April, 2022

- Get in touch to find out more about the features in this release or how to get even more out of the system.

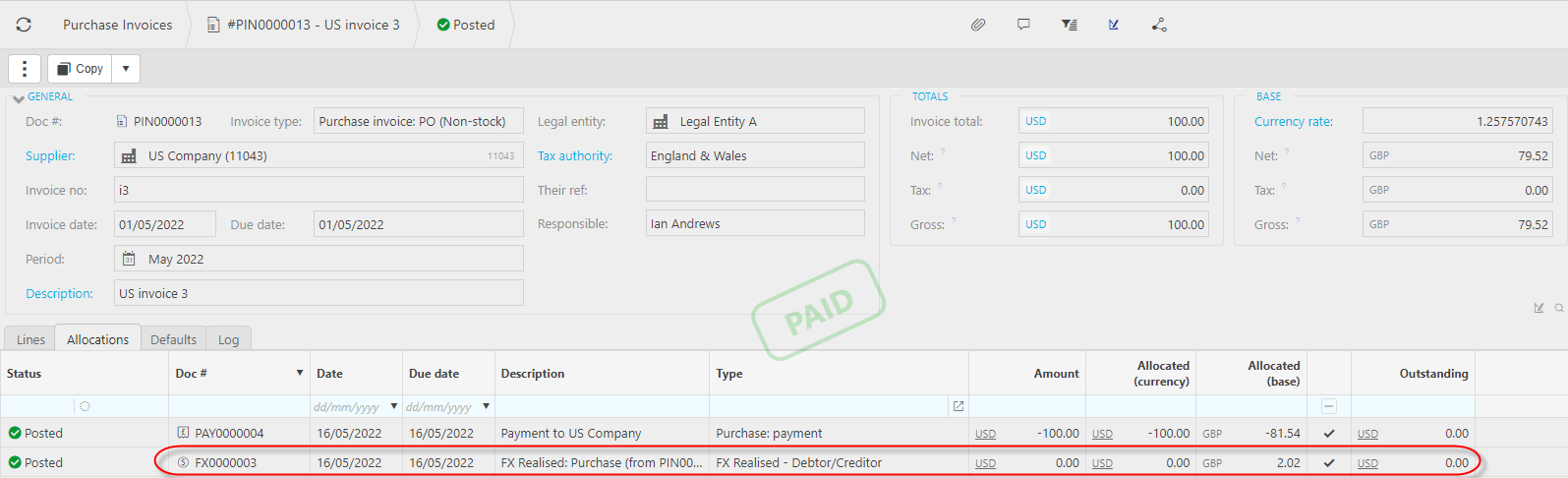

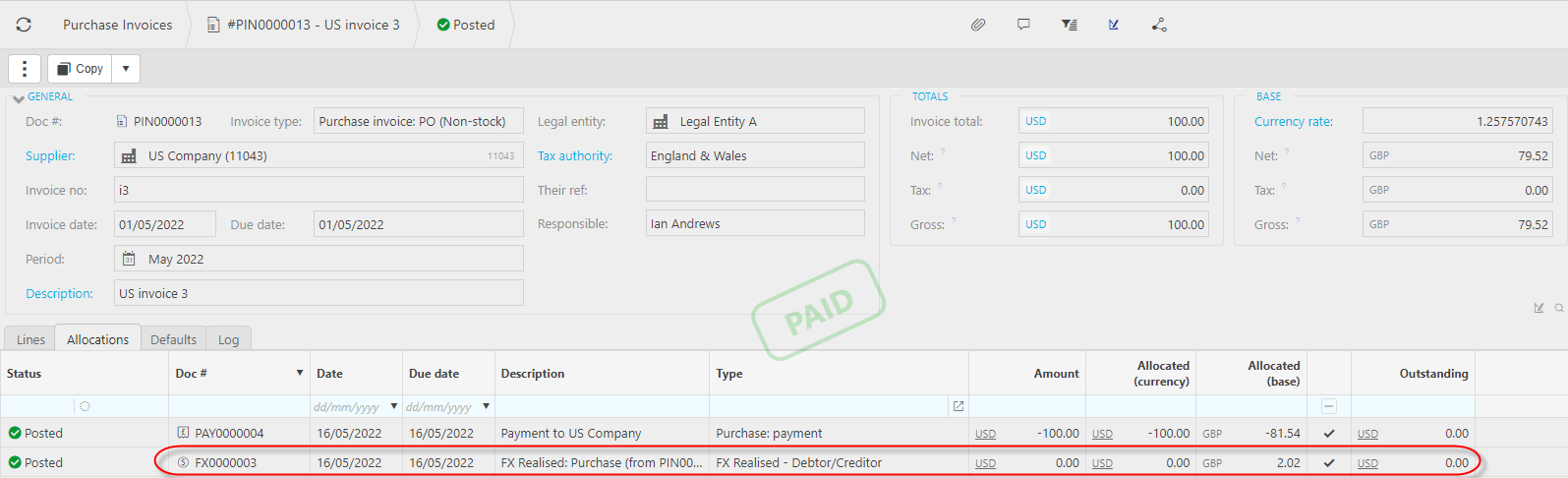

Automation: FX realised: Purchase & Sale

- This feature allows FX realised journals to be automatically created upon the posting of e.g. payments/ receipts. Separate tolerances are used for Purchases/ Sales and if the penny difference is within tolerance, a penny correction journal will be created.

