Tax Return Treatments

Tax return treatments refer to the various ways you can handle and report your taxes. Here are some key aspects:

Self-Assessment: This is a system used by HM Revenue and Customs (HMRC) to collect Income Tax. Taxpayers must complete a tax return each year if they have income that isn’t taxed at source.

Claiming Refunds: If you’ve paid too much tax, you can claim a refund. This might happen if you had multiple jobs, changed jobs, or had other income adjustments.

Correcting Returns: You can correct a tax return within 12 months of the self-assessment deadline if you realise you’ve made a mistake.

Uncertain Tax Treatments: For large businesses, there are specific rules for reporting uncertain tax treatments. This applies to Corporation Tax, Income Tax, PAYE, and VAT returns.

How to view Tax Return Treatments

Viewing Tax Return Treatments

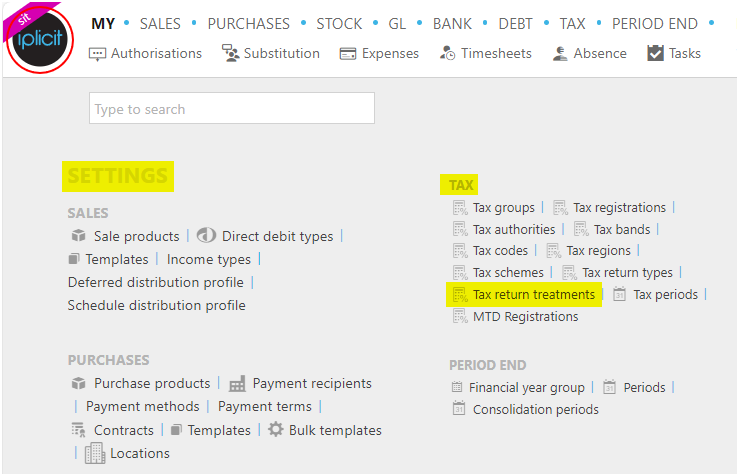

Select Tax / Tax return treatments from the Settings section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

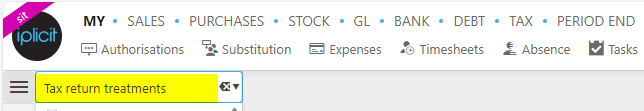

or enter Tax return treatments in the Quick Launch Side Menu.

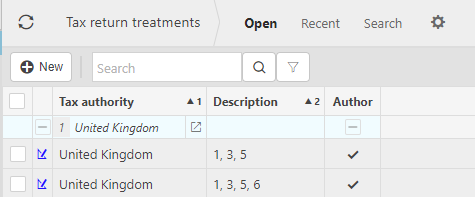

This will then show the Tax return treatments on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

Updated September 2024