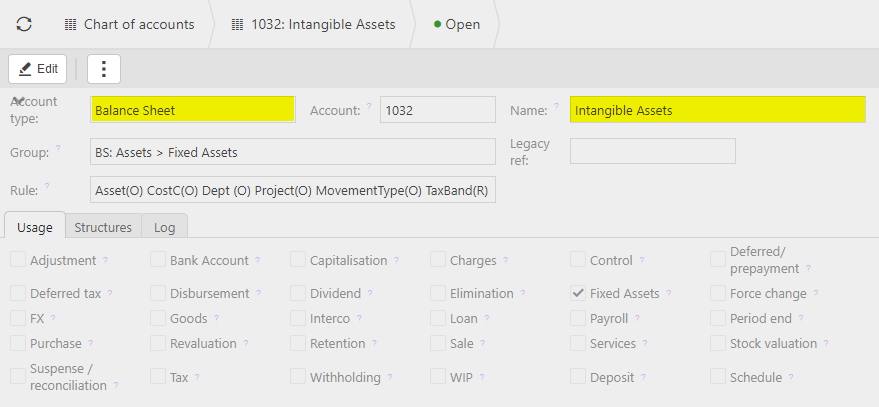

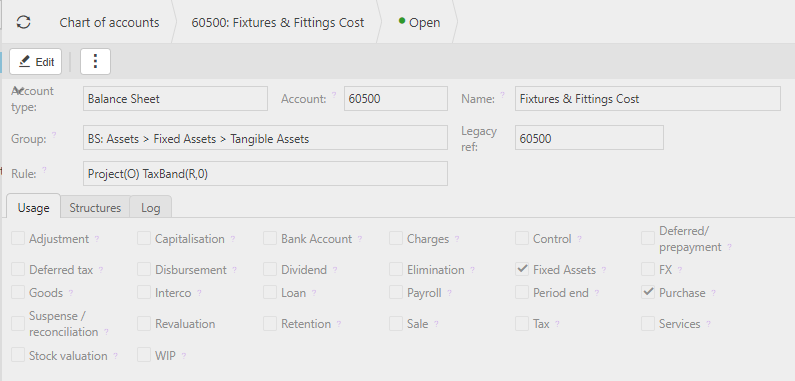

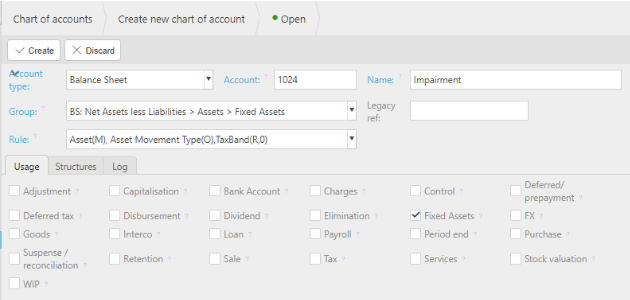

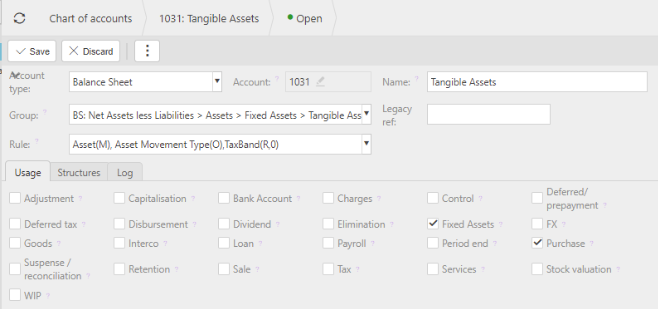

Create Tangible / Intangible Chart of Accounts account per logical grouping that you would wish to see in the Balance sheet.

Tangible example -

Intangible example -

Note

Create additional Balance sheet accounts where e.g. you want to distinguish Fixture & fittings tangible, etc.