- This feature can be ran automatically upon posting, manually or scheduled.

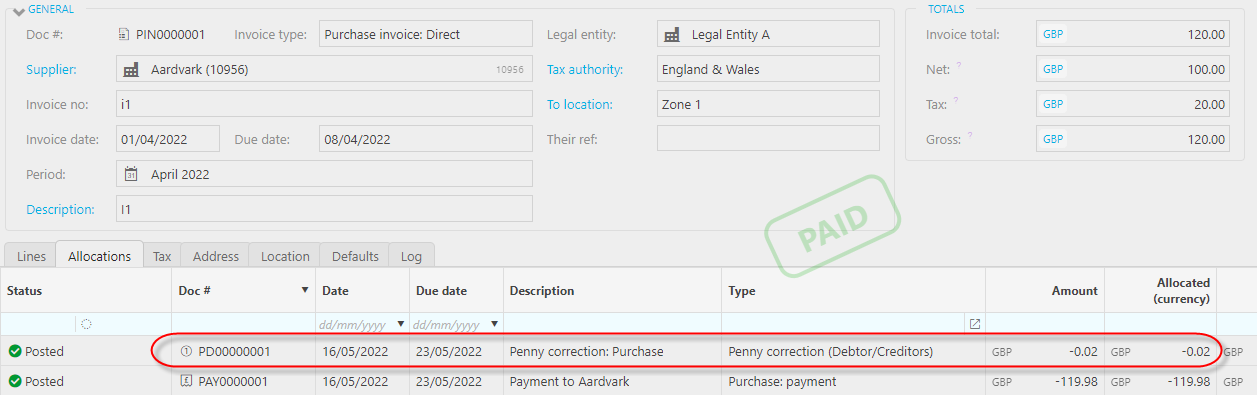

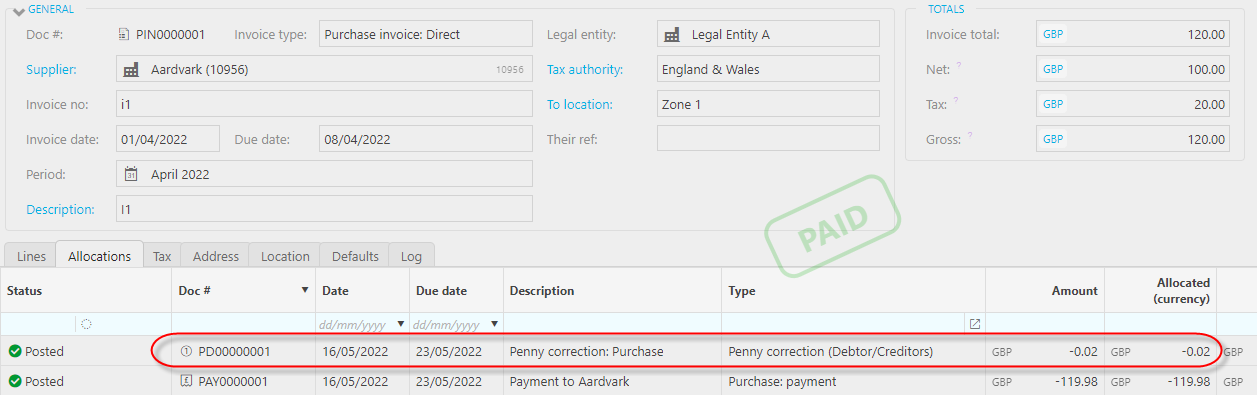

Automation: Penny correction: Purchase & Sale

- This feature allows Penny correction journals to be automatically created upon the posting of e.g. payments/ receipts. Separate tolerances are used for Purchases/ Sales and if the penny difference is within tolerance, a penny correction journal will be created.

- This feature can be ran automatically upon posting, manually or scheduled.

