Credit Control

Credit controls are strategies used by businesses to manage the credit they extend to Customers.

Only Users with access to the Credit control entry or read only role will be able to view the Credit Control section.

The Credit Control screen is the central point for debt chasing as this displays the current situation of each account, the history of previous debt control actions & where current updates are recorded which can also be marked to act as reminders.

How to view Credit Controls

Viewing Credit Controls

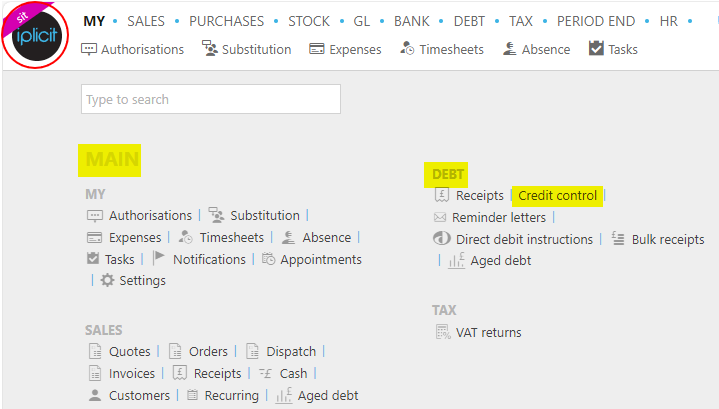

Select Debt / Credit control from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

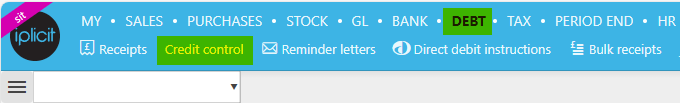

or from the Main Menu select Debt then Credit control -

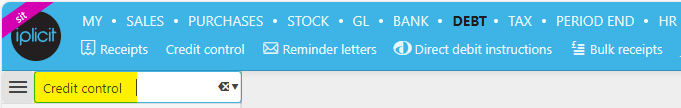

or enter Credit control in the Quick Launch Side Menu.

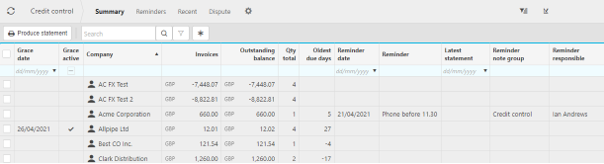

This will then show the Credit controls on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

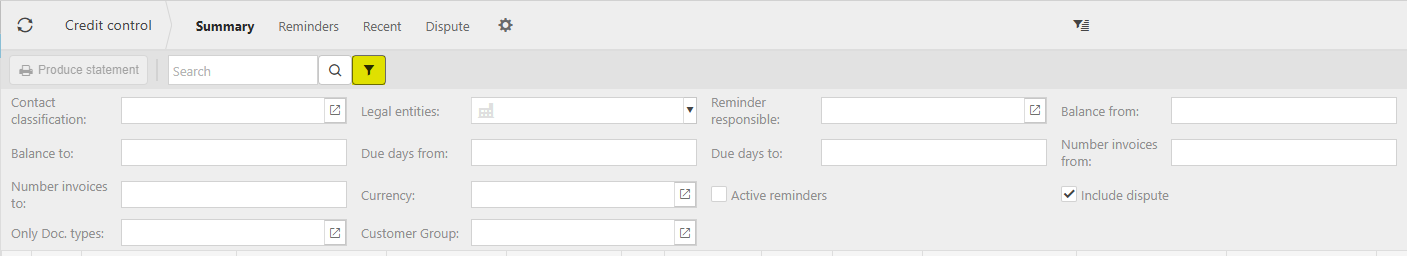

The Credit Control screen offers a range of filters to refine the display.

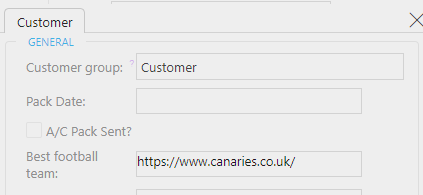

- Customer group: Enables filtering the credit control screen by customer group to perform credit control activities more effectively.

