February 2020

- Release: 570 Check my version

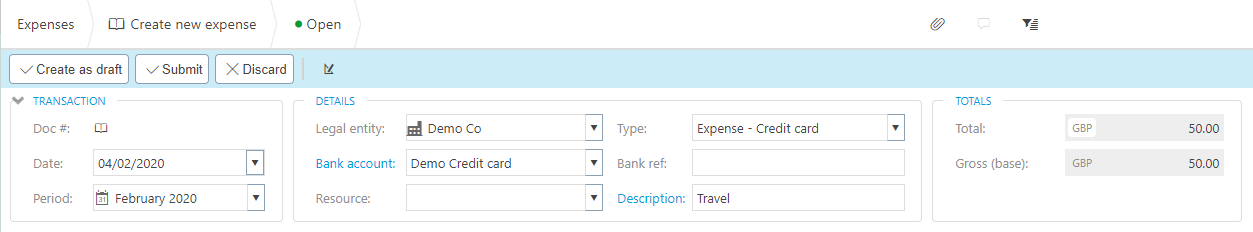

Credit card expenses

Expenses can now also be made to company credit cards as well as personal expenses. For this type of claim, the cashbook is auto populated upon authorisation and no expense is available for payment.

These cashbook entries are available for reconciliation providing the credit card bank account is available for reconciliation.

- Make sure to unlock the document type if it's not available already.

- To make a bank account eligible for credit card expenses, click into the bank account and tick the "Credit card" tick-box.

Staff Expenses

You can now make payments on Staff Expenses with different control accounts. Additionally, for staff expenses to be paid, the associated staff resource record no longer needs to be set to also be a Supplier.

- An optional total check is now available for expenses. When used, this acts as a double-check that the expense total matches a previously identified total. Submission for authorisation will not be possible where the totals do not match.

- A specific Document Type can be used which is reserved for the "Quick payments" of staff expenses.

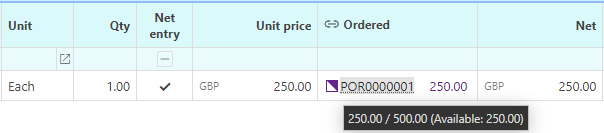

Amount matching

The matching of documents can be based upon quantity OR amount.

- An example of a quantity based matching would be 5 widgets on the Purchase order to 5 widgets on associated Purchase Invoice(s).

- An example of amount based matching would be £500 of consultancy services which would be treated as a call-off amount matching during the course of the year.

Identification of amount or quantity based matching is set on the document type.

Authorisations

Document header and detail details can be in conjunction as the basis of distribution.

- Example: Header Supplier = Water company and detail product = Water then go to John Doe Custom fields can now be used as the basis of distribution

- Example: project.custom field (e.g. Program) = X then go to Jane Doe

- Custom fields can now be created via catalogs. Create a new catalog and then open the contact group you'd like to add the custom field to. Within the final tab "Custom fields", you can add the relevant field where you can also set defaults and ensure that certain fields are required upon creation. The ability to have custom fields on groups of suppliers and projects allows for more in-depth authorisation workflows.

- The aforementioned custom fields are now easier to find within both contact account and project editors allowing for easier entry of these fields.

Cancellation of document authorisation request

- If you have submitted a document for a workflow, you now have the option to cancel the document you have submitted.

- You cannot cancel submissions on behalf of other users except in "Pending authorisations" Rejected authorisation task handling

- If an authorisation request is rejected. The user who had submitted the document will now receive a notification informing them that the request has been rejected.

Desktop app automatic updates (windows / mac)

- Desktop apps with the version 1.0.16 or later will now receive automatic updates.

- See https://apps.iplicit.com/ to make sure you have the latest version of the desktop app.

- Find out what version of the desktop app you're on by clicking here.

Recurring payments and receipts

Recurring purchase transactions now supports recurring payments whilst recurring sales transactions now supports recurring receipts.

- You can find these features within their respective menu links, or simply head to document templates.

Multi tax authority simplification

Legal Entities with tax registrations in multiple tax authorities can auto allocation the tax liability to the prevailing tax registration.

- Example: If southern Irish company X has both UK and Irish tax registrations, the vat return responsible will be determined by the tax authority of the supplier the goods / services are being delivered to.

- When multiple registrations are applicable, tax authority will become visible and available for selection.

Customers & Suppliers

It is now possible to update the tax authority for multiple contact accounts at a time.

Excel add-in new functions

New functions available:

- IP.GLPROJBASEAMOUNT(legalEntity, period, account, project)

- IP.ATTRIBUTEGETPROPERTY(attribute, property, code)

Click here to learn more about custom functions.

Project codes

Support for auto generated codes

- This is achieved via a number series for project group.

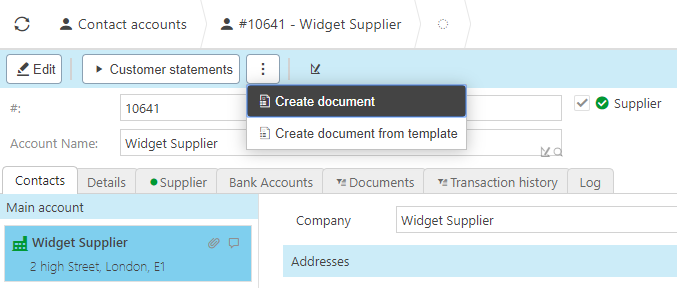

Document creation from contact accounts

Documents can now be created directly from the contact account. Example: Purchase invoice, Purchase Order, payment.

Other Enhancements

FX corrections

FX corrections now supports posting fields.

- You can now post FX realised documents with multiple required posting fields setup within the chart of account rules.

Improvements in multi currency

- More amendable currency rates

- Bank reconciliations to payments now supports 2/3 currency variations.

Budgets

- Consolidation: editor to select forecasts to consolidate

Custom fields improvements.

Project / customer / supplier custom field now apply the default values and validate missing mandatory fields.

Tax account settings now has a criteria for tax group

Allows setting up different vat input/output accounts on a per vat group basis.

Their ref:

- Available on more document types.

- Defaulted from contact account on docs

- Multi-amendable

Apps download page

Additional items are now available on the downloads page.

- Drag and drop tool from outlook and browsers.

- The apps downloads page has been updated

Desktop App fixes

- Downloading and printing of reports in the Iplicit for desktop apps has been fixed.

New bank payment interfaces

New bank payment interfaces available including:

- RBS Bankline payment file

- NatWest AutoPay