August 2020

- Release: 621 Check my version

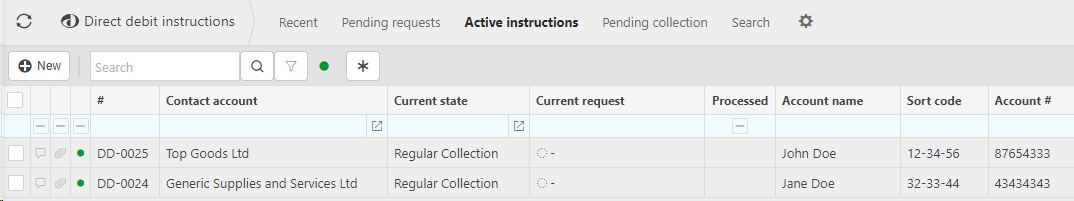

Direct Debit

Instructions

- You can now create and manage Direct Debit instructions in the system, producing files for your bank or Direct Debit processing software:

- Creation of new Direct Debit instructions

- Cancelling of existing Direct Debit instructions

- Email communications and reports support the process, notifying customers of new or cancelled instructions.

Batch receipts for Direct Debits

- To compliment the handling of Direct Debit instructions, this release also includes batch receipt handling for Direct Debit collections.

- Direct Debit batch receipts enable the creation collection files for your bank or Direct Debit processing software for customers with active Direct Debit instructions.

- Email communications and reports support the process, notifying customers of pending collections.

Document automations

This release sees the first deliverables for our new document automation tools.

You will now be able to create Intercompany Sale invoices (to Legal Entity B) in Legal Entity A and this tool will automatically create a related Purchase Invoice document in Legal Entity B. The same is available for Intercompany Purchase to Sale invoice.

Look out for additional related features in future releases which will include Intercompany cashbook movements, automated accruals, prepayments, deferred income, cross charging, etc.

Bank statement import - Multi bank accounts

- We have added support to import bank statement transactions for multiple bank accounts at once. This includes banks such as Lloyds, HSBC & Barclays who provide file extracts for their customers whom have multiple bank accounts.

- This is potentially a considerable time saving for customers with high volumes of bank accounts per bank.

New Excel functions

Support for ranges

The generic General Ledger amount functions now support specifying multiple comma separated values, such as multiple Legal Entities, Periods or Chart of Account Codes:

=IP.GLBASEAMOUNT("LEGE1,LEGE2,LEGE3","202006","1020")

=IP.GLBASEAMOUNT("LEGE1","202006,202007,202008","1020")

=IP.GLBASEAMOUNT("LEGE1","202006","1020,1030,1040")

Or by specifying a cell range:

=IP.GLBASEAMOUNT(A1:A5, "202006", "1020")

Support for multiple posting attributes

The generic General Ledger amount functions now support variable list of posting attributes, these can be used to return balances at multiple levels of analysis:

=GLBASEAMOUNT("LEGE", "202006", "1020", "Department","JCR", "CostCentre", "A")

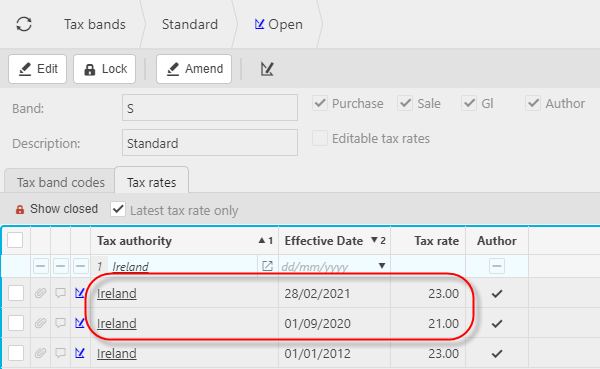

21% Standard tax rate - Ireland

- For Irish Customers, the Irish Tax Authority have introduced a reduced standard tax rate of 21% applied between September 2020 and February 2021.

- Tax rates are deployed with new releases and are automatically available and therefore applied to your documents based upon the document tax date.

- This underlines the flexibility of our tax solution which allows for the existence of multiple tax rates per tax authority with effective dates and thus and the automatic application of the correct rate to the document at the point of entry.

- Tax returns and reverse charges also automatically take account of any changes to the prevalent rate without your having to concern yourself with doing any setup or special behaviour.

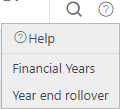

Online help

We are constantly working on our online help and in addition to new sections such as Year end rollover, we are now embedding this help as quick links from the finders and editors.

