PSWT Submission

Withholding Tax option is a process where the User can withhold the Tax element of a payment to a Supplier, so they can pay that tax to the revenue body separately.

This withheld tax is known as Professional Services Withholding Tax (PSWT) and is an option available to payments made by Irish Users initially.

The User is then required to submit a PSWT returns to the tax authorities and pay the deducted PSWT.

How to view PSWT Submissions

Viewing PSWT Submissions

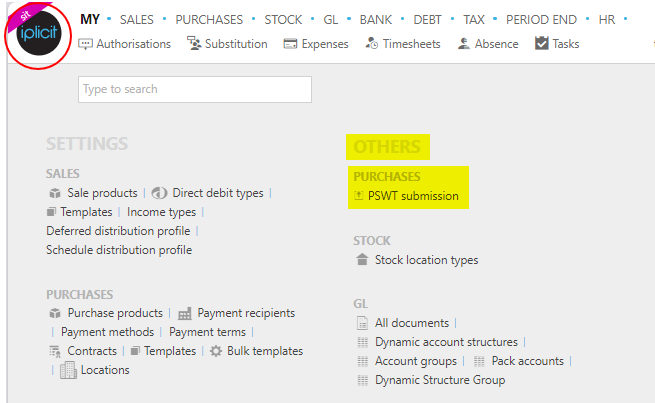

Select Purchases / PSWT submission from the Others section of the pulse menu -

Note

This is an example screen shot of the pulse menu.

Position of the menu items within pulse will vary according to available options and dependant on personal screen resolution.

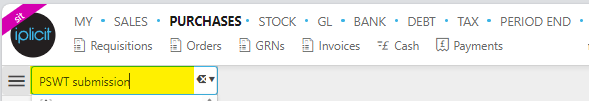

or enter PSWT submission in the Quick Launch Side Menu.

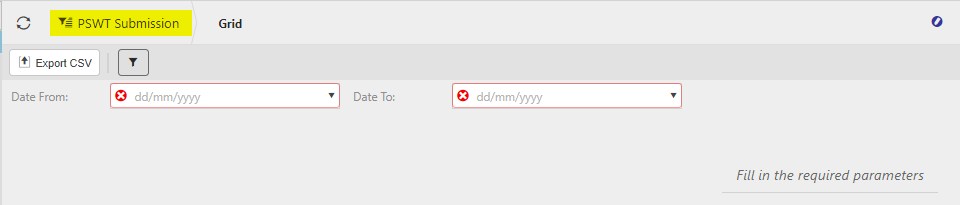

This will then show the PSWT submission entry screen.

How to list PSWT Submissions

List PSWT Submissions

Select PSWT Submissions from one of the options as shown above in Viewing PSWT Submissions.