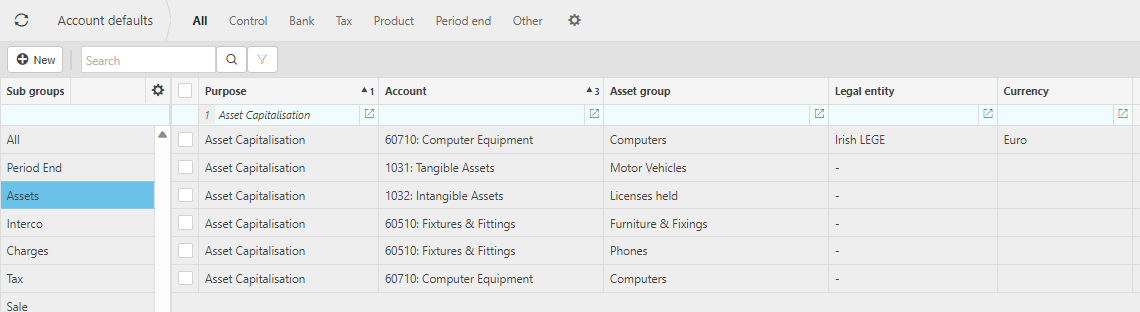

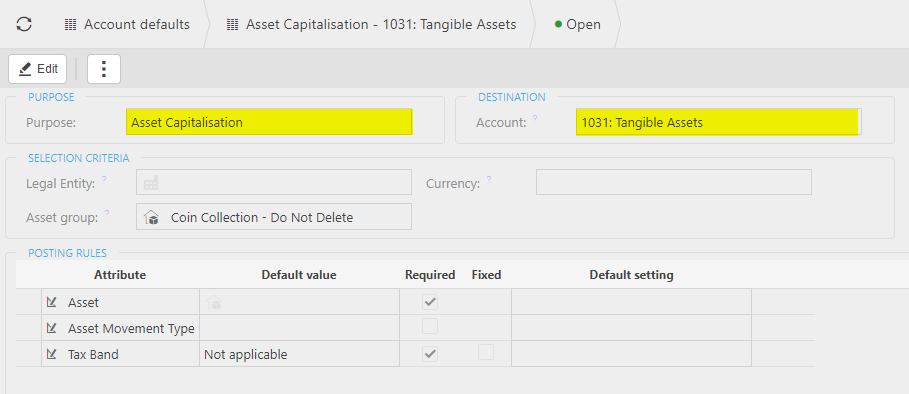

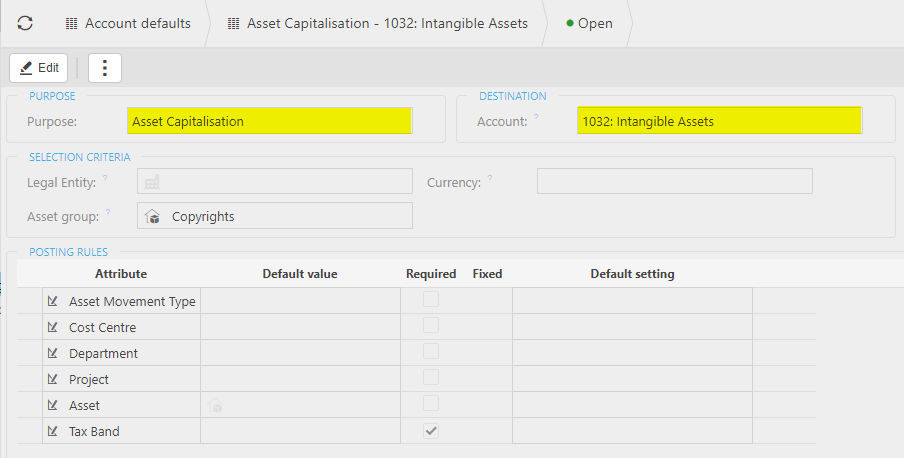

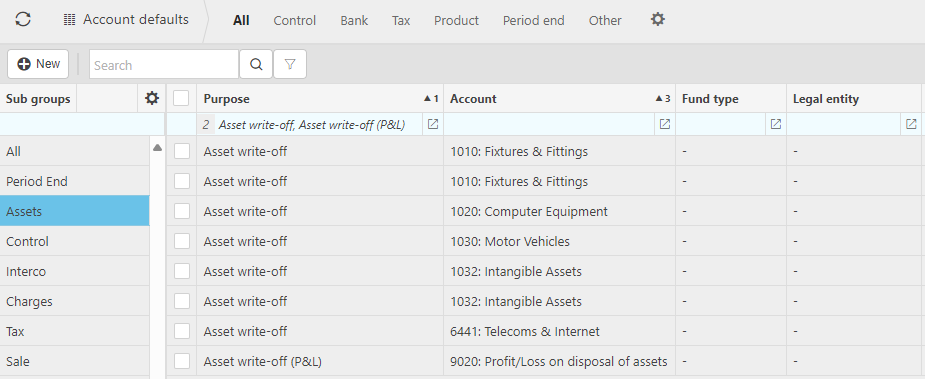

Create capitalisation Account defaults

Tangible example -

Intangible example -

Note

Note the use of the Asset Group to e.g. allow Intangible.