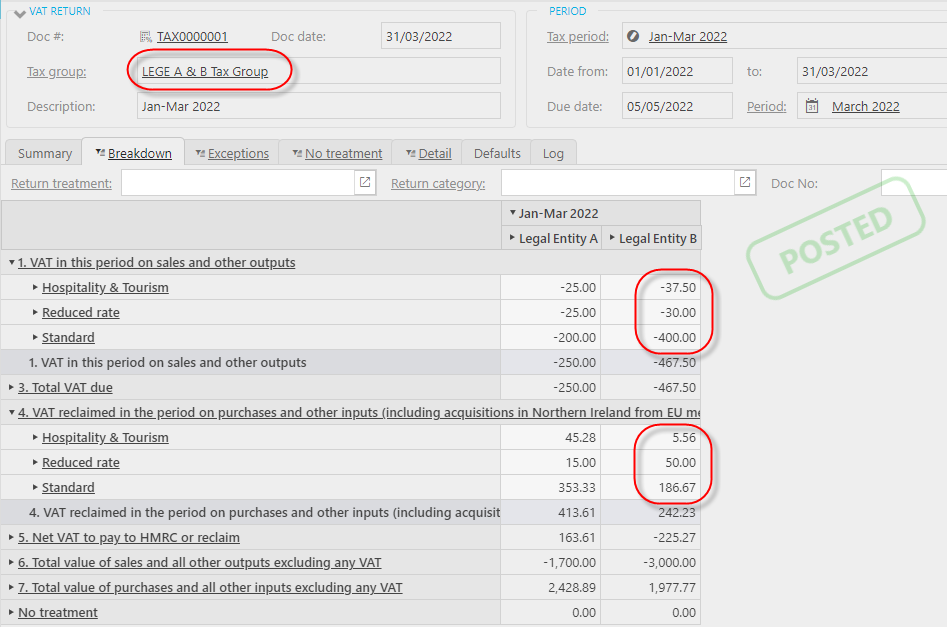

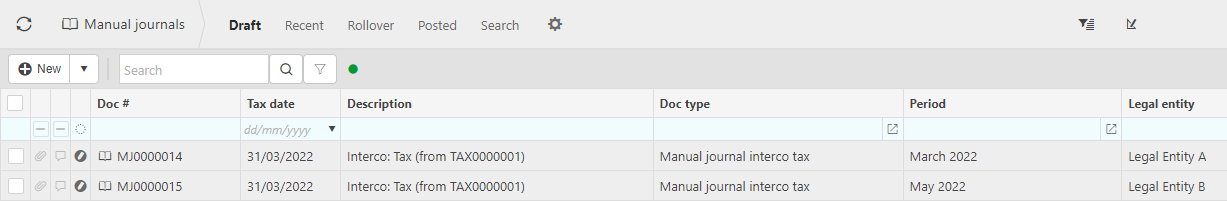

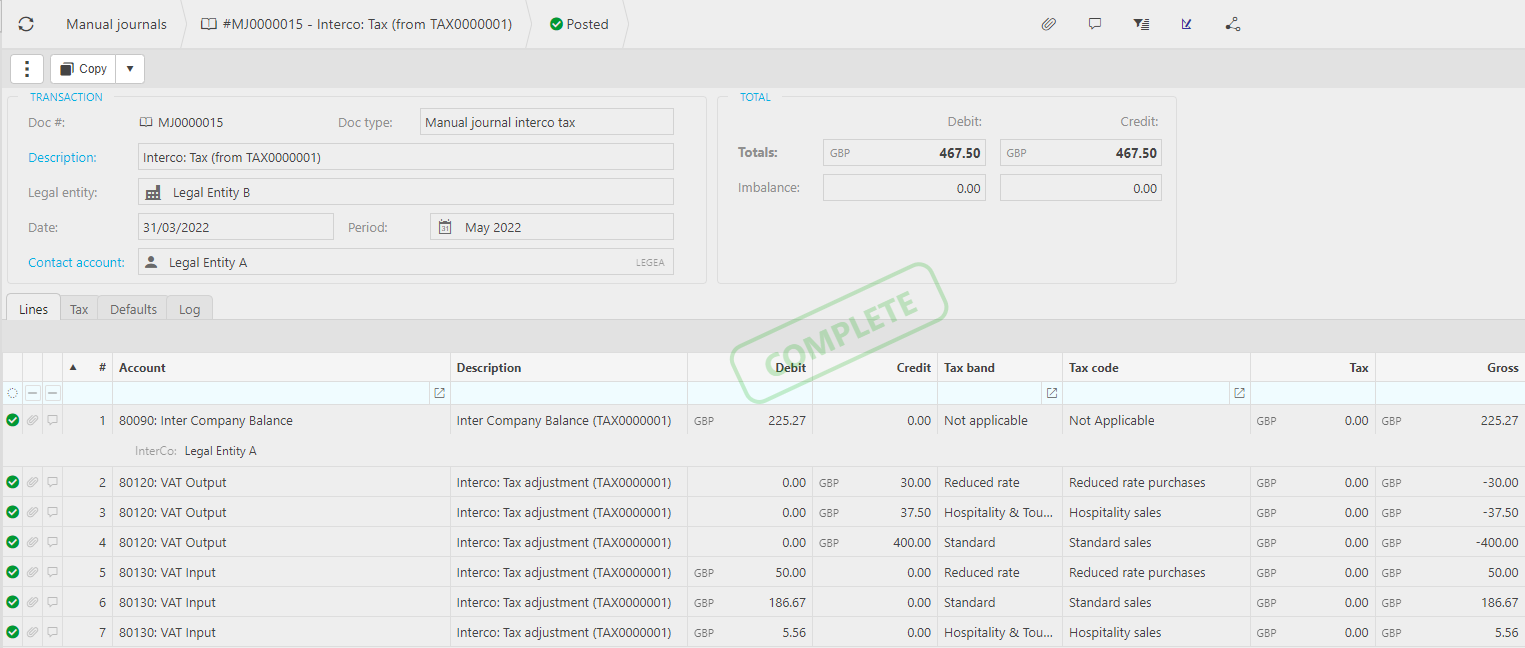

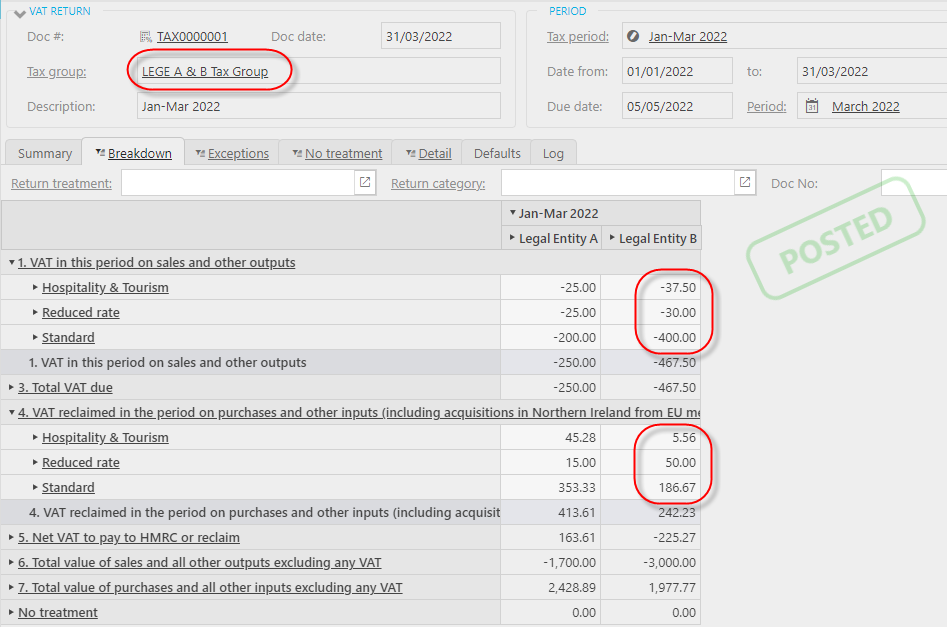

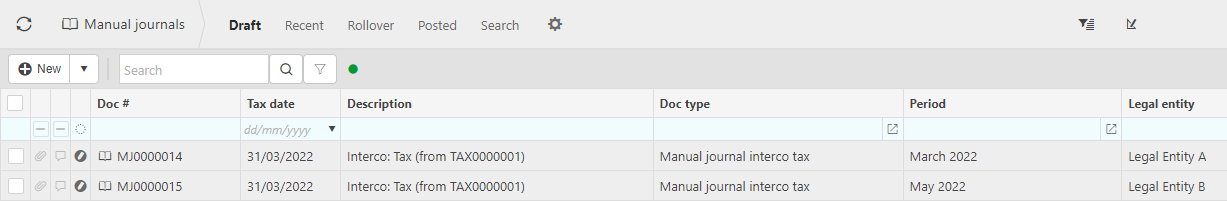