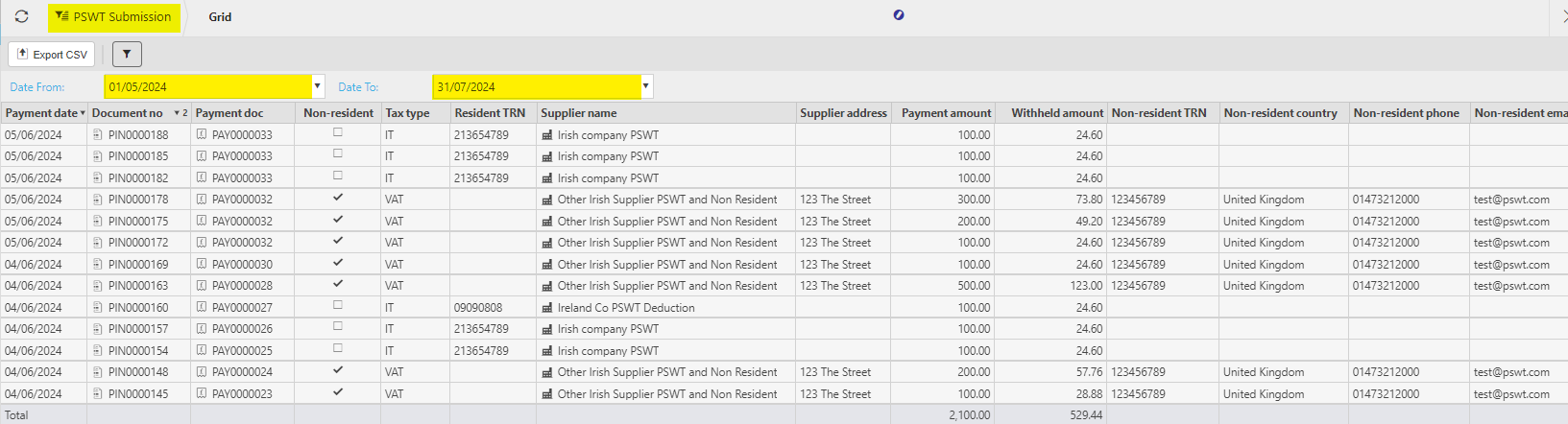

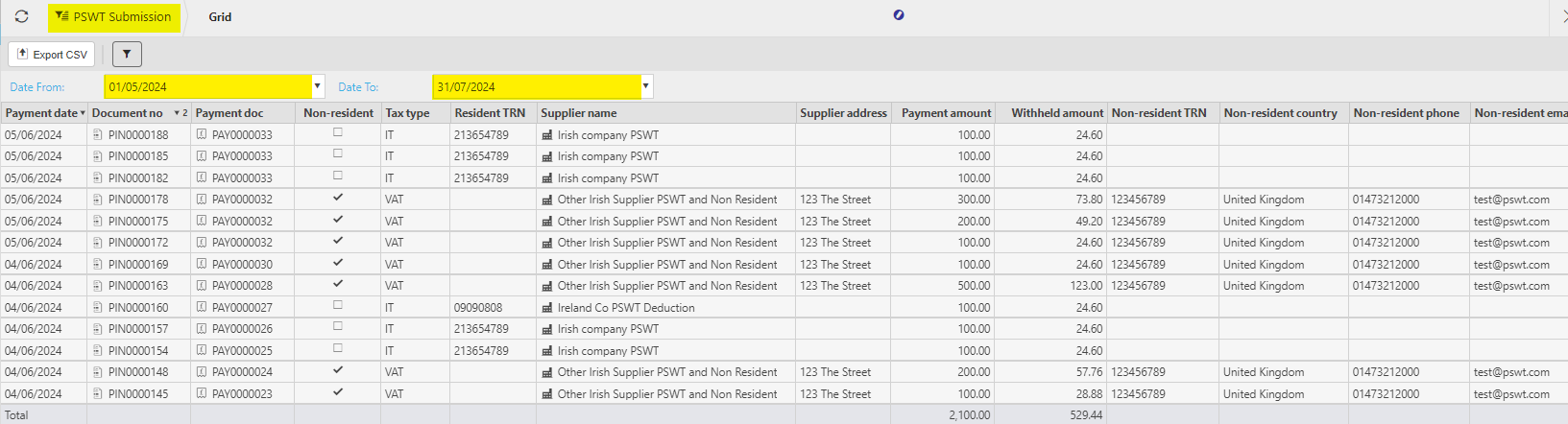

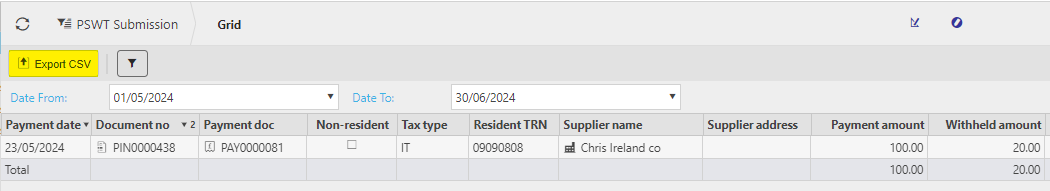

On the PSWT submission entry screen ...

... enter From Date and To Date.

