July, 2024

- Release: 789 Check my version

Authorisation Workflow Substitutions

An "Out of Office" style feature where users can delegate authorisation workflow tasks to defined Substitute users. Administrators manage the allowed substitute(s) centrally, specifying substitutes for individual users and workflows, or set a general substitute applicable across all workflows for a user. Users can then activate their allowed substitutes within specified date ranges, such as during annual leave.

Additionally, the administrators can centrally enable/disable substitution for users, to deal with unplanned absences or instances where users neglect to enable or disable substitutes themselves.

In-app status notification

Users will now receive a notification within iplicit to advise of any changes to the platform’s status. These notifications will directly inform users about scheduled maintenance, reported incidents, and resolved platform issues.

Irish Professional Services Withholding Tax (PSWT)

Our new withholding tax feature supports Irish Professional Service Withholding Tax. This functionality automatically calculates and deducts the required amount from Purchase invoices issued by designated suppliers before payment is processed to them. The amounts withheld can be paid over and submitted directly to Revenue Ireland via the built-in ePSWT CSV interface.

Fixed Asset Enhancements

Resolution of issues with the calculation of depreciation book for specific combination of depreciation methods and configurations.

3 new environment default settings that can be used to adjust how the depreciation book is calculated; the default behaviour remains as prior releases.

Stop full depreciation within useful life.

NBV deduct residual.

NBV deduct residual annually.

Tracking tick box available on Asset Import/Export

Prevention of the Submit button remaining on screen for asset movements when not appropriate state.

Financial Year Set Up

Enhanced protection measures have been added to identify and prevent the creation of overlapping financial periods within a financial year group, ensuring accurate data setup.

Multi-Company Sale & Deferred Income

The Multi-Co Sales process now includes support for deferred income. Automated deferred income journals are generated in the appropriate Legal Entities according to the details of the Multi-Company sale document that has been entered.

Multi-Co Purchase & Prepayments

The Multi-Co Purchase process now includes support for prepayments. Automated prepayment journals are generated in the appropriate Legal Entities according to the details of the Multi-Company purchase document that has been entered.

Other Enhancements

Data Access Control has been enhanced to cover attachments links where the user does not have access to the source Legal Entity.

Improved logging of actions on AP Automation registered documents.

Customer Statement enhancement to enable the inclusion/exclusion of documents related to subsidiary (child) customers.

Data Entry Control is now available for the Team posting attribute.

Enhancement to Bank Feeds, the Statement Balance check is now calculated when bank statements are generated automatically.

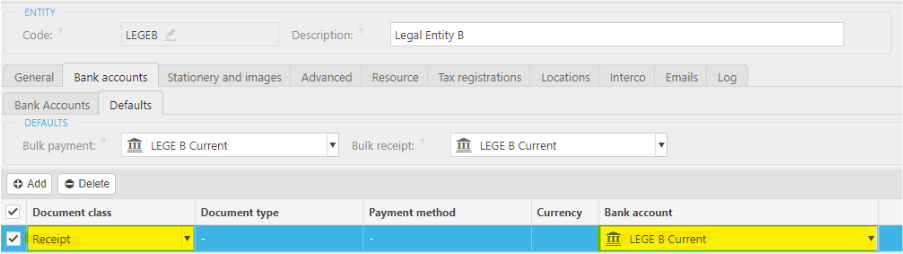

The Legal Entity Bank Account Defaults screen has been updated to support a new feature in a forthcoming release. This new feature will allow you to define the bank details used on report outputs, such as Sales Invoices, based on a combination of Document Type, Currency and Payment Method.

Until this feature has been released, the previous behaviour will be retained, and the new fields will be read-only.

When configuring new Legal Entity and Bank Account defaults, the updated screen must be populated – see below (existing data prior to this release will be automatically migrated).

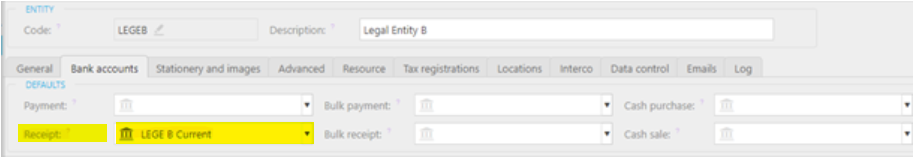

Old screen

New screen

Support

Improvements and resolution of minor issues for Bank Feeds when granting and revoking consent for multiple bank accounts.

Expense authorisation communications now send to the original submitter when restarting an item in the Pending Authorisation screen.

Improvements to the Pending Authorisation screen to allow filtering when an item is assigned to multiple people.

Credit Control now included improved support for selection of multiple customers for production of statements.

The Year End Rollover process has been enhanced to identify the Fund Type based on the posting value, rather than solely from its relationship to the Fund.

When using the Correction Posting Attribute feature, updating project values will also update the related pending Disbursement items.

When configuring processes to run automatically via the Scheduler, the Time Zone is displayed and can be set when defining the Recurrence.

Contact Import now supports importing values for Tax Band, Country and Currency values.

iplicit Excel add-in has been enhanced to ensure the format in the worksheet is retained when no data is returned from a linked enquiry.

Enquiries

New

- Debt collection performance enquiry

Updated

Purchase Order (quantity) - enquiry updated to take GRN into account for outstanding/matched remaining on the Purchase Order.

Stock cost of sales analysis - new filter option to allow inclusion/exclusion of stock adjustments.

Tax

Ireland

New tax band Fourth reduced rate to support Livestock Rate (4.8%)

New Tax Third reduced rate to support the Flat rate compensation percentage for Farmers (4.8%)

Irish Second Reduced Tax Rate, updated to use correct tax rate code

Germany

- Custom tax band available when using a German (GB) legal entity for suppliers on purchases/EU customers on sales.

Switzerland

- New tax authority: Switzerland (GB)

USA

- New tax authority: Florida USA

Qatar

- New tax band: Not applicable

Vietnam

Custom tax rate

Custom tax band for local sales and purchases

Interfaces

Paypal Activity Statement

Lloyds SEPA CSV Bulk Payment

Lloyds International CSV Bulk Payment

CashBacs Direct Debit Processing File

CashBacs Direct Debit Receipt File

ePSWT CSV Export

API

See API changelog for an update on what's new.