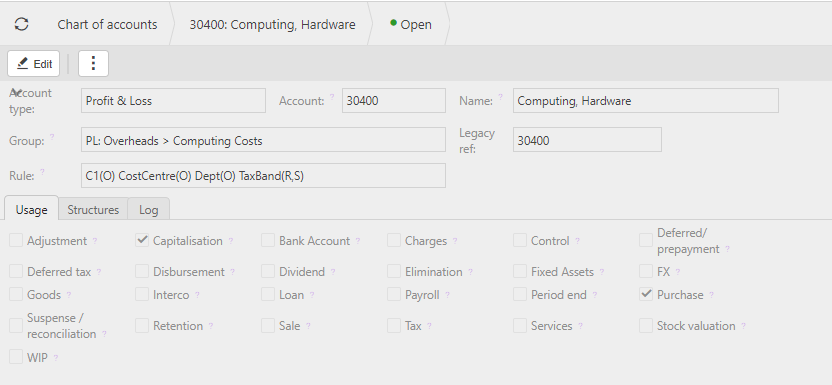

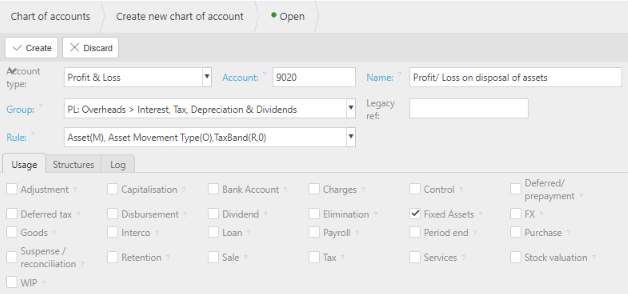

Check that Profit & Loss and Balance sheet accounts in Chart of Accounts that will be used for capitalisation have capitalisation set to true. For example -

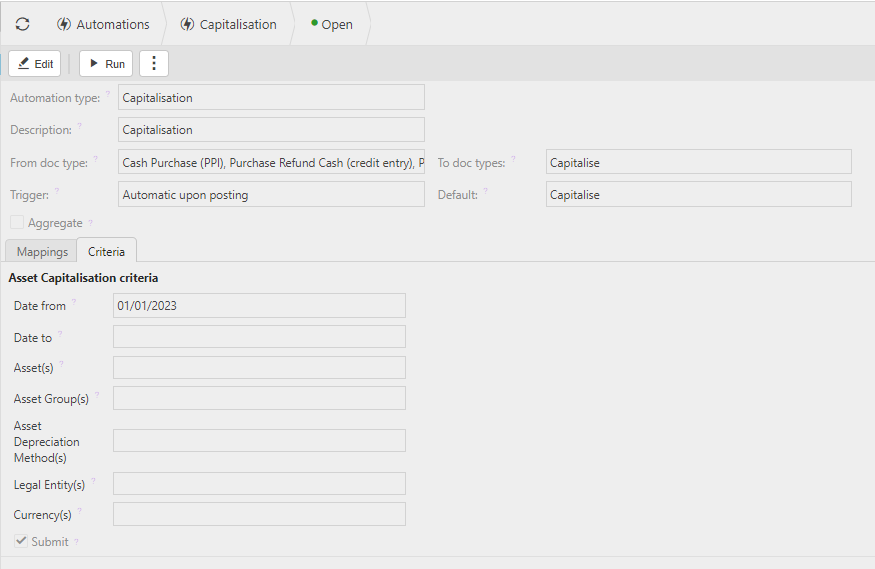

Create Capitalise Automation

Note

Accept defaults but you may wish to have a date from so it doesn’t attempt to capitalise old purchases.

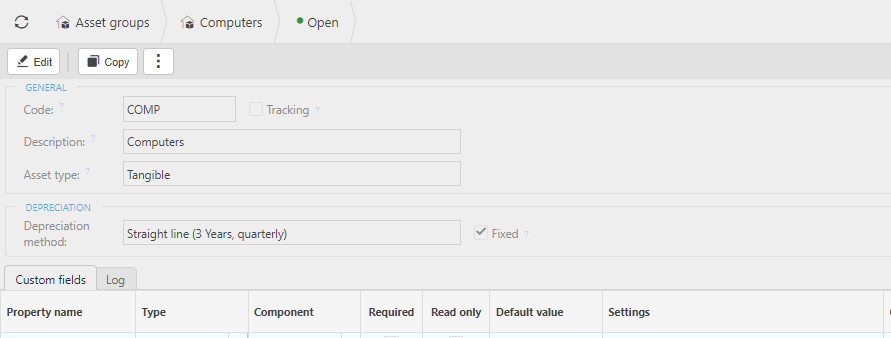

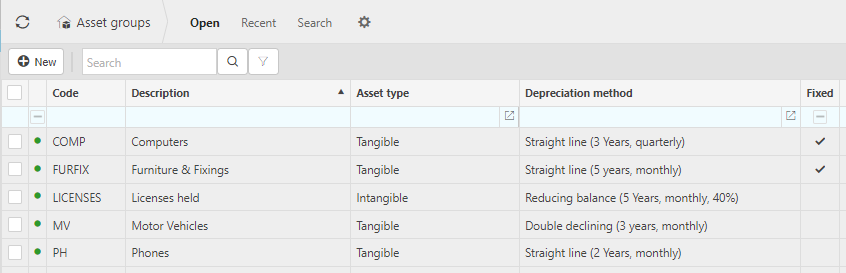

Create Asset Group(s)

