November, 2023

- Release: 786 Check my version

AP Automation

Introducing our new AP Automation solution, simplifying the accounts payable process by enabling the submission of invoices via email, where AI-driven data extraction ensures precision, minimises errors, and enhances efficiency in financial transaction management.

AP Automation - Adding Supplier and Editing Documents

Email Document Submission:

Users can conveniently submit invoices and related documents via email, eliminating the need for manual data entry.

AI Technology:

Artificial Intelligence (AI) algorithms automatically extract data from emailed documents, ensuring accuracy and efficiency.

Automatic Document Registration:

The software automatically creates registered documents from the extracted data, reducing the time and effort spent on data processing.

Intelligent Document Review:

Users have the option to review the generated documents, ensuring accuracy and compliance with company policies before further processing.

Conversion to Purchase Invoices:

Verified documents can be seamlessly converted into fully accurate purchase invoices with just a few clicks, expediting the accounts payable workflow.

Error Reduction and Compliance:

Automation significantly reduces the risk of manual errors, ensuring compliance with accounting standards and regulations.

Time and Cost Savings:

Dramatically reduces the time and resources required for manual invoice processing, leading to substantial cost savings for the organisation.

Vendor Relationship Improvement:

Enables prompt and accurate payments, enhancing vendor relationships by ensuring timely settlements and reducing payment-related disputes.

Scalability and Efficiency:

Scales effortlessly with the growing volume of invoices, ensuring consistent efficiency even as the business expands.

Multi-Co Sale Invoices and Cash Sales

For Companies with multiple Legal entities, it is now possible to make a sale from one Legal entity on behalf of other Legal entity(s). The Multi-Co Sales process will then create the appropriate Interco documents to reflect the Interco balances and income.

Custom Data Access Control (CDAC)

Custom Data Access Control (CDAC) empowers users to enforce document access restrictions based on specific criteria. By implementing CDAC, organisations can require users to enter a designated control field, ensuring secure access to relevant documents. For instance, businesses can categorise users into departments, and CDAC can be configured to limit document visibility to respective departmental groups. Common CDAC fields include Cost centre, Department, or other customisable attributes. This feature provides a tailored and robust access control solution, enhancing document security and confidentiality.

MY/ALL documents

Within the document finders, a MY/ALL option is available, enabling users to switch between viewing documents created exclusively by themselves or by all users. Customisable roles can be assigned to users, ensuring they only have visibility of documents they've authored. This feature can be employed independently or in tandem with CDAC, providing a versatile solution for tailoring document access to meet organisational needs.

Correction posting attribute

The Correction Posting Attributes feature allows audited corrections to Posting Attributes that have been posted to the General Ledger.

It also includes custom posting attributes - attributes that Customers have created themselves.

As appropriate, changes are made to the document, the document detail lines and the document payments as well as the GL.

Fixed Assets

This feature has been enhanced to include Asset Disposal to Debtor.

Additionally, for manually entered assets, upon capitalisation, if previous depreciation existed, this will be automatically reflected in the capitalisation journal.

New enquiries have been added for GL asset reconciliation, depreciation schedule and asset movements.