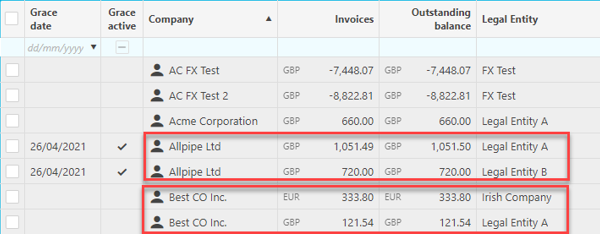

Automatically any Customer who trades with more than one Legal entity will list on a per Legal entity basis displaying the values in the base currency of the Legal entity.

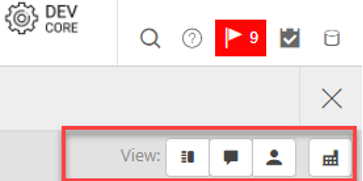

View Icons

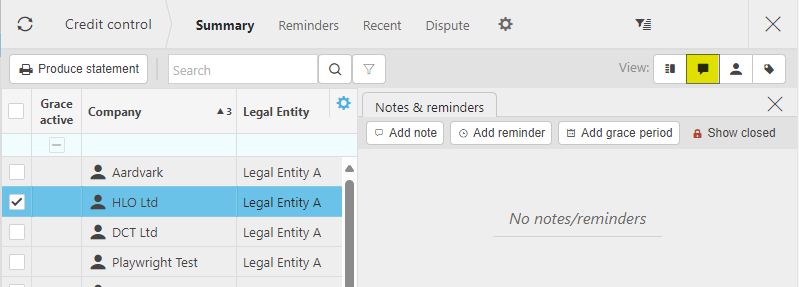

The Credit Control screen can be displayed in several ways depending on the settings applied using the View icons at the top right-hand section of the screen.

- Displays a panel below the list of Customers which lists the individual transactions related to the currently highlighted account.

- Displays a panel below the list of Customers which lists the individual transactions related to the currently highlighted account. - Displays any notes related to the currently highlighted account. Also allows adding notes, reminders and grace period.

- Displays any notes related to the currently highlighted account. Also allows adding notes, reminders and grace period.

- Displays any Contacts related to the currently highlighted account.

- Displays any Contacts related to the currently highlighted account.

- Displays any Customers related to the currently highlighted account.

- Displays any Customers related to the currently highlighted account.

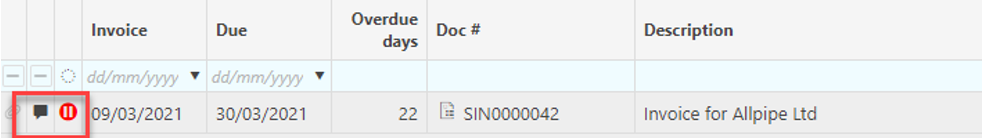

Any transaction in Dispute will list with an indicator & a note icon which can be clicked to display the details of the dispute.

Note

Only Submitted invoices are displayed.

The second icon displays a panel adjacent to the list of Customers which lists the historic notes from previous debt chasing, this is also where additional notes can be added.

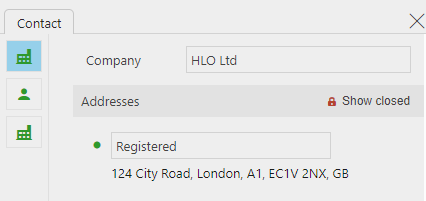

The third icon displays the details from the Contact account. With VOIP software available calls can be dialled out directly by clicking on the telephone number.

The fourth icon is a filter related to Currency display. When initially populated the screen lists & displays all transactions based on the default Base currency per Legal entity.

Display Currency

With the Transaction currency option ticked if a single currency is selected from the available list this will display all transactions based as a Translated value using the current Exchange Rate for the Exchange Pairs.

Tip

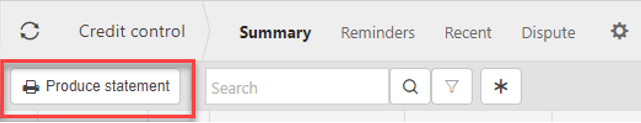

You can see the transaction outstanding values in both Base & Original Currencies by selecting the relevant columns to display. As part of the Credit Control operation it is possible to Produce & Send a statement to a Customer directly from the screen.