Tangible example -

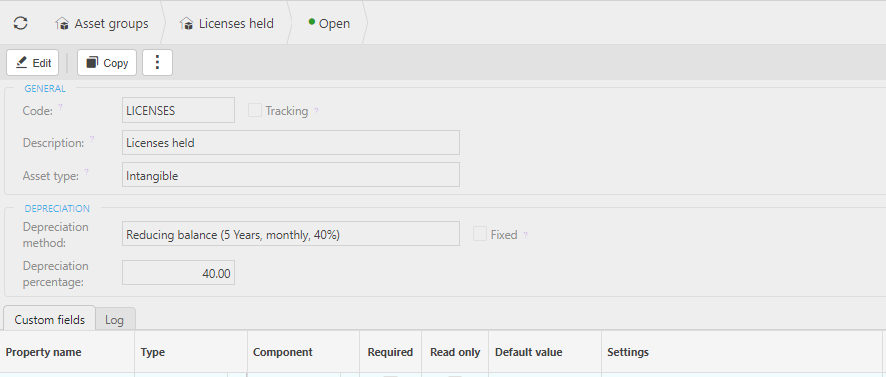

Intangible example -

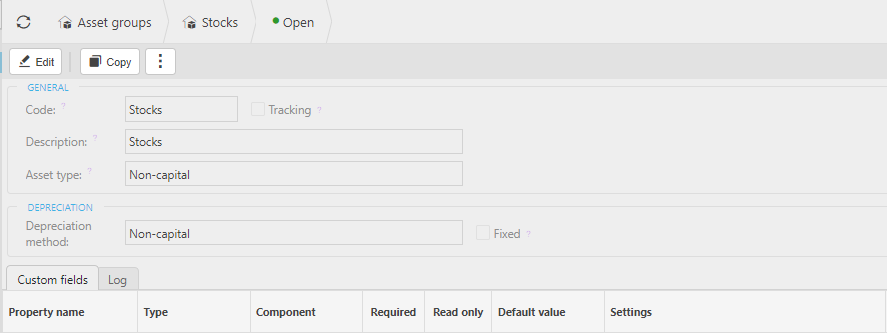

Non-capital example (allows an Asset to be created but doesn't create any depreciation) -

Tip

You probably want to have a different Asset Group for each combination of defaults. e.g.

Lock Depreciation methods which you don't think you will use. This will reduce the list available to you. You can also create your own.

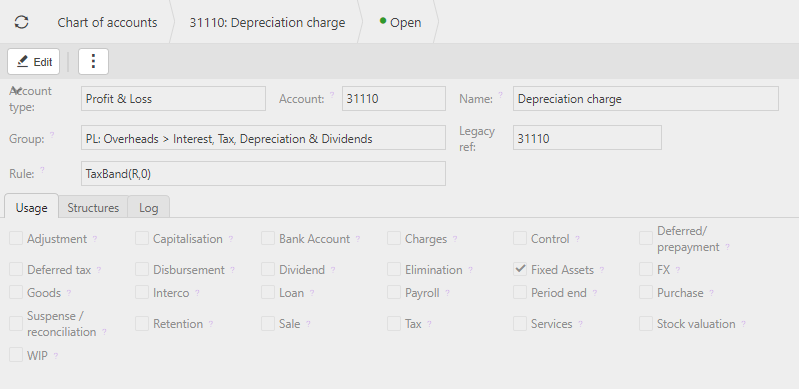

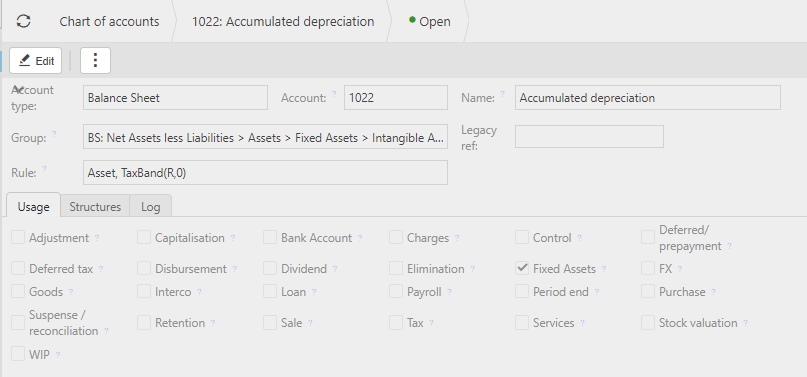

In the Chart of accounts menu, create accounts for Depreciation.