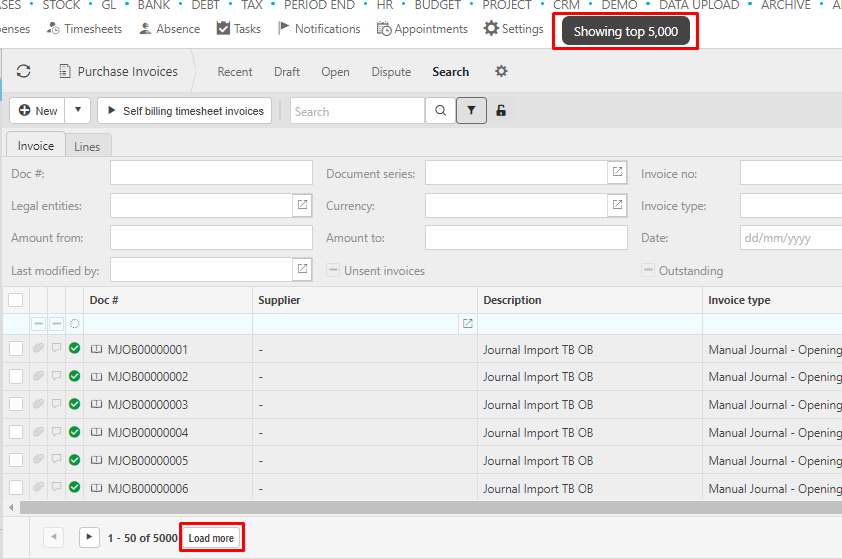

Working with large datasets

In this update, we have made changes to enhance the efficiency of our system. Loading large data sets will now display only the top 5,000 rows initially. Should you require the complete data set, you can easily load more rows as needed.

Additionally, to optimise system performance and avoid unnecessary load, the refresh button on finders will be disabled until the current request is fully processed.

These improvements aim to streamline your experience and ensure smoother operations while using our platform.

Data Import enhancements

- Support has been added for import of documents requiring Deferred Income, Prepayments, Reversing journals and Multi-tax authority.

Other changes

Properties

- Now have the ability to define Property Units.

Documents API endpoints

- Now introduce support for explicitly specified net/tax/gross amounts. Such documents cannot be edited in iplicit without recalculating in iplicit. Click here to read more.

Single Sign On (SSO)

- Setup has been simplified to only present the relevant configuration fields.

Reverse sign tool

- Added to expense detail mobile layout / Negative sign toggle in mobile apps.

Manual journal

- Import changes: Auto-reversing support.

Automation types:

- New: Multi-Co Sale

- New: Asset Disposal Cash

- New: Asset Disposal Debtor

Other form layout changes:

- Document Type Setup: Purchase tab: New field: Pay Term

- AP Automation Inbox: Added field: Subject

- AP Automation Mailbox: Added field: Legal entity fixed

- Project - Field added: WIP

- Project group - Field added: WIP

- Sale Orders: Defaults tab: Added fields Payment method, Payment terms

Dashboards:

- Removed: Aged Creditors, CRM Log, CRM Pipeline

Document types:

- New: Interco journal (eliminates)

- New: Multi-Co Sale

Enquiries:

- Trial Balance (Audit): new filter: Fund

- P/L: new filter: Fund

- P/L by department: new filter: Fund

- TB by department: new filter: Fund

- Expense claims: new filter: Product(s)

- Purchase invoice payments: new filters: Bank Account(s), Invoice date from, Invoice date to, Payment date from, Payment date to, Payment Period(s), Payment Method(s), Paid only

- Trial balance (Local & consolidation): new column: Asset

- Trial balance: new column: Asset

- Balance Sheet (Local & consolidation): new column: Asset

- Balance Sheet: new column: Asset

- Document approvals: new columns: Invoice no, Cost Centre, Department, Fund

New enquiries:

- Depreciation schedule

- Prepayments

- Contact addresses

- Asset GL reconciliation

Environment settings:

- User email type: User accounts will use this email type as a reference on the contact record.

- AP Automation Due Date override: Tick if you want due dates to be calculated from the Supplier payment terms. When this is the case, the due date on the Supplier invoice will be ignored.

Tax authority band code:

- Denmark:

- Standard - Standard Sales ROW

- Ireland:

- Standard - Standard Purchases ROW

- Standard - Standard Sales ROW

- Zero rated - Zero rated purchases ROW

- Malaysia:

- Exempt - Exempt purchases

- Exempt - Exempt sales

- Not applicable - Not Applicable

- Outside scope - Outside scope purchases

- Outside scope - Outside scope purchases - ROW

- Outside scope - Outside scope sales

- Outside scope - Outside scope sales - ROW

- Reduced rate - Reduced rate purchases

- Reduced rate - Reduced rate purchases ROW

- Reduced rate - Reduced rate sales

- Reduced rate - Reduced rate sales ROW

- Second reduced rate - Reduced rate 2 purchases

- Second reduced rate - Reduced rate 2 sales

- Standard - Standard purchases

- Standard - Standard Purchases ROW

- Standard - Standard sales

- Standard - Standard Sales ROW

- Zero rated - Zero rated purchases

- Zero rated - Zero rated purchases ROW

- Zero rated - Zero rated sales

- Zero rated - Zero rated sales ROW

- United Kingdom:

