MTD

MTD stands for Making Tax Digital. It is a UK government initiative aimed at simplifying and modernising the tax system by requiring businesses and individuals to keep digital records and submit tax returns using compatible software. This initiative is designed to reduce errors and make tax management more efficient and closer to real-time.

Note

You must complete this process for each Tax Group.

HMRC MTD Registration

Create a new MTD registration.

Note

An MTD registration is required for each VAT registration as defined on the Tax Group. Only one registration is required for Tax Groups.

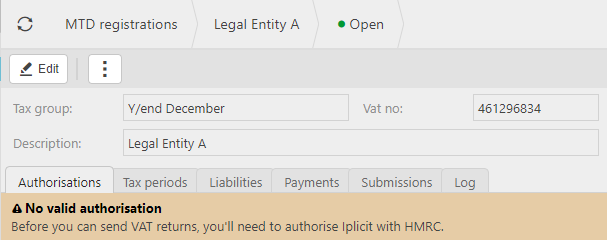

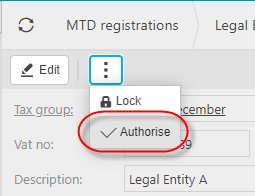

Open the MTD registration and select Authorise.

Note

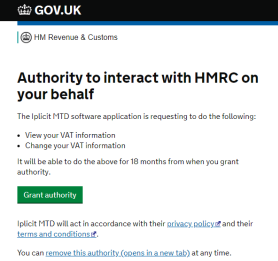

You will be taken to the HMRC https://www.gov.uk/guidance/making-tax-digital-for-vat website.

Login using your HMRC Government Gateway credentials.

Follow the instructions on the HMRC website to sign your business up for MTD.

Grant Authority.

Note

You must already be registered for MTD to be able to GRANT authority.

Following MTD Registration with HMRC, you must grant authority to iplicit to make MTD submissions on your behalf.

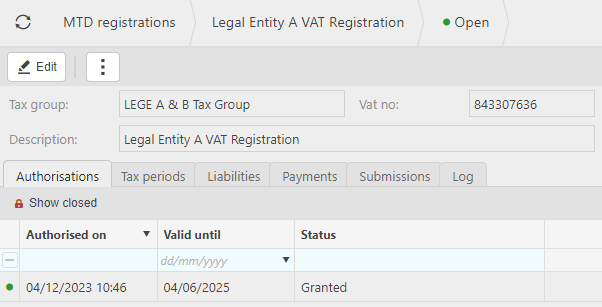

Refresh the MTD registration.

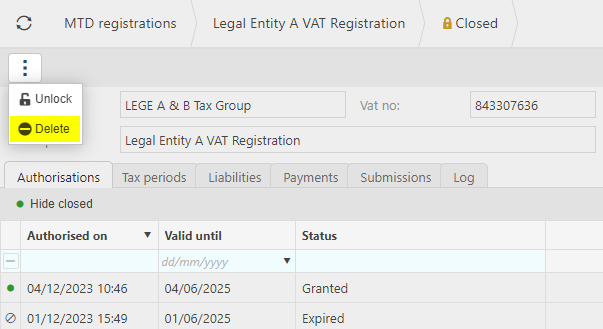

The Authorisations tab will show the authorisation and future expiry.

Note

You must already be registered for MTD to be able to GRANT authority.

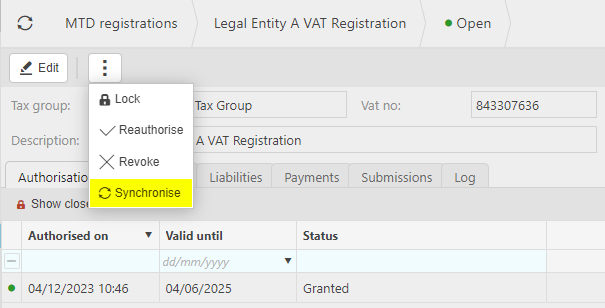

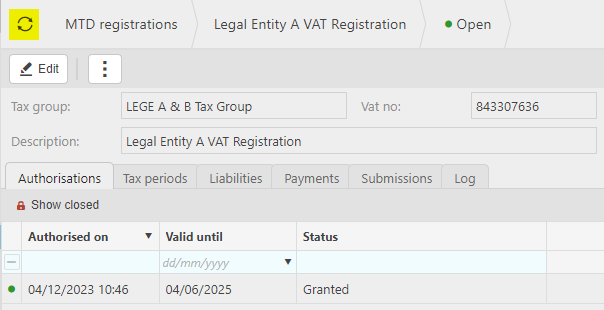

Select Synchronise to retrieve tax periods.