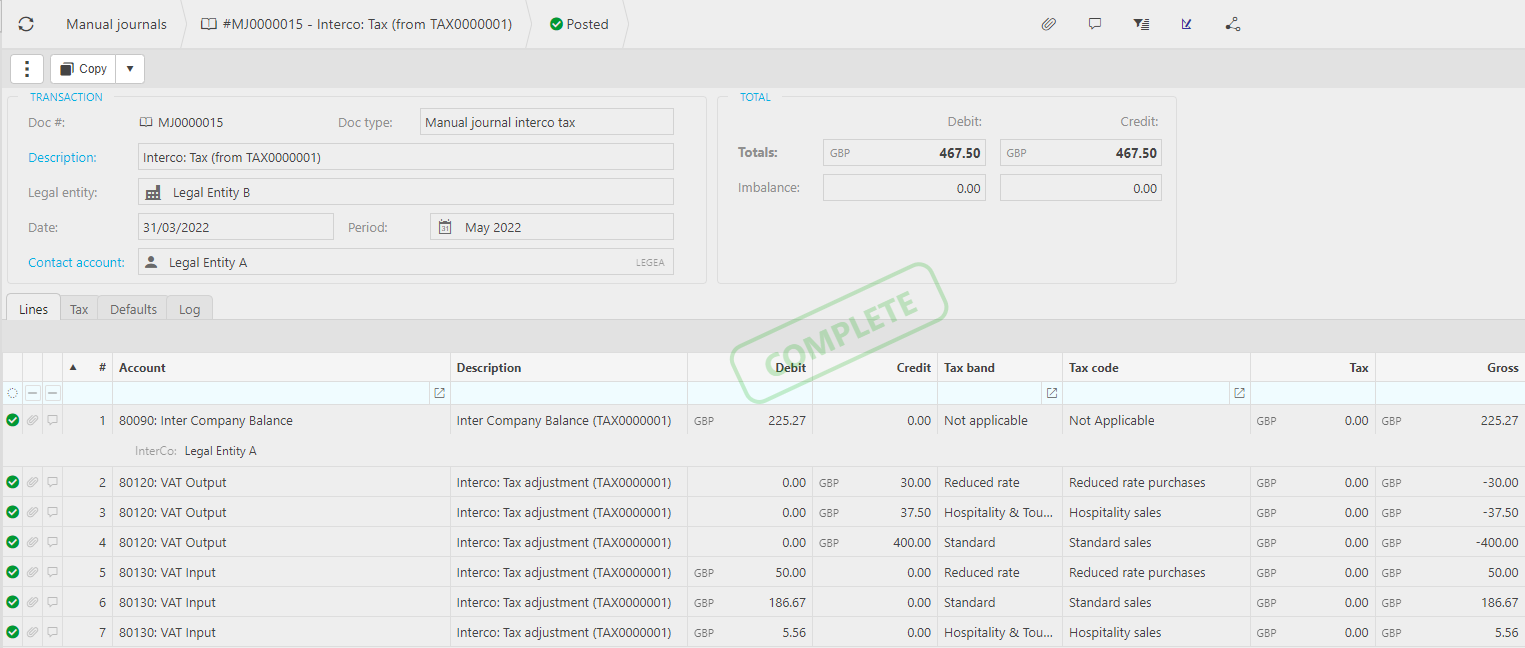

Automation: Interco tax

- This feature is useful for Customers that use VAT Groups with more than one contributory Legal Entity. It enables the automatic creation of an Interco tax manual journal to reflect the Input/ Output tax balances as well as creating an Interco balancing entry. This can be run manually or automatically upon posting of the VAT Return.