Tip

You might want to have different depreciation accounts for each asset type group.

Depreciation charge -

Accumulated Depreciation -

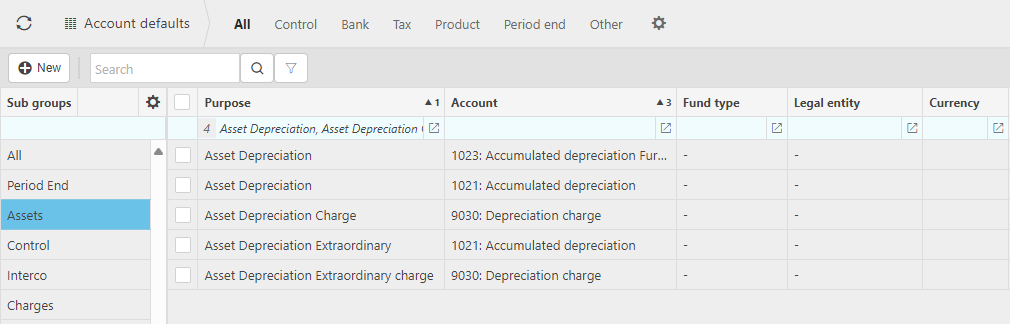

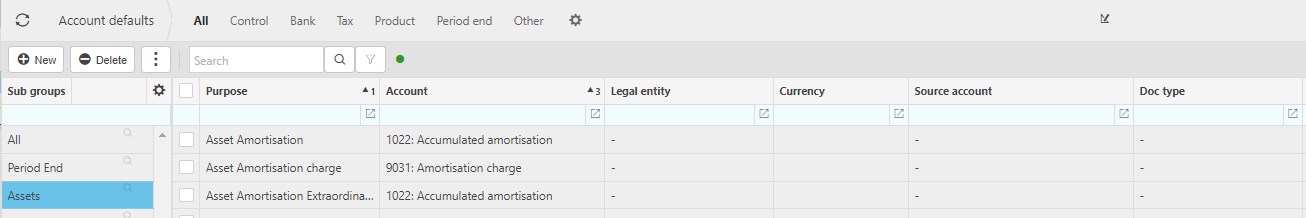

In the Account defaults menu, update the Account defaults for Asset Depreciations.

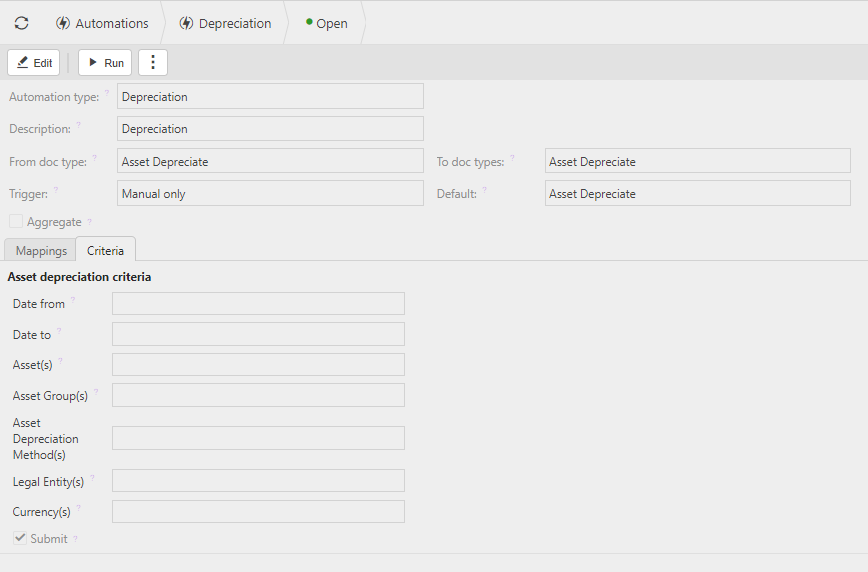

In the Automations menu, create Depreciation automation.

Setup an Extraordinary depreciation account and set the account defaults.