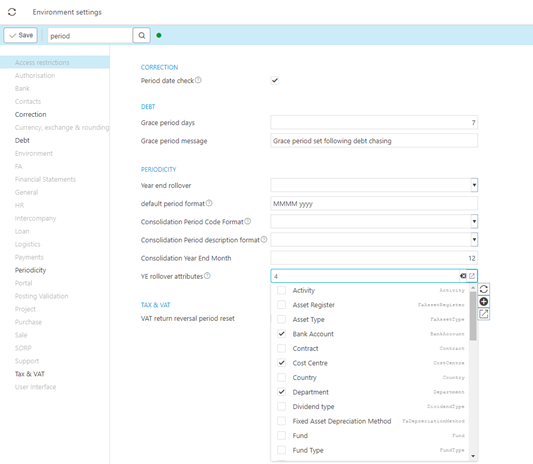

Year end rollover

- We have increased the flexibility of the year-end rollover process. This release sees the ability to select the posting attributes that you wish to include in your balance sheet aggregations.

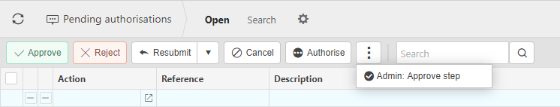

Authorisation updates

Admin approve step

The Admin approve step is enabled under the Authorisation admin approver role and allows overriding the authorisation assignment to authorise the current step. This allows approving urgent tasks without making changes to the current workflow.

Restart step

Ability to restart a workflow at the current step to fix assignment to authorisation roles or user roles. Note this does not allow restarting at a newer revision of the workflow.

Authorisation workflow revisions

When a new workflow revision is created, previous authorisation tasks still pending on older revisions are now allowed to continue. Any pending tasks can be resubmitted to be moved to the new revision.

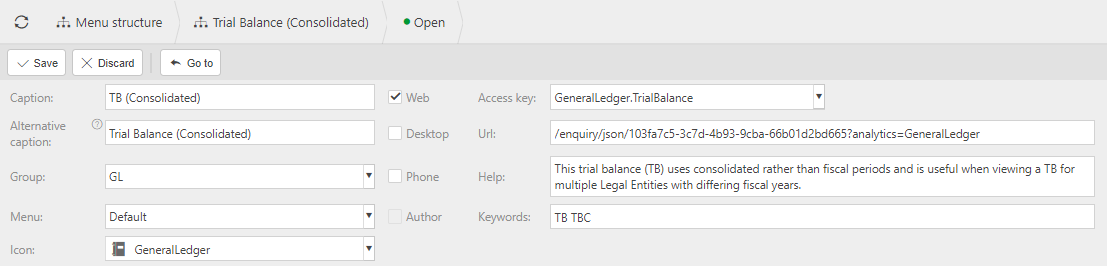

User defined menu options

We now support the creation of user defined menu options in addition to author based menu options. A popular requirement for these user menu options is the addition of enquiries.

Other minor enhancements

Faster posting of documents submitted in bulk

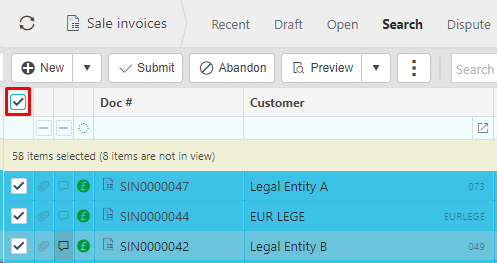

Ability to select all across all pages by control+clicking on the select all checkbox

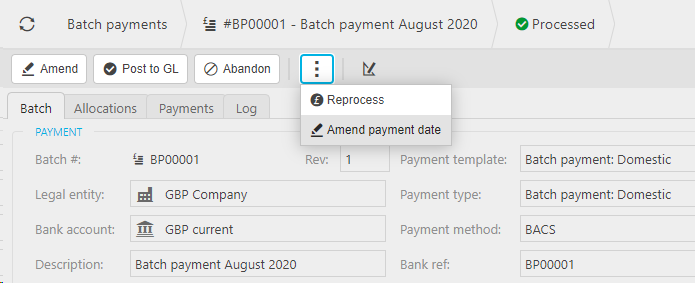

- Bulk payments amend payment date

Partial tax will not be applied to Non Recoverable tax codes

Partial tax handling has been extended to support Sales documents

Support for consolidation years in consolidated reporting & periods