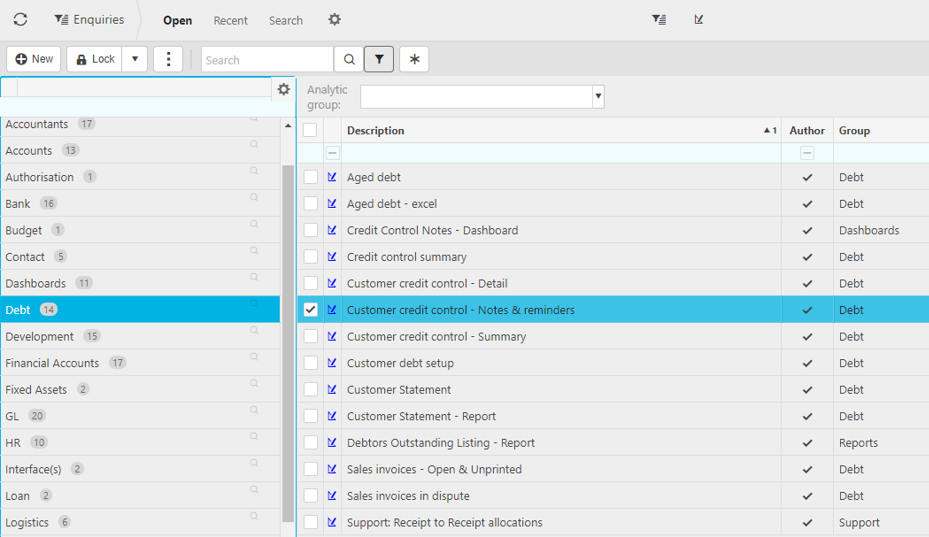

Enquiries

There are a number of Enquiries relating to Debts & Credit Control available, the following image shows a subset of these.

Using Credit Control

Select the View as preferred, in this example all Views will be displayed.

The main panel lists all Customers who currently have an outstanding balance.

Note

A separate row will display for the same Customer per Legal entity which will use the base currency of the Legal entity.

This screen displays all the relevant columns providing the information at a glance of the current position. As with all displays, the preference for the columns can be amended using the

icon column selection.

icon column selection.Highlight a Customer, the panels will display the following:

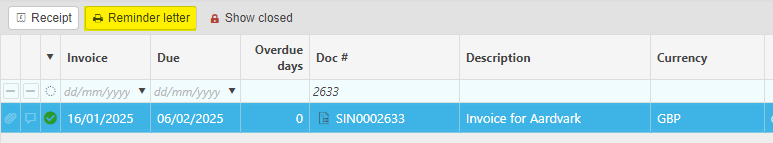

- A list of the transactions that make up the outstanding Balance

- The Notes & Reminders from previous Credit Control sessions

- The Contact account details.

If VOIP software is available calls can be made directly from the Contact panel by clicking on the telephone number, alternatively emails can be sent from the email address.