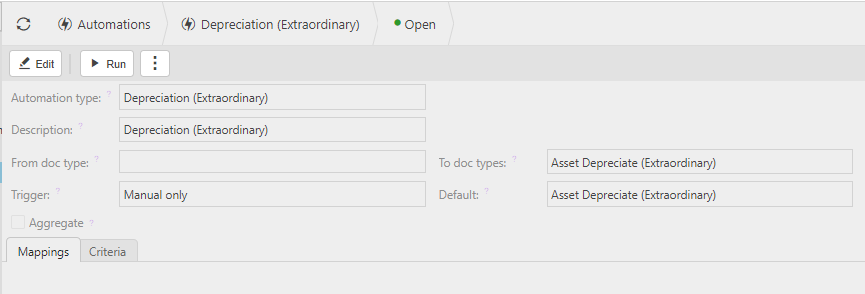

In the Automations menu, create Extraordinary depreciation.

In the Automations menu, create impairment automation.

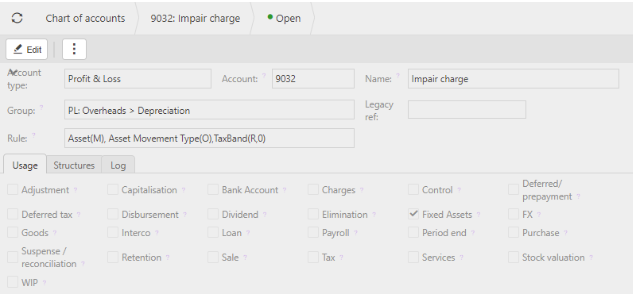

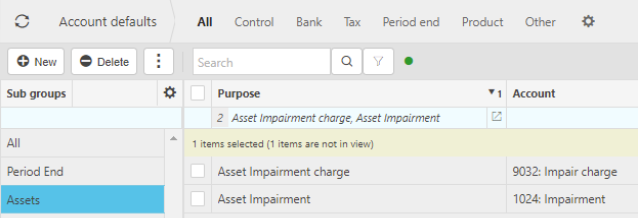

Create Impairment accounts and account defaults

Note

Depreciation is against Tangible Assets

Amortisation is against Intangible Assets

Impairment -

Impairment charge -

In the Account defaults menu, setup impairment account defaults in the Assets group.

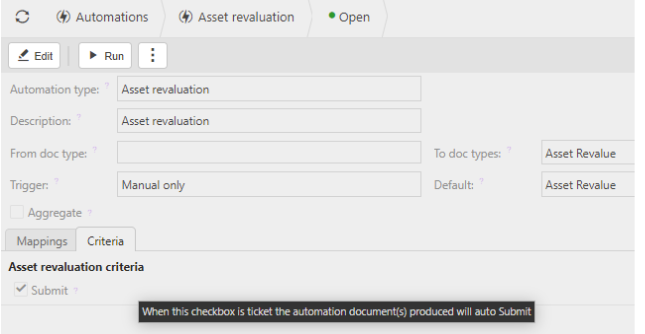

In the Automations menu, create Asset revaluation automation.

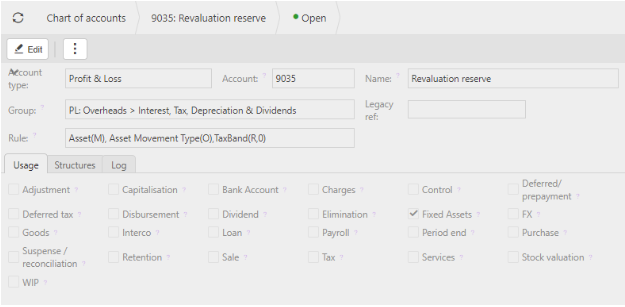

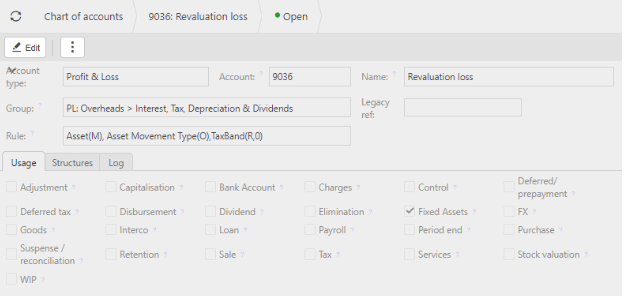

In the Chart of accounts menu, create accounts for revaluations.

