Cashflow Forecast Rules

Cashflow forecast Rules are rules for Cashflow Forecasts to follow.

Realistic Projections: Accountants make conservative estimates to avoid overestimating income or underestimating expenses. This helps prevent cash shortages.

Accurate Timing: They recognize that revenue isn’t realised until it’s received, and expenses aren’t incurred until they’re paid. This timing accuracy is crucial for a reliable forecast.

Comprehensive Inclusion: All potential income and expenses, including irregular or small ones, are included to avoid surprises.

Regular Updates: Forecasts are continuously updated to reflect actual performance and any changes in the business environment. This keeps the forecast relevant and accurate.

Inventory Management: Proper inventory levels are maintained to ensure cash isn’t unnecessarily tied up in stock, while also avoiding stockouts that could lead to missed sales.

Use of Reliable Tools: Accountants use tools that suit the business’s complexity, whether simple spreadsheets or specialised software, to ensure accuracy and efficiency.

How to view Cashflow Forecast Rules

Viewing Cashflow Forecast Rules

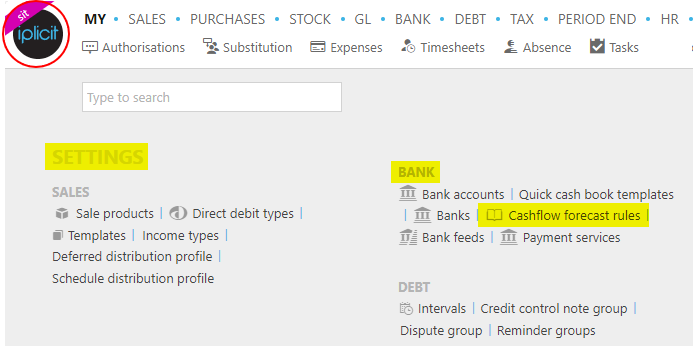

Select Bank / Cashflow forecast rules from the Settings section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

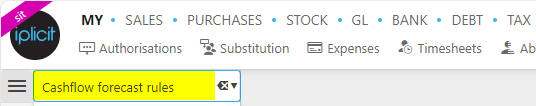

or enter Cashflow forecast rules in the Quick Launch Side Menu.

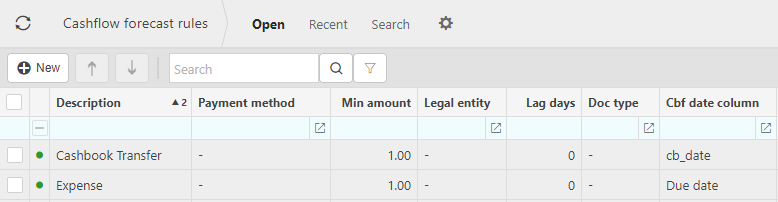

This will then show the Cashflow forecast rules on the system where normal customisation of Sets can be used.

Tip

To modify the columns displayed, select  on the top right of the page, then tick/untick the information you want to hide or display.

on the top right of the page, then tick/untick the information you want to hide or display.

Updated September 2024