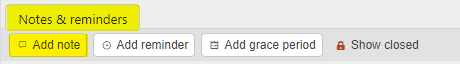

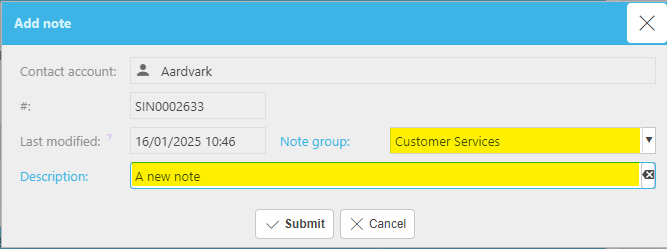

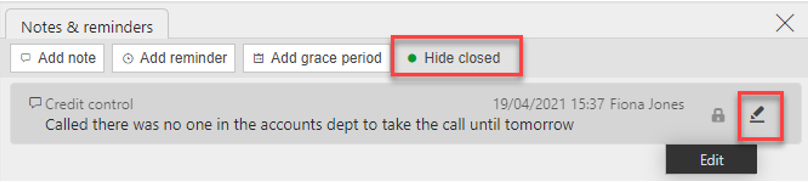

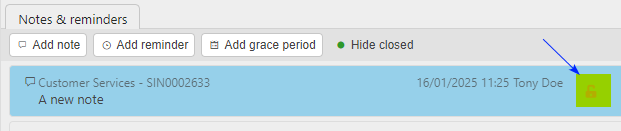

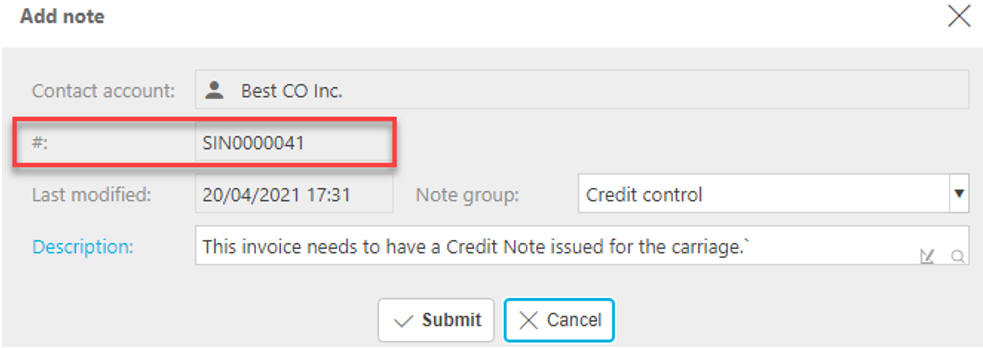

With a Customer highlighted, on the Notes & reminders panel click Add note, this will default to today's date, as a default there is a separate Credit Control note group. Once completed, select Submit this will display the note on the panel.

Credit Control Notes

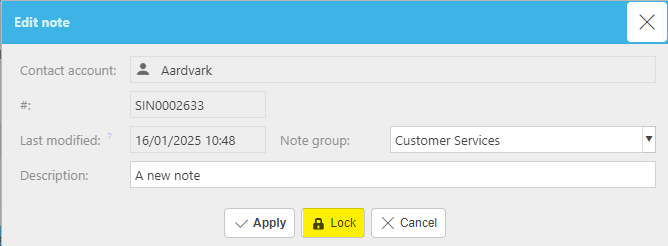

Each note is assigned to a note group, the main panel can be filtered to display note groups.

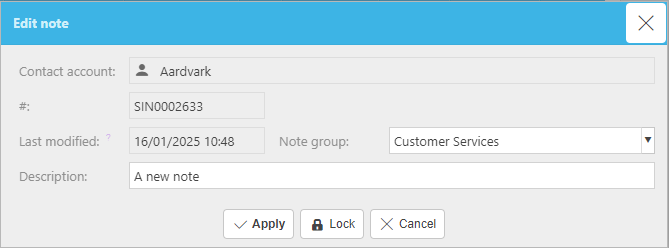

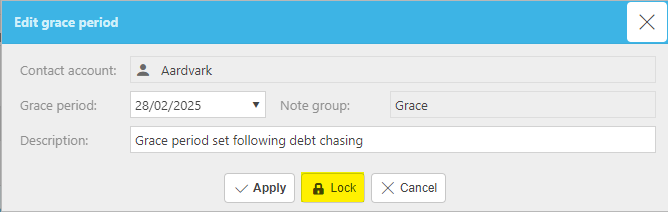

If necessary, the note can be edited by clicking on it to open, once completed selecting Apply will update the note.

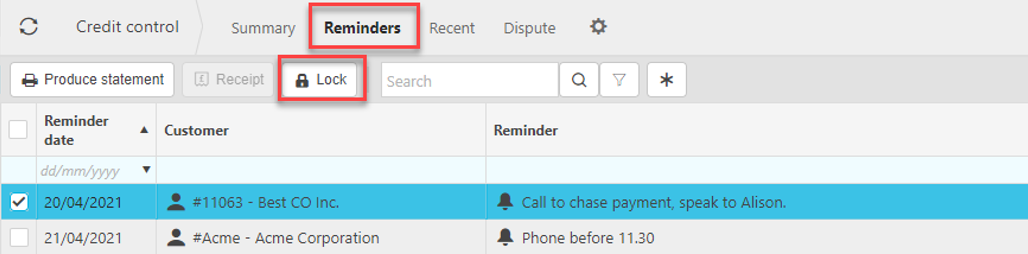

Selecting Lock will take the note off display.