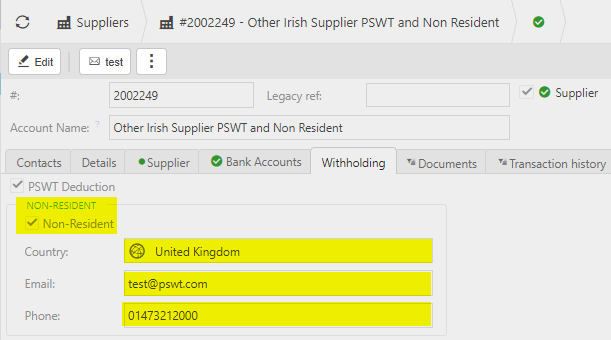

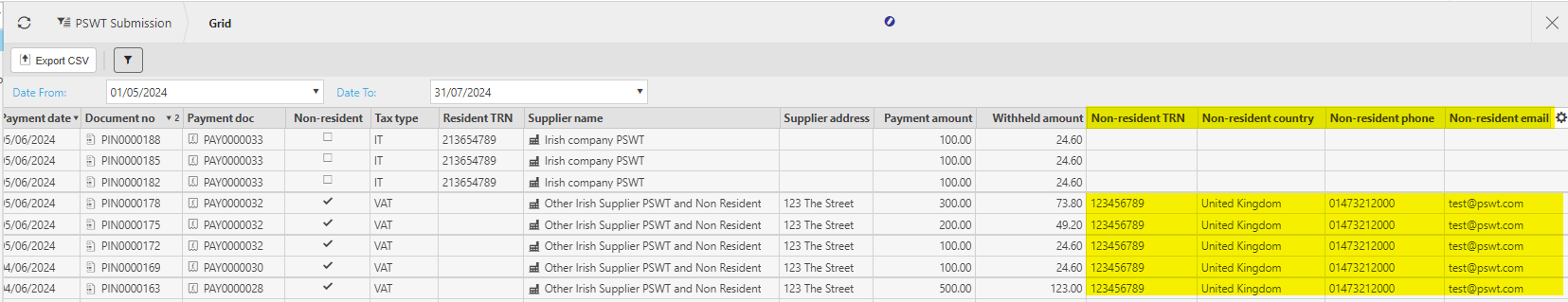

The information displayed will be based on the Withholding defaults set in the Supplier.

If the Non-Resident option is ticked on the Supplier, then the PSWT list above will have data in the Non-resident fields e.g.

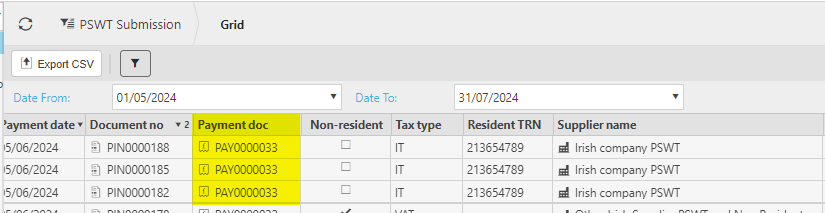

Document nos with the same Payment doc number will indicate Bulk payments.

Select the

refresh button to show any PSWTs within those dates.

refresh button to show any PSWTs within those dates.These will be the PSWTs that will be Exported to a CSV file.

Note

These results are based on the original PIN being paid.

If the User has only paid the PIN to the Tax revenue body and not the originating PIN, then it won't show up in these submission results.

How to Export PSWT Submissions

Export PSWT Submissions

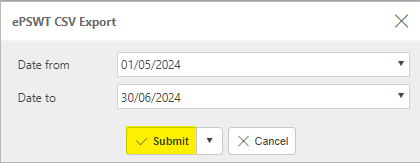

Select PSWT Submissions within required dates as shown in List PSWT Submissions above.

Select the Export CSV option.

Confirm the dates are correct, then press Submit.

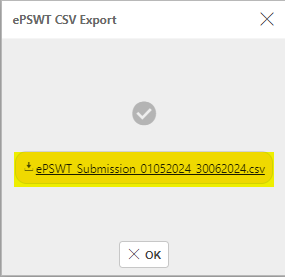

Select the CSV file to open.

Updated June 2024