Revaluation reserve -

Revaluation loss -

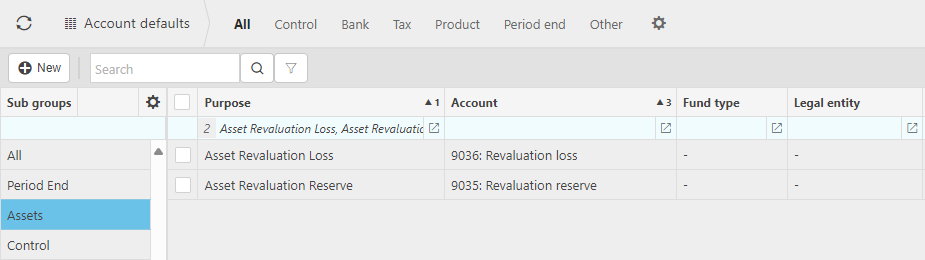

In the Account defaults menu, update revaluation account defaults in the Assets group.

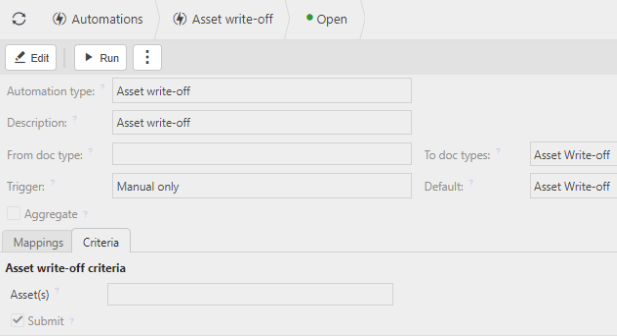

In the Automations menu, create Write-off automation.

In the Chart of accounts menu, create accounts for write-off.

Profit/Loss on disposal of assets -

Tangible/Intangible WO -

In the Account defaults menu, update Write-off account defaults in the Assets group.

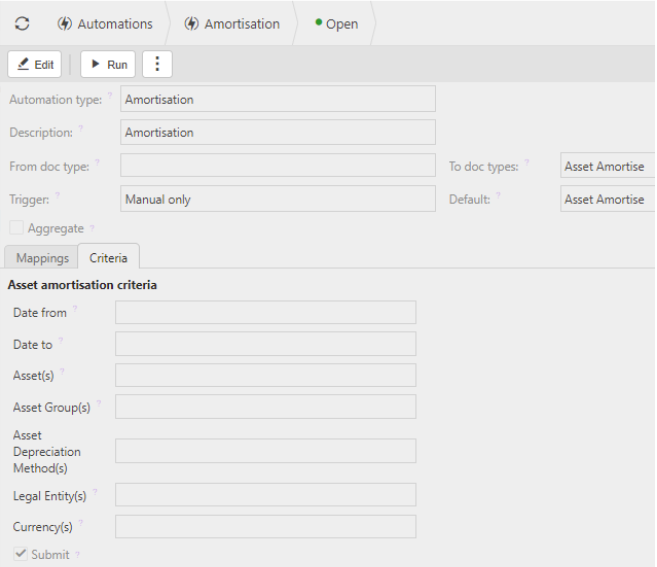

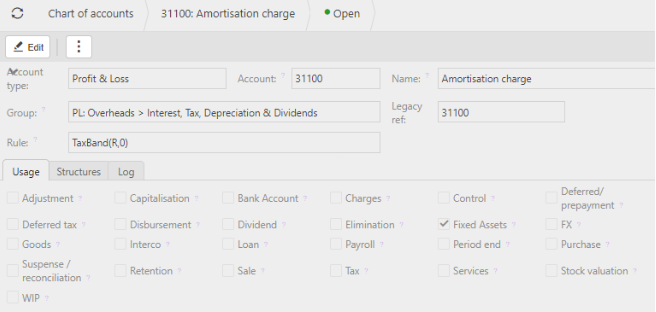

In the Automations menu, create amortisation automation.

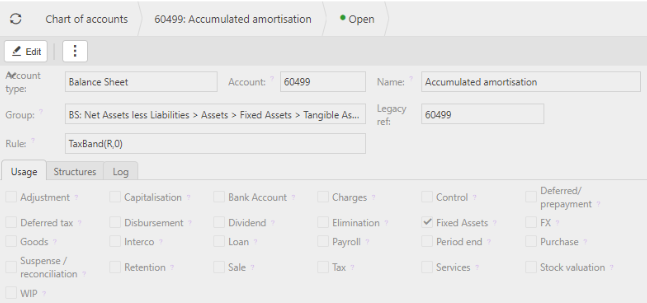

In the Chart of accounts menu, create accounts for Amortisation.

Amortisation charge -

Accumulated Amortisation -

In the Account defaults menu, update amortisation account defaults in the Assets group.