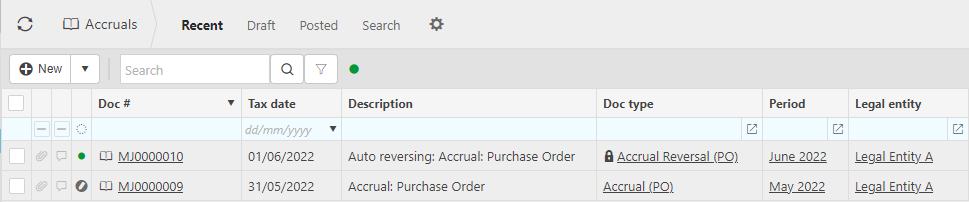

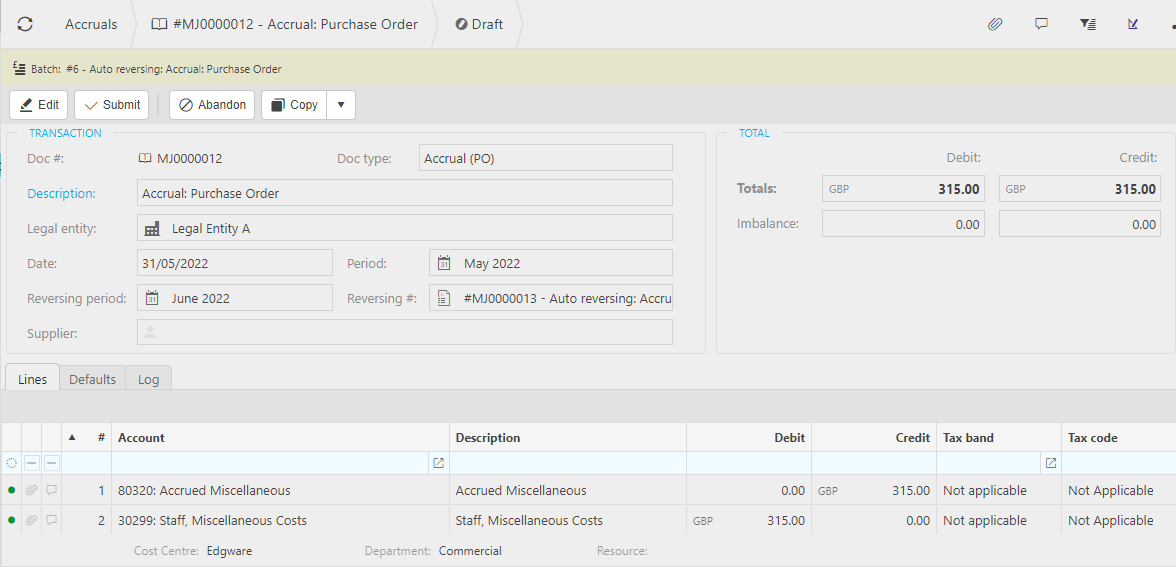

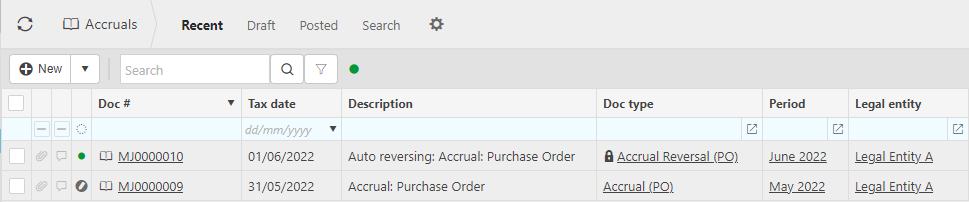

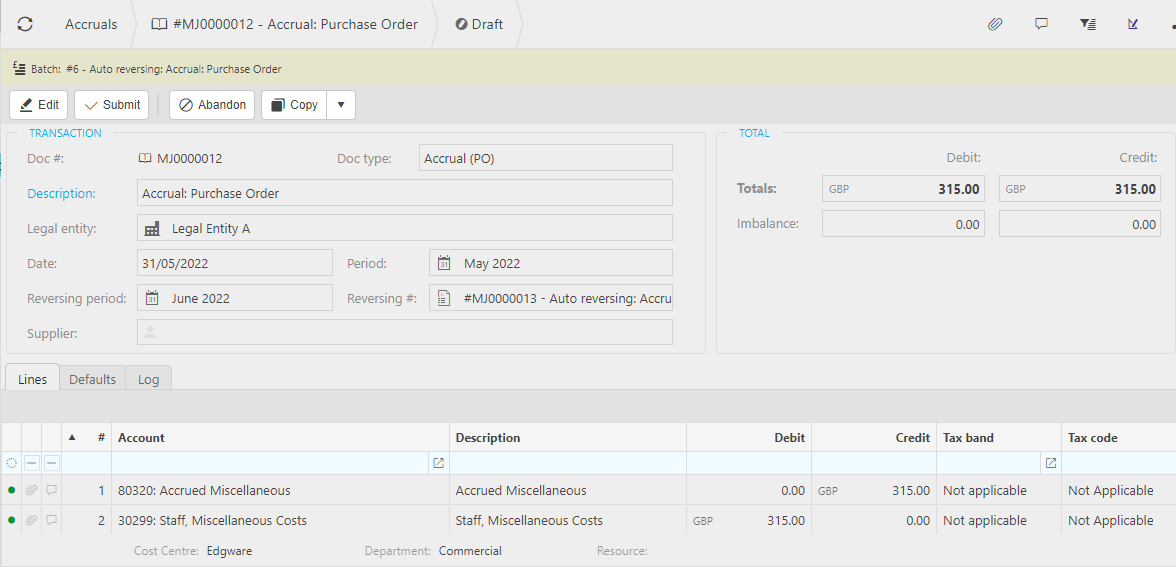

Automation: Accruals: Purchase Order, Draft Purchase invoice; Goods receipt (GRN)

- Accrual automations have been separated into three so that you can elect to run only those that you wish to reflect as accruals. These automations can be run manually or scheduled.

- The accrual journals created automatically reverse in the following period.