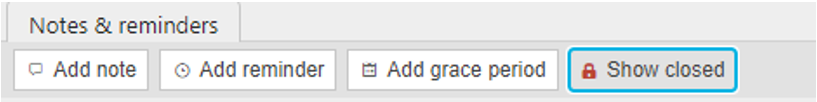

If Locked in error the Hide closed/Show closed toggle button can be used to display the note.

Select the padlock icon to re-instate the note.

With an individual transaction highlighted, on the Notes & reminders panel click Add note this will display the same window, but the transaction number will be pre-populated as part of the note.

Credit Control Reminders

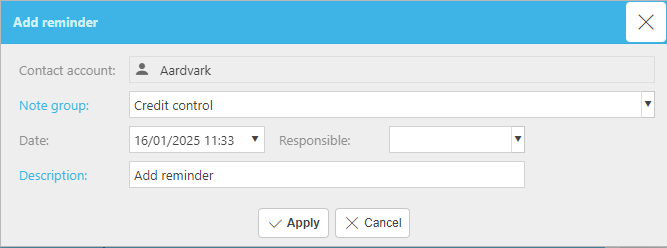

Add a Reminder, this will default to today's date but should be changed to the date the reminder is required.

The reminders display in the main Credit Control panel (if the column is on display). There is also a separate set on the Credit Control header section.

When no longer required the reminder line can be selected & Locked.

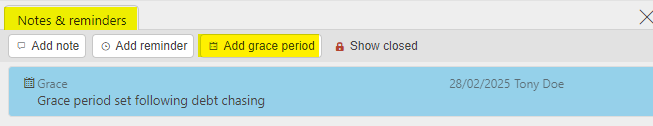

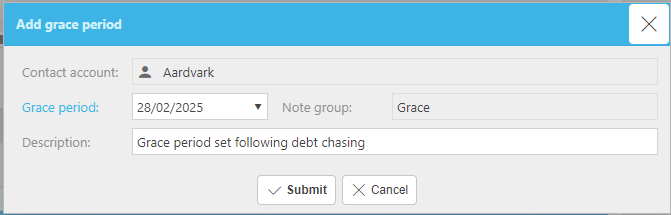

Credit Control Grace Period

As part of the Credit control operations, if it has been agreed to allow additional time then a Grace period can be applied to avoid unnecessary debt chasing.

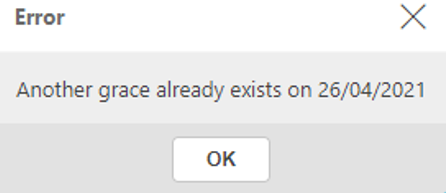

An error will display if there is any attempt to apply an update to an account with a Grace period.

Grace periods can be Edited or removed using the Lock option in the Notes & reminders section.

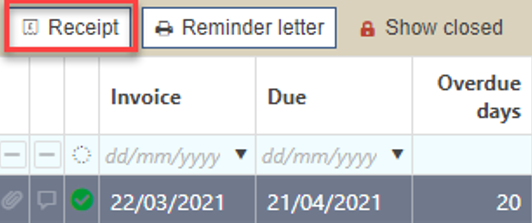

Credit Control Receipt

With a transaction highlighted, clicking on the Receipt button displays the Receipt document type for the transaction to be created directly from this screen.

At the time of creating the receipt the allocations tab will be available to clear additional outstanding invoices for the Customer.

Tip

If there is any confusion relating to previous receipt allocations by clicking on the Show Closed icon previously paid invoices will display.

If necessary, transactions can be un-allocated & re-allocated directly from this screen.

Credit Control Reminder letter

With a transaction highlighted clicking on the Reminder letter button displays the window for the appropriate Reminder Letter in accordance with the customer reminder group & history of previous reminder letters relating to the transaction.

Updated April 2025