- Exempt - Exempt purchases ROW

- Exempt - Exempt sales ROW

- Second reduced rate - Reduced rate 2 purchases

- Second reduced rate - Reduced rate 2 sales

- Zero rated - Zero rated purchases ROW

- Zero rated - Zero rated sales ROW

- Vietnam:

- Exempt - Exempt purchases ROW

- Exempt - Exempt sales ROW

- Reduced rate - Reduced rate purchases ROW

- Reduced rate - Reduced rate sales ROW

- Standard - Standard Purchases ROW

- Standard - Standard Sales ROW

Tax code return treatments:

- United Kingdom:

- Zero rated purchase goods ROW - 7, 9

- Zero rated purchase services ROW - 7, 9

- Zero rated purchases ROW - 7, 9

- Zero rated sales ROW - 7, 9

- Exempt purchases ROW - 7

- Exempt sales ROW - 6

- Reduced rate 2 purchases - 4, 5, 7

- Reduced rate 2 sales - 1, 3, 5, 6

- Zero rated purchases ROW - 7

- Zero rated sales ROW - 6

- Output reversal domestic reverse charge - 1, 3, 5

User roles:

Removed: Analytics: OLD

Updated:

- Asset: Advanced Entry

- GL reconciliation: Draft Entry

- Bank Transaction: Cash Journal

- Cash Journal: Correction (date & period)

- GL reconciliation: Read Only

- GL reconciliation: Admin

- Cash Journal: Correction Unpost

- Bank Transaction: Cash Journal

- Cash Journal: Submit

- Cash Journal: Entry

- GL reconciliation: Core

- GL reconciliation: Entry

- Cash Journal: template

- Cash Journal template: View

- Cash Journal: Draft Entry

- Cash Journal: reversal

- Cash Journal: View

- Cash Journal: Partial Tax Ignore

- Cash Journal: Read Only

- Cash Journal: Delete

- GL reconciliation: Delete

- Cash Journal: Core

New:

- All: Manager

- Receipt: My ONLY

- Sale Invoice: My ONLY

- Cash Sale: My ONLY

- Sale Dispatch: My ONLY

- Sale Quote: My ONLY

- Purchase Invoice: My ONLY

- Sale Order: My ONLY

- All: My ONLY

- Requisition: My ONLY

- Manual Journal: My ONLY

- Purchase Order: My ONLY

- Cash journal: My ONLY

- Cash Purchase: My ONLY

- GRN: My ONLY

- Payment: My ONLY

- Accrual: Correction posting attribute

- Sale Invoice: Correction Posting Attribute

- Cash Purchase: Correction Posting Attribute

- Receipt: Correction Posting Attribute

- Revaluation: Correction Posting Attribute

- Manual Journal: Correction Posting Attribute

- Purchase Invoice: Correction Posting Attribute

- Expense: Correction Posting Attribute

- Cash Journal: Correction posting attribute

- Penny difference: Correction Posting Attribute

- Cash Sale: Correction Posting Attribute

- FX Realised: Correction Posting Attribute

- Payment: Correction Posting Attribute

- Asset: Correction Posting Attribute

- Data Access Control: View

- Correction: Posting Attribute (All)

- Manual Journal: Multi-Co Sale

Interfaces:

- New:

- HSBC CSV (Multi account)

- NatWest Bankline XML import (SEPA - standard pain.001.001.03 credit transfer)

Other fixes

- Timesheet customer recording as non-chargeable in error.

- Grid Excel export.

- Project allowed resources not applied when user does not have resource.

- Bank feeds: bank transaction timezone handling.

- Communication email preview sometimes does not save changes on save.

API:

See API changelog for an update on what's new.

Note

Get in touch to find out more about the features in this release or how to get even more out of the system.