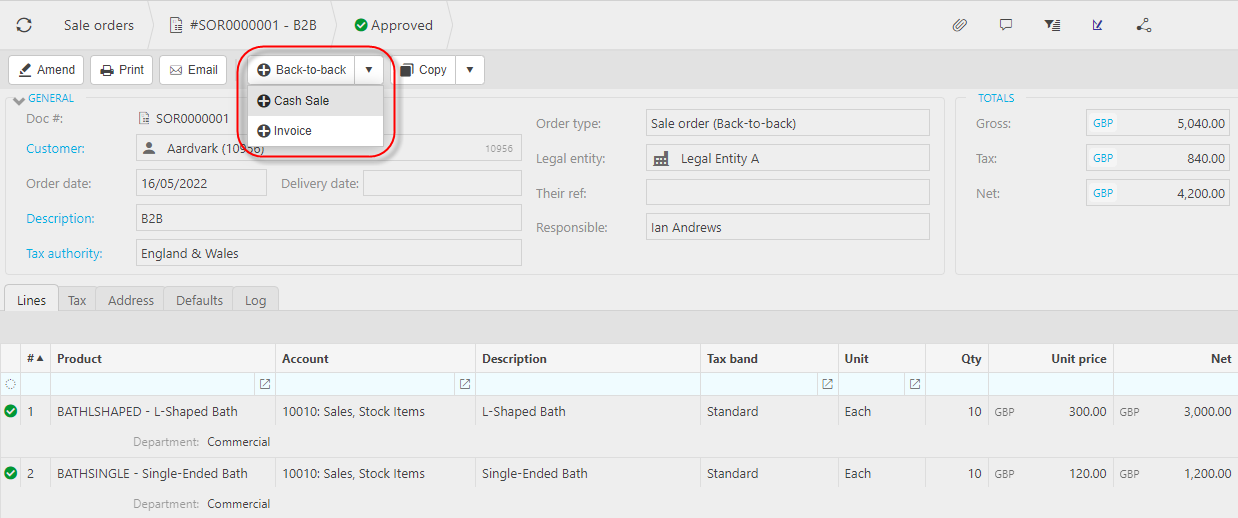

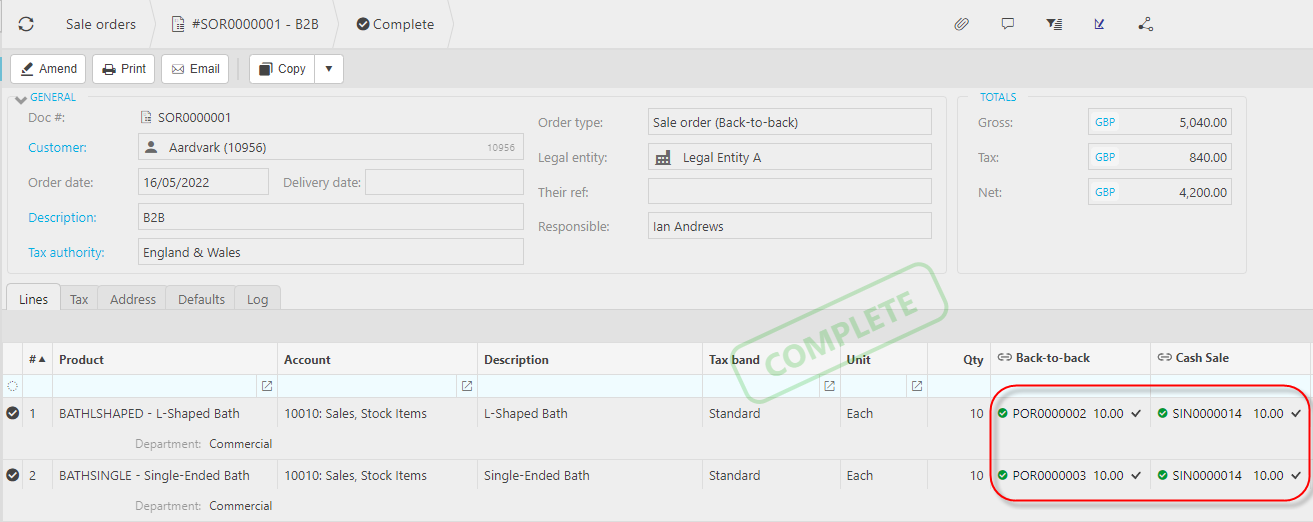

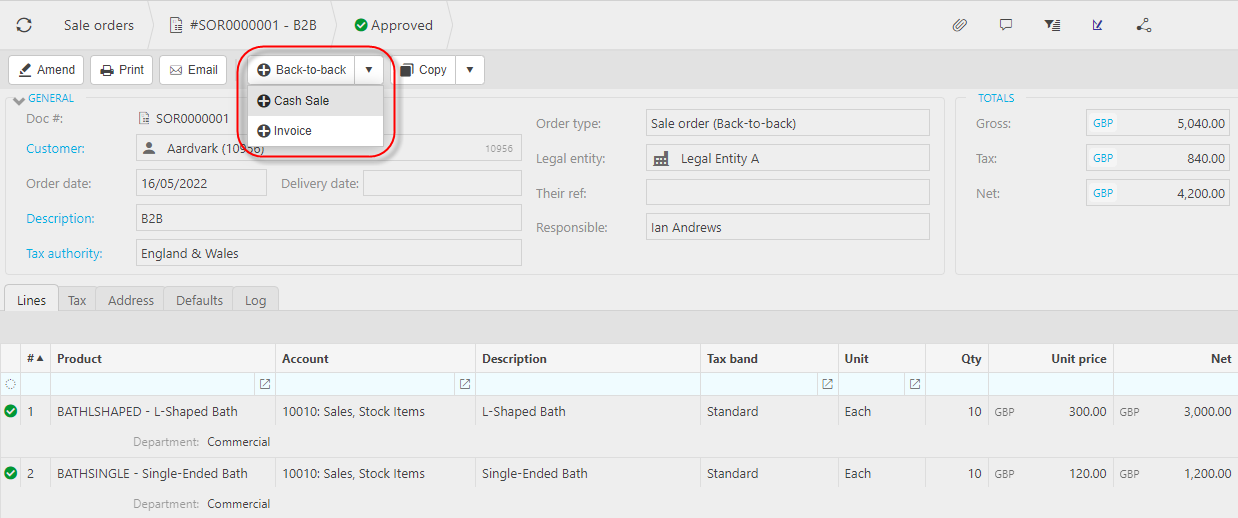

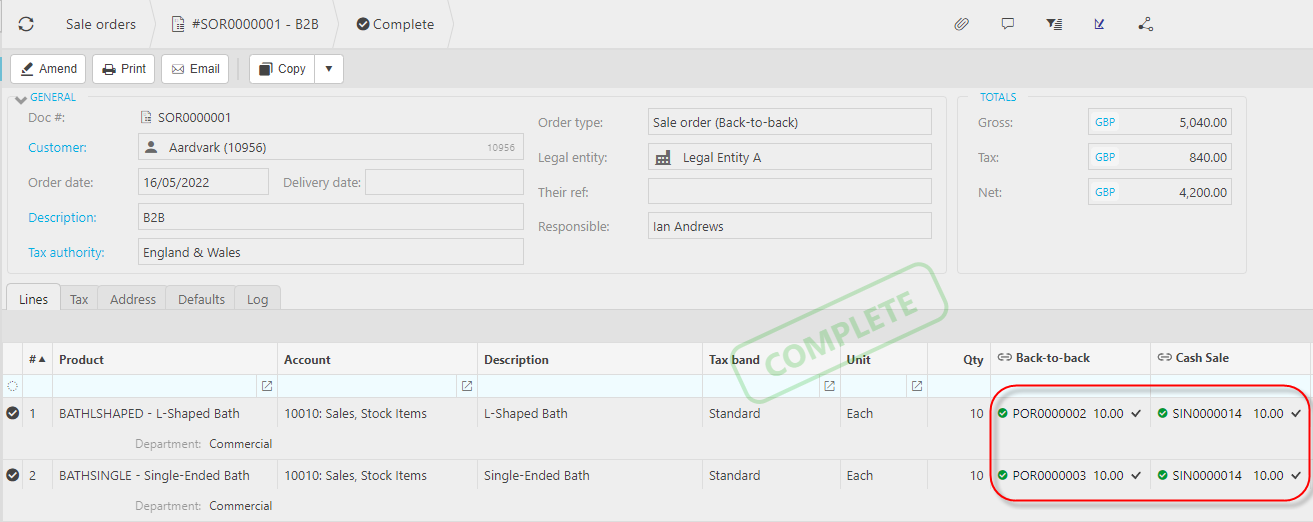

Back-to-back orders

- In response to Customer demand to satisfy "drop-shipping", it is now possible to create "back-to-back" Sale Orders which can then be used to create both Purchase Orders and Sale invoices or Cash Sales.

Timesheet invoices: bulk status amendment

- In response to high volumes of Timesheet invoices by Customers, we have introduced a feature to enable bulk amendment of invoice status.

Customer & Supplier: default locations

- As part of our stock solution, it is now possible to record default locations against both Customers and Suppliers. These locations can then be used as default stock locations upon the creation of related documents.