Note

The VAT registration number on the associated Tax Group must match that for the granted MTD registration.

Previous & Pending Submissions

- Following successful registration and granting of authority, you can view previous and pending VAT submissions.

Submit MTD VAT Submission

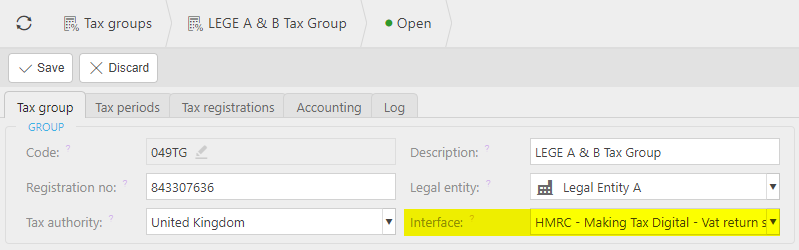

You must associate the Tax Group with the MTD registration interface to be able to process VAT returns using MTD.

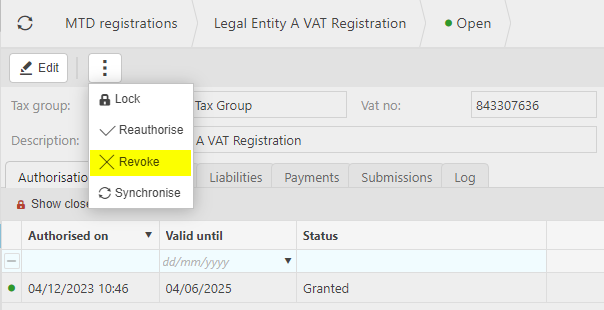

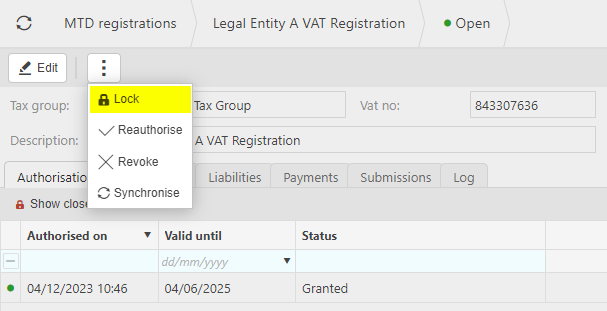

Revoke MTD registration

You can Revoke an MTD registration by selecting Revoke.

You will then be taken to the HMRC website to complete the Revocation.

Note

Revoke is only available for active, granted registrations.

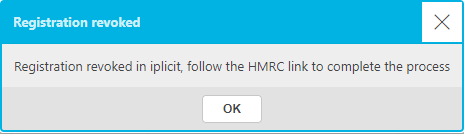

Note

The revocation will be shown as a row in the Authorisations tab.

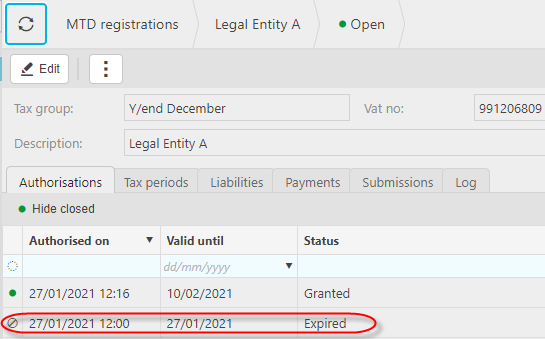

Lock MTD registration

A locked registration will not be available for VAT Returns.

The registration can be locked without authority being revoked with HMRC.

Note

Following locking, the registration can be deleted.

Delete MTD registration

Only locked registrations can be deleted.

Note

Following deletion, you can recreate the MTD registration in iplicit by restarting the process from scratch.

Updated September 2024