August, 2022

- Release: 753 Check my version

- Get in touch to find out more about the features in this release or how to get even more out of the system.

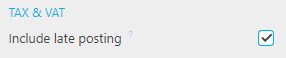

Tax (VAT) Return: Include late postings

It is now possible to include tax documents where the tax date is <= the tax return "date to" but where the GL period is greater than the tax return "date to".

Tip

Set the "Include late posting" environment variable to enable this

#

#

Timesheets: Mobile enhancements

- We have given our mobile timesheet entry a facelift to make it more intuitive and simpler to both enter and approve timesheets.

Partial tax: Project

- Our Partial tax solution has been extended to include optionally include Project when evaluating partial tax rate(s) to be applied.

Bulk payment: Unpost

- This release includes the ability to unpost a Bulk payment. Where this is the case, all related payments will also be unallocated and unposted.

Authorisation: edit document whilst in workflow

- Workflow has been extended to optionally include steps where the authoriser can edit the document whilst in workflow.

Tax code evaluation: Product precedence

- Where a product is specified on a document line which has tax defaults, this will now be evaluated in advance of Contact Account (e.g. Supplier) defaults.

Tax Group: Auto creation of tax periods

- TBA