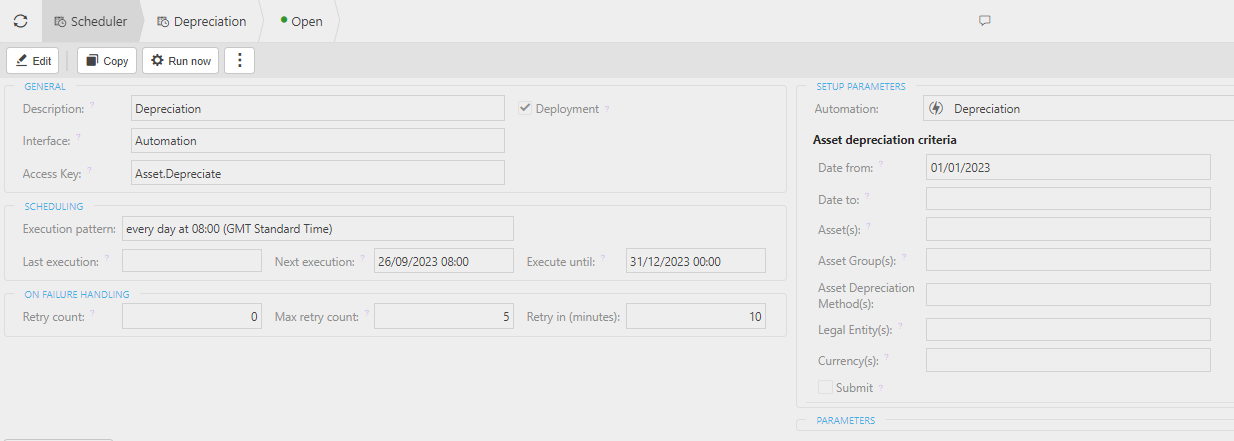

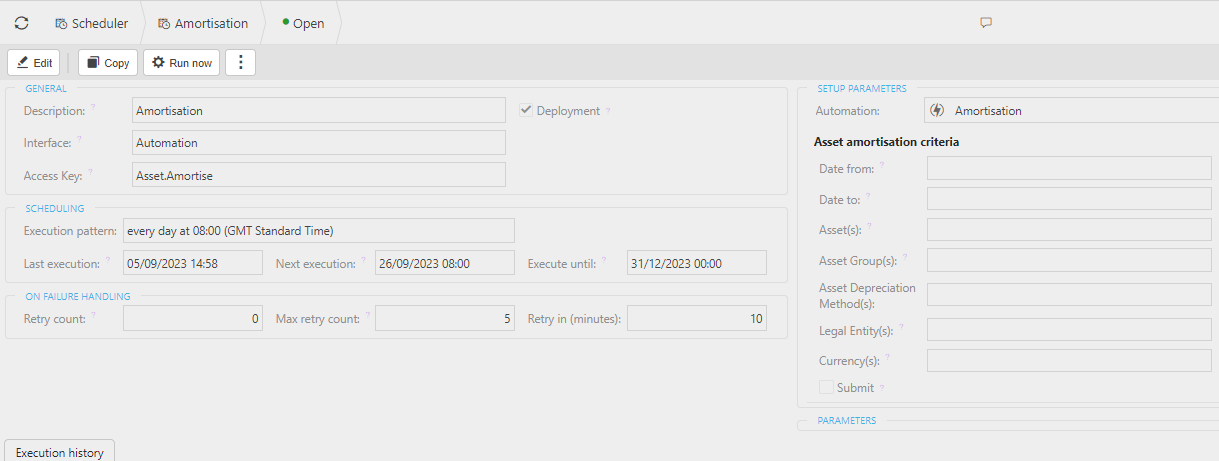

Scheduler setup.

Details for setting up Scheduled sessions for Depreciation and Amortisation can be found in the Scheduler User Guides.

Depreciation Scheduler

Amortisation Scheduler

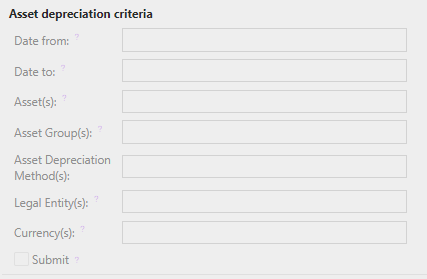

Asset depreciation criteria - extra fields for both depreciation and amortisation schedulers.

- Date from: This is the earliest depreciation date that you wish to include (leave blank for all).

- Date to: This is the latest depreciation date that you wish to include (leave blank for all).

- Asset(s): Select specific Asset(s), if required.

- Asset Group(s): Select specific Asset Group(s), if required.

- Asset Depreciation Method(s): Select specific Asset Depreciation Methods(s), if required.

- Legal Entity(s): Select specific Legal Entity(s), if required.

- Currency(s): Select specific Currency(s), if required.

Except for the date fields, all the other fields have the multi option icon

, meaning that you can add more than one option.

, meaning that you can add more than one option.

Updated March 2025