Bank statements

- Bank statements can be created using several methods, regardless of the chosen method the resulting statement layout screen will remain the same. Each individual statement is used in conjunction with the Bank reconciliation screen.

Manual creation

- Statements can be created using a simple manual input, however it is not advised to do so. The manual edit screen is useful when making amendments if perhaps incorrect data has been entered when importing statements (covered in more detail later).

Creating a statement from an import

Statements can be created using a simple bank export file which is imported onto the bank statement screen. Once downloaded, if any amendments are needed e.g. incorrect dates, then rows can be manually added, changed or removed.

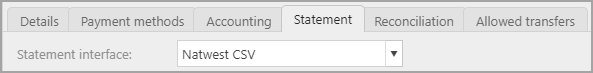

The relevant Statement interface must be assigned to the bank account in the settings.

How to view Bank Statements

Viewing Bank Statements

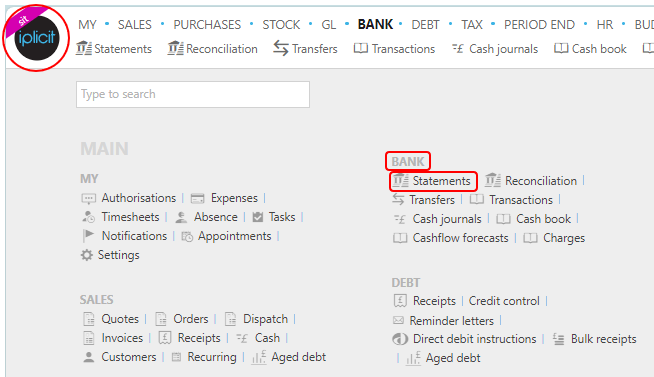

Select Bank / Statements from the Main section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

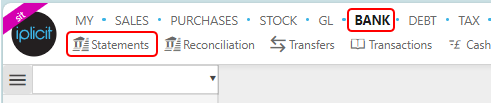

or from the Main Menu select Bank then Statements -

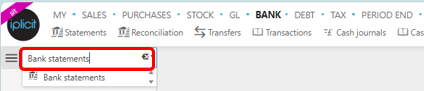

or enter Bank statements in the Quick Launch Side Menu.

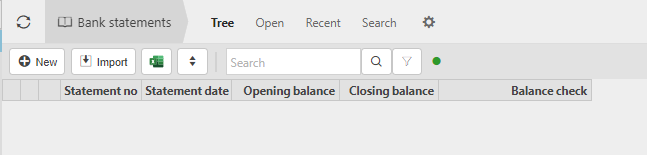

This will then show the Bank statements on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

How to import Bank Statements

Importing a Bank Statement

Select the Import button from the Bank Statement screen.

Browse to, and select the Bank Statement file.

Statement no - Automatically populated displaying the next 'Statement number', which can be amended.

Note: This is a system identifier, it does not have to be the statement number from the bank.Statement date - The statement 'Closing date'.

Opening balance - Automatically populated displaying the 'Opening balance' from the previous statement.

Closing balance - Manual entry of the 'Closing balance' from the bank.

Select the Submit button

How to create manual Bank Statements

Creating a manual bank statement

Open the Bank > Bank statements menu.

This screen will list existing bank statements.Selecting the New icon displays the list of available bank accounts for selection.

All information on the bank statement screen will be manually entered except for the opening balance which will automatically be populated by the current system's reconciled bank balance & the closing check figure which is a rolling balance as per the entry lines.

Statement no - Mandatory field for displaying the statement number. If left blank the system will populate the field with the next number when created.

Note

This is a system identifier, it does not have to be the statement number from the bank

Bank account - This field will be pre-populated from the previous bank account selection.

Statement date - The statement closing date. Only transactions dated on or before this date can be entered.

Their ref - Optional field, for additional identification.

Rows can be added by using the Add button to add an individual blank row or a batch of individual rows with each row created having numerous fields.

Opening Balance - Mandatory pre-populated field displaying the Current reconciled' balance.

Closing Balance - Mandatory field, this should be manually entered with a positive or negative value for the closing balance from the bank statement which should agree to the closing check value to ensure no input errors.

Closing Check - Mandatory pre-populated field displaying the final balance.

Each row allows for the relevant information to be entered, the Date, Description, Withdrawal or Deposit fields are mandatory.

Lines can be deleted if row contains incorrect information, rows can also be edited.

Lines can be unassigned from a statement if they should actually belong on an alternative statement.

Once unassigned, they then become available to be used on an alternative

statement (or can be reassigned to the current one if unassigned in error) by selecting the Assign button.

Once completed, save the bank statement by selecting Save, which will then create the bank statement ready for use with the bank reconciliations.

- Open bank statements can be edited if required even when in use on a bank reconciliation. Any lines that have been reconciled will have the Locked Padlock icon to protect the integrity of the bank reconciliation, should these need to be amended the line will need to be Unmatched on the bank reconciliation.